This version of the form is not currently in use and is provided for reference only. Download this version of

Form CT-501

for the current year.

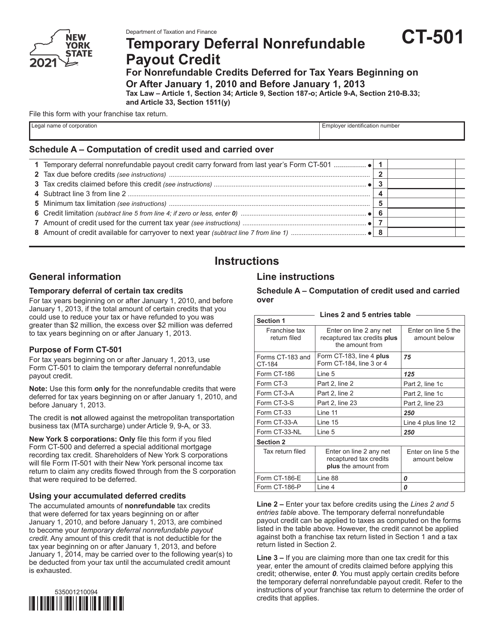

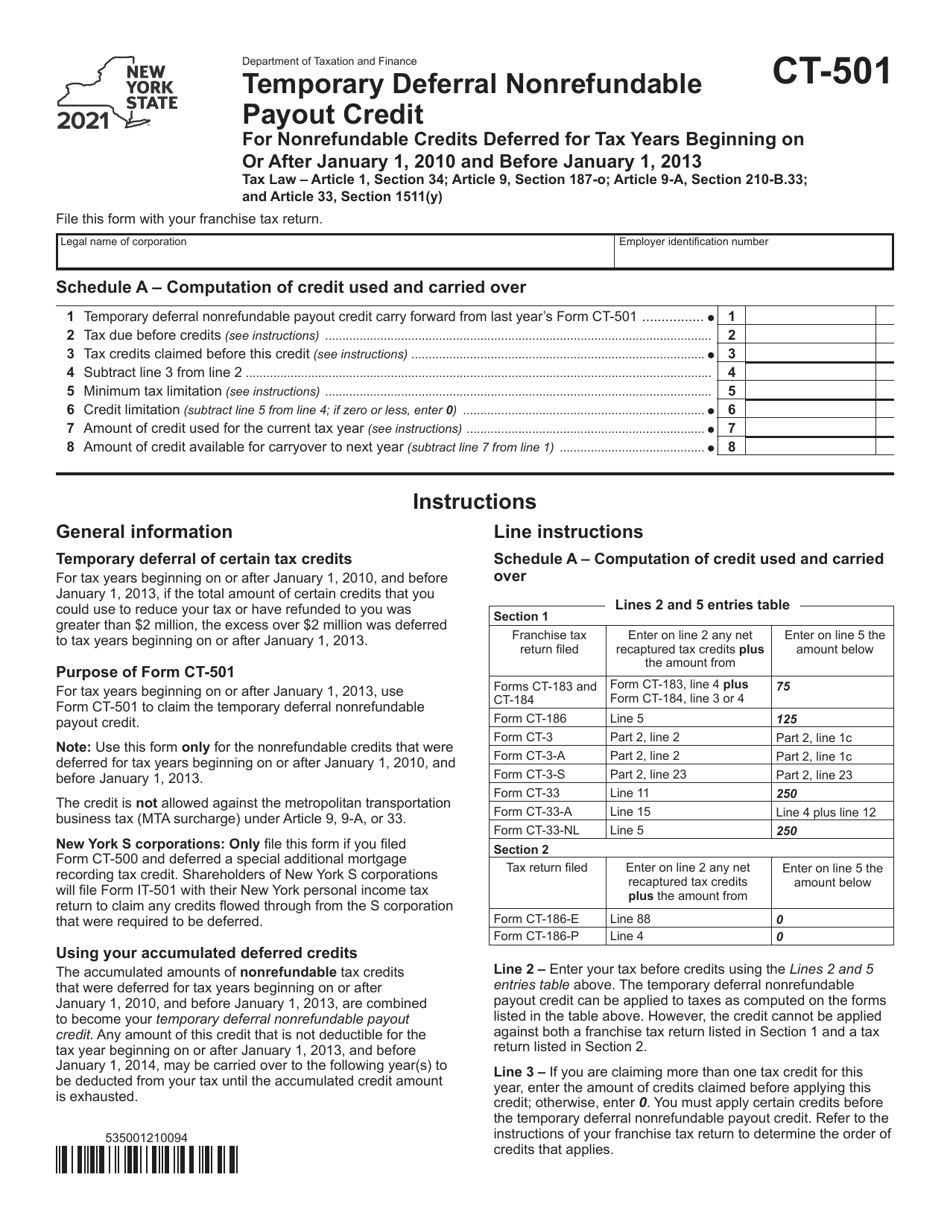

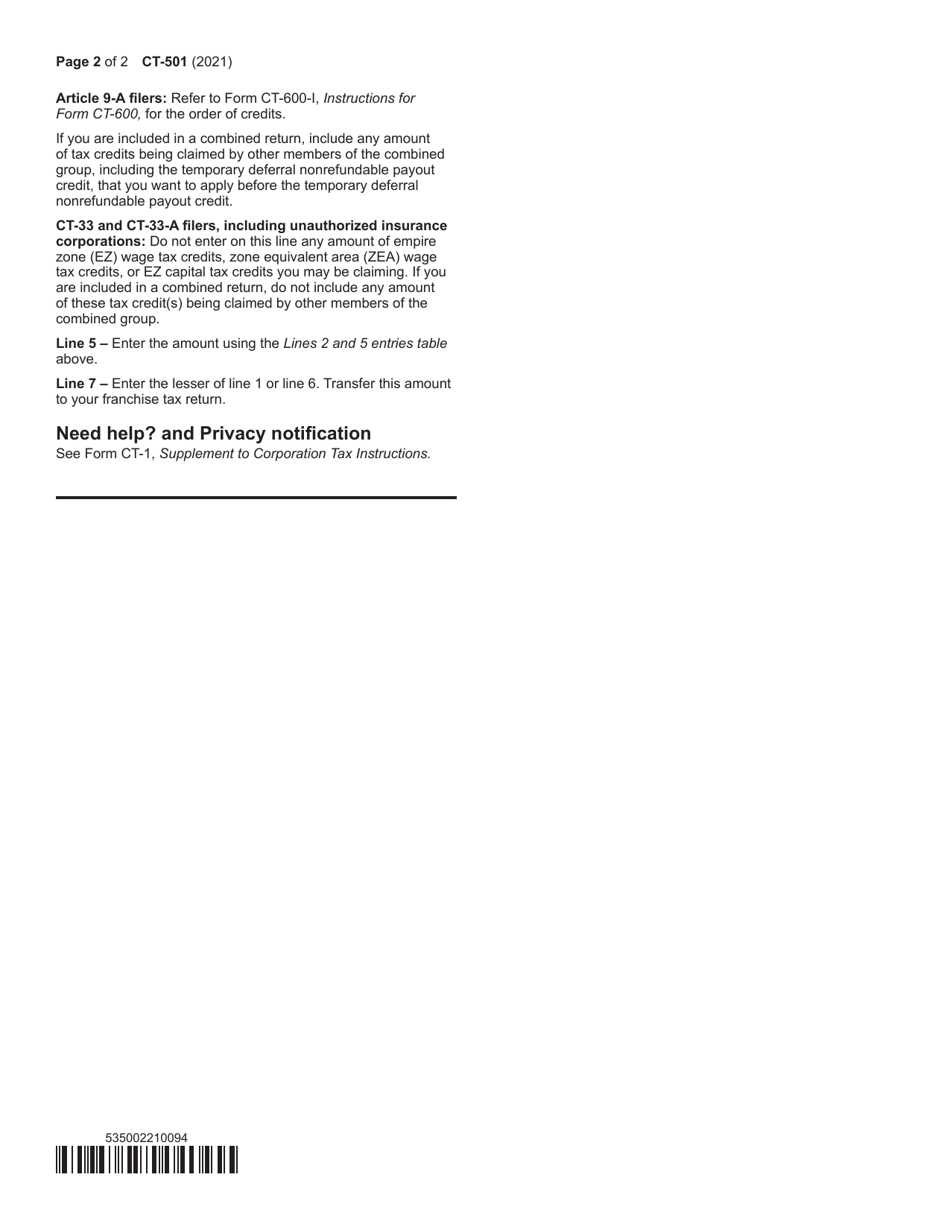

Form CT-501 Temporary Deferral Nonrefundable Payout Credit for Nonrefundable Credits Deferred for Tax Years Beginning on or After January 1, 2010 and Before January 1, 2013 - New York

What Is Form CT-501?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-501?

A: Form CT-501 is a form used in New York for the Temporary Deferral Nonrefundable Payout Credit for Nonrefundable Credits Deferred for Tax Years Beginning on or After January 1, 2010 and Before January 1, 2013.

Q: Who is eligible to use Form CT-501?

A: Taxpayers in New York who have deferred nonrefundable credits for tax years beginning on or after January 1, 2010 and before January 1, 2013 are eligible to use Form CT-501.

Q: What is the purpose of Form CT-501?

A: Form CT-501 is used to claim the Temporary Deferral Nonrefundable Payout Credit for Nonrefundable Credits Deferred. It allows taxpayers to receive a payout of their nonrefundable credits that were deferred in previous years.

Q: When should Form CT-501 be filed?

A: Form CT-501 should be filed when a taxpayer wants to claim the Temporary Deferral Nonrefundable Payout Credit for Nonrefundable Credits Deferred.

Q: Is Form CT-501 available for tax years after January 1, 2013?

A: No, Form CT-501 is only applicable for tax years beginning on or after January 1, 2010 and before January 1, 2013.

Q: Can Form CT-501 be filed electronically?

A: No, Form CT-501 cannot be filed electronically. It must be filed by mail.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-501 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.