This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form CT-241

for the current year.

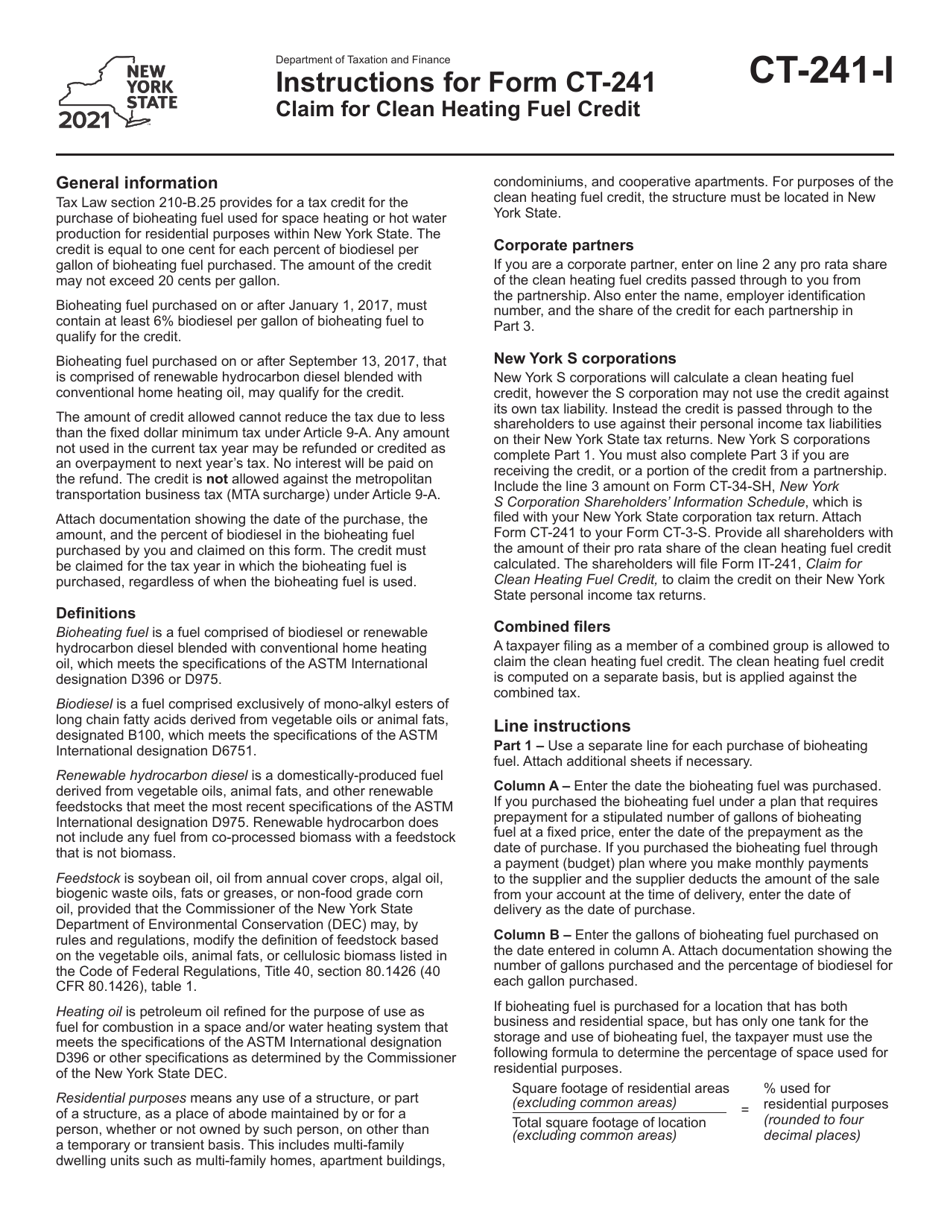

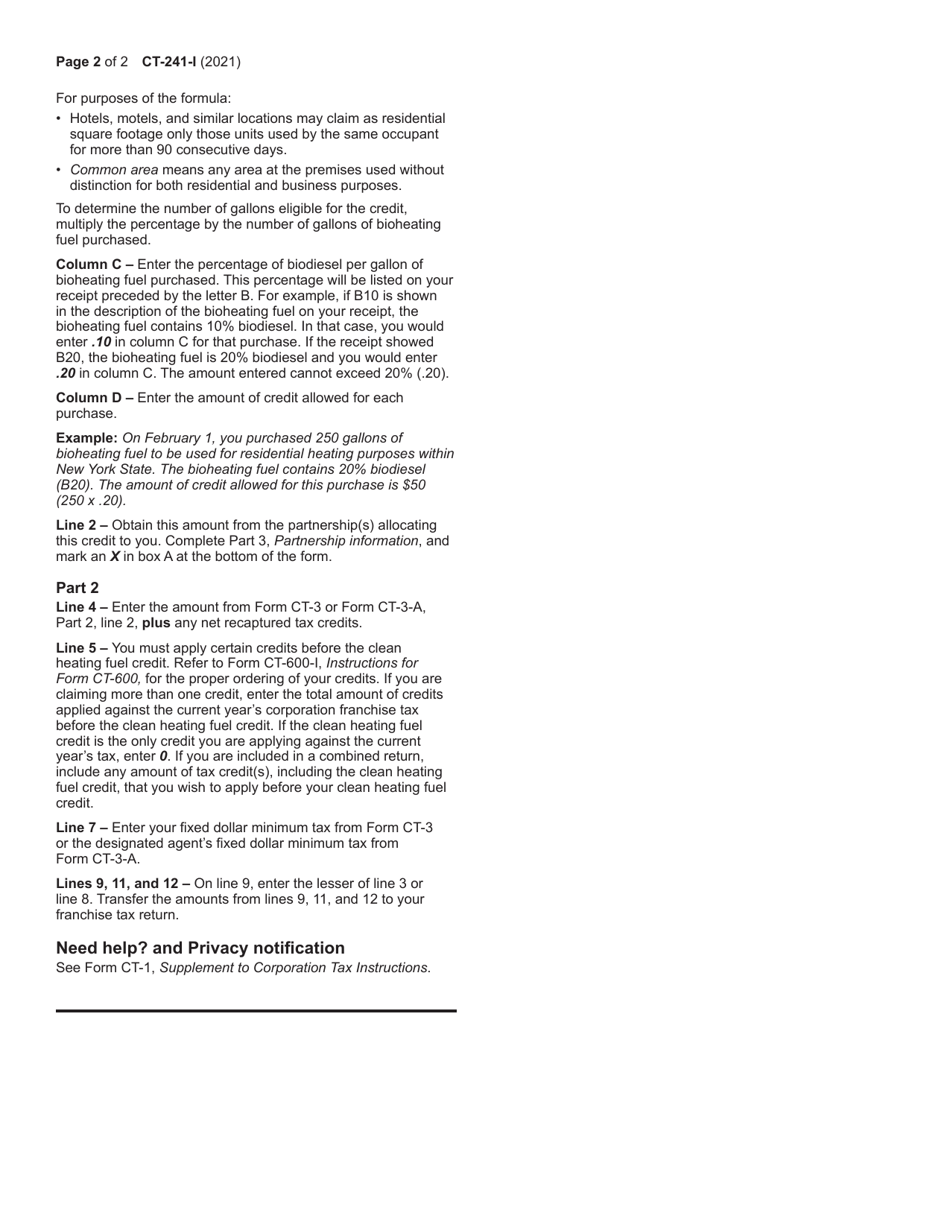

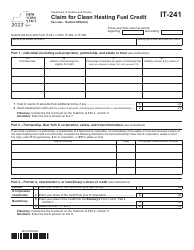

Instructions for Form CT-241 Claim for Clean Heating Fuel Credit - New York

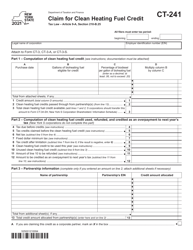

This document contains official instructions for Form CT-241 , Claim for Clean Heating Fuel Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-241 is available for download through this link.

FAQ

Q: What is Form CT-241?

A: Form CT-241 is a tax form used to claim the Clean Heating Fuel Credit in New York.

Q: Who is eligible to claim the Clean Heating Fuel Credit?

A: Residential taxpayers in New York who use clean heating fuel are eligible to claim the credit.

Q: What is considered clean heating fuel?

A: Clean heating fuel includes biodiesel, ethanol, and natural gas.

Q: How much is the Clean Heating Fuel Credit?

A: The credit is $0.01 per gallon of clean heating fuel used.

Q: What documentation is required to claim the credit?

A: You must attach original receipts or invoices that show the amount of clean heating fuel purchased and used.

Q: What is the deadline to file Form CT-241?

A: The deadline to file Form CT-241 is the same as the deadline for your New York state income tax return.

Q: Can the Clean Heating Fuel Credit be carried forward or refunded?

A: No, the credit cannot be carried forward or refunded.

Q: Are there any income restrictions to claim the Clean Heating Fuel Credit?

A: No, there are no income restrictions to claim the credit.

Q: Is the Clean Heating Fuel Credit refundable?

A: No, the credit is non-refundable and can only be used to offset your tax liability.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.