This version of the form is not currently in use and is provided for reference only. Download this version of

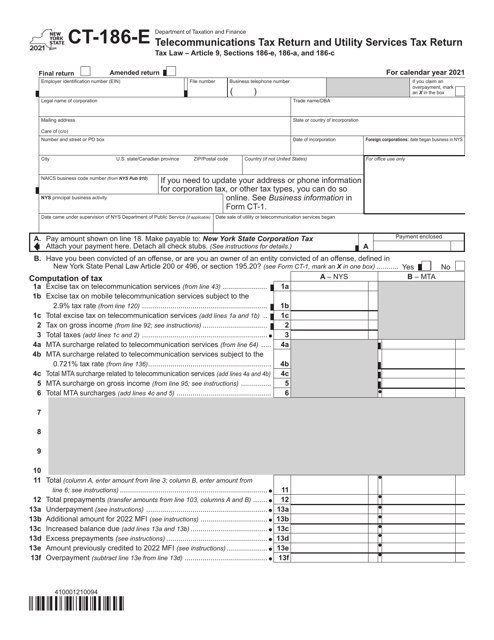

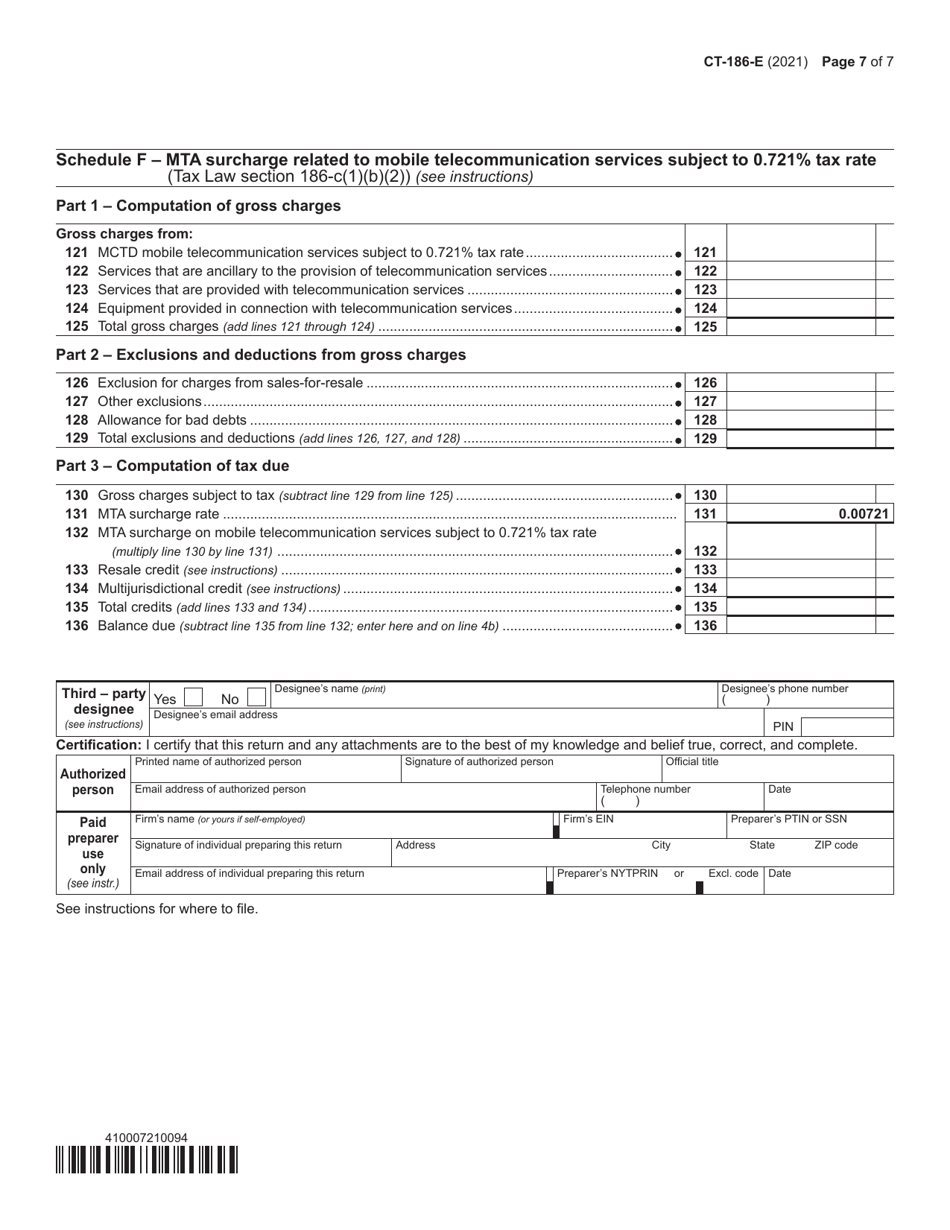

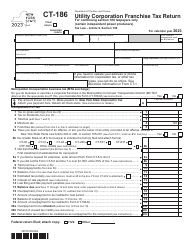

Form CT-186-E

for the current year.

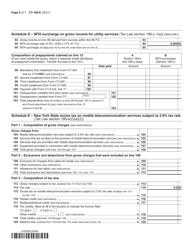

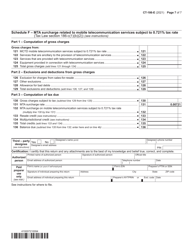

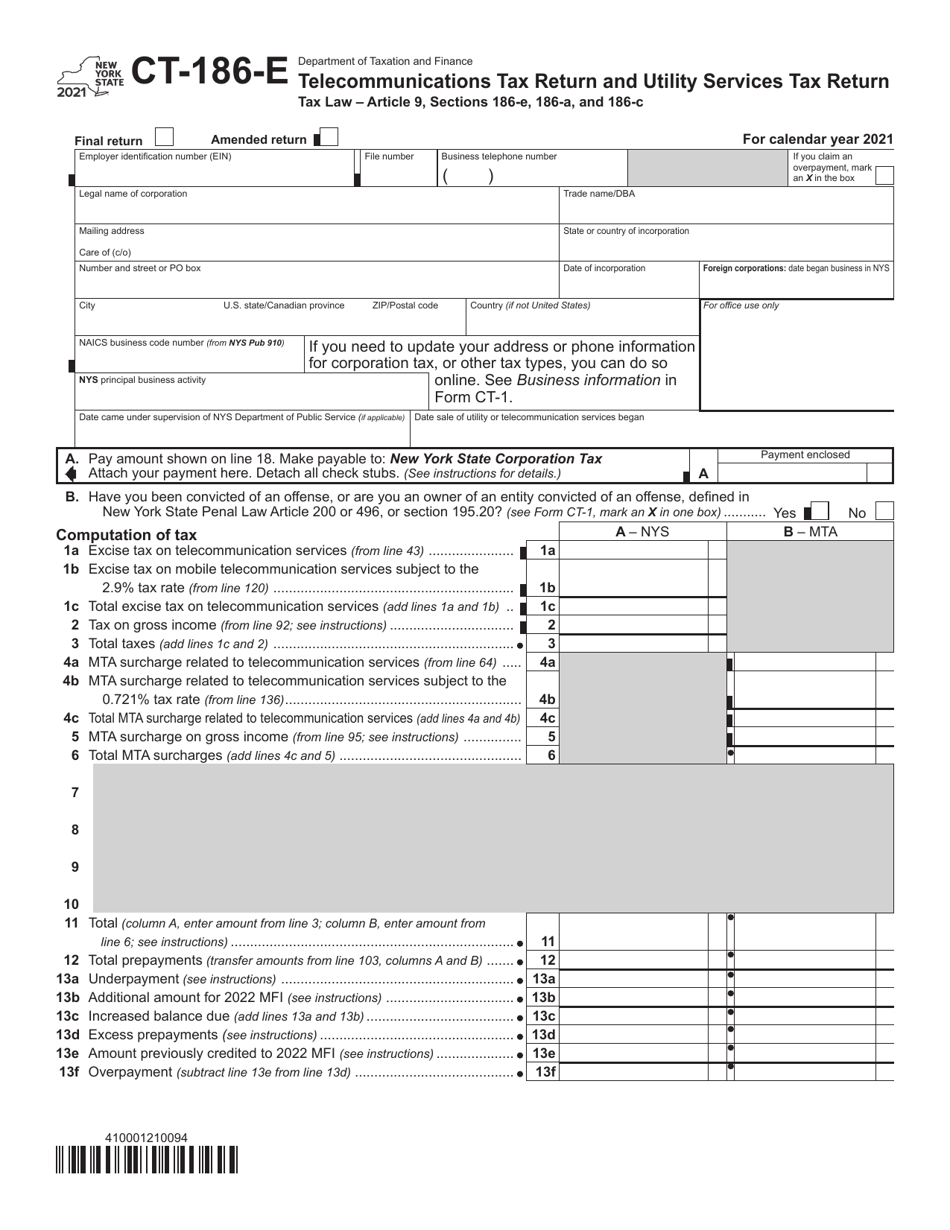

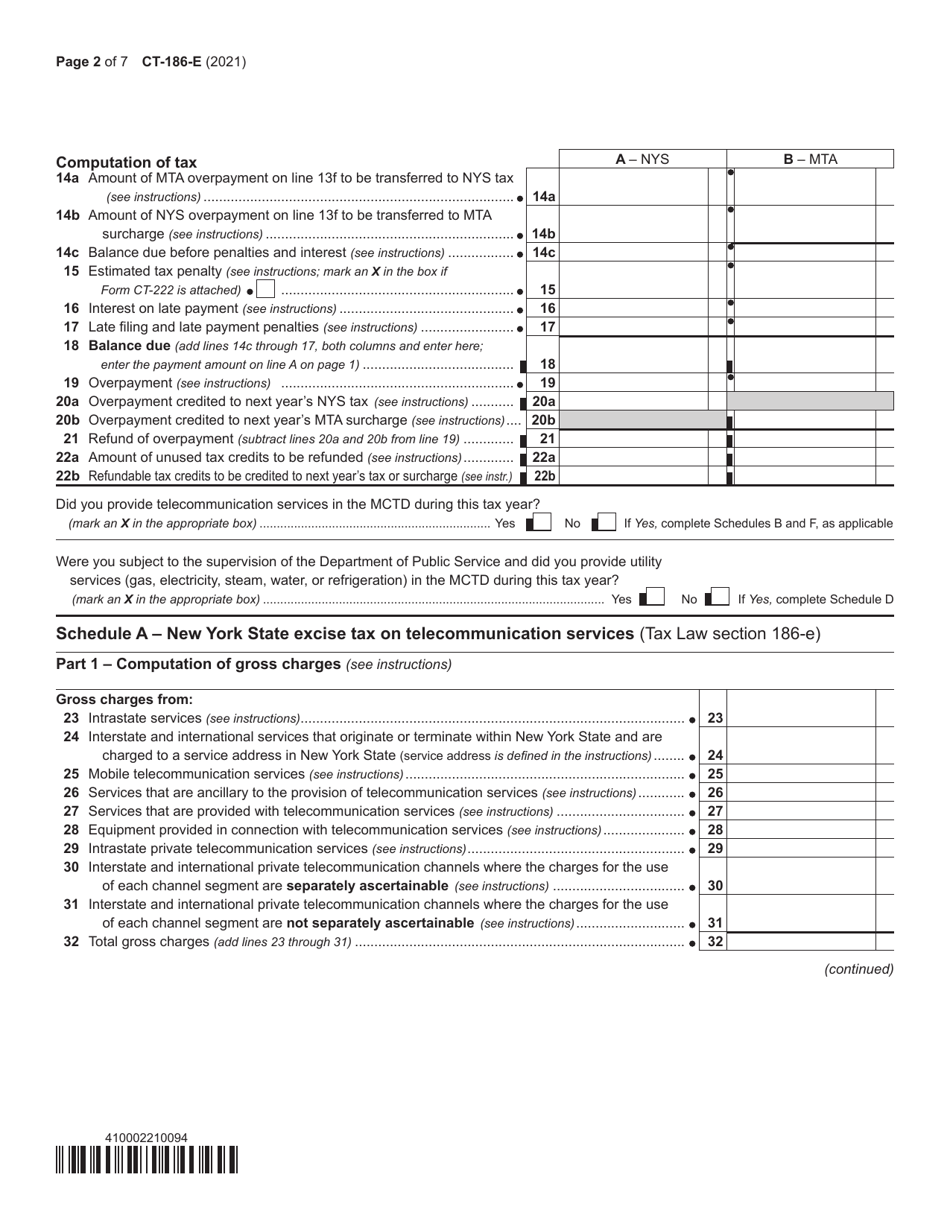

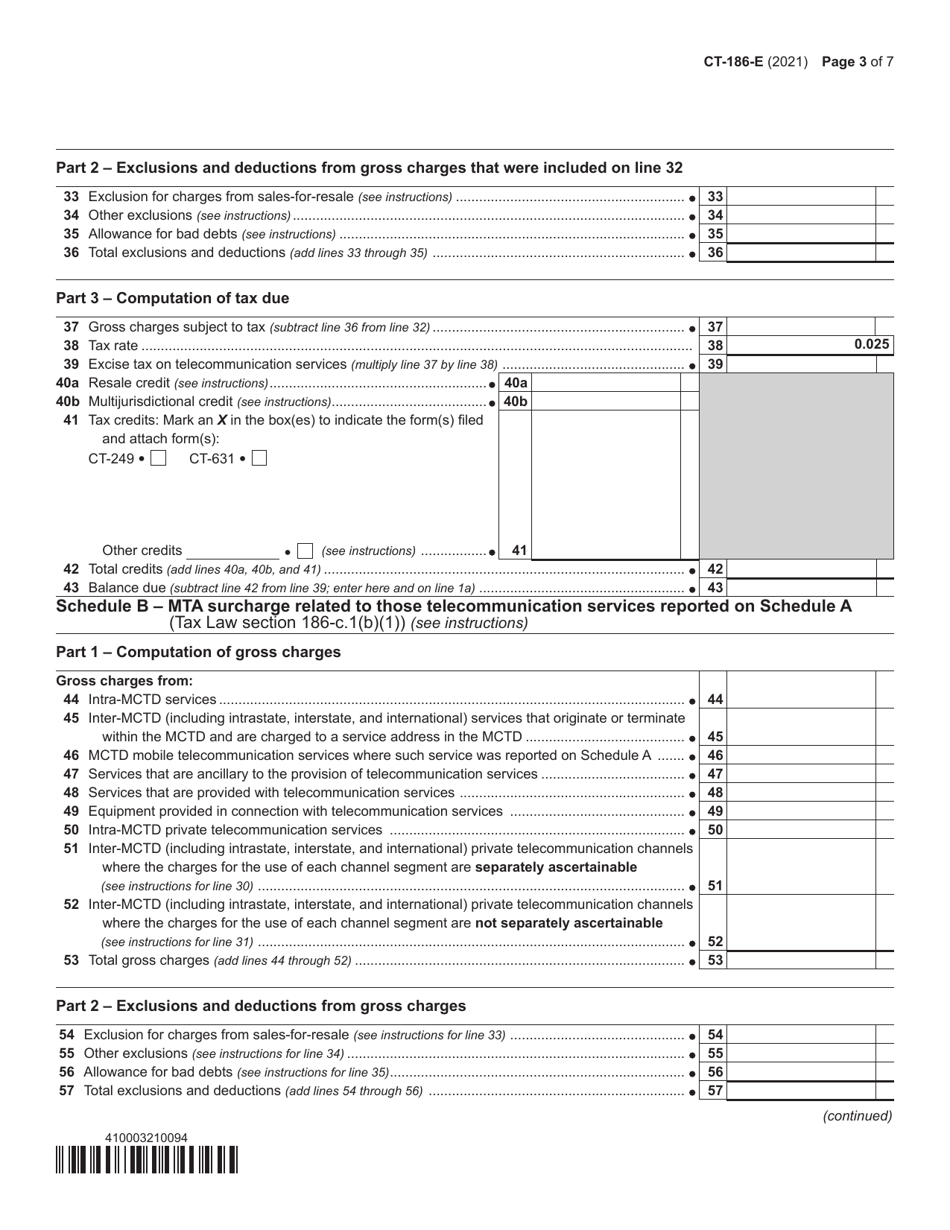

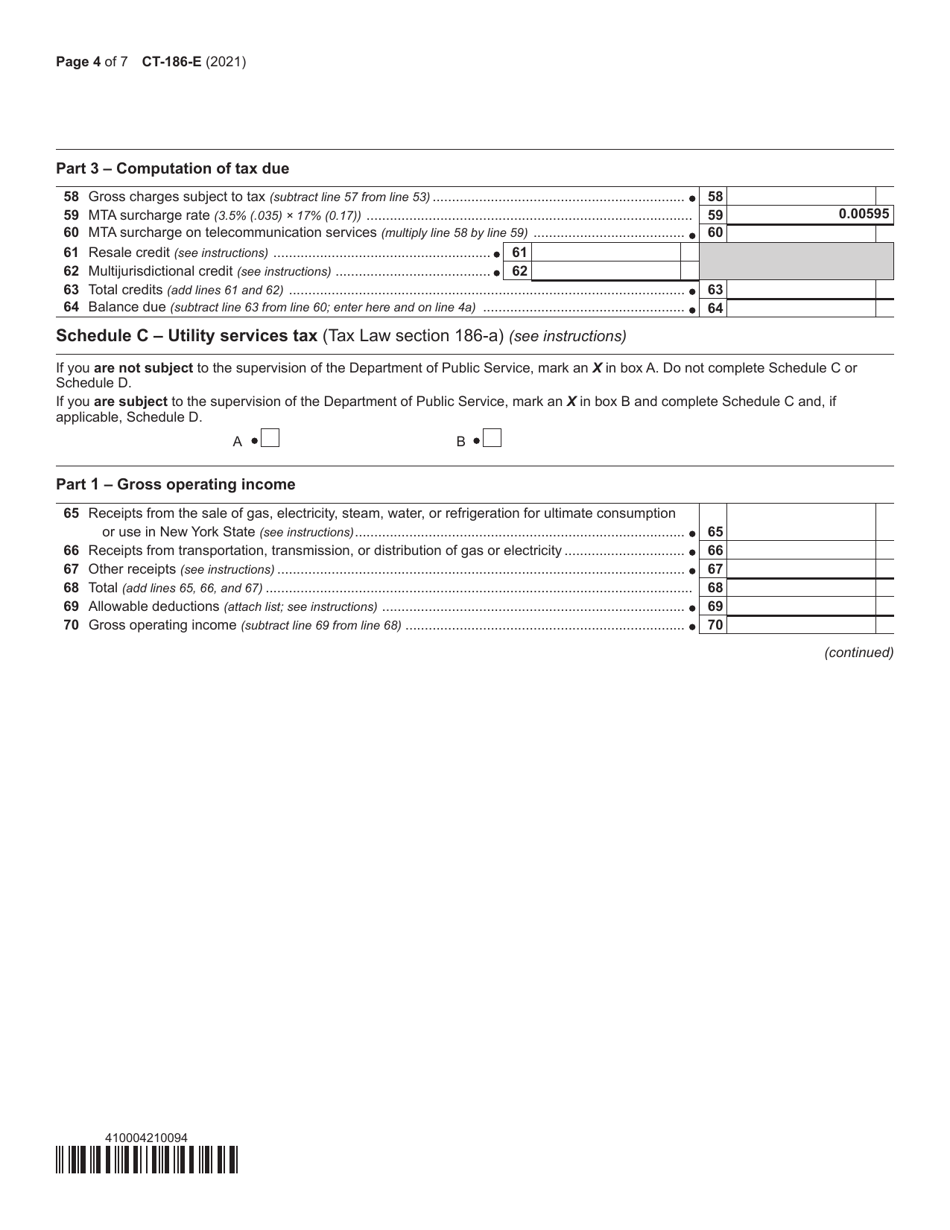

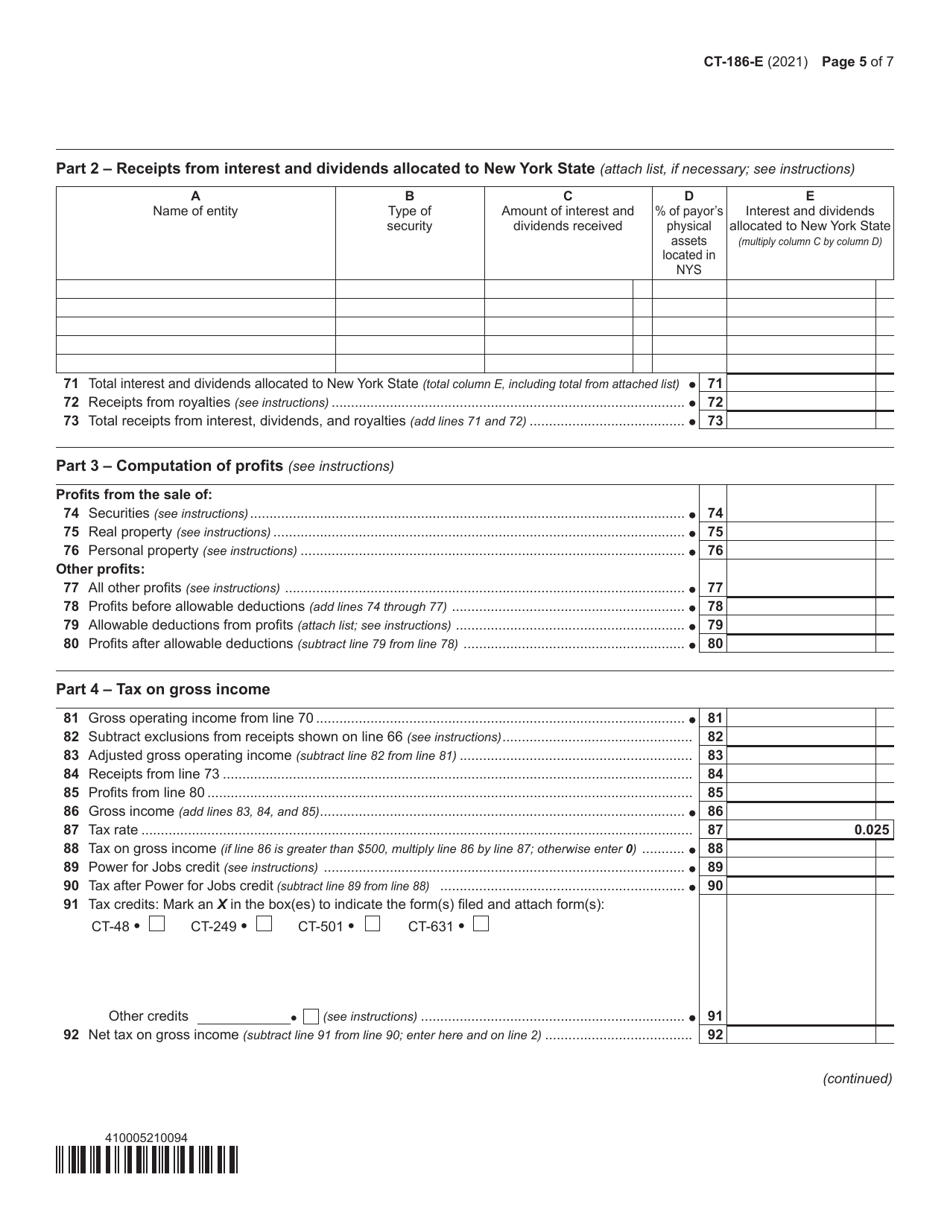

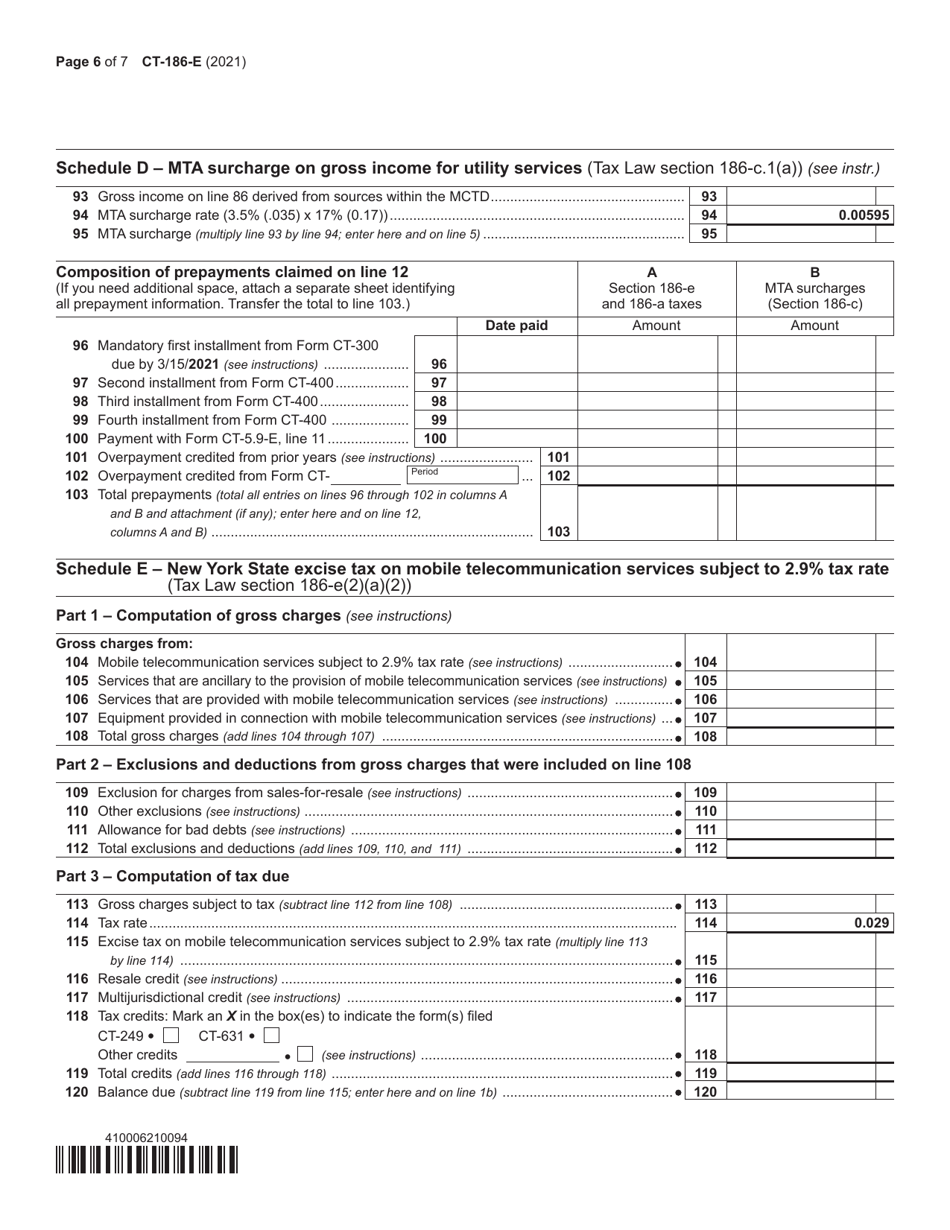

Form CT-186-E Telecommunications Tax Return and Utility Services Tax Return - New York

What Is Form CT-186-E?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-186-E?

A: Form CT-186-E is the Telecommunications Tax Return and Utility Services Tax Return in New York.

Q: Who needs to file Form CT-186-E?

A: Businesses engaged in the telecommunications industry or providing utility services in New York need to file Form CT-186-E.

Q: What is the purpose of Form CT-186-E?

A: The purpose of Form CT-186-E is to report and pay the telecommunications tax and utility services tax in New York.

Q: When is Form CT-186-E due?

A: Form CT-186-E is due on a quarterly basis, with specific due dates varying depending on the quarter.

Q: What information do I need to fill out Form CT-186-E?

A: You will need information about your business, gross receipts, and taxable receipts from telecommunications or utility services in New York.

Q: Are there any penalties for not filing Form CT-186-E?

A: Yes, failure to file Form CT-186-E or paying the taxes owed on time can result in penalties and interest being assessed.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-186-E by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.