This version of the form is not currently in use and is provided for reference only. Download this version of

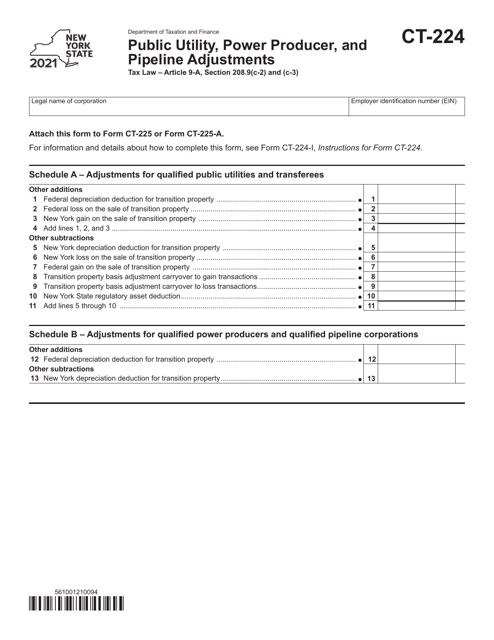

Form CT-224

for the current year.

Form CT-224 Public Utility, Power Producer, and Pipeline Adjustments - New York

What Is Form CT-224?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-224?

A: Form CT-224 is a tax form used by public utilities, power producers, and pipeline companies in the state of New York to report their adjustments for tax purposes.

Q: Who needs to file Form CT-224?

A: Public utilities, power producers, and pipeline companies operating in New York need to file Form CT-224.

Q: What information is required on Form CT-224?

A: Form CT-224 requires information about the company's income, deductions, adjustments, and tax liability.

Q: When is the due date for filing Form CT-224?

A: The due date for filing Form CT-224 is usually on or before March 15th of each year.

Q: Are there any penalties for late filing of Form CT-224?

A: Yes, there may be penalties for late filing of Form CT-224. It is important to file the form on time to avoid any penalties or interest charges.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-224 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.