This version of the form is not currently in use and is provided for reference only. Download this version of

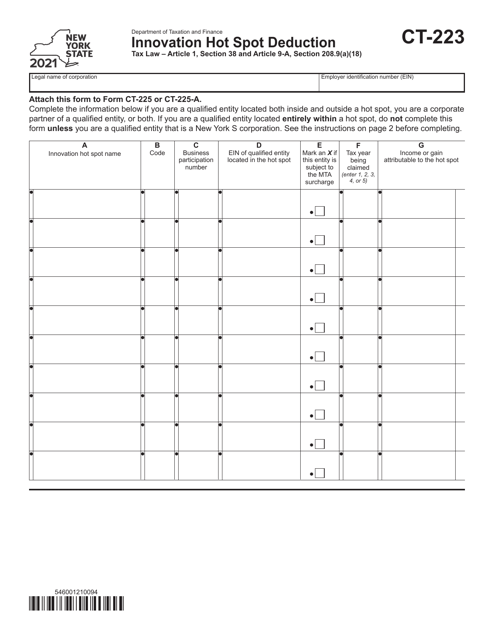

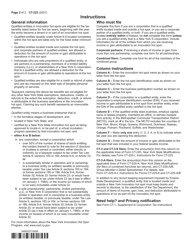

Form CT-223

for the current year.

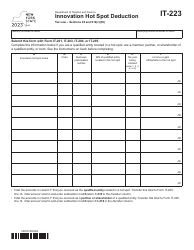

Form CT-223 Innovation Hot Spot Deduction - New York

What Is Form CT-223?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-223?

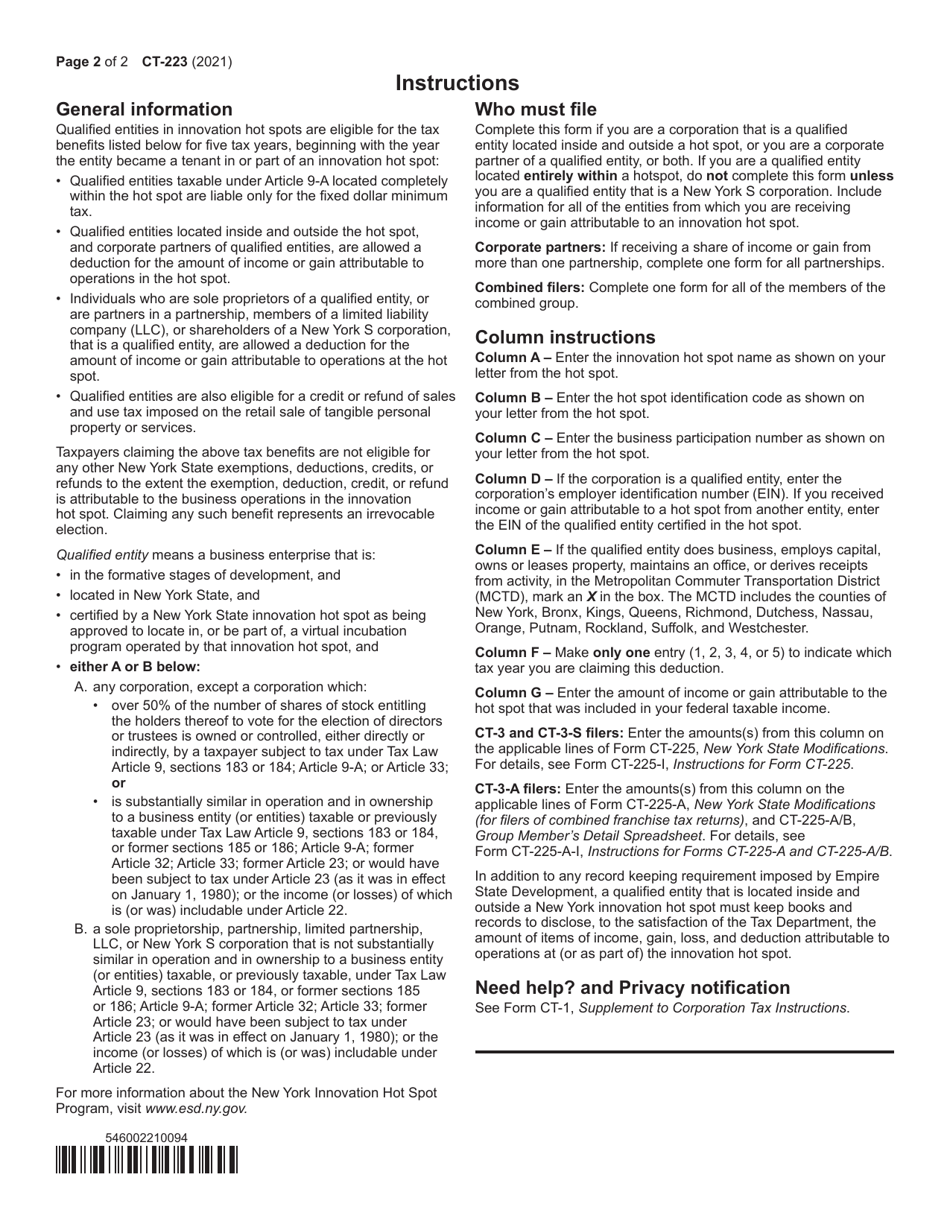

A: Form CT-223 is a tax form used in New York to claim the Innovation Hot Spot Deduction.

Q: What is the Innovation Hot Spot Deduction?

A: The Innovation Hot Spot Deduction is a tax incentive in New York that encourages businesses to locate or expand in designated areas.

Q: Who is eligible for the Innovation Hot Spot Deduction?

A: Businesses that are located in or expand into designated innovation hot spots in New York are eligible for the deduction.

Q: How do I claim the Innovation Hot Spot Deduction?

A: To claim the Innovation Hot Spot Deduction, you need to fill out and submit Form CT-223 with your tax return in New York.

Q: What are the benefits of the Innovation Hot Spot Deduction?

A: The Innovation Hot Spot Deduction provides businesses with a tax credit equal to the sum of base employment, new employment, and capital investment components.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-223 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.