This version of the form is not currently in use and is provided for reference only. Download this version of

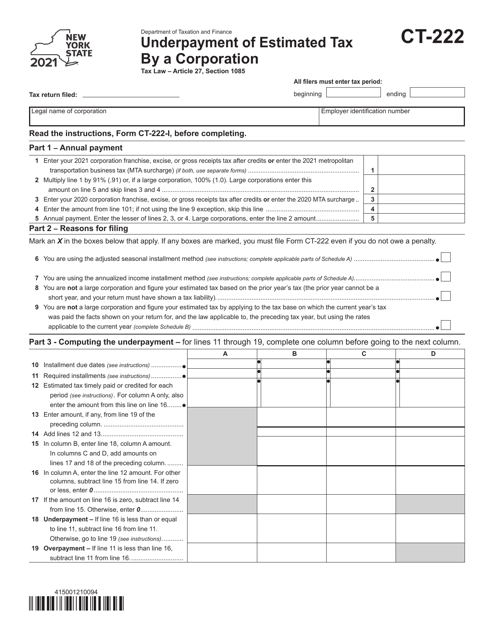

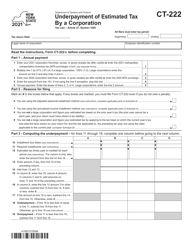

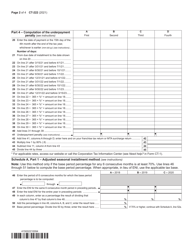

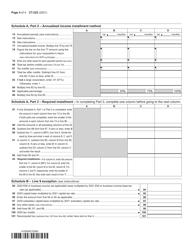

Form CT-222

for the current year.

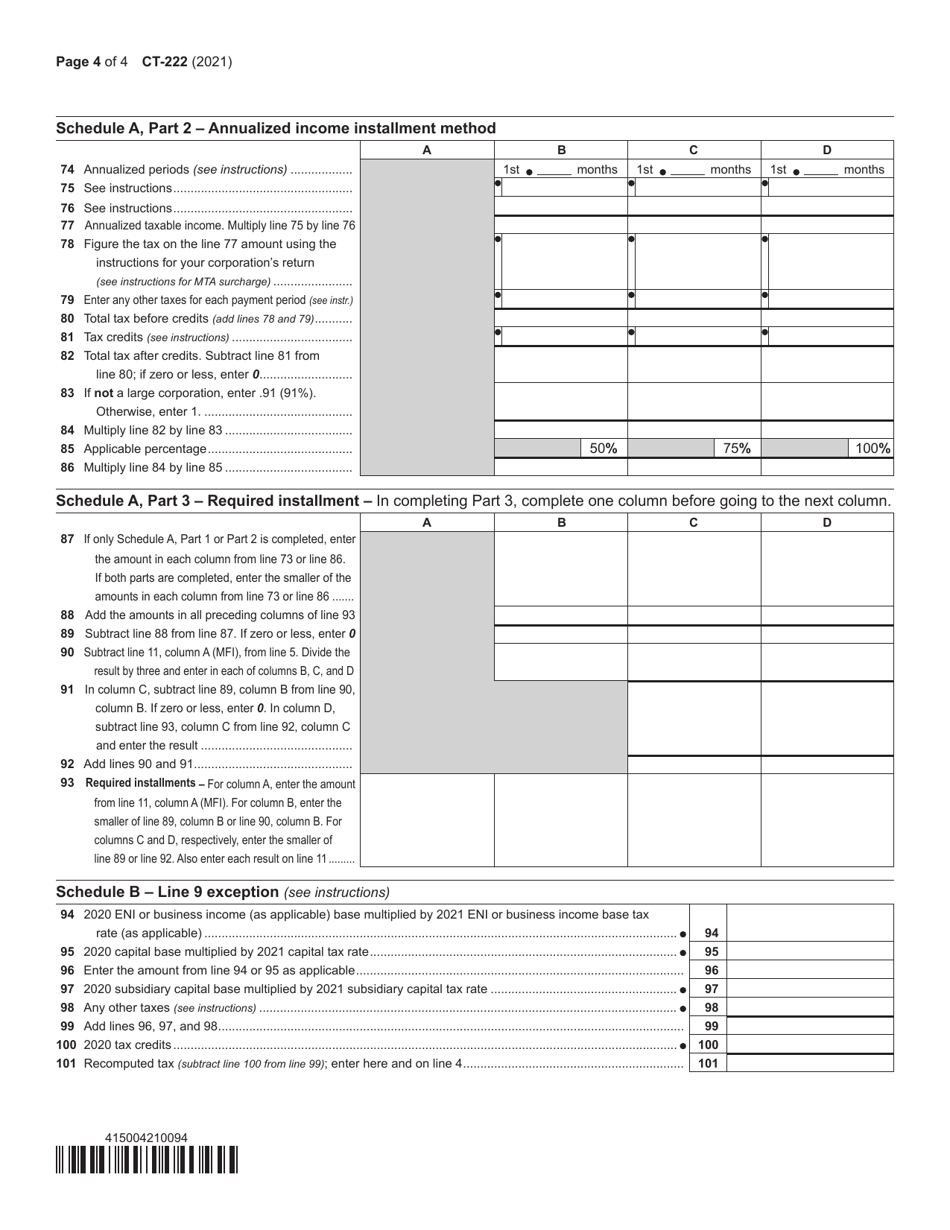

Form CT-222 Underpayment of Estimated Tax by a Corporation - New York

What Is Form CT-222?

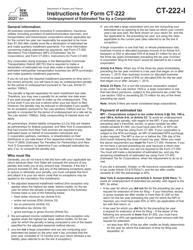

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-222?

A: Form CT-222 is a tax form used by corporations in New York to calculate underpayment of estimated tax.

Q: Who needs to file Form CT-222?

A: Corporations in New York that have underpaid estimated taxes are required to file Form CT-222.

Q: What is the purpose of Form CT-222?

A: The purpose of Form CT-222 is to calculate and report the underpayment of estimated tax by a corporation in New York.

Q: When is Form CT-222 due?

A: Form CT-222 is typically due on the same day as the corporation's annual tax return, which is generally March 15th.

Q: What should I do if I underpaid estimated tax as a corporation in New York?

A: If you underpaid estimated tax as a corporation in New York, you should complete and file Form CT-222 to calculate and report the underpayment.

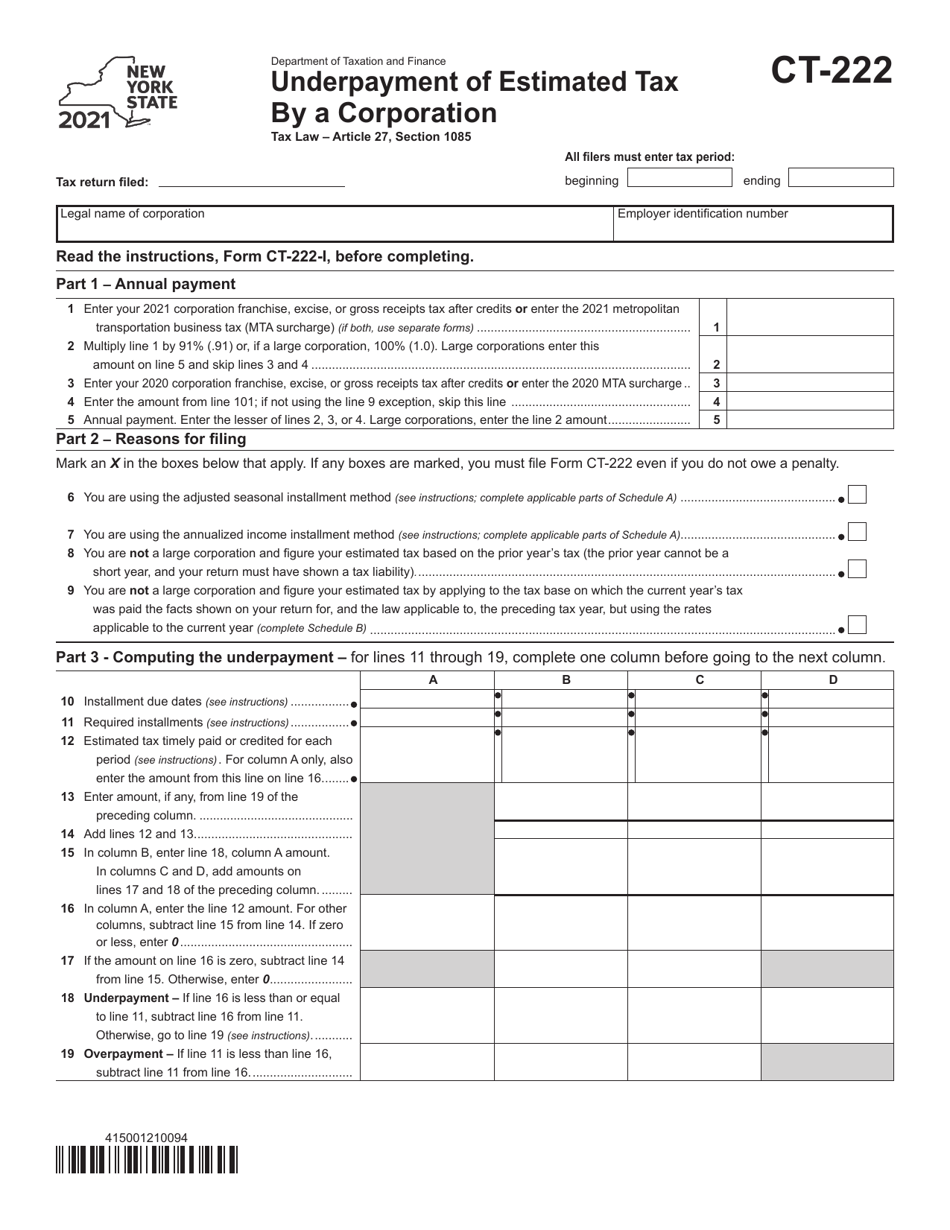

Q: Are there any penalties for underpayment of estimated tax by a corporation in New York?

A: Yes, there may be penalties for underpayment of estimated tax by a corporation in New York. The penalties vary depending on the amount of underpayment and the circumstances.

Q: Is there any additional documentation required when filing Form CT-222?

A: Yes, you may need to provide supporting documentation such as payment vouchers or proof of estimated tax payments made.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-222 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.