This version of the form is not currently in use and is provided for reference only. Download this version of

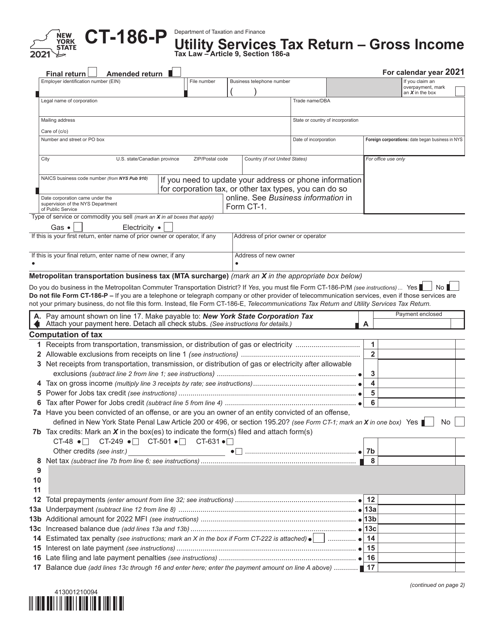

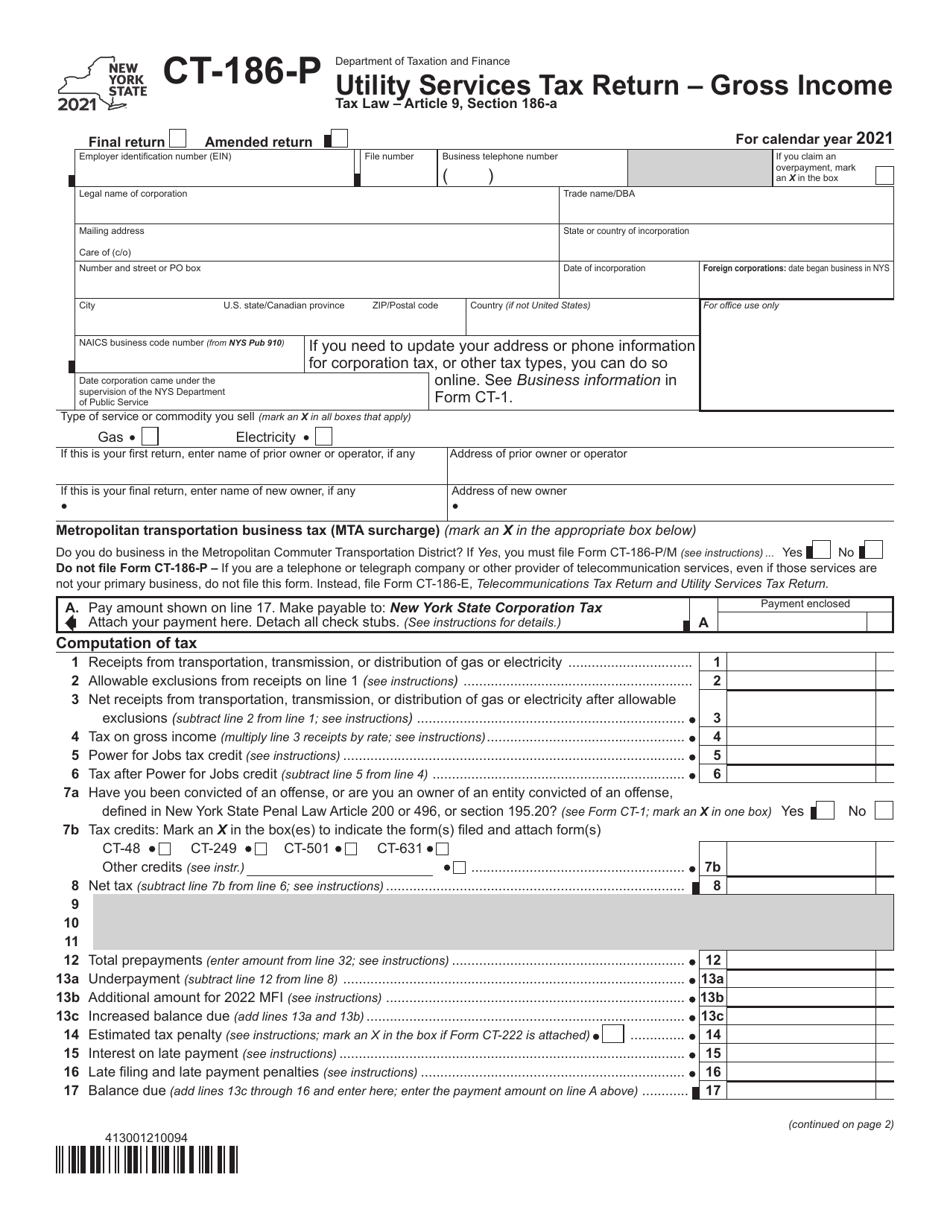

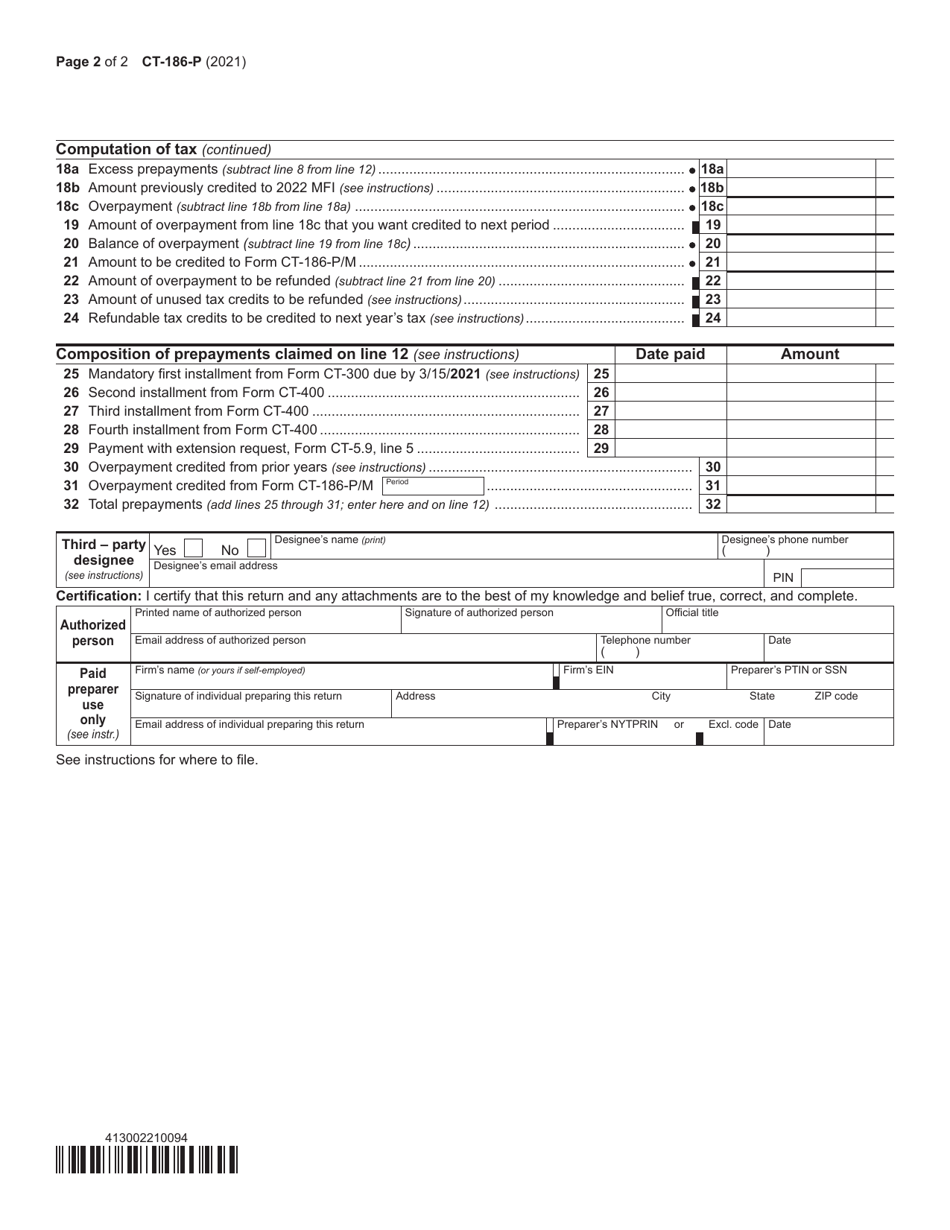

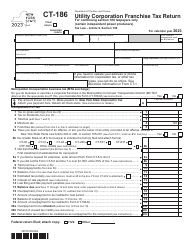

Form CT-186-P

for the current year.

Form CT-186-P Utility Services Tax Return - Gross Income - New York

What Is Form CT-186-P?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-186-P?

A: Form CT-186-P is a tax return form for reporting gross income from utility services in New York.

Q: Who needs to file Form CT-186-P?

A: Businesses and individuals who provide utility services in New York need to file Form CT-186-P.

Q: What is considered gross income from utility services?

A: Gross income from utility services includes all income received from providing services such as electricity, water, gas, and telecommunications.

Q: When is Form CT-186-P due?

A: Form CT-186-P is generally due on the 20th day of the month following the end of the reporting period.

Q: What happens if I don't file Form CT-186-P?

A: Failure to file Form CT-186-P or filing it late may result in penalties and interest charges.

Q: Are there any exemptions to the utility services tax?

A: Yes, there are certain exemptions available for specific types of utility services. You should consult the instructions for Form CT-186-P or contact the New York State Department of Taxation and Finance for more information.

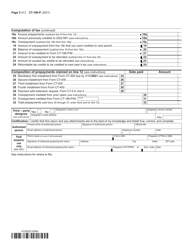

Q: Can I amend a filed Form CT-186-P?

A: Yes, you can file an amended Form CT-186-P to correct any errors or omissions in a previously filed return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-186-P by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.