This version of the form is not currently in use and is provided for reference only. Download this version of

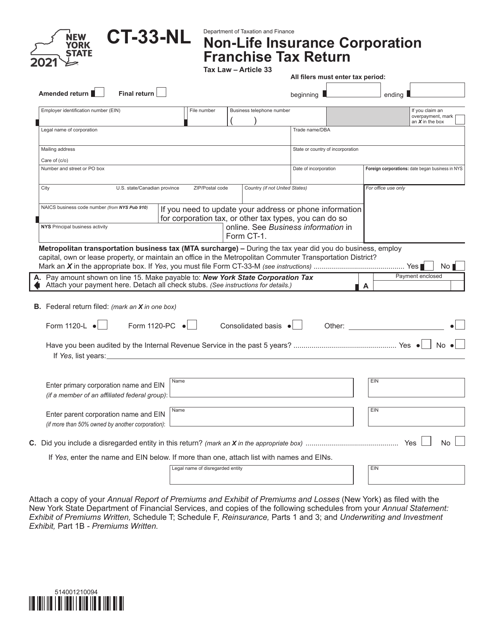

Form CT-33-NL

for the current year.

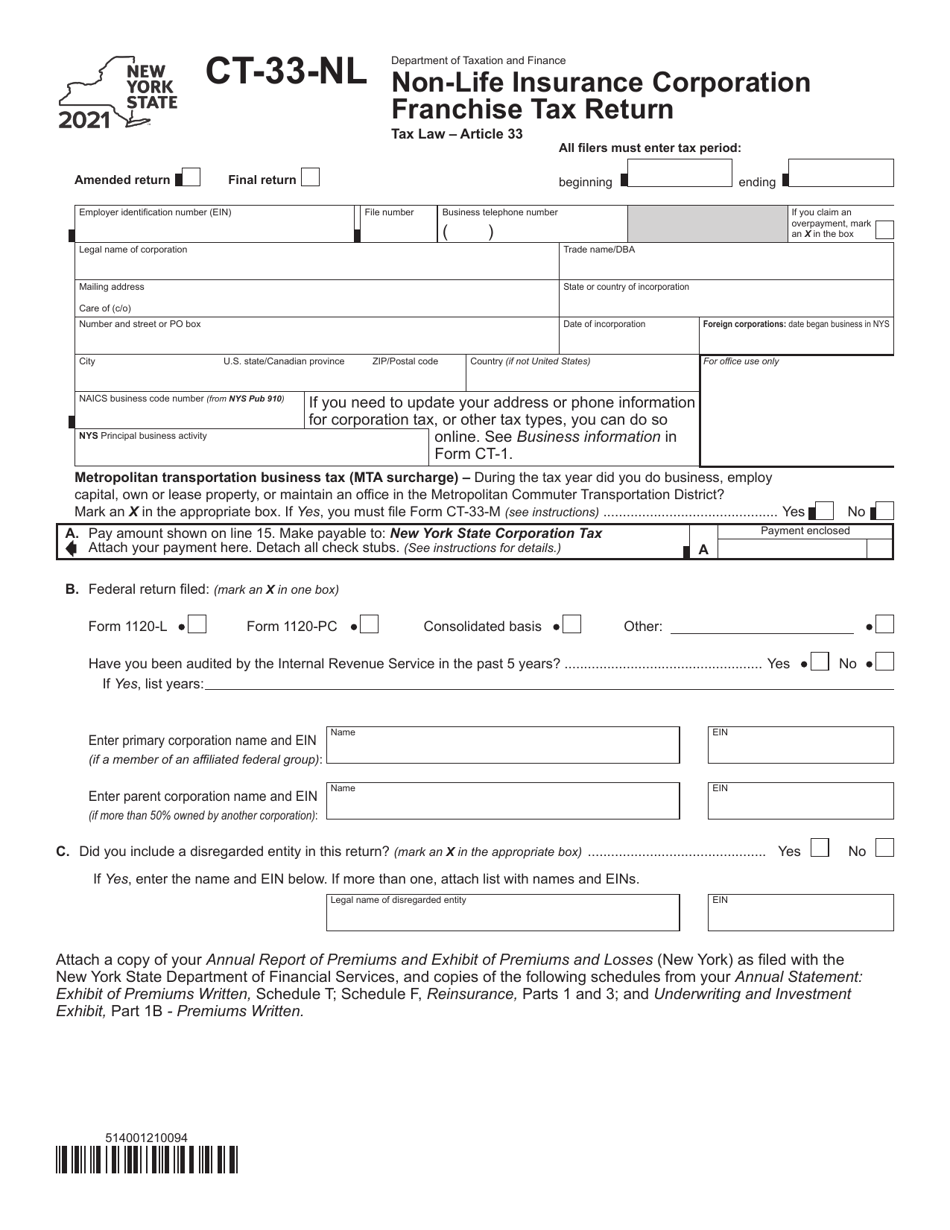

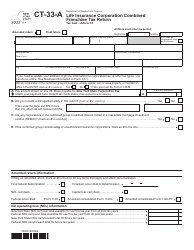

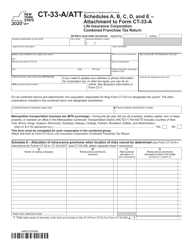

Form CT-33-NL Non-life Insurance Corporation Franchise Tax Return - New York

What Is Form CT-33-NL?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-33-NL?

A: Form CT-33-NL is the Non-life Insurance CorporationFranchise Tax Return for New York.

Q: Who needs to file Form CT-33-NL?

A: Non-life insurance corporations operating in New York need to file Form CT-33-NL.

Q: What is the purpose of Form CT-33-NL?

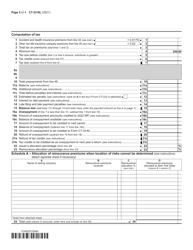

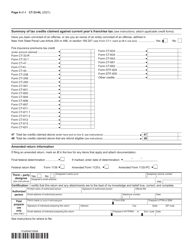

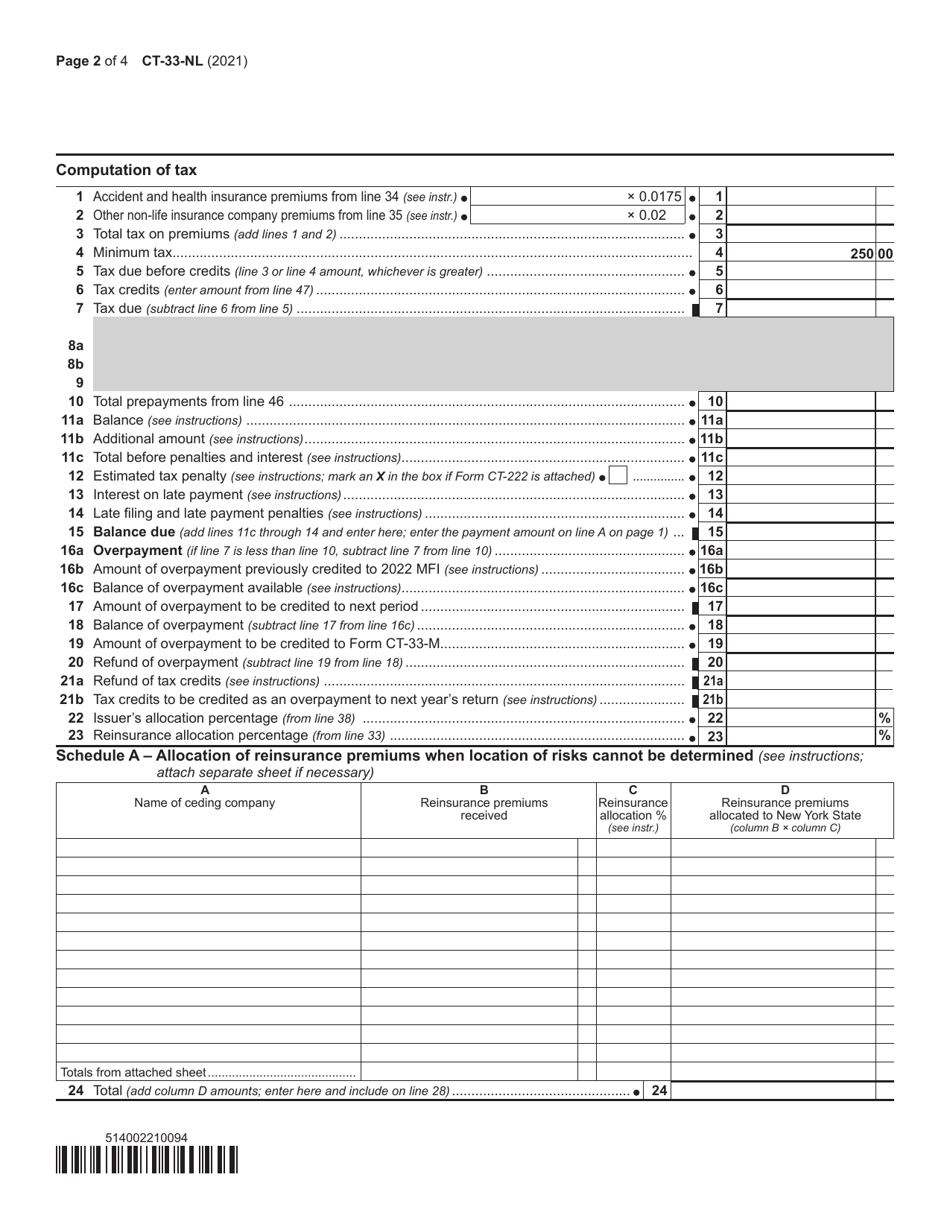

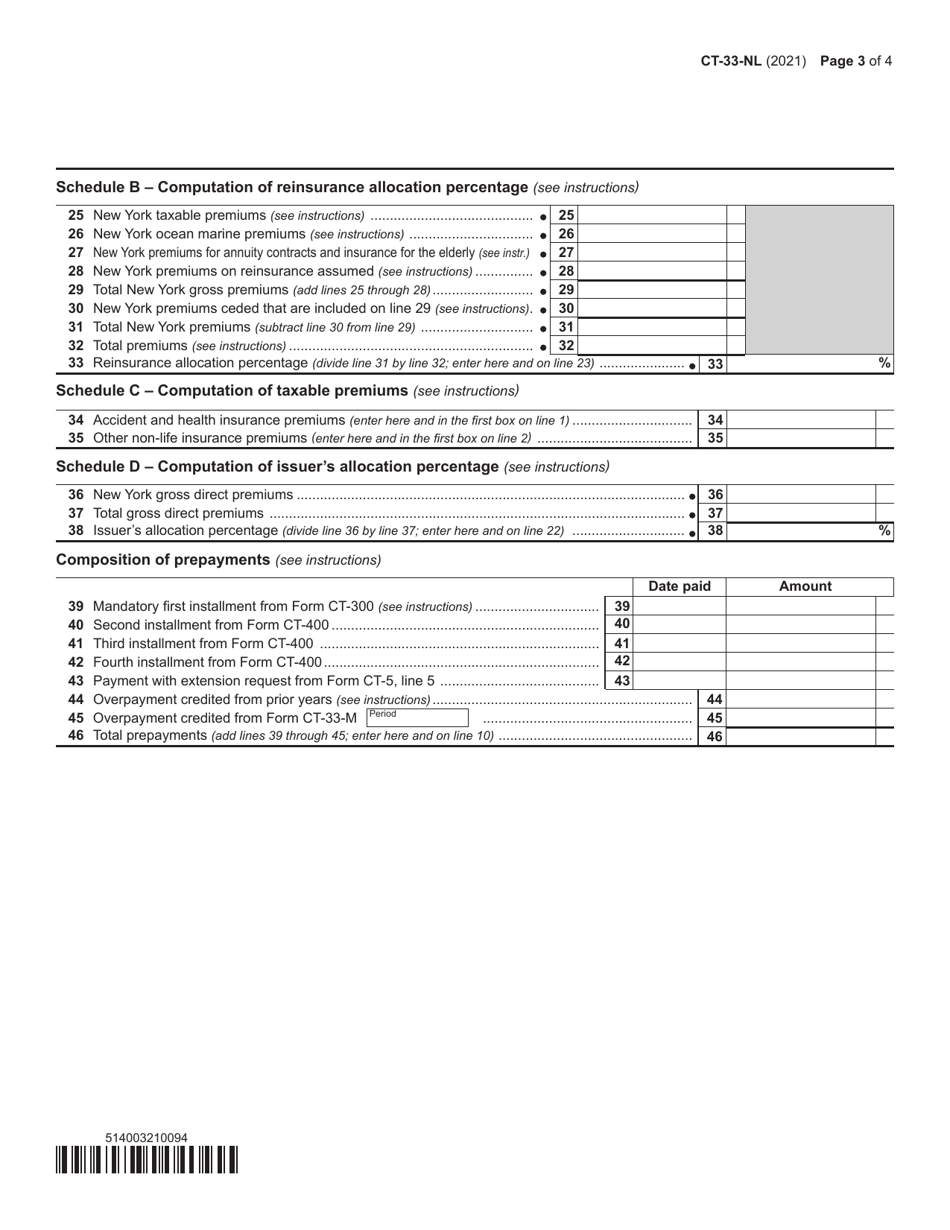

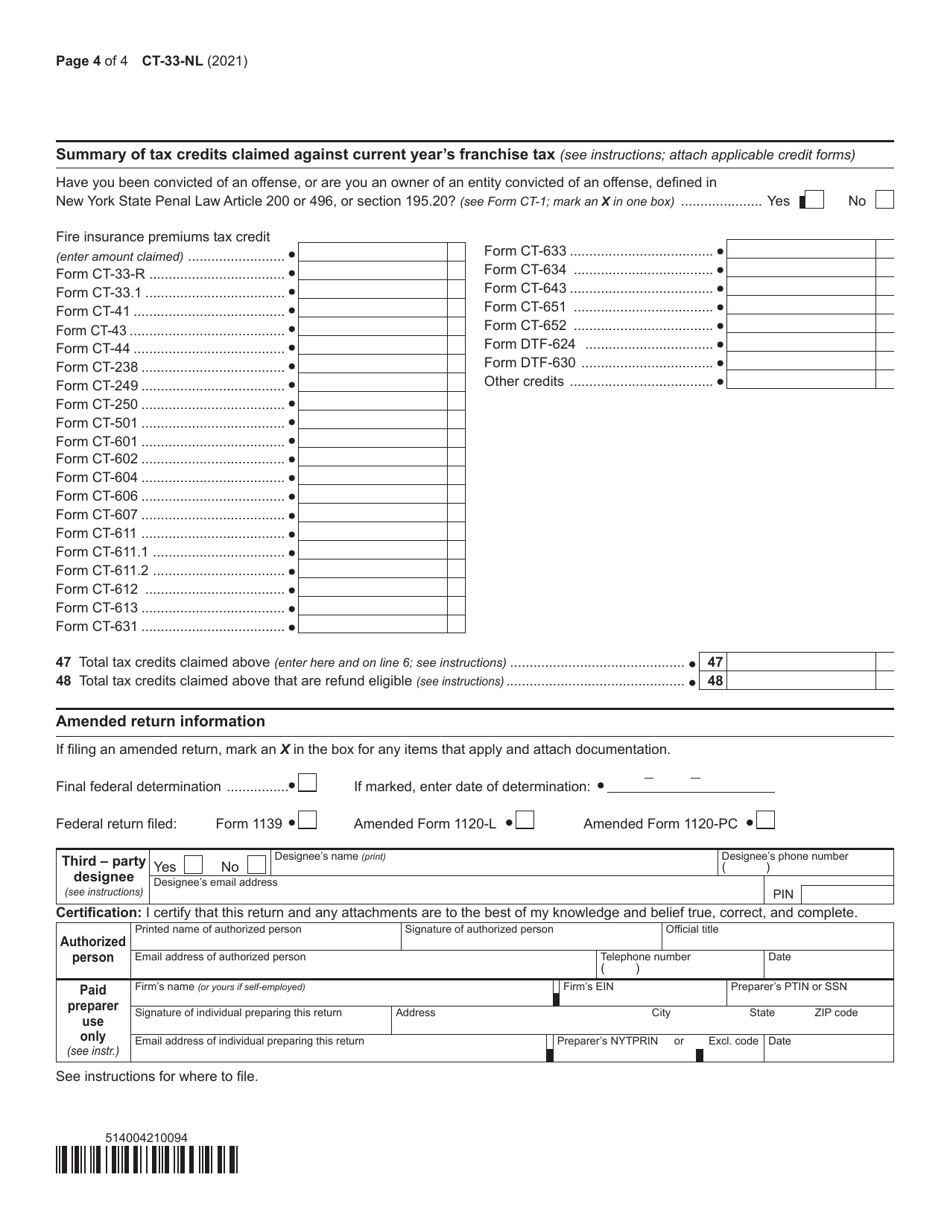

A: Form CT-33-NL is used to calculate and report the franchise tax owed by non-life insurance corporations in New York.

Q: When is Form CT-33-NL due?

A: Form CT-33-NL is generally due on or before March 15th of each year.

Q: How can Form CT-33-NL be filed?

A: Form CT-33-NL can be filed electronically or by mail.

Q: Is there a minimum tax requirement for non-life insurance corporations in New York?

A: Yes, non-life insurance corporations in New York must pay a minimum franchise tax of $350.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-33-NL by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.