This version of the form is not currently in use and is provided for reference only. Download this version of

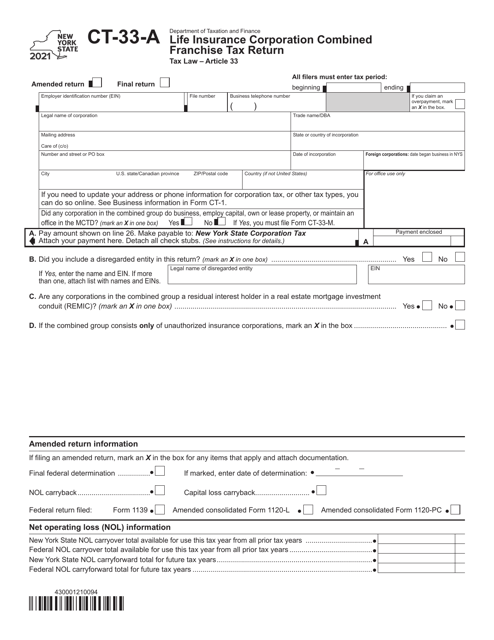

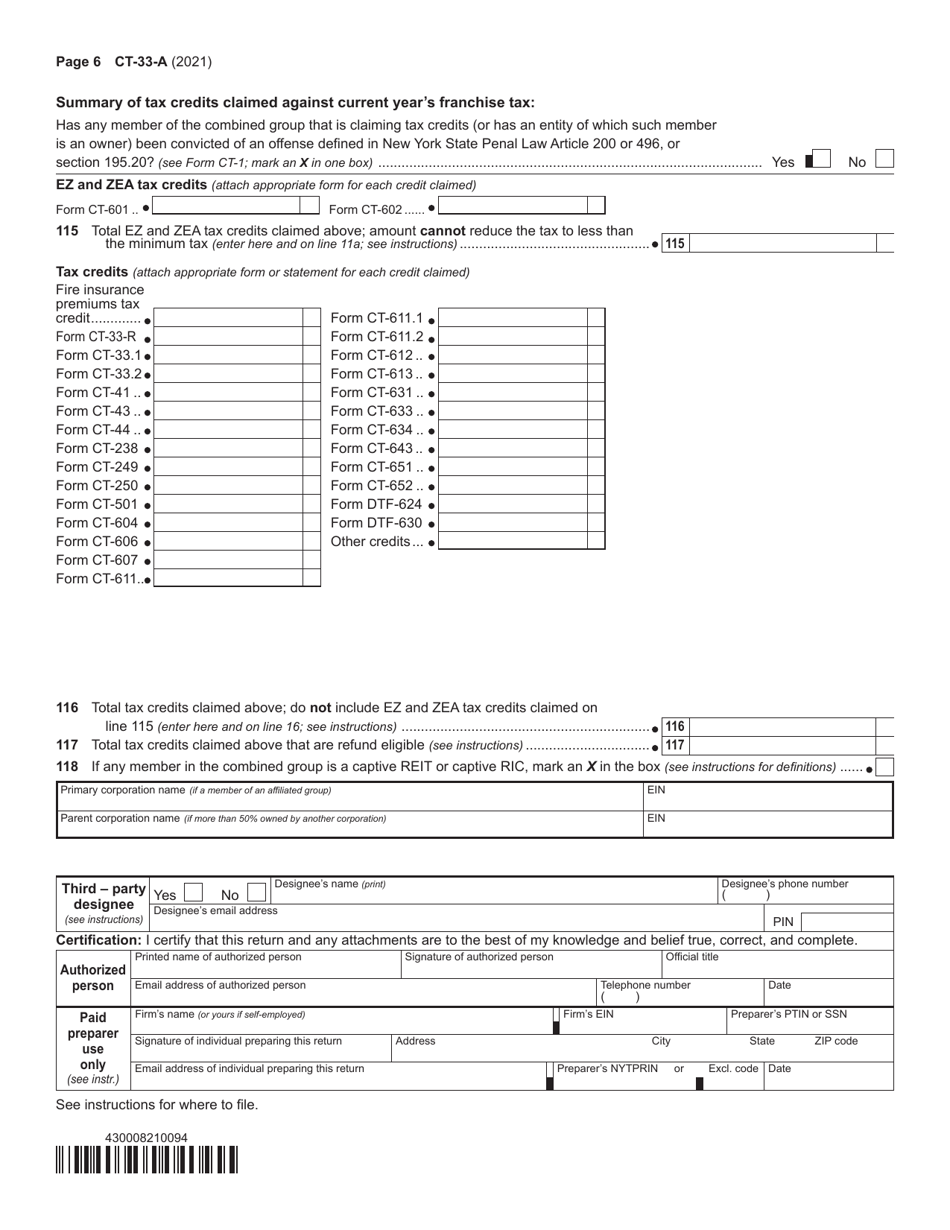

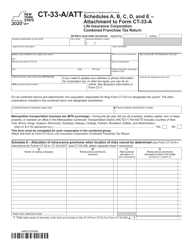

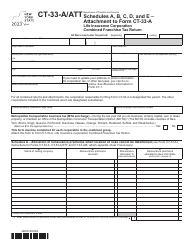

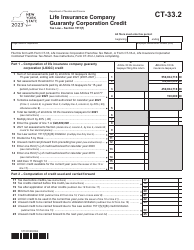

Form CT-33-A

for the current year.

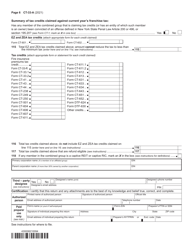

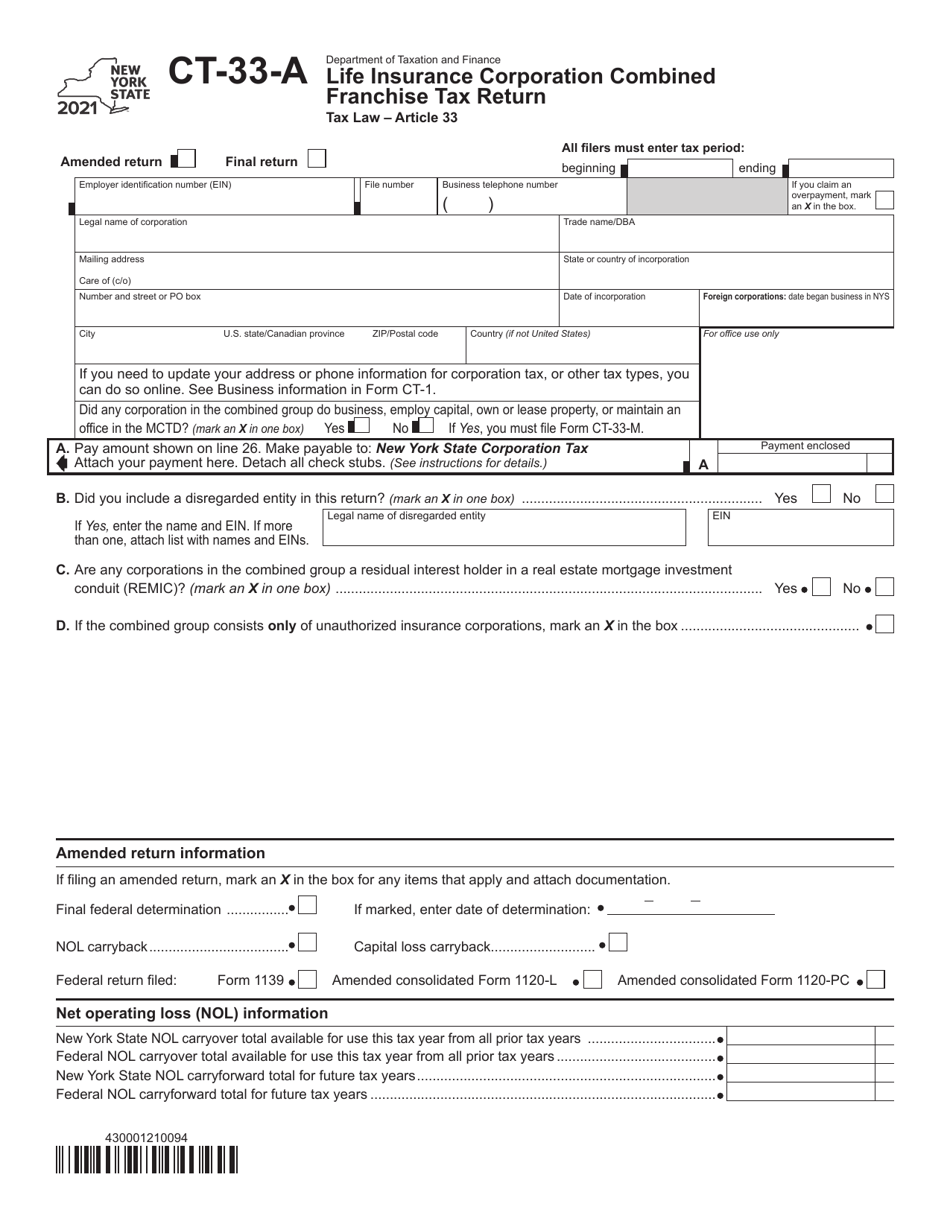

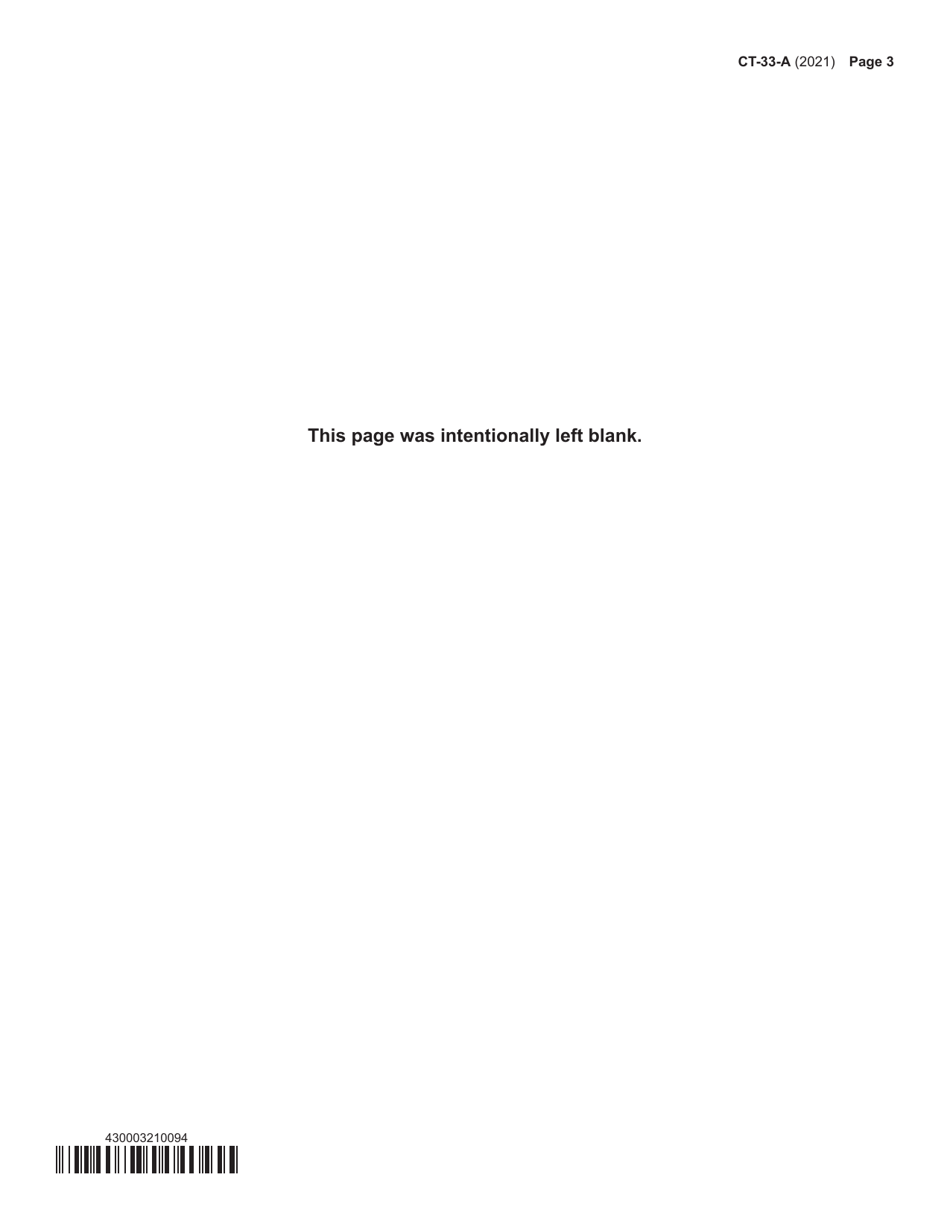

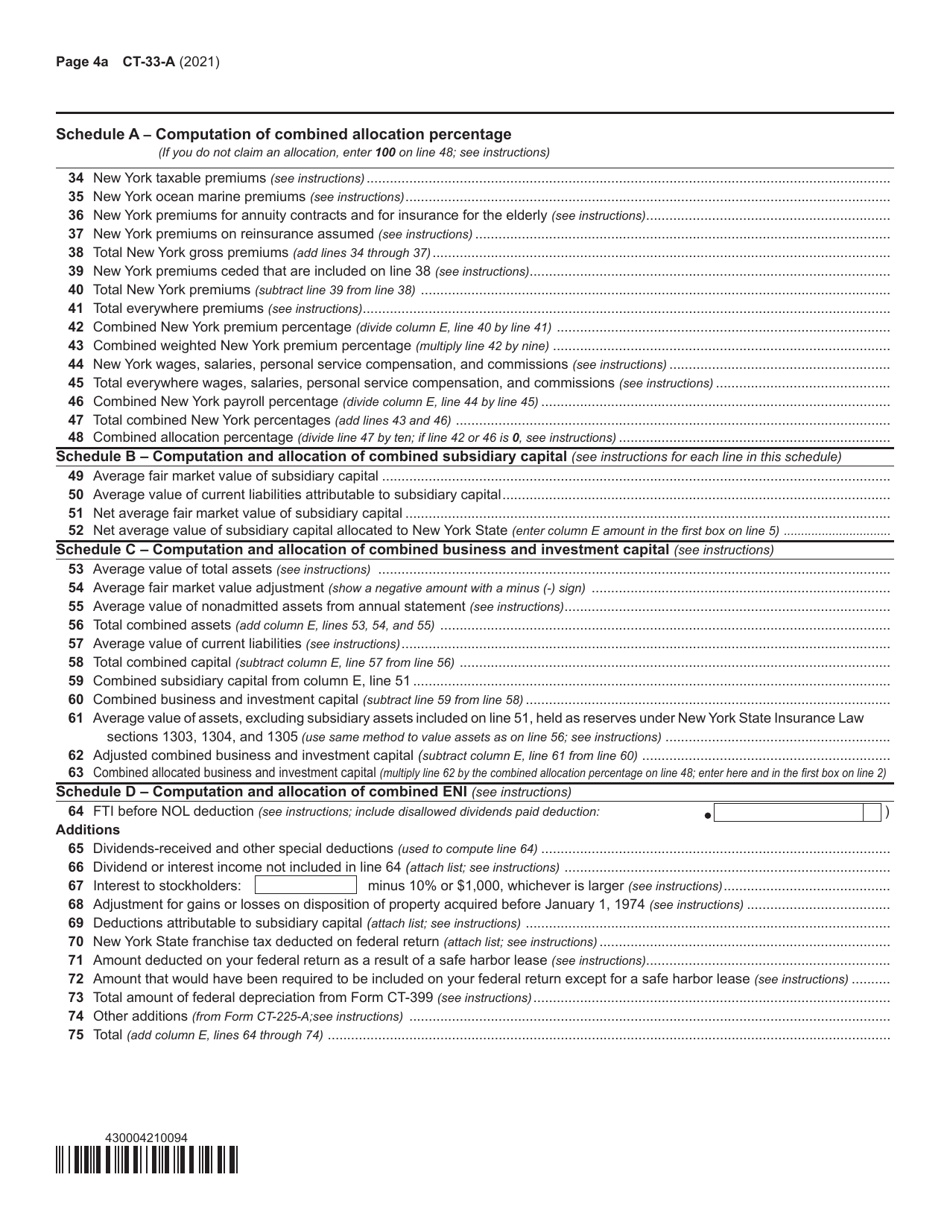

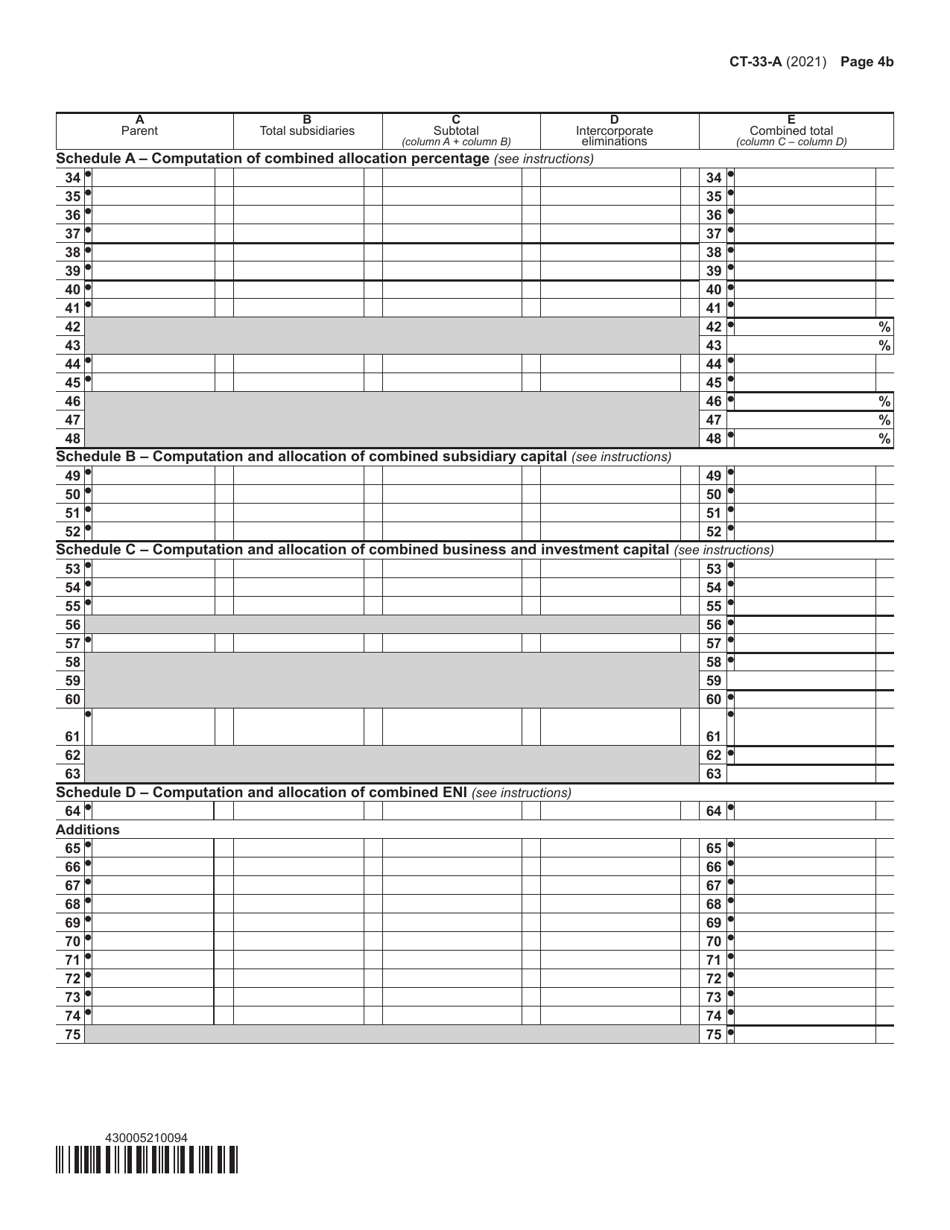

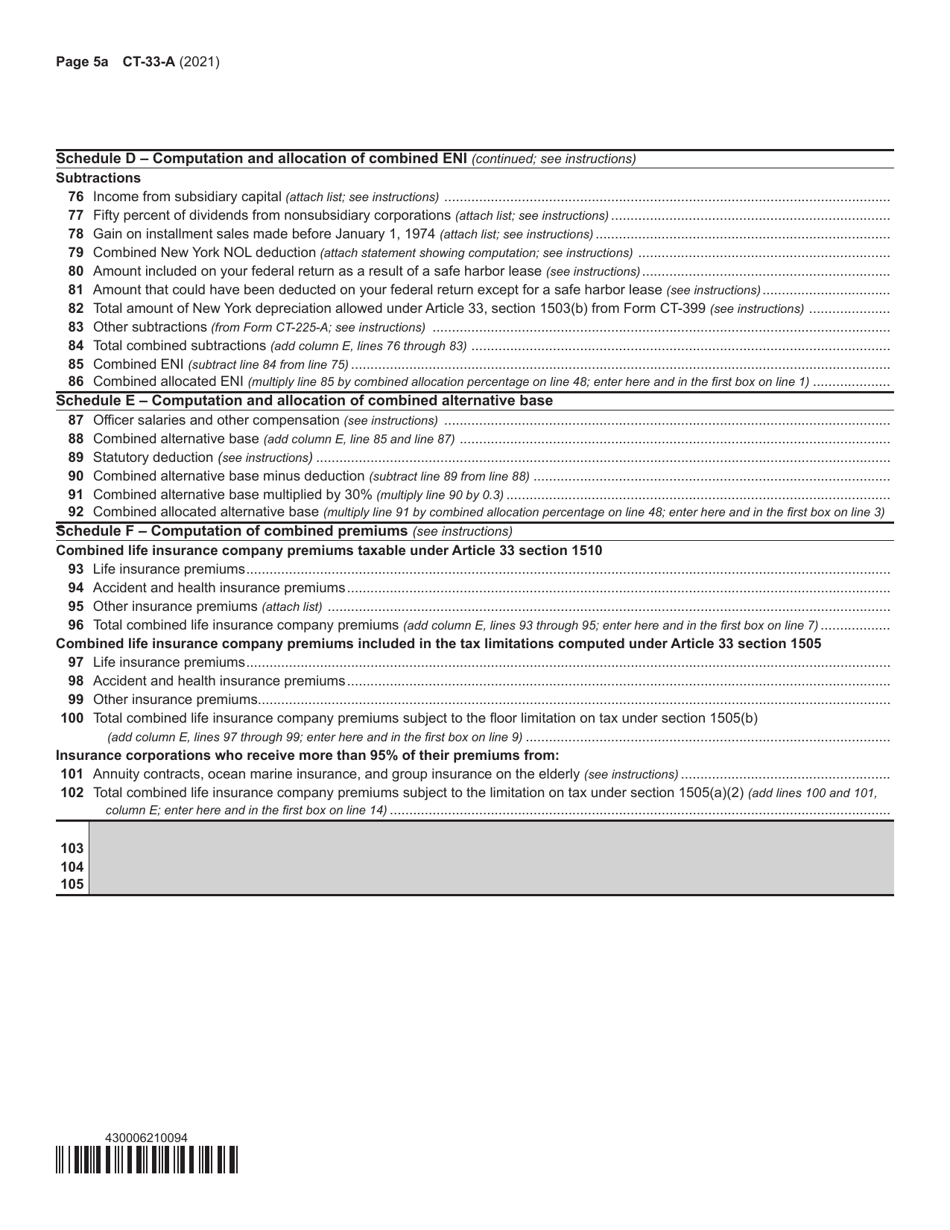

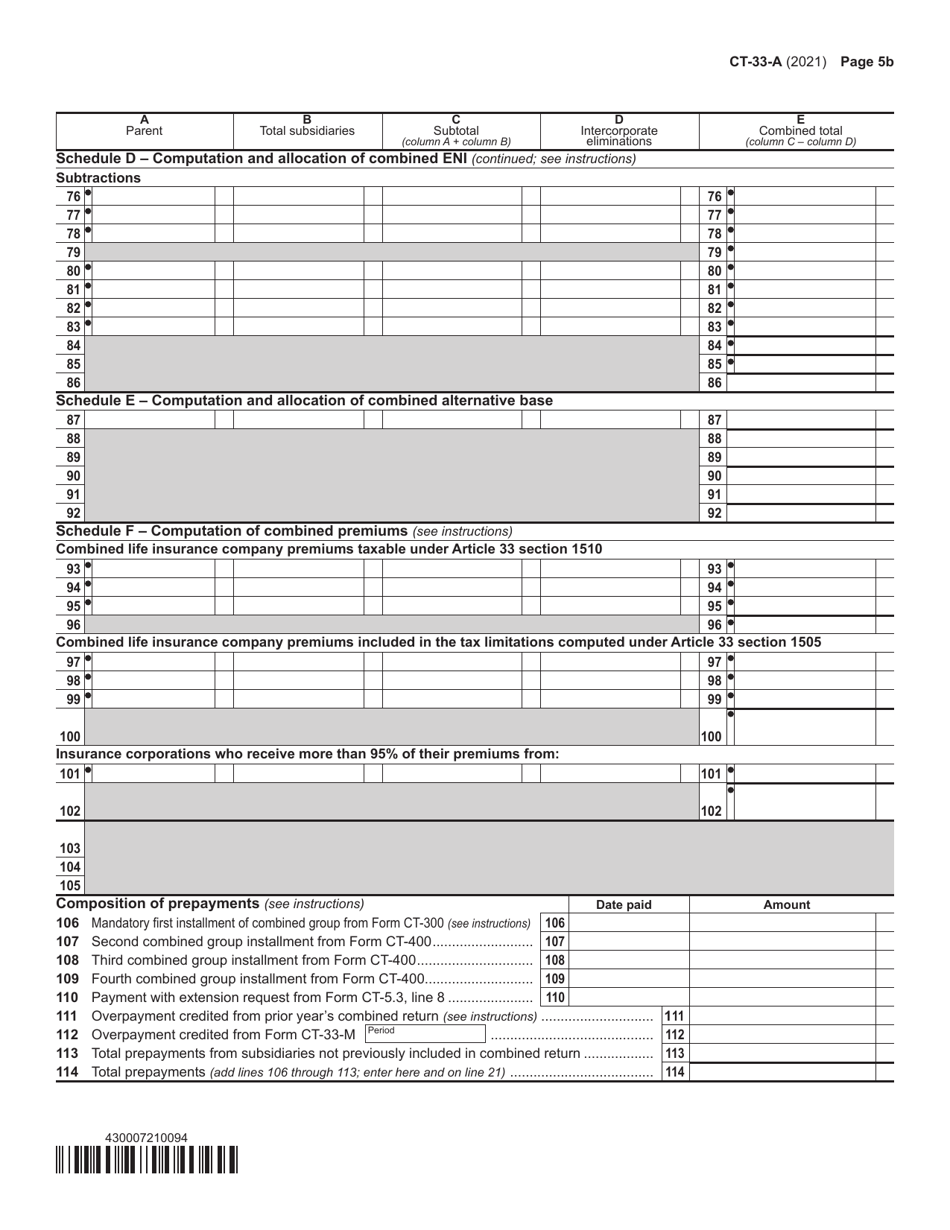

Form CT-33-A Life Insurance Corporation Combined Franchise Tax Return - New York

What Is Form CT-33-A?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-33-A?

A: Form CT-33-A is the Life Insurance Corporation Combined Franchise Tax Return for New York.

Q: Who needs to file Form CT-33-A?

A: Life insurance corporations in New York need to file Form CT-33-A.

Q: What is the purpose of Form CT-33-A?

A: Form CT-33-A is used to calculate and report the franchise tax liability for life insurance corporations in New York.

Q: Is Form CT-33-A only for corporations located in New York?

A: Yes, Form CT-33-A is specifically for life insurance corporations that operate in New York.

Q: When is the deadline to file Form CT-33-A?

A: The deadline to file Form CT-33-A is on or before the fifteenth day of the fourth month following the close of the tax year.

Q: Are there any penalties for late filing of Form CT-33-A?

A: Yes, there are penalties for late filing of Form CT-33-A. It is important to file the form on time to avoid these penalties.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-33-A by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.