This version of the form is not currently in use and is provided for reference only. Download this version of

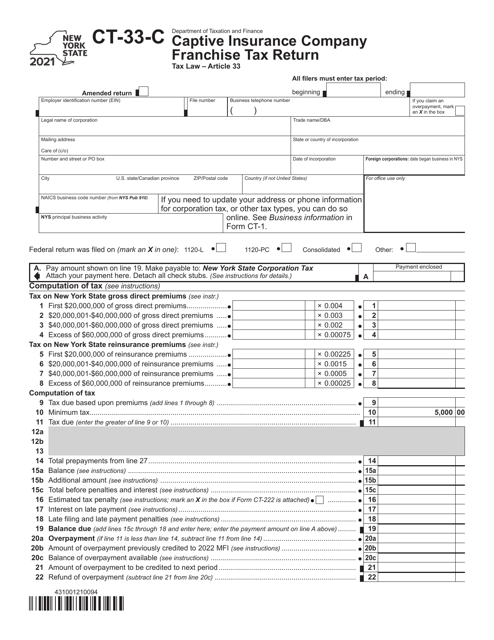

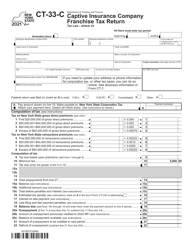

Form CT-33-C

for the current year.

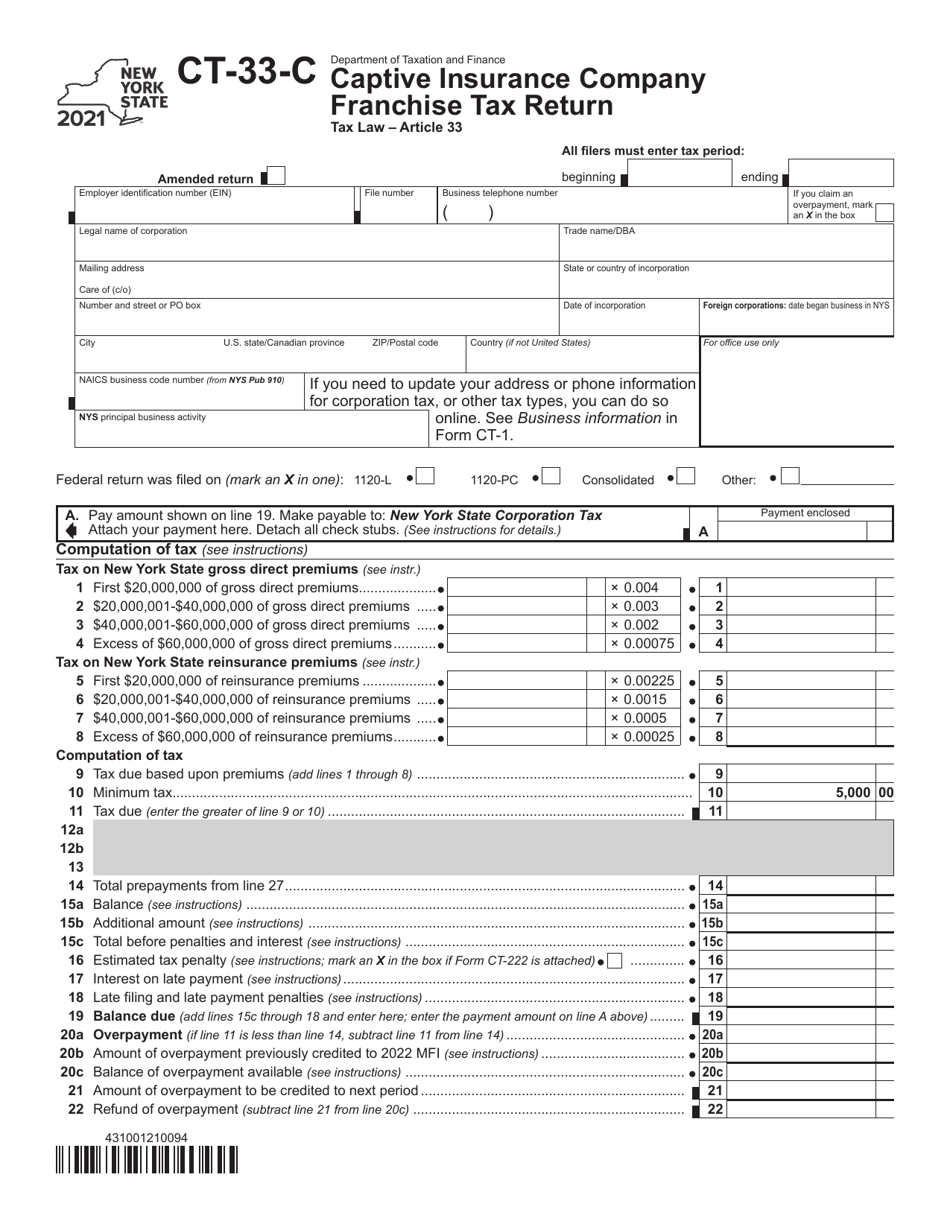

Form CT-33-C Captive Insurance Company Franchise Tax Return - New York

What Is Form CT-33-C?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-33-C?

A: Form CT-33-C is the Captive Insurance CompanyFranchise Tax Return for New York.

Q: Who needs to file Form CT-33-C?

A: Captive insurance companies in New York need to file Form CT-33-C.

Q: What is the purpose of Form CT-33-C?

A: The purpose of Form CT-33-C is to calculate and report the franchise tax owed by captive insurance companies in New York.

Q: When is Form CT-33-C due?

A: Form CT-33-C is generally due on or before March 15th of the year following the end of the tax year.

Q: Are there any penalties for late filing of Form CT-33-C?

A: Yes, there are penalties for late filing of Form CT-33-C. It is important to file the return on time to avoid any penalties or interest charges.

Q: Is there a minimum tax for captive insurance companies in New York?

A: Yes, captive insurance companies in New York are subject to a minimum tax of $1,500.

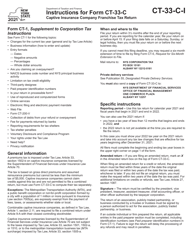

Q: Are there any specific instructions for completing Form CT-33-C?

A: Yes, there are specific instructions provided by the New York State Department of Taxation and Finance for completing Form CT-33-C. It is important to carefully review and follow these instructions when filling out the form.

Q: Can Form CT-33-C be filed electronically?

A: Yes, Form CT-33-C can be filed electronically using the New York State Department of Taxation and Finance's e-file system.

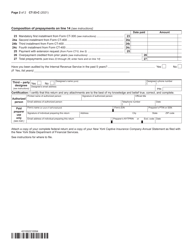

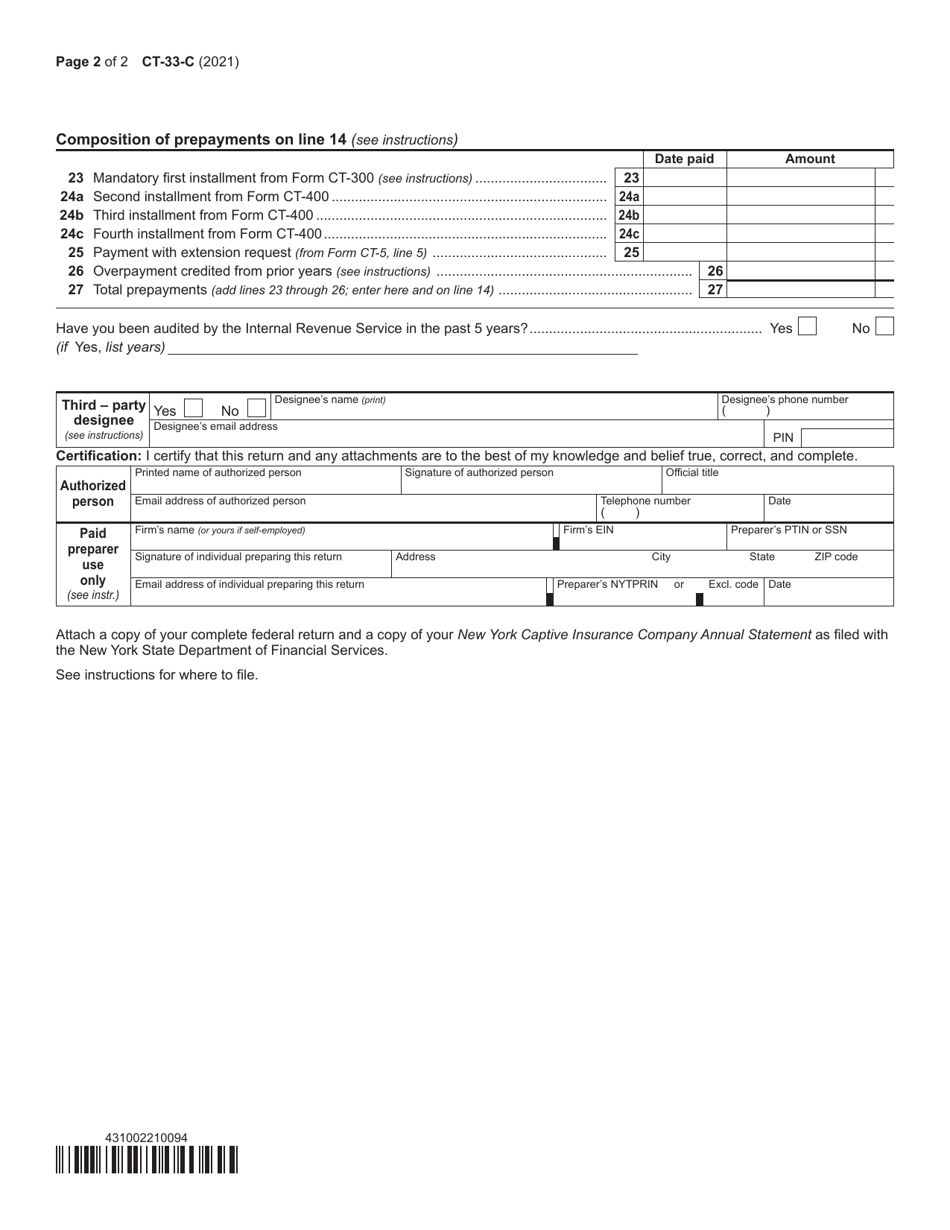

Q: What other supporting documents may be required with Form CT-33-C?

A: Depending on the specific circumstances, additional supporting documents may be required, such as a certificate of incorporation and financial statements. It is important to review the instructions for Form CT-33-C to determine the required supporting documentation.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-33-C by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.