This version of the form is not currently in use and is provided for reference only. Download this version of

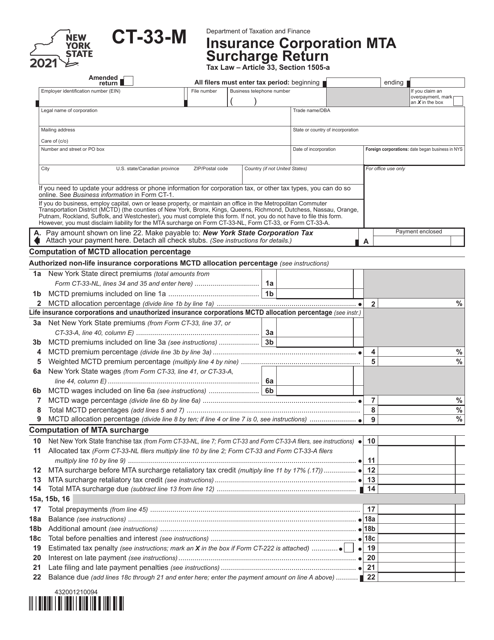

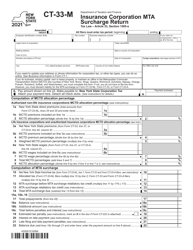

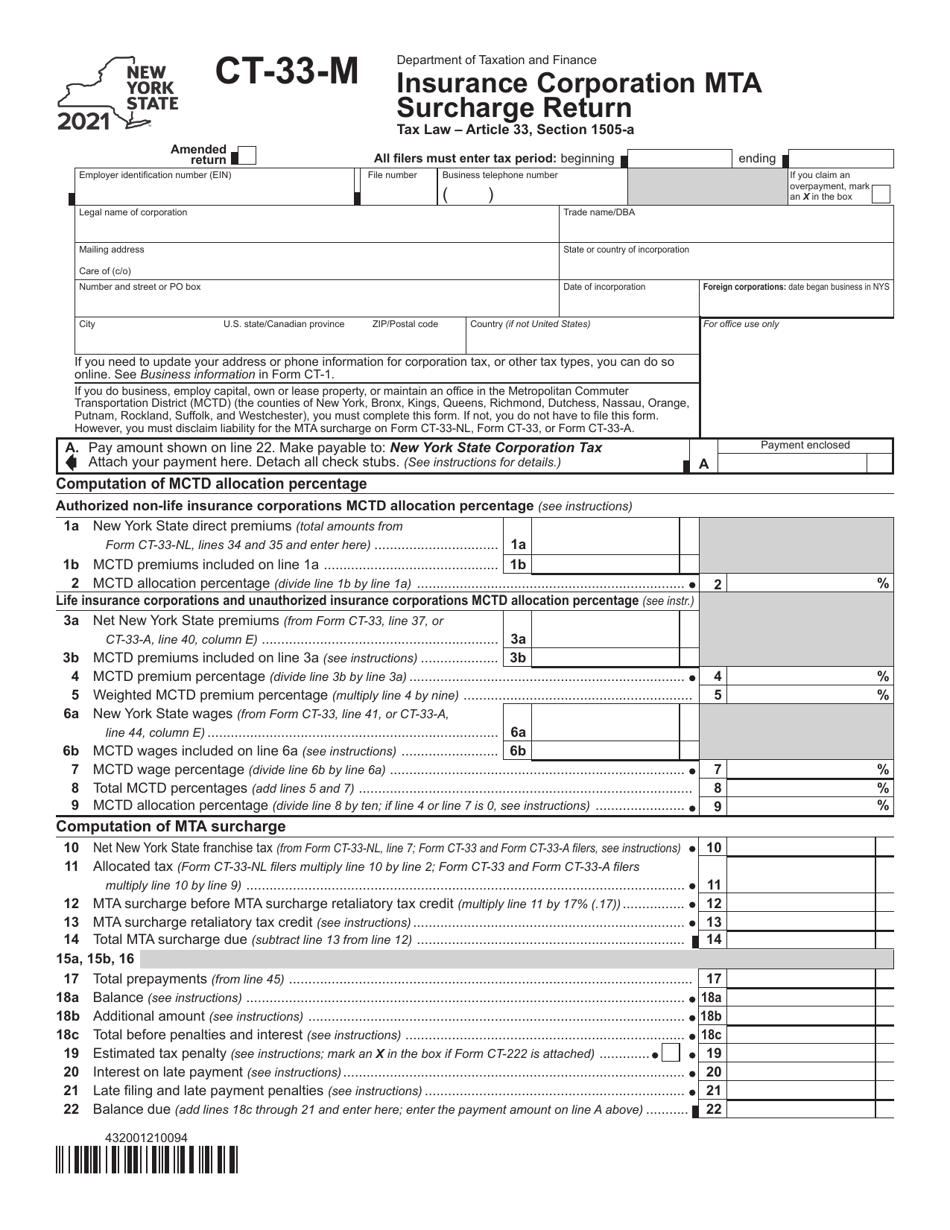

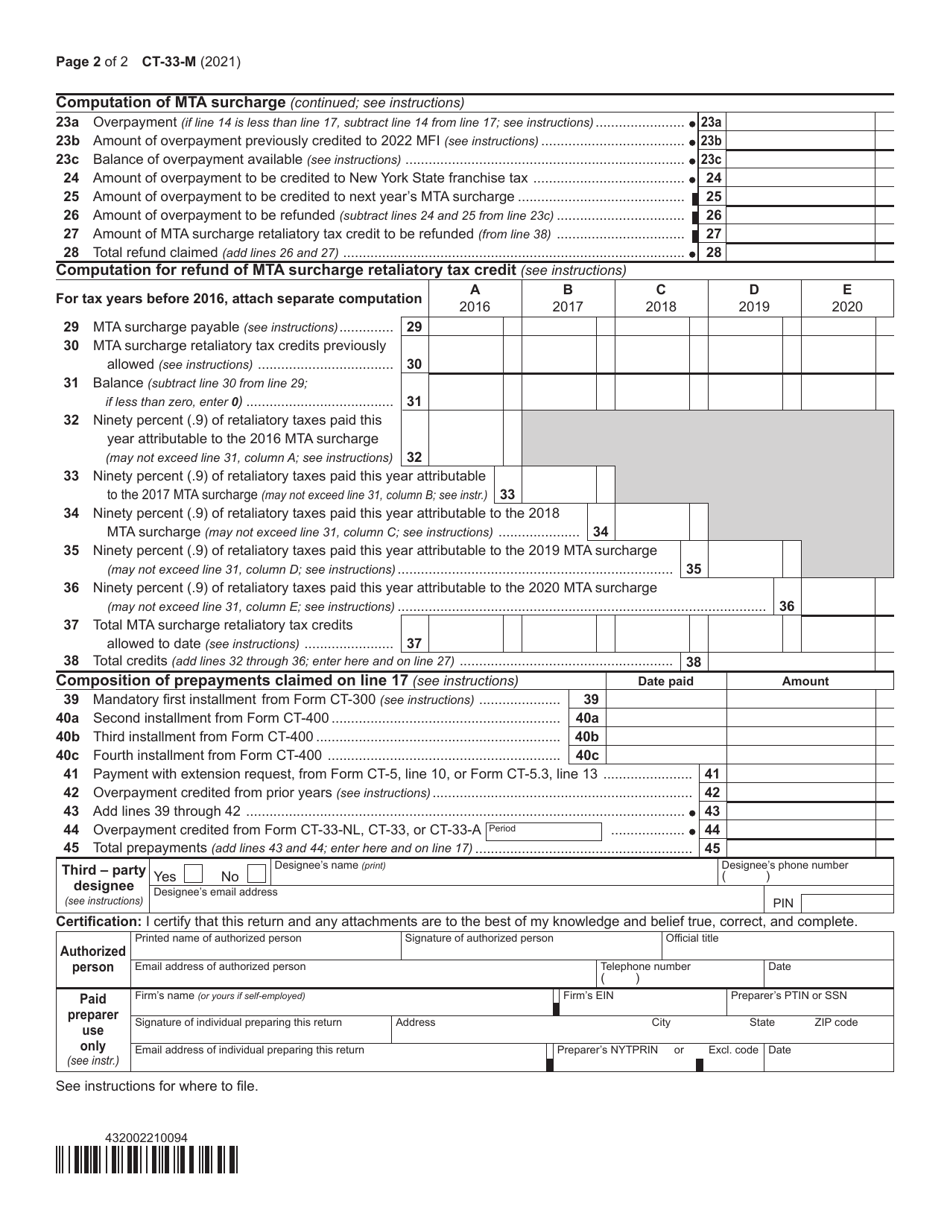

Form CT-33-M

for the current year.

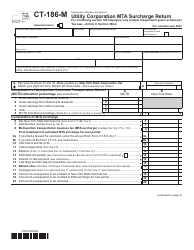

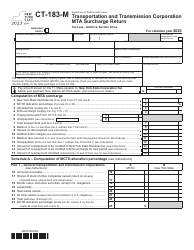

Form CT-33-M Insurance Corporation Mta Surcharge Return - New York

What Is Form CT-33-M?

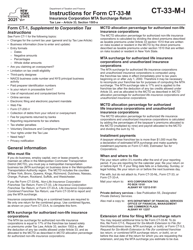

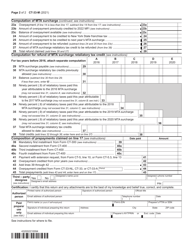

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-33-M?

A: Form CT-33-M is an Insurance Corporation MTA Surcharge Return form used in New York.

Q: Who needs to file Form CT-33-M?

A: Insurance corporations in New York need to file Form CT-33-M.

Q: What is the purpose of Form CT-33-M?

A: The purpose of Form CT-33-M is to report and pay the Metropolitan Transportation Authority (MTA) surcharge by insurance corporations.

Q: When is the due date for filing Form CT-33-M?

A: The due date for filing Form CT-33-M is 15th day of the fourth month after the end of the tax year.

Q: Are there any penalties for late filing of Form CT-33-M?

A: Yes, there are penalties for late filing of Form CT-33-M. It is important to file the form on time to avoid penalties.

Q: Is there any information that needs to be attached to Form CT-33-M?

A: Yes, certain supporting documents need to be attached to Form CT-33-M, such as Schedule C and Schedule P.

Q: Are there any exemptions or deductions available on Form CT-33-M?

A: Yes, there are exemptions and deductions available on Form CT-33-M. You should consult the instructions for the form to determine if you qualify for any exemptions or deductions.

Q: What should I do if I make a mistake on Form CT-33-M after filing?

A: If you make a mistake on Form CT-33-M after filing, you should file an amended return using Form CT-33-M-A.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-33-M by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.