This version of the form is not currently in use and is provided for reference only. Download this version of

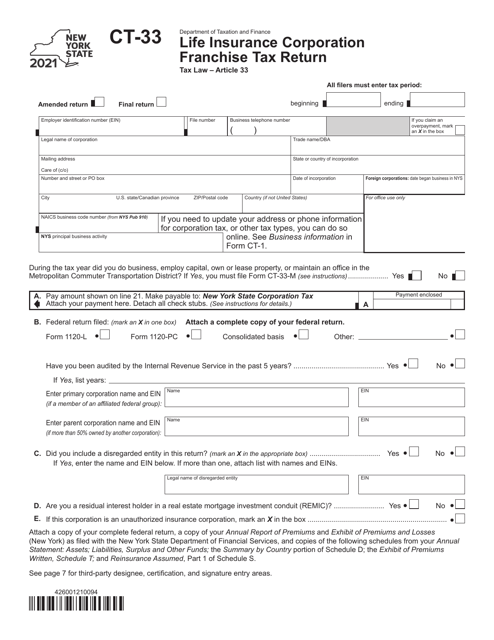

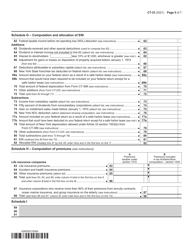

Form CT-33

for the current year.

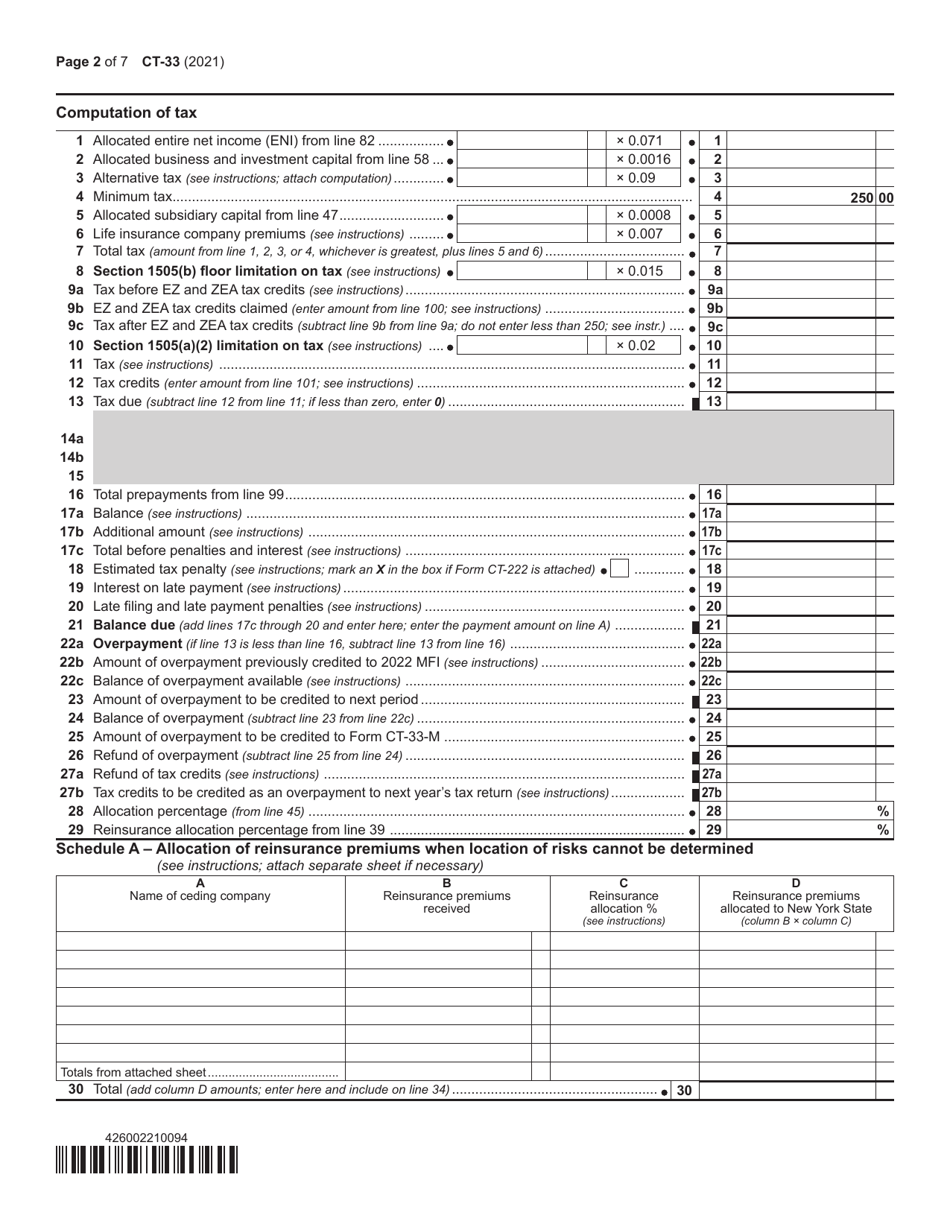

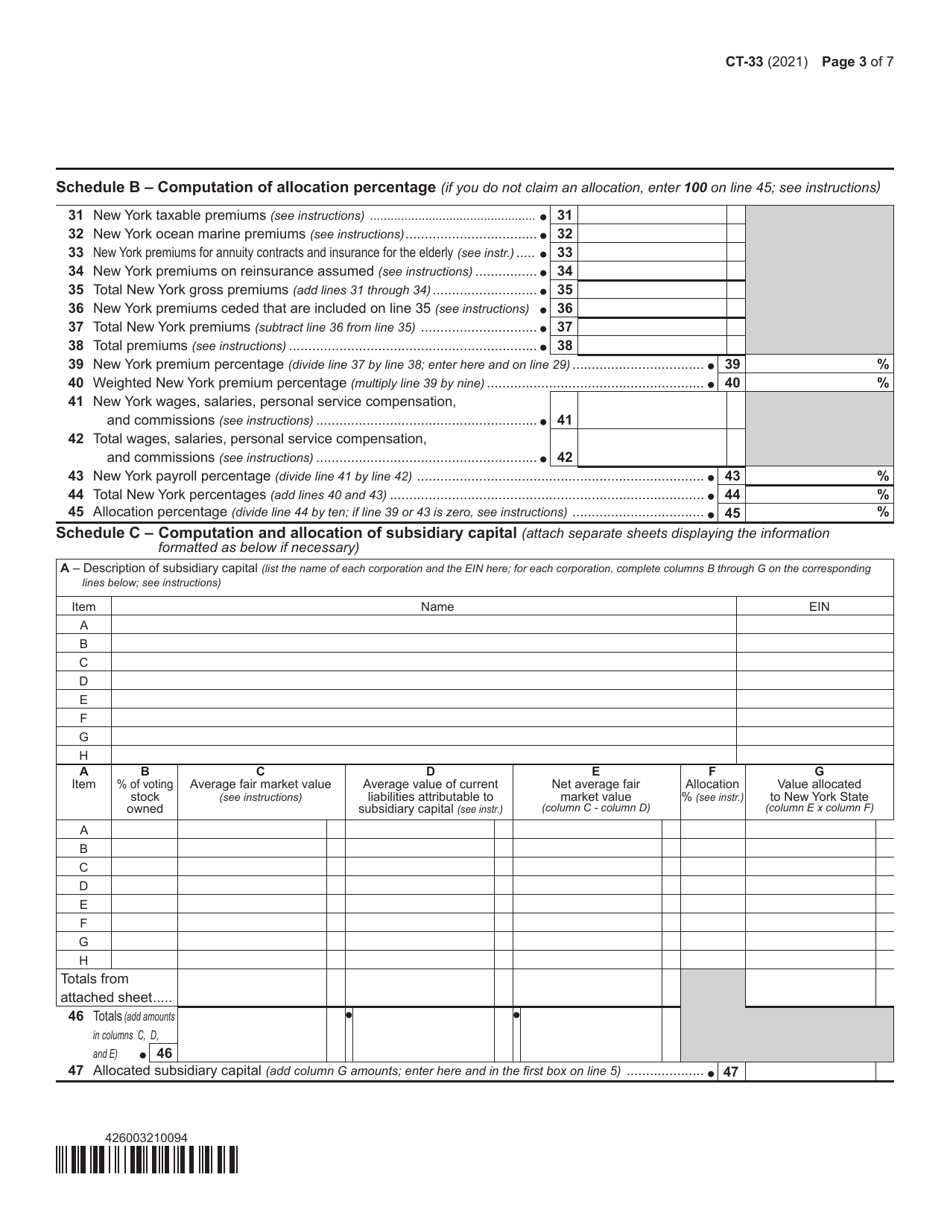

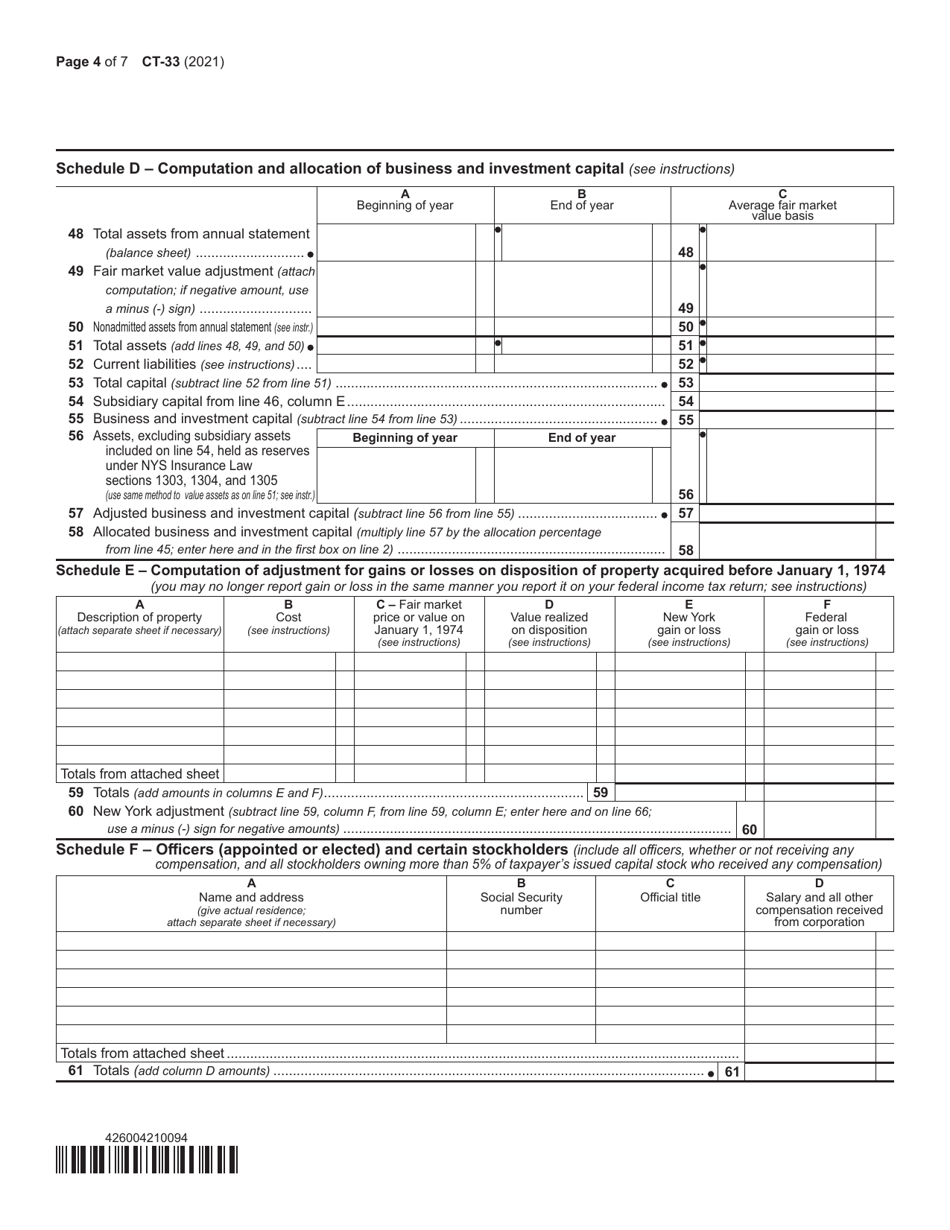

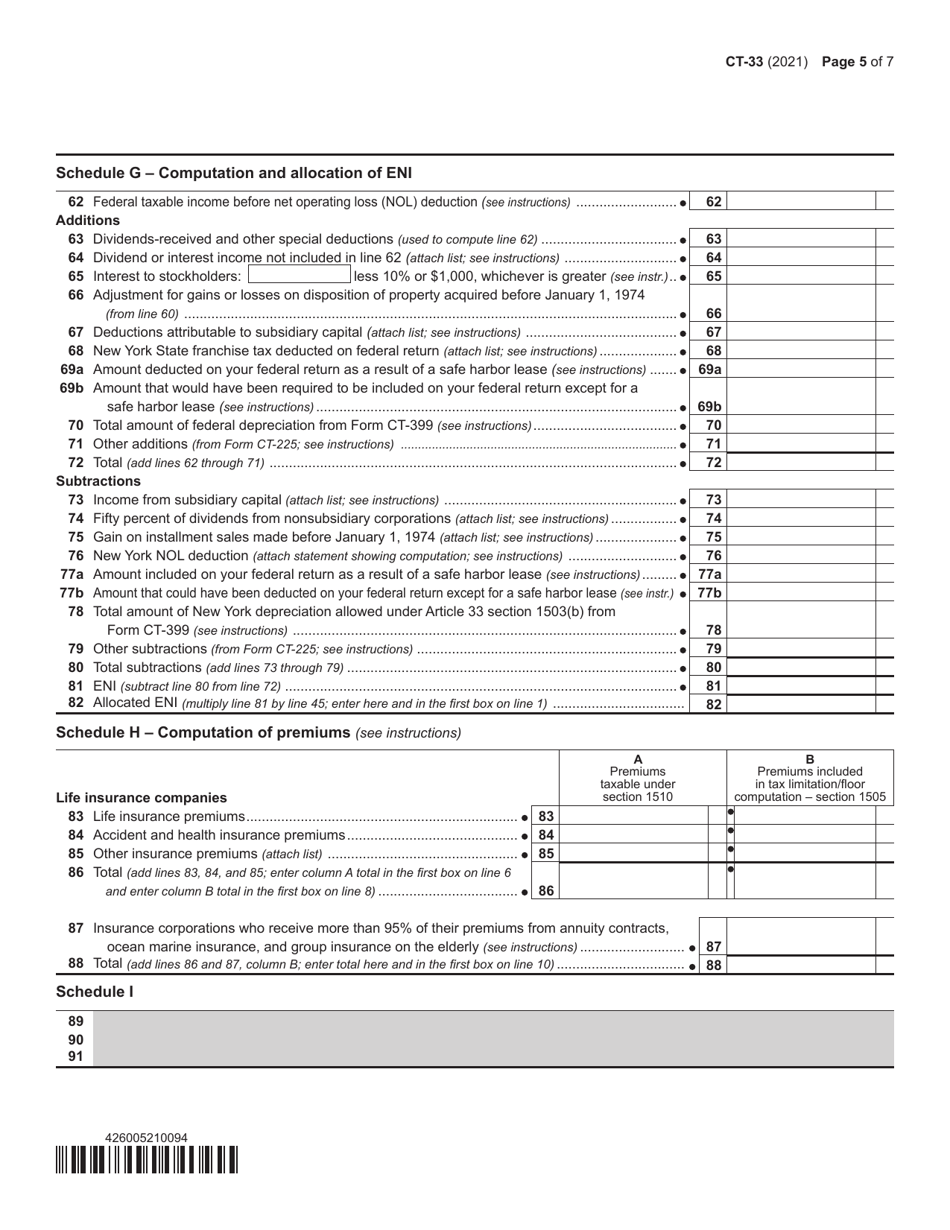

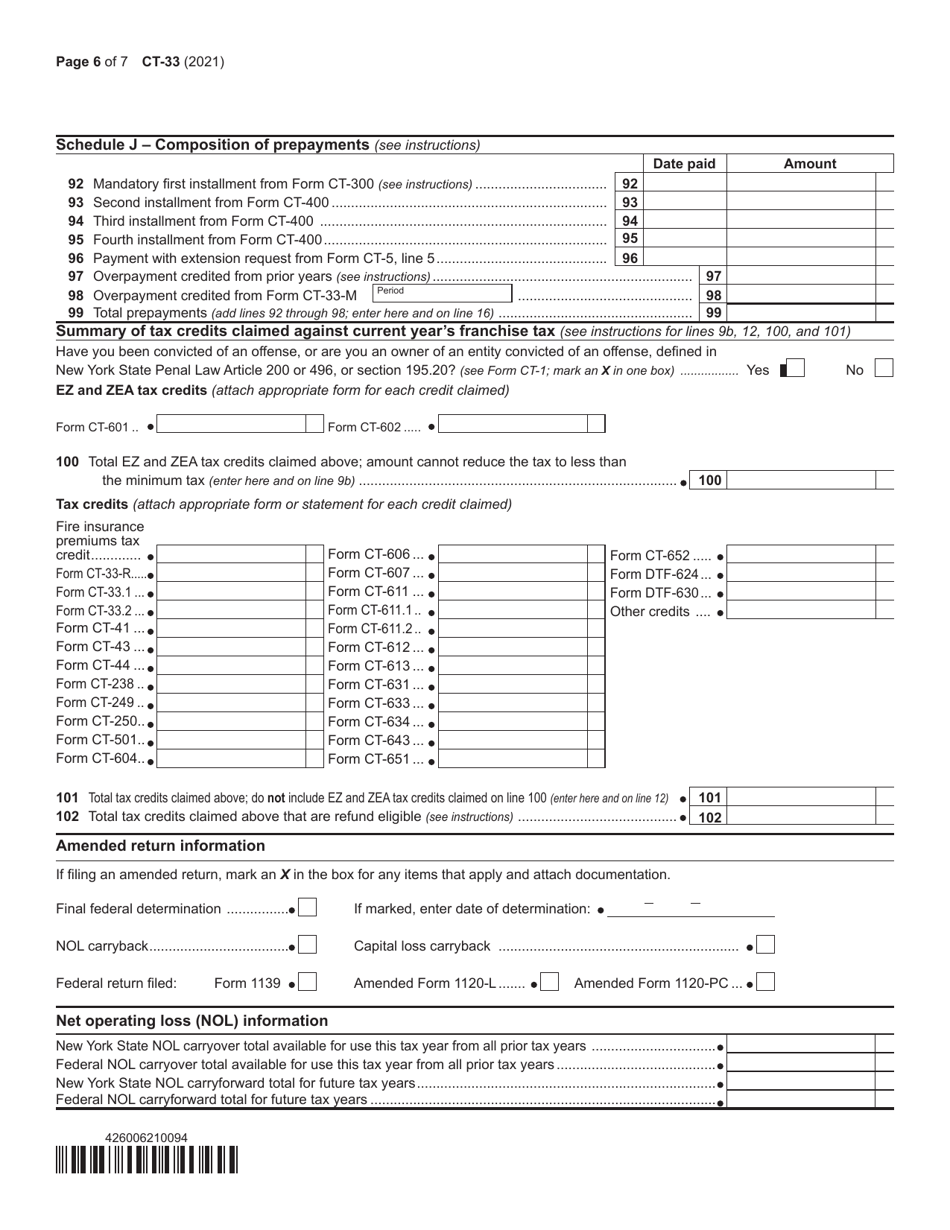

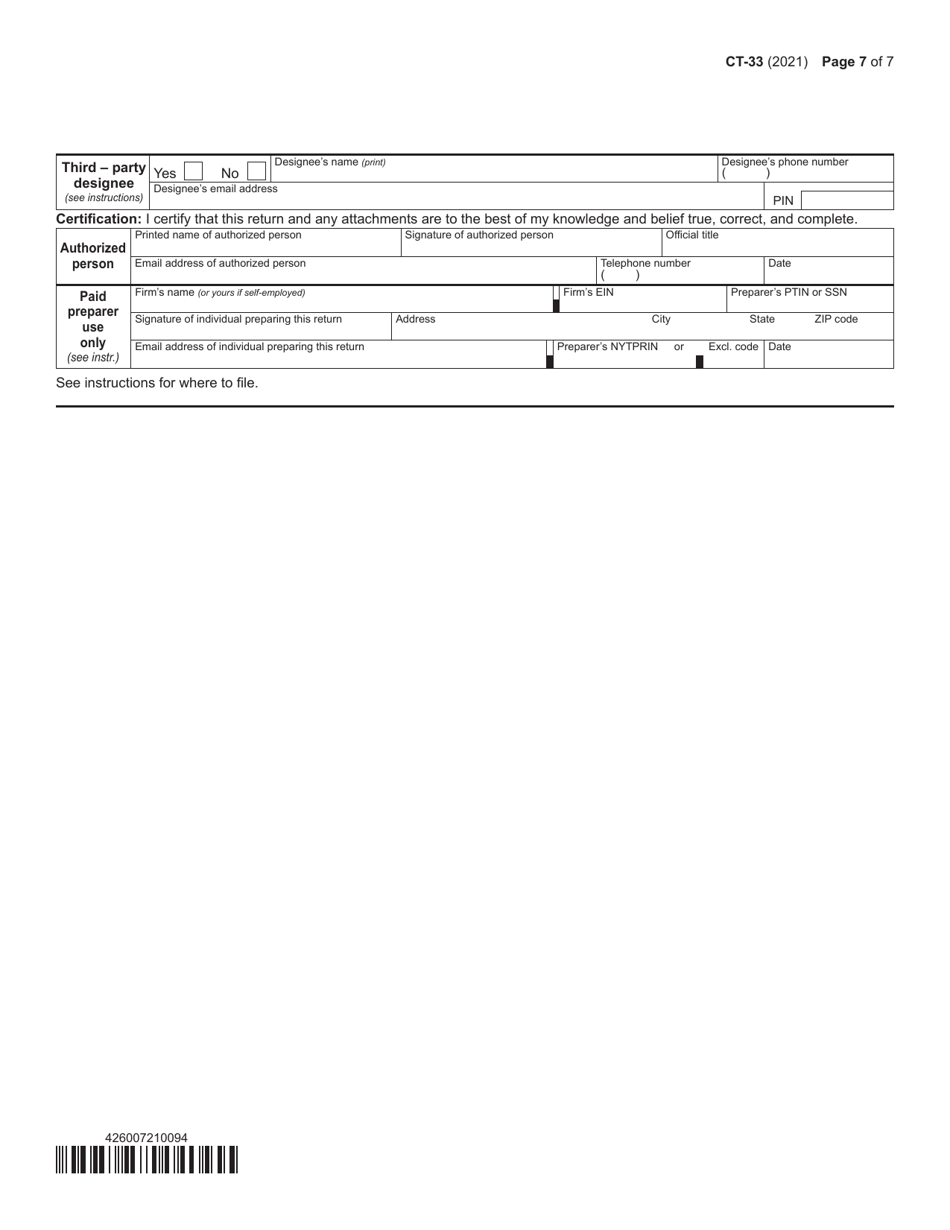

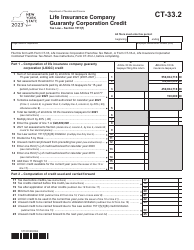

Form CT-33 Life Insurance Corporation Franchise Tax Return - New York

What Is Form CT-33?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: Who needs to file Form CT-33?

A: Life insurance corporations operating in New York are required to file Form CT-33.

Q: What is the purpose of Form CT-33?

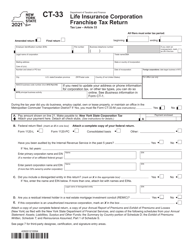

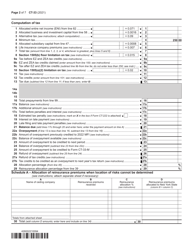

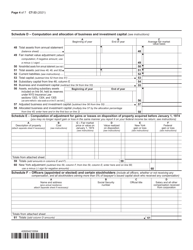

A: Form CT-33 is used to report and calculate the franchise tax owed by life insurance corporations in New York.

Q: When is Form CT-33 due?

A: Form CT-33 is generally due on the 15th day of the third month following the end of the tax year.

Q: How do I file Form CT-33?

A: Form CT-33 can be filed electronically or by mail. Electronic filing is recommended.

Q: What information is required to complete Form CT-33?

A: You will need to provide information about your corporation's income, deductions, and other relevant details.

Q: Are there any penalties for late filing of Form CT-33?

A: Yes, there are penalties for late filing or failure to file Form CT-33. It is important to file the form on time.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-33 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.