This version of the form is not currently in use and is provided for reference only. Download this version of

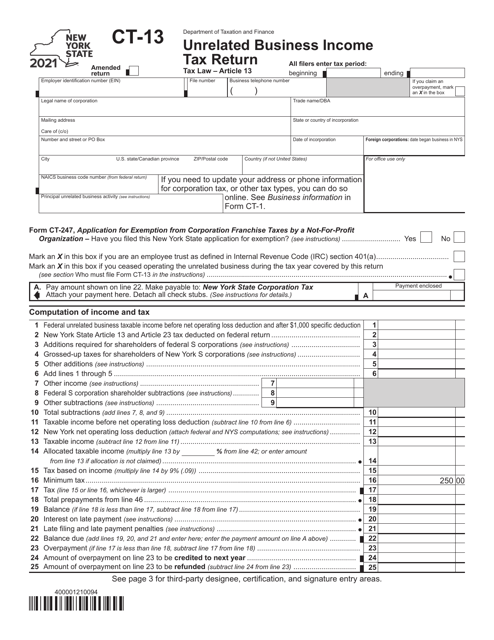

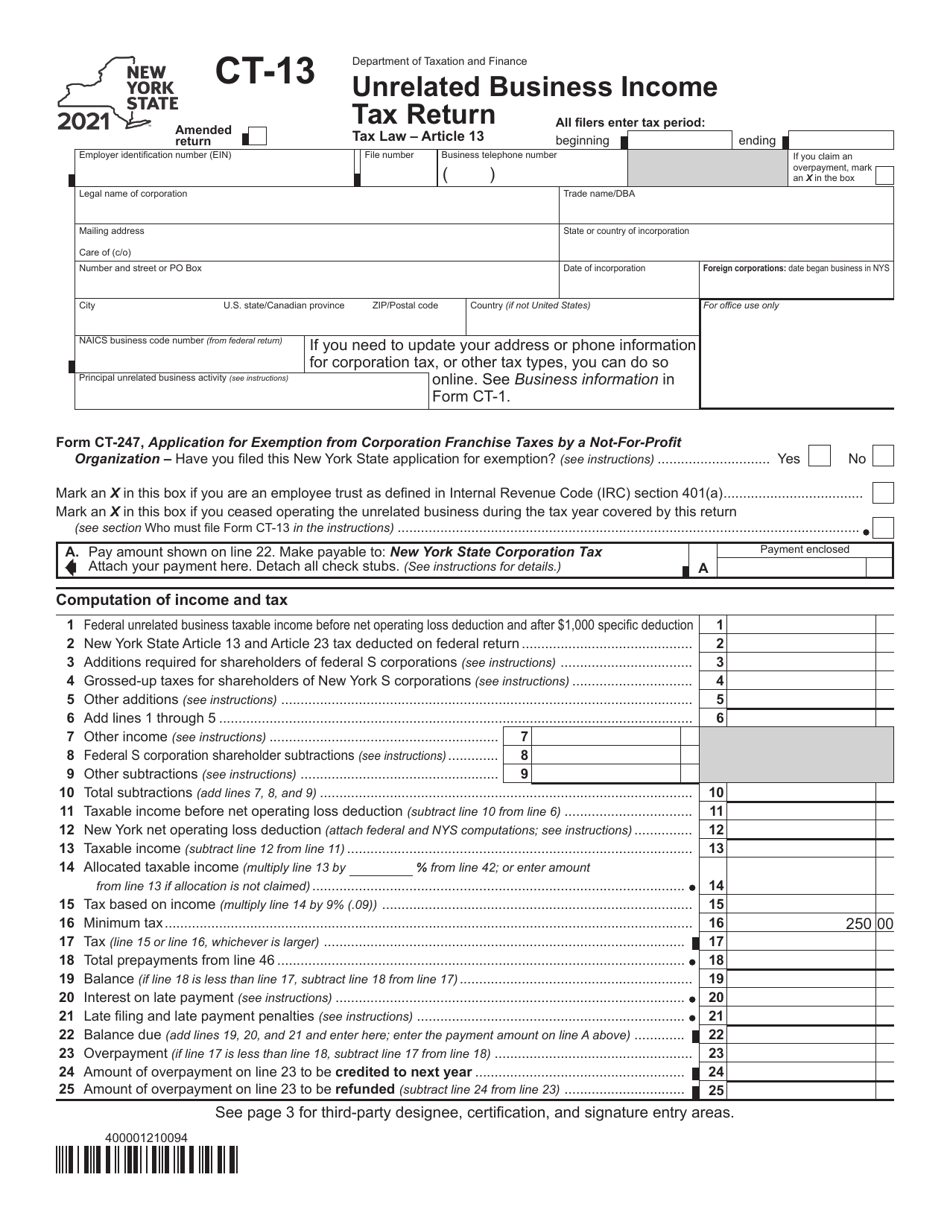

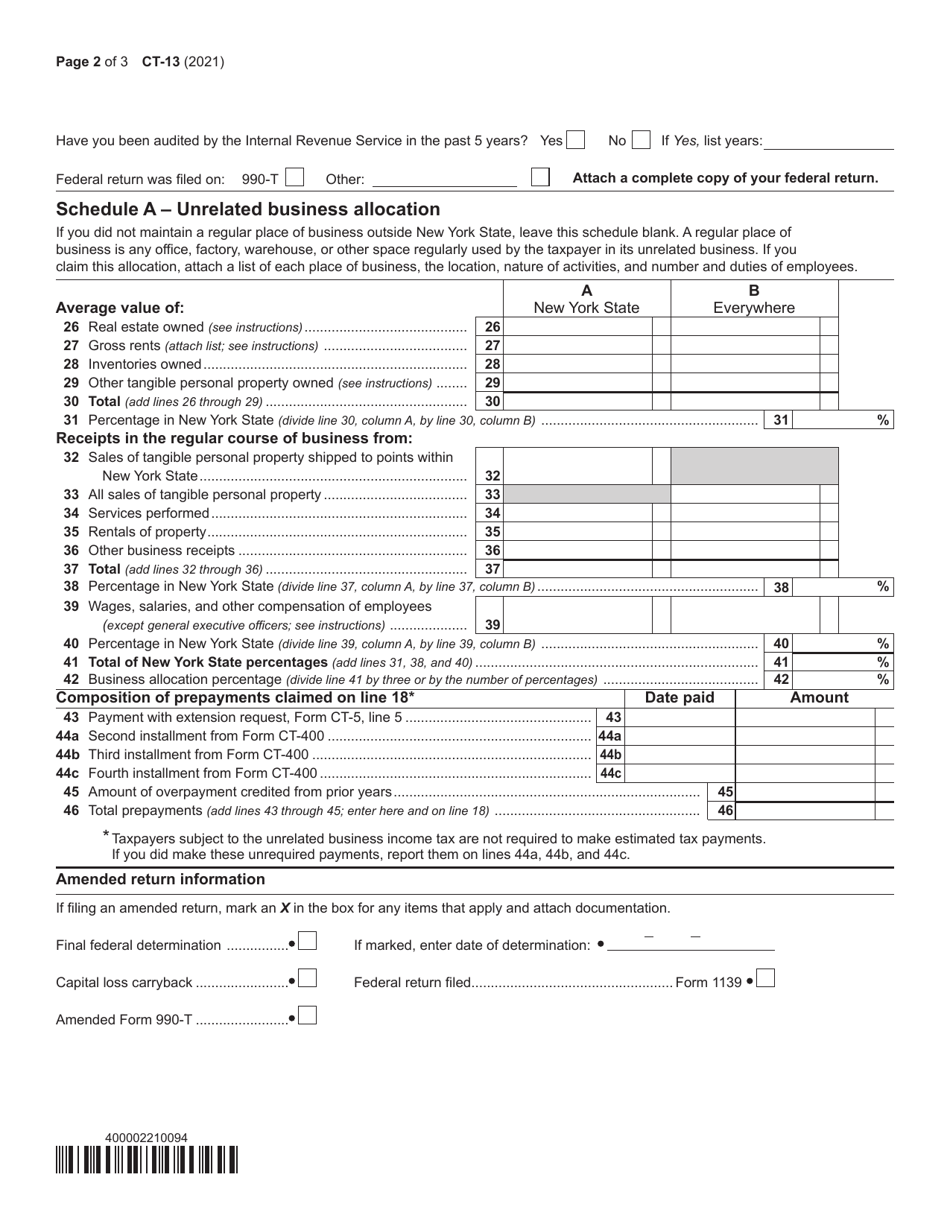

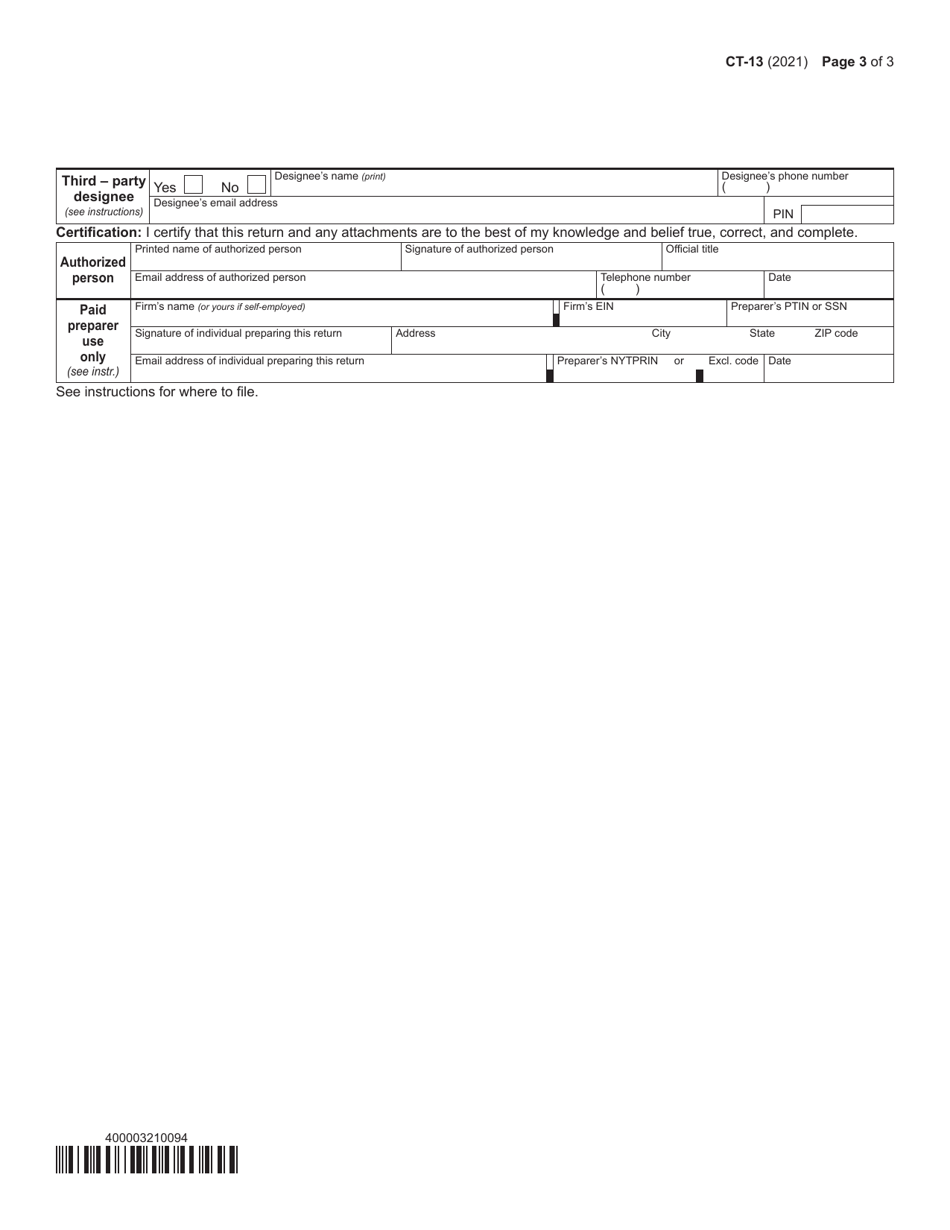

Form CT-13

for the current year.

Form CT-13 Unrelated Business Income Tax Return - New York

What Is Form CT-13?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-13?

A: Form CT-13 is the Unrelated Business Income Tax Return for New York.

Q: Who needs to file Form CT-13?

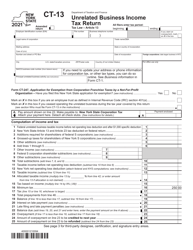

A: Nonprofit organizations operating in New York that have unrelated business income need to file Form CT-13.

Q: What is unrelated business income?

A: Unrelated business income refers to income from a trade or business that is not substantially related to the nonprofit organization's exempt purpose.

Q: How often should Form CT-13 be filed?

A: Form CT-13 is generally filed annually.

Q: When is Form CT-13 due?

A: The due date for Form CT-13 is usually the 15th day of the fifth month following the close of the nonprofit organization's fiscal year.

Q: Are there any exceptions to filing Form CT-13?

A: Some nonprofit organizations may be exempt from filing Form CT-13 if they meet certain criteria outlined by the New York State Department of Taxation and Finance.

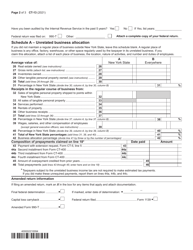

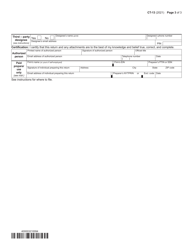

Q: Is there a penalty for late filing of Form CT-13?

A: Yes, there may be penalties for late filing of Form CT-13. It is important to file the form by the due date to avoid penalties.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-13 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.