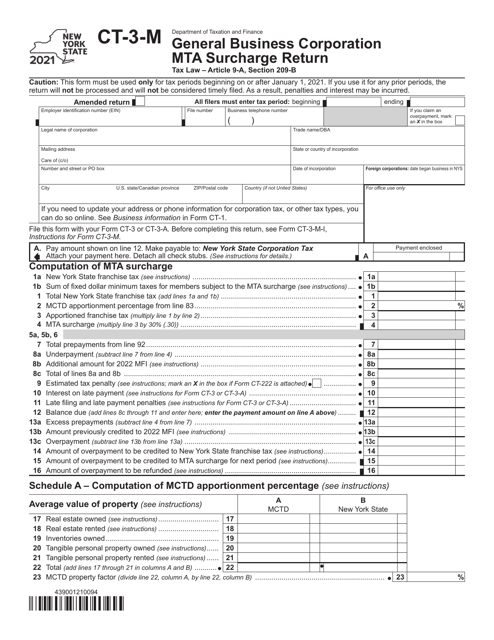

This version of the form is not currently in use and is provided for reference only. Download this version of

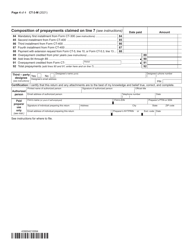

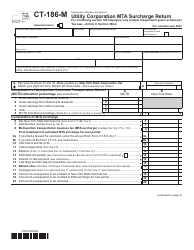

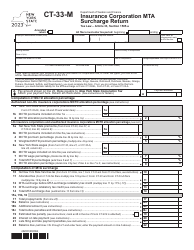

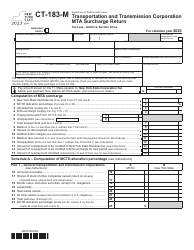

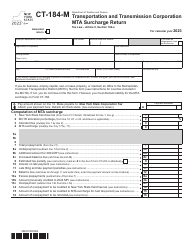

Form CT-3-M

for the current year.

Form CT-3-M General Business Corporation Mta Surcharge Return - New York

What Is Form CT-3-M?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-3-M?

A: Form CT-3-M is the General Business Corporation MTA Surcharge Return in New York.

Q: Who needs to file Form CT-3-M?

A: General business corporations in New York that are subject to the Metropolitan Transportation Authority (MTA) Surcharge.

Q: What is the MTA Surcharge?

A: The MTA Surcharge is a tax imposed on certain businesses in the Metropolitan Commuter Transportation District to fund the metropolitan transportation authority.

Q: How often do you need to file Form CT-3-M?

A: Form CT-3-M is filed on a quarterly basis.

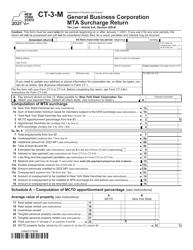

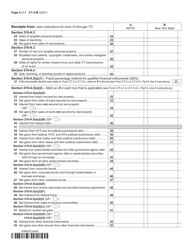

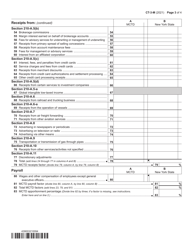

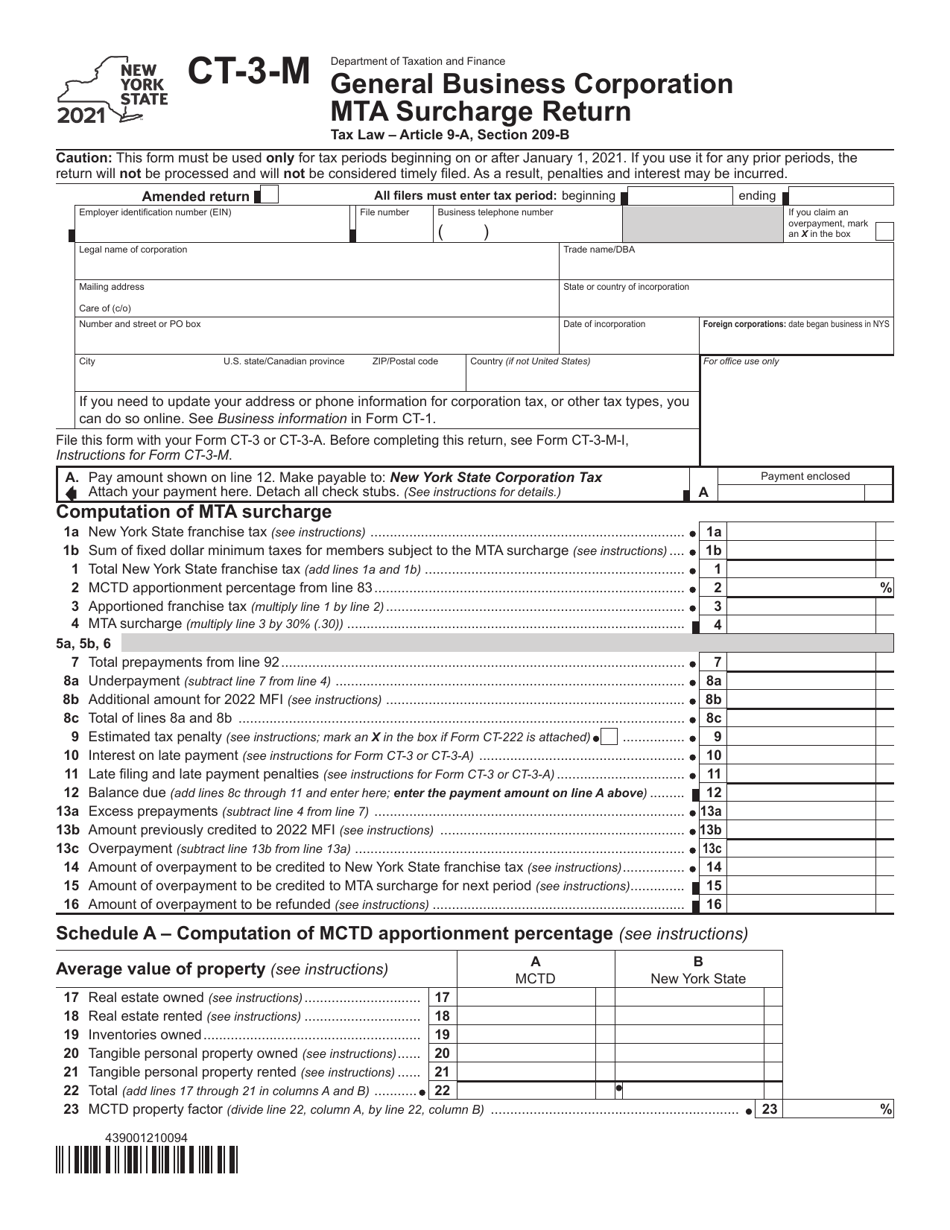

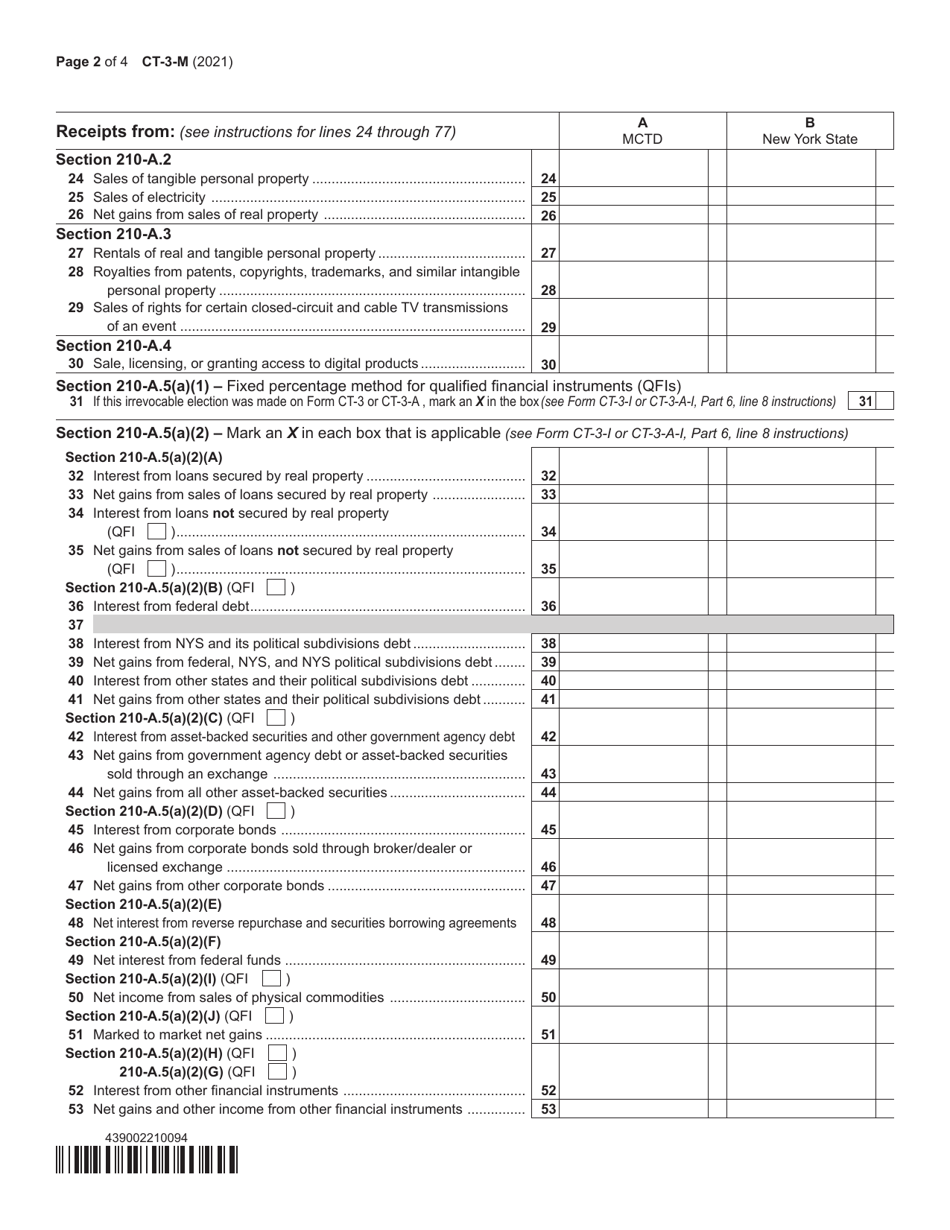

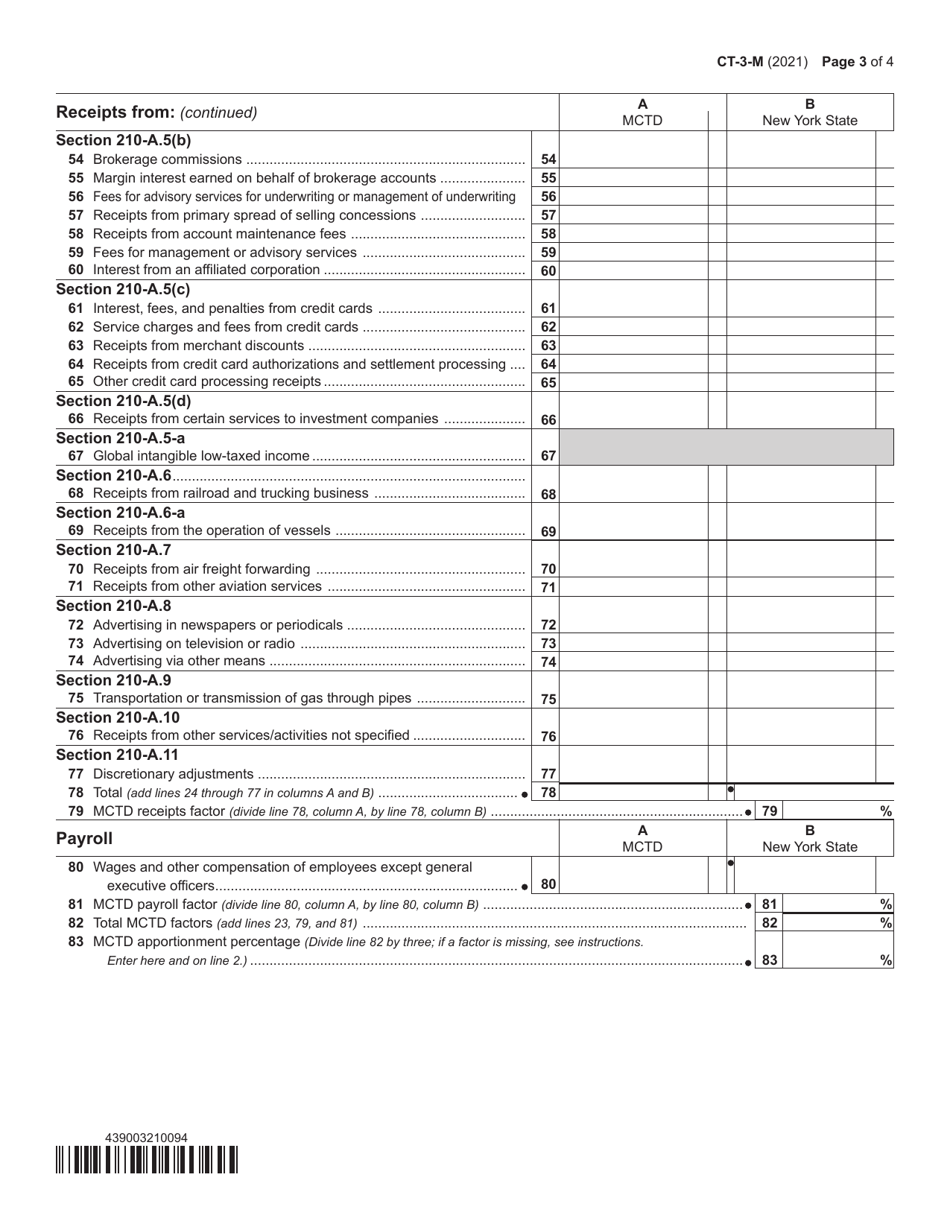

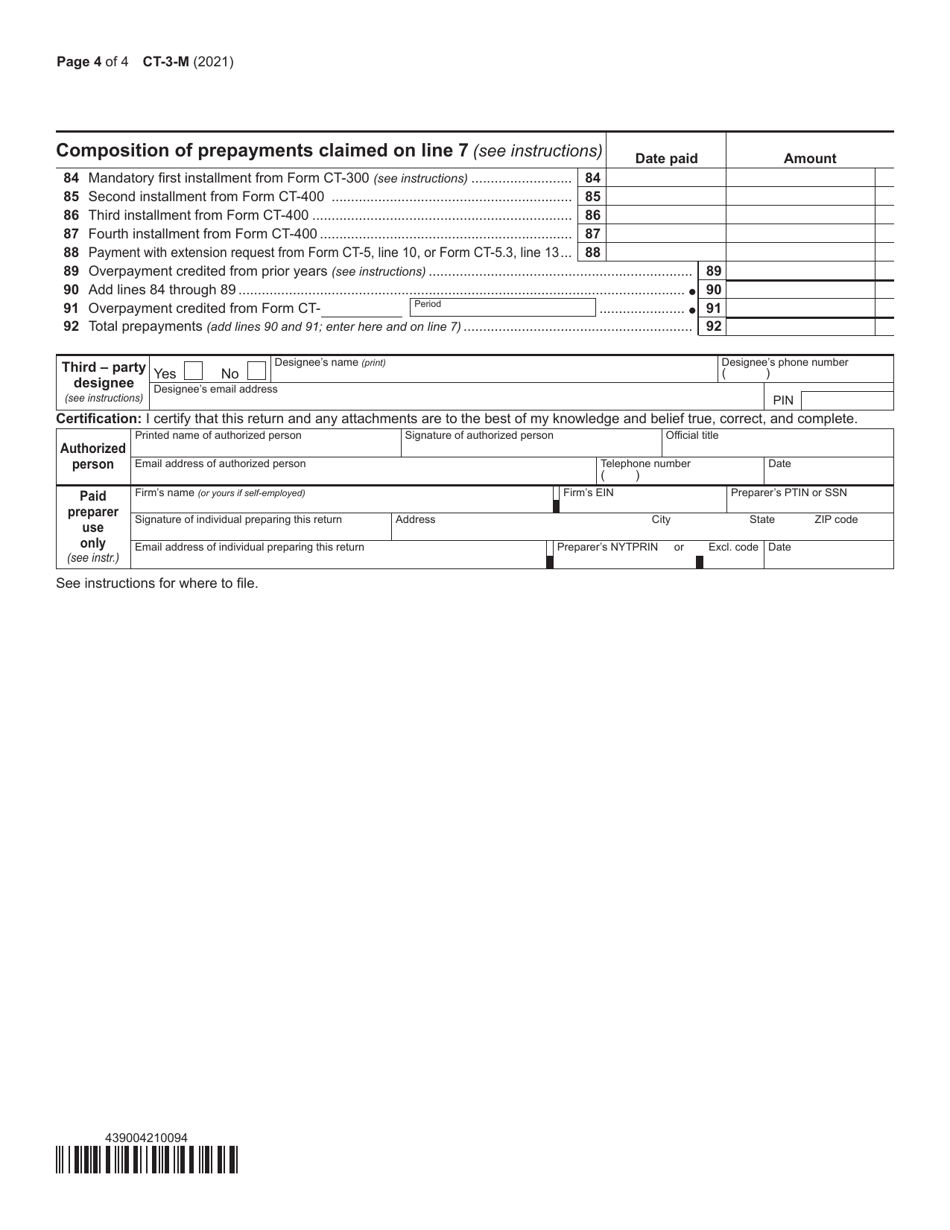

Q: What information is required on Form CT-3-M?

A: Form CT-3-M requires information such as gross receipts, expenses, and the calculation of the MTA surcharge.

Q: Are there any penalties for not filing or late filing?

A: Yes, there are penalties for not filing or late filing Form CT-3-M. It is important to file on time to avoid penalties and interest.

Q: Is there a minimum threshold for filing Form CT-3-M?

A: Yes, there is a minimum threshold for filing Form CT-3-M. You should check the instructions for the specific threshold amount.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-3-M by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.