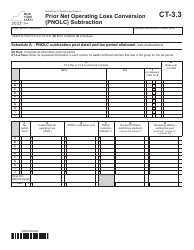

This version of the form is not currently in use and is provided for reference only. Download this version of

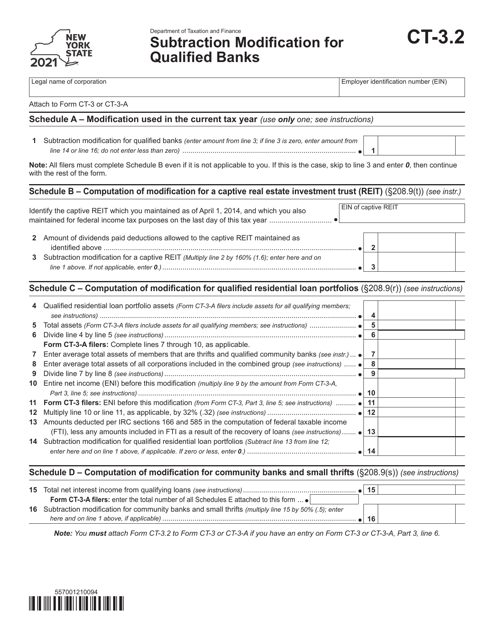

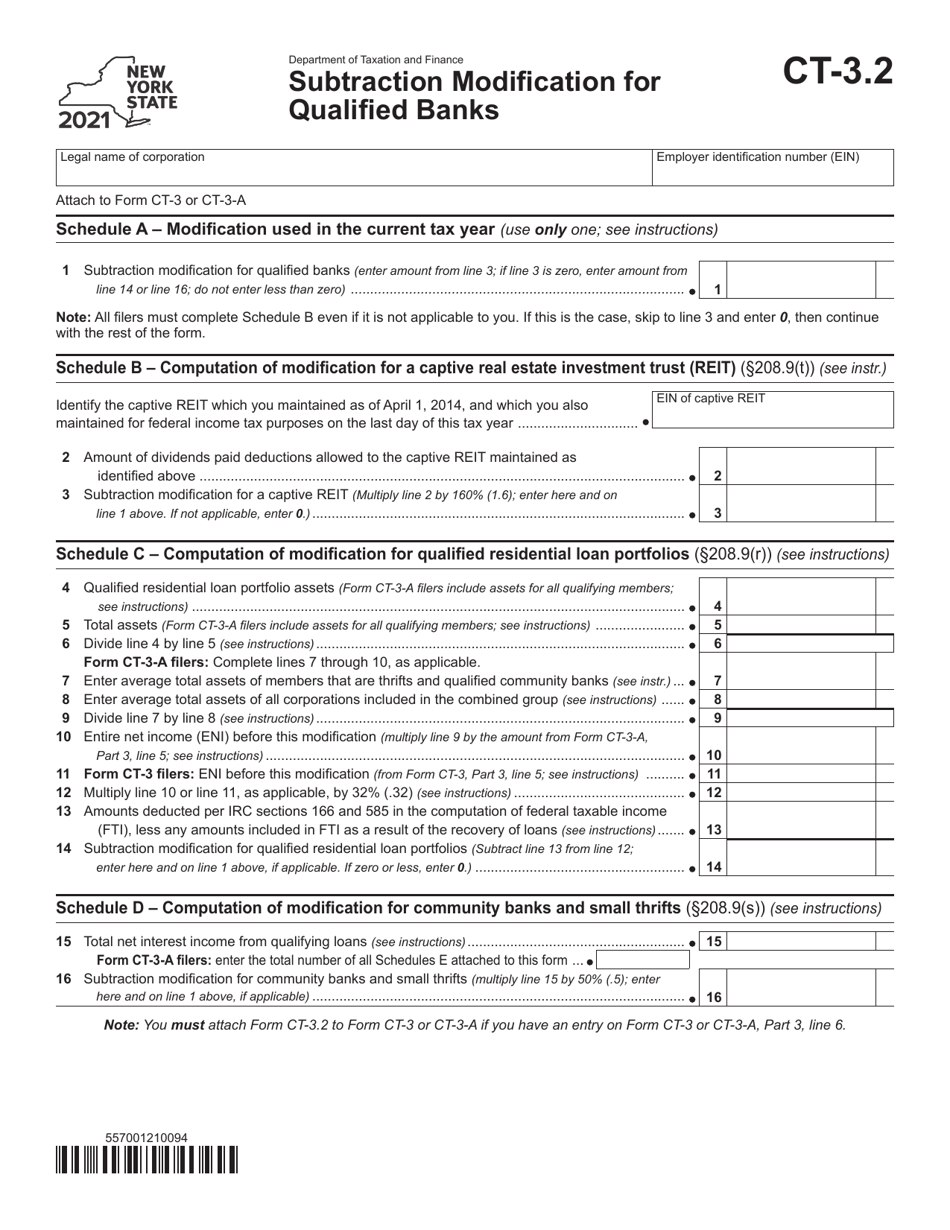

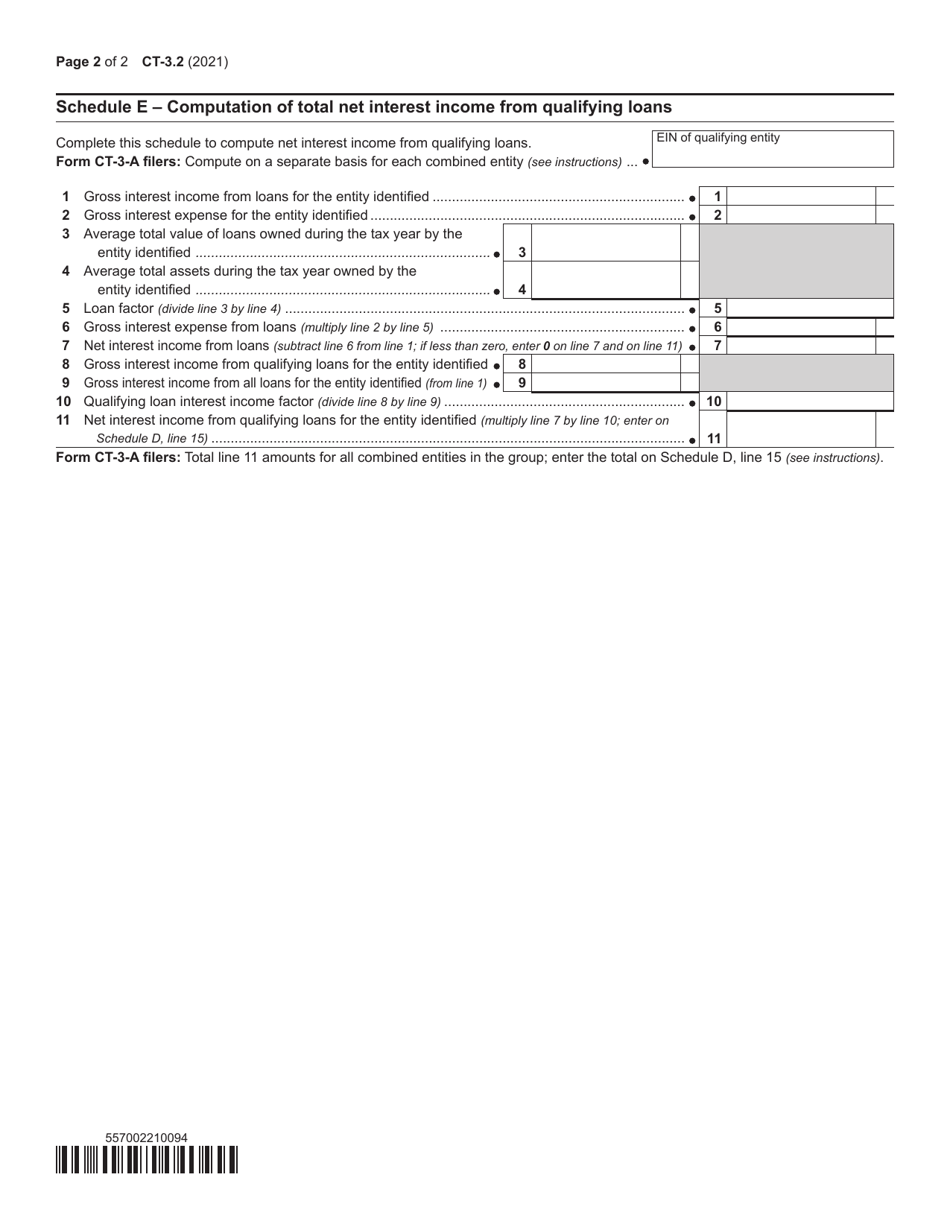

Form CT-3.2

for the current year.

Form CT-3.2 Subtraction Modification for Qualified Banks - New York

What Is Form CT-3.2?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-3.2?

A: Form CT-3.2 is a tax form used by qualified banks in New York.

Q: What is the purpose of Form CT-3.2?

A: The purpose of Form CT-3.2 is to report subtraction modifications for qualified banks in New York.

Q: Who needs to file Form CT-3.2?

A: Qualified banks in New York need to file Form CT-3.2.

Q: What are subtraction modifications?

A: Subtraction modifications are adjustments made to a bank's taxable income.

Q: What qualifies a bank to use Form CT-3.2?

A: Banks that meet the qualifications set by the state of New York can use Form CT-3.2.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-3.2 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.