This version of the form is not currently in use and is provided for reference only. Download this version of

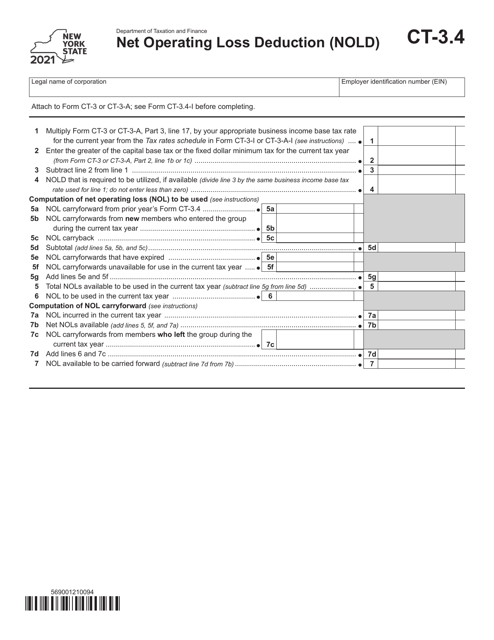

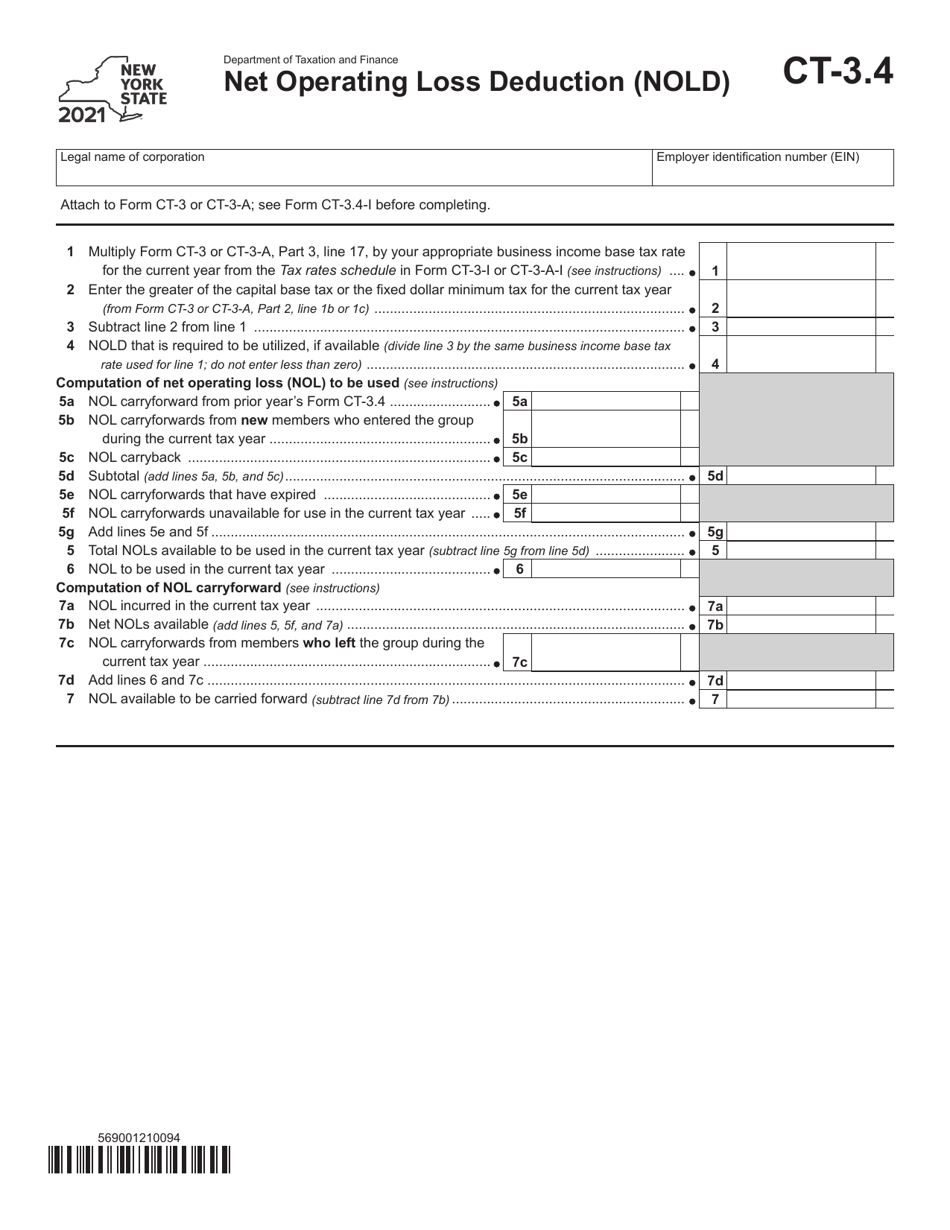

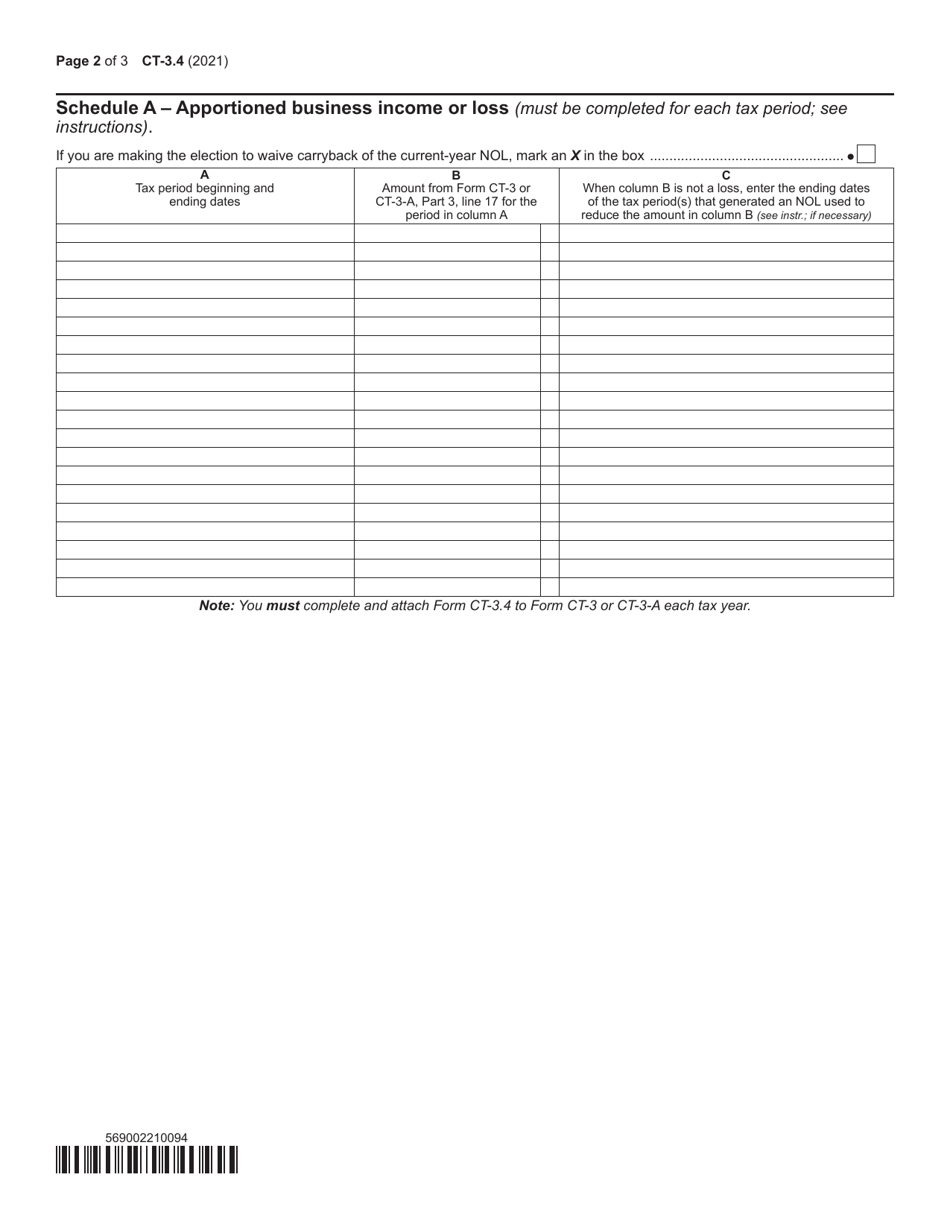

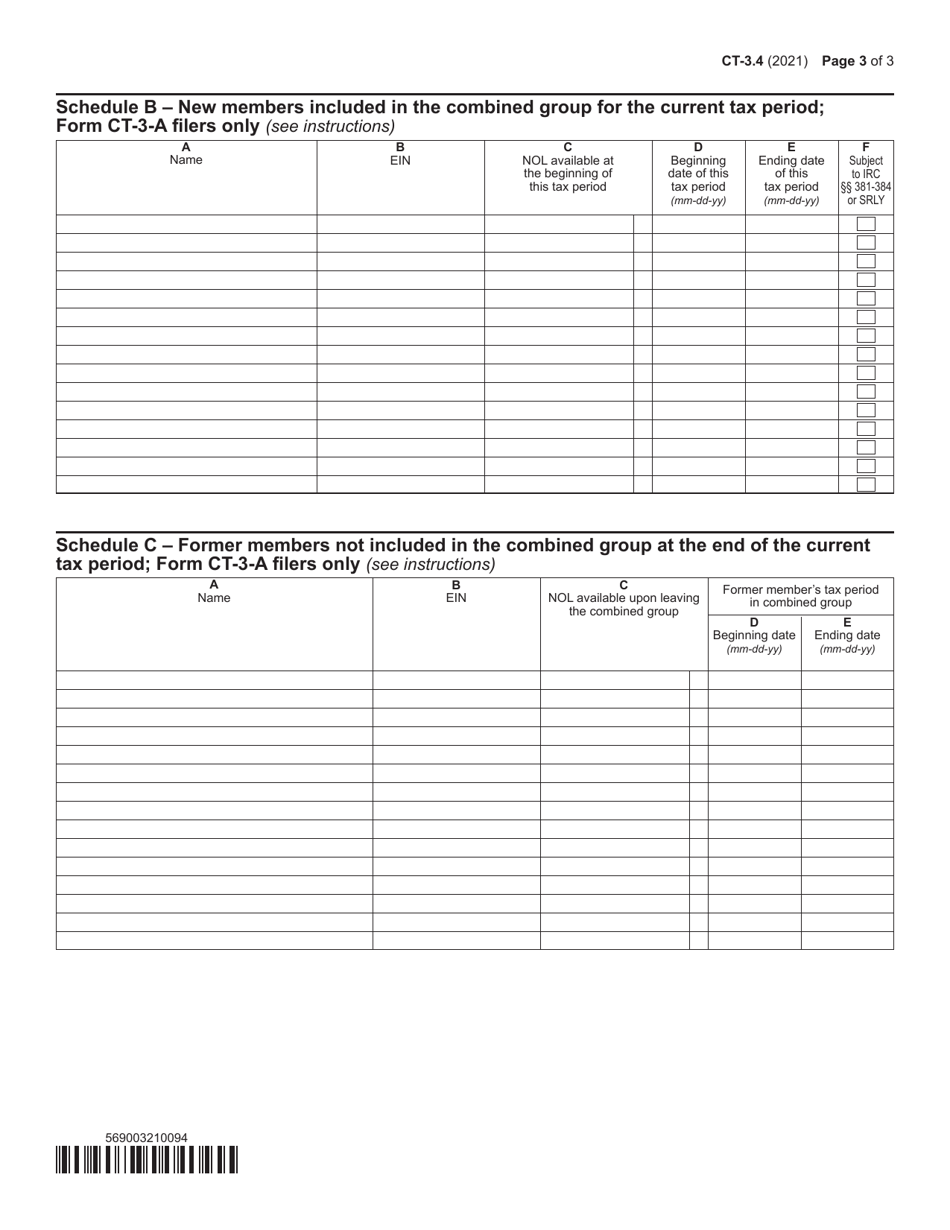

Form CT-3.4

for the current year.

Form CT-3.4 Net Operating Loss Deduction (Nold) - New York

What Is Form CT-3.4?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-3.4?

A: Form CT-3.4 is the form used to claim the Net Operating Loss Deduction (Nold) in New York.

Q: What is the Net Operating Loss Deduction?

A: The Net Operating Loss Deduction (Nold) allows businesses to offset their losses from one year against their profits from other years.

Q: Who can claim the Net Operating Loss Deduction?

A: Corporations that operate in New York and have a net operating loss can claim the deduction.

Q: What is the purpose of the Net Operating Loss Deduction?

A: The purpose of the deduction is to provide tax relief to businesses that have experienced financial losses.

Q: How do I calculate the Net Operating Loss Deduction?

A: The calculation of the deduction is explained in detail in the instructions for Form CT-3.4.

Q: When is the deadline to file Form CT-3.4?

A: The deadline to file Form CT-3.4 is the same as the deadline to file the corporation's tax return, which is generally March 15th for calendar year taxpayers.

Q: Can I claim the Net Operating Loss Deduction on my personal tax return?

A: No, the Net Operating Loss Deduction is only available for corporations and is not applicable to individual tax returns.

Q: Are there any limitations on the Net Operating Loss Deduction?

A: Yes, there are certain limitations and restrictions on the deduction. These are outlined in the instructions for Form CT-3.4.

Q: Can I carry forward unused Net Operating Loss Deductions?

A: Yes, unused Net Operating Loss Deductions can be carried forward for up to 20 years.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-3.4 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.