This version of the form is not currently in use and is provided for reference only. Download this version of

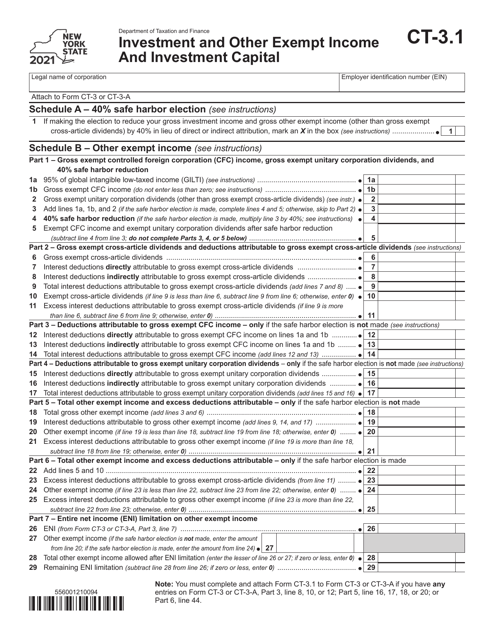

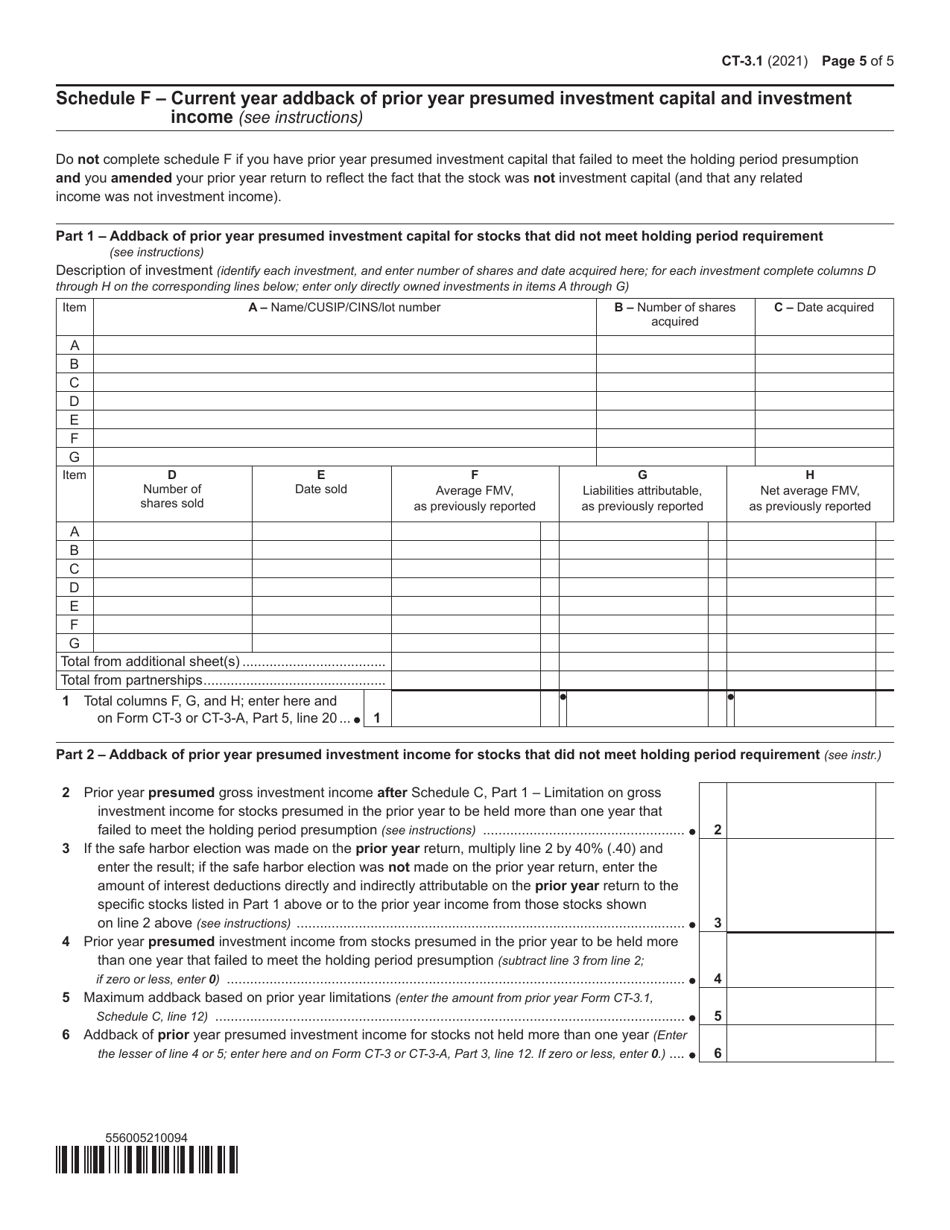

Form CT-3.1

for the current year.

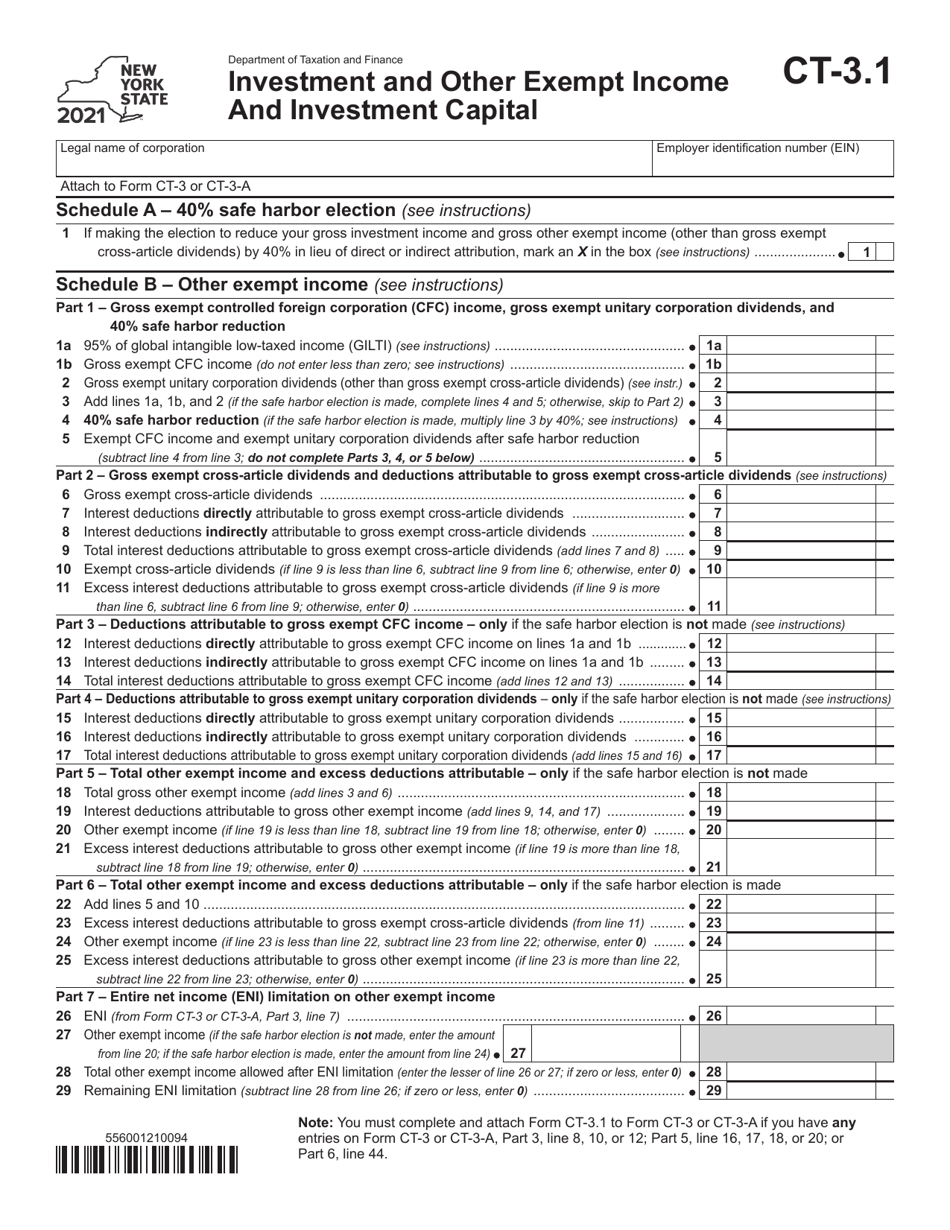

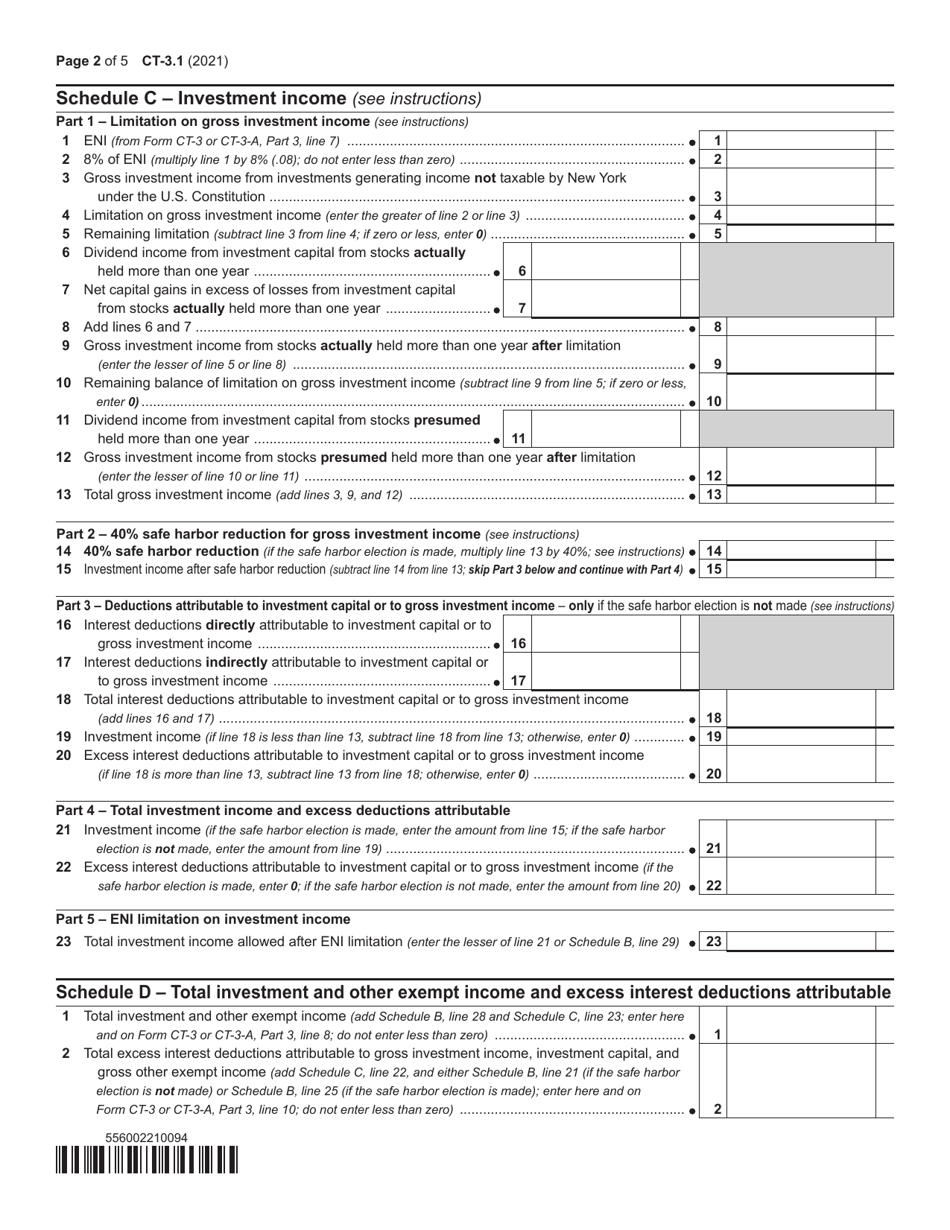

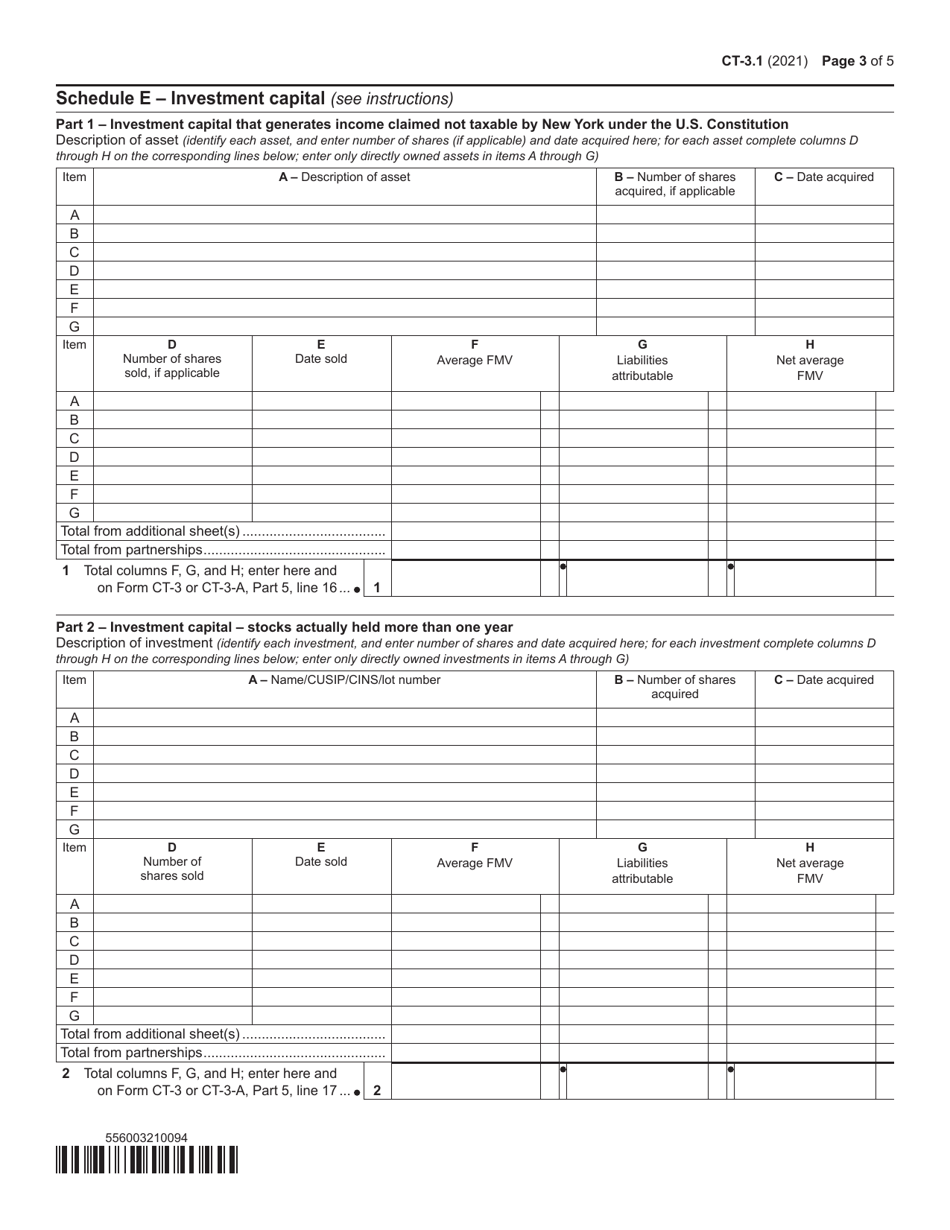

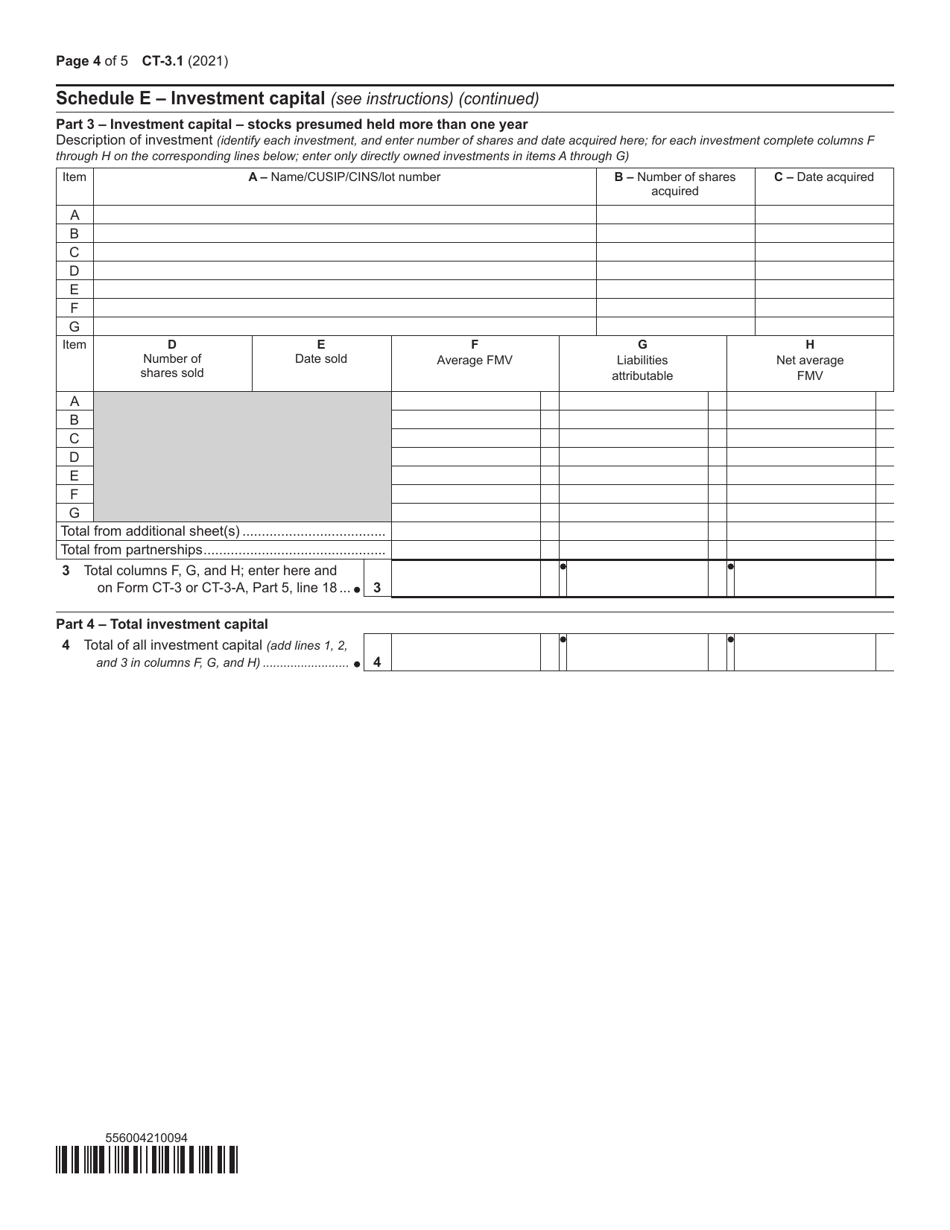

Form CT-3.1 Investment and Other Exempt Income and Investment Capital - New York

What Is Form CT-3.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-3.1?

A: Form CT-3.1 is a tax form used in New York to report investment and other exempt income and investment capital.

Q: Who needs to file Form CT-3.1?

A: Corporations that have investment and other exempt income and investment capital in New York need to file Form CT-3.1.

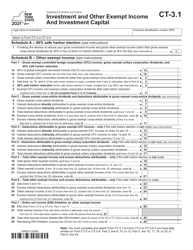

Q: What is investment and other exempt income?

A: Investment and other exempt income includes income from stocks, bonds, and other investments that are not subject to regular income tax.

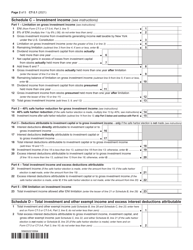

Q: What is investment capital?

A: Investment capital is the money or assets used to make investments for the purpose of generating income.

Q: When is the deadline to file Form CT-3.1?

A: The deadline to file Form CT-3.1 is the same as the deadline for filing the corporation's Franchise Tax Return, which is usually March 15th.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-3.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.