This version of the form is not currently in use and is provided for reference only. Download this version of

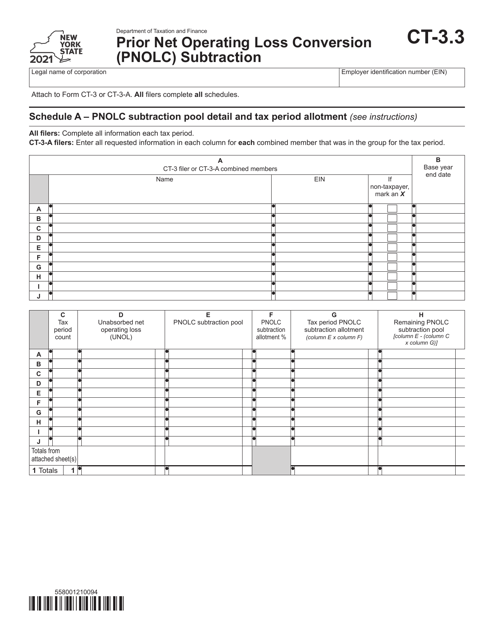

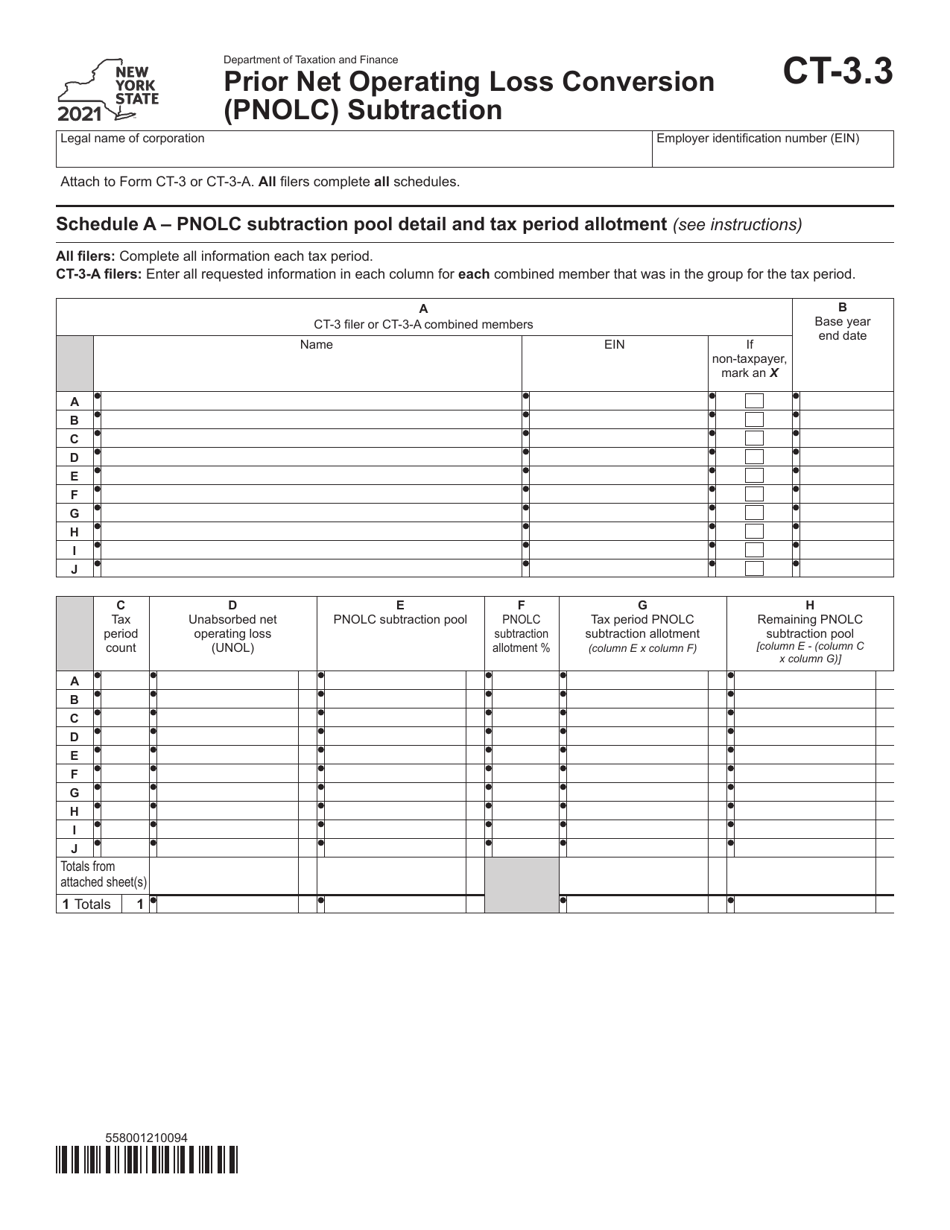

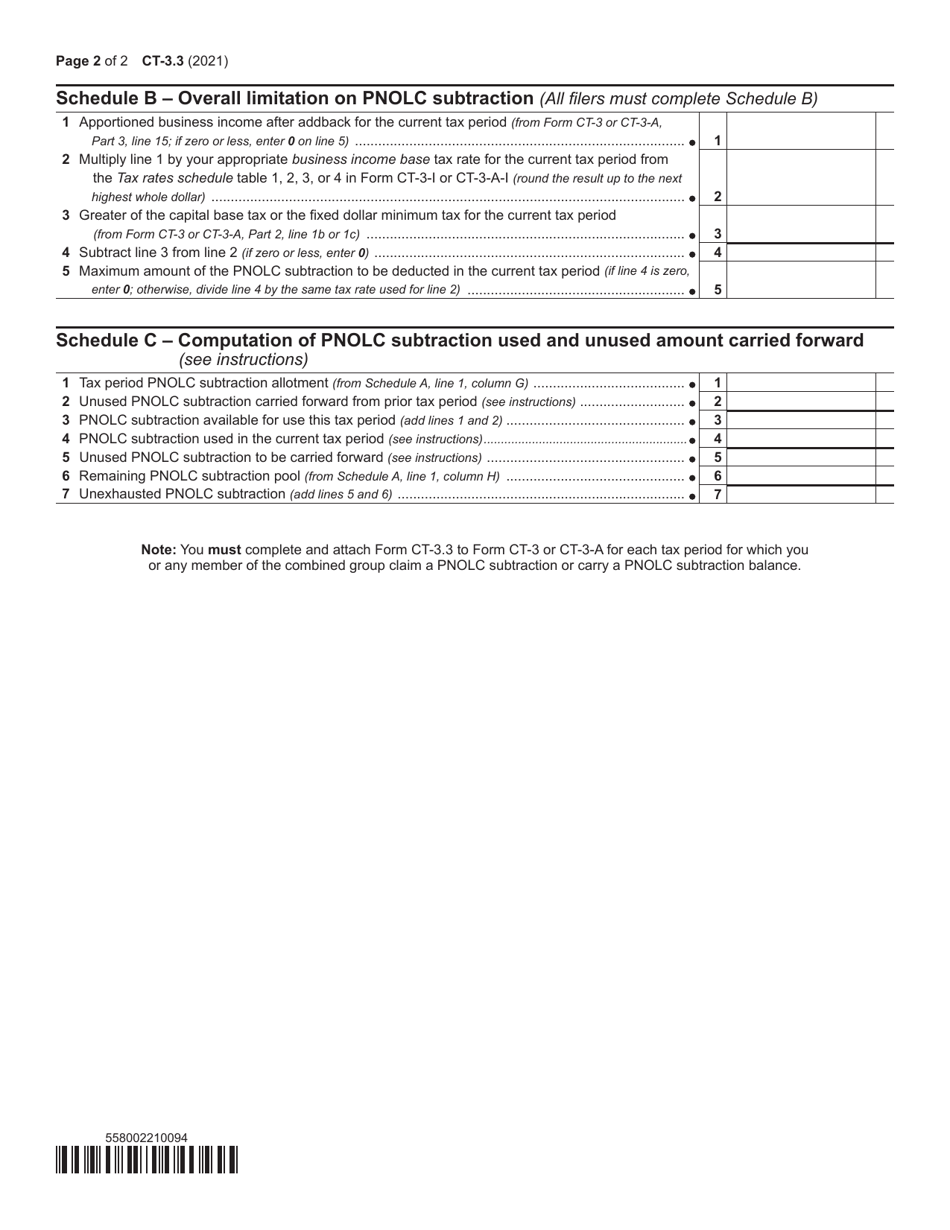

Form CT-3.3

for the current year.

Form CT-3.3 Prior Net Operating Loss Conversion (Pnolc) Subtraction - New York

What Is Form CT-3.3?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-3.3?

A: Form CT-3.3 is a tax form used in the state of New York.

Q: What is Prior Net Operating Loss Conversion (Pnolc) Subtraction?

A: Prior Net Operating Loss Conversion (Pnolc) Subtraction is a deduction on the Form CT-3.3.

Q: What is the purpose of Form CT-3.3?

A: Form CT-3.3 is used to calculate the Prior Net Operating Loss Conversion (Pnolc) Subtraction.

Q: Who needs to file Form CT-3.3?

A: Taxpayers in the state of New York who have a Prior Net Operating Loss Conversion (Pnolc) Subtraction need to file Form CT-3.3.

Q: When is the deadline to file Form CT-3.3?

A: The deadline to file Form CT-3.3 in New York is usually the same as the deadline for filing the annual tax return, which is April 15th.

Q: Are there any penalties for late filing of Form CT-3.3?

A: Yes, there may be penalties for late filing of Form CT-3.3, including interest charges and possible fines.

Q: Is Form CT-3.3 required for individuals or only for businesses?

A: Form CT-3.3 is typically required for businesses, but individuals with certain types of income may also need to file it.

Q: Can I e-file Form CT-3.3?

A: Yes, Form CT-3.3 can be e-filed using approved tax preparation software.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-3.3 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.