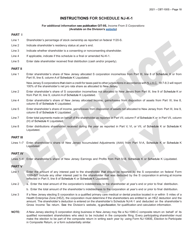

This version of the form is not currently in use and is provided for reference only. Download this version of

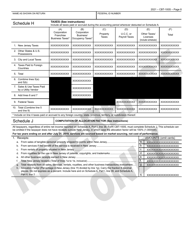

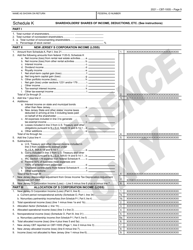

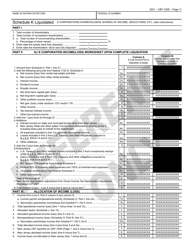

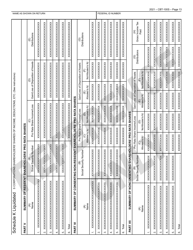

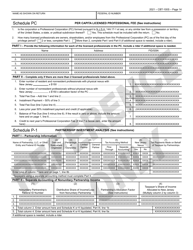

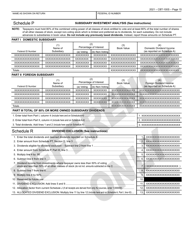

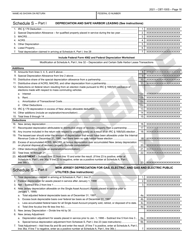

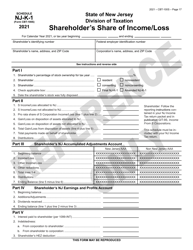

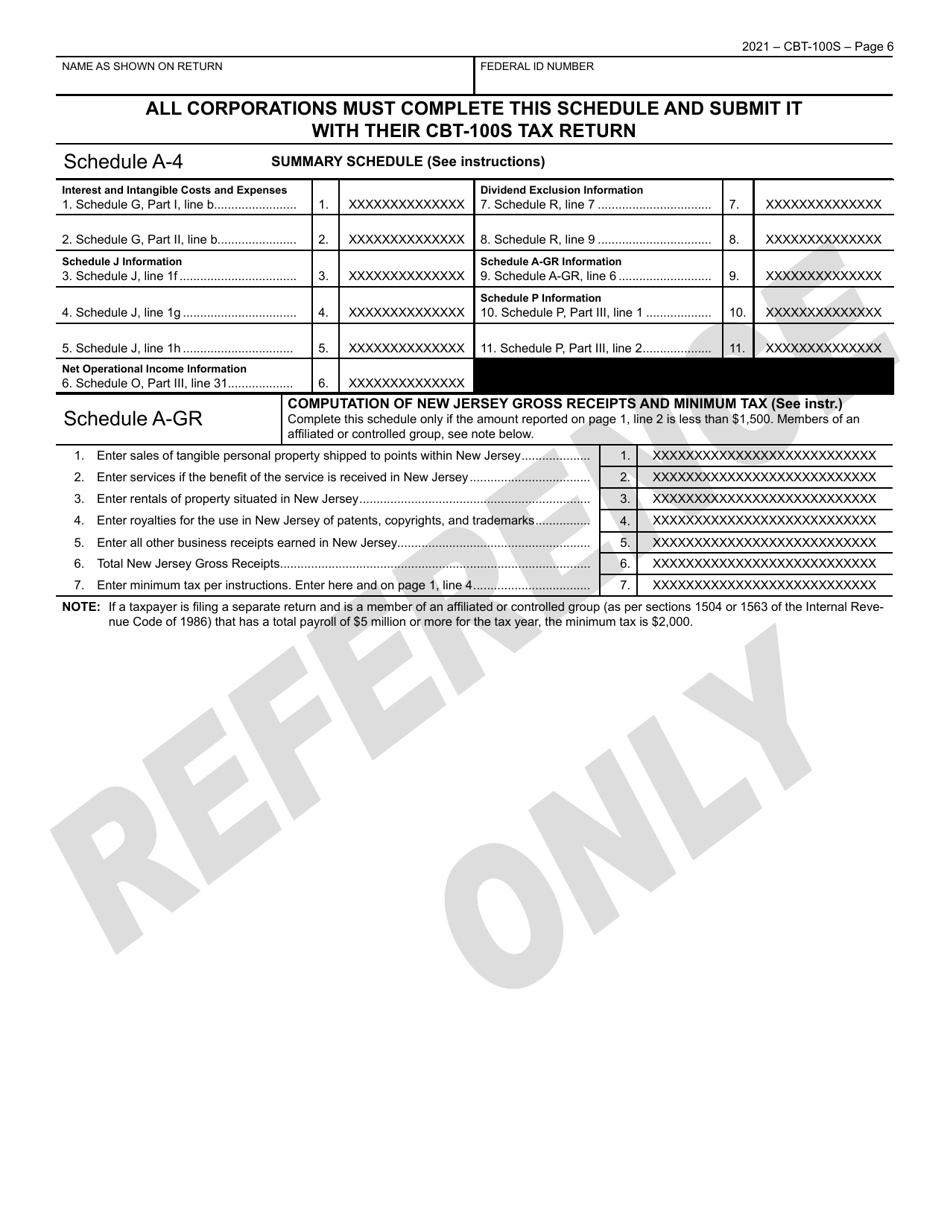

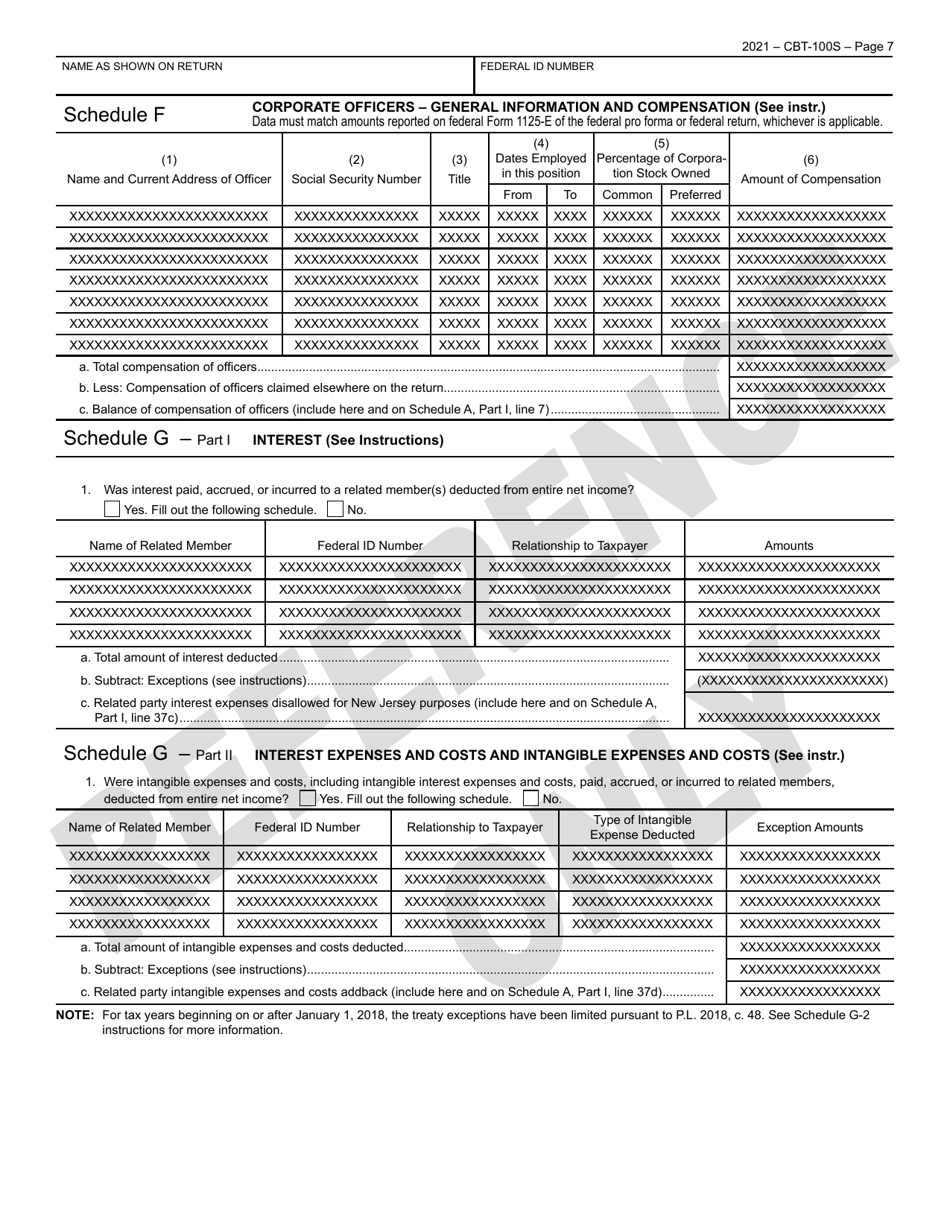

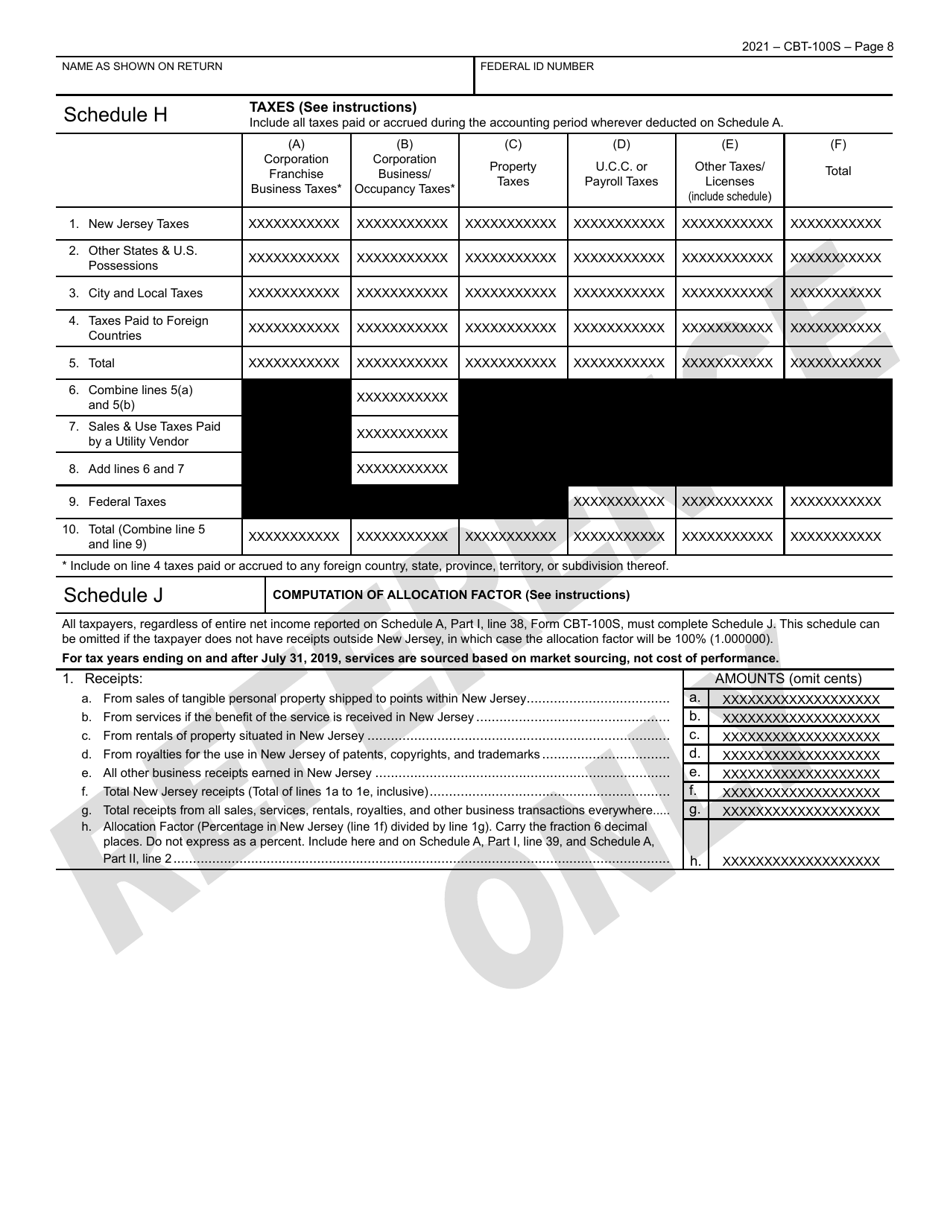

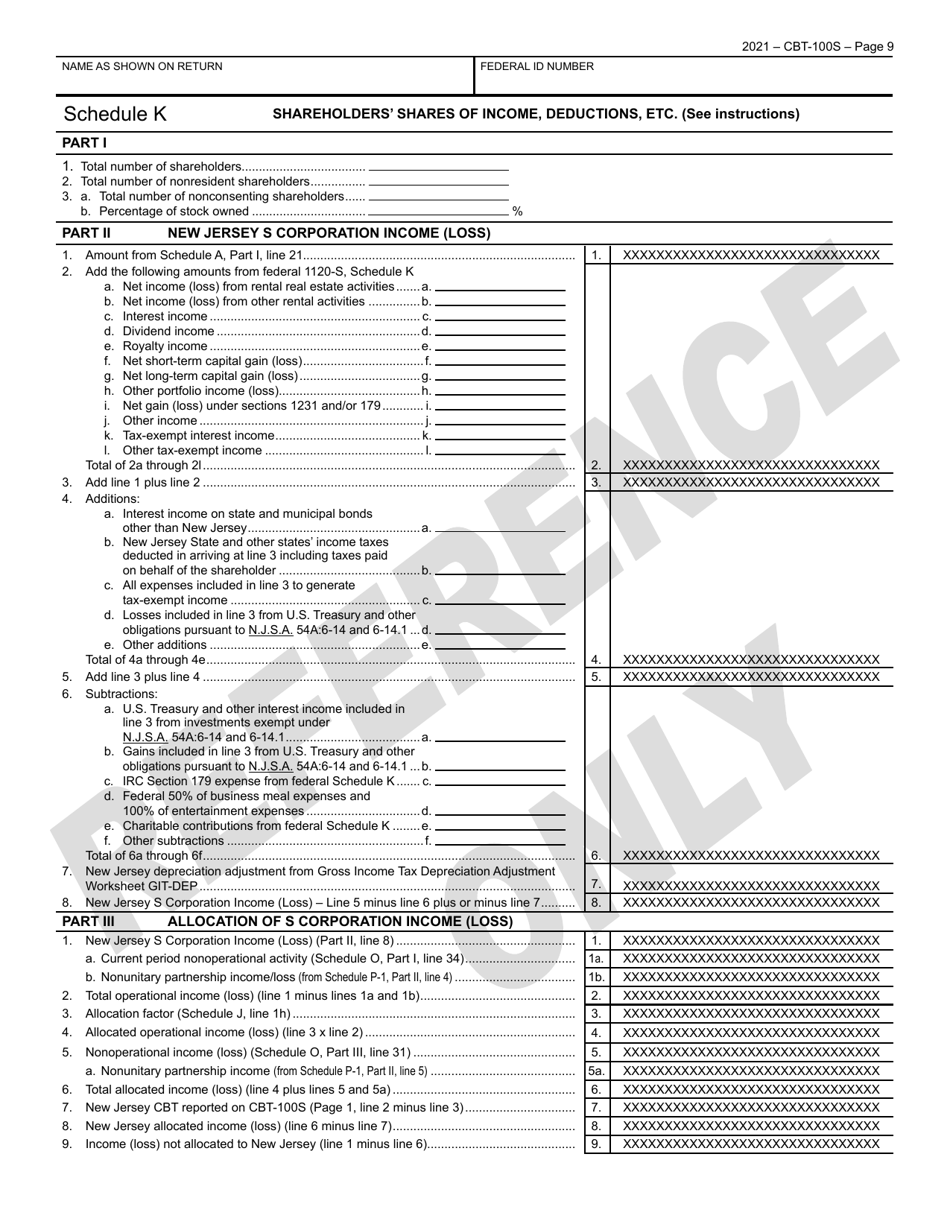

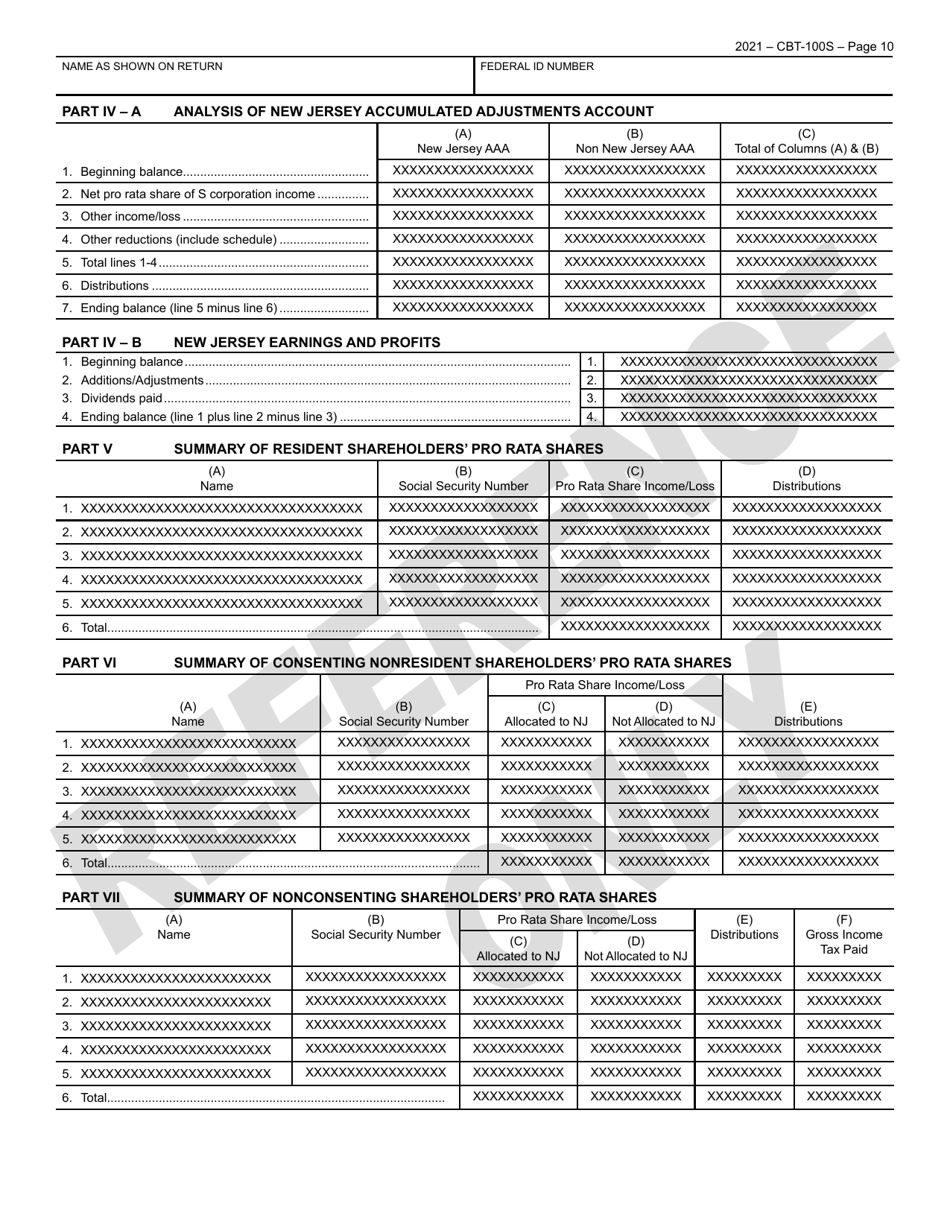

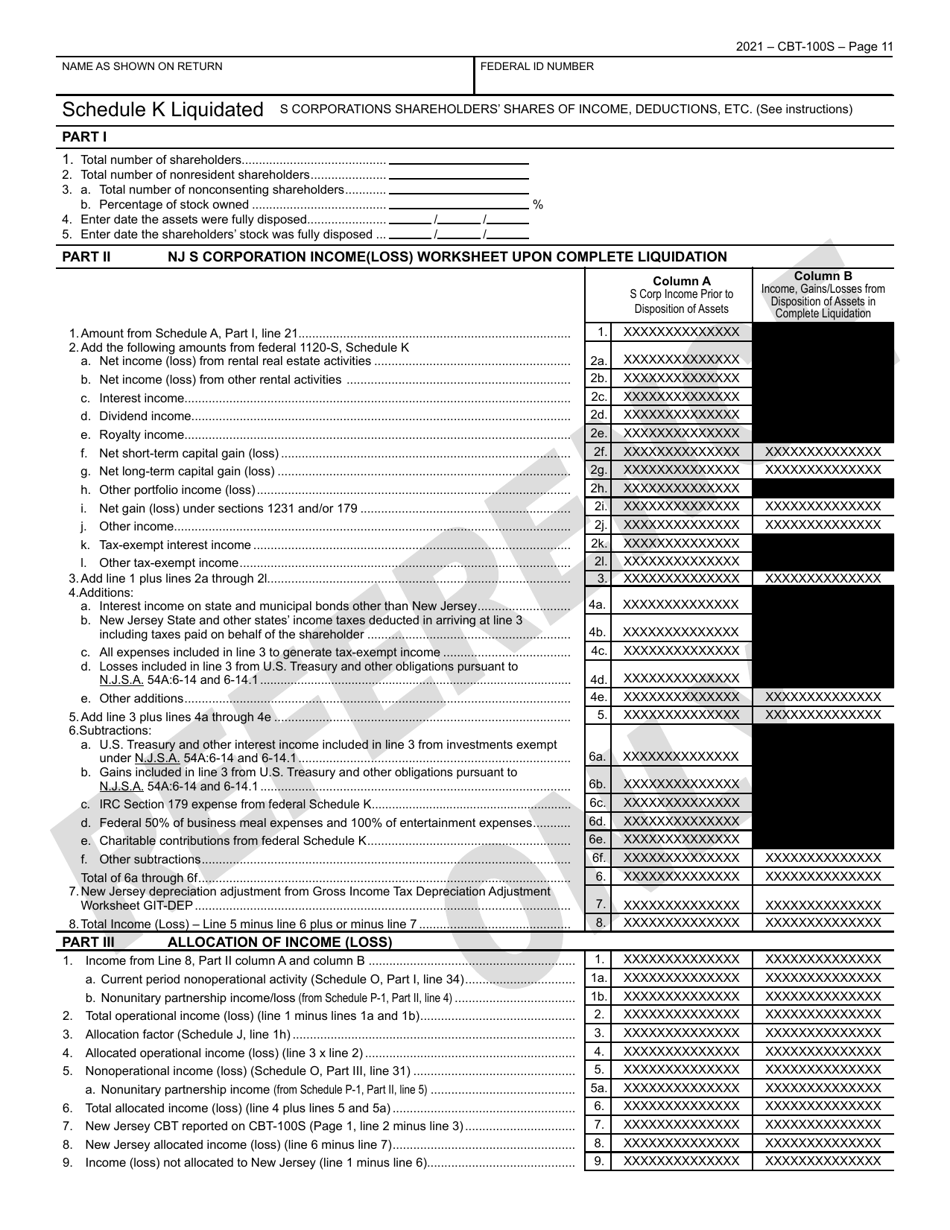

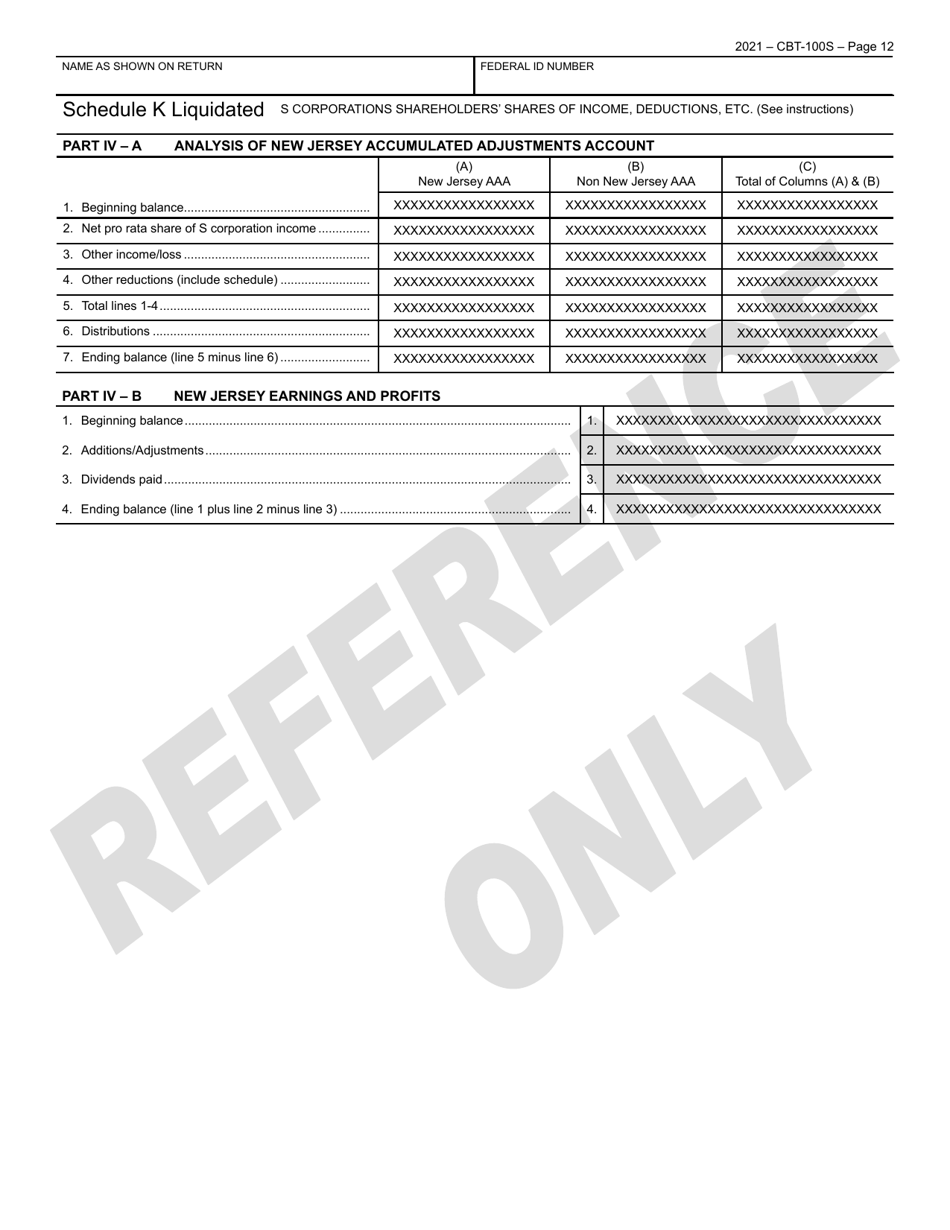

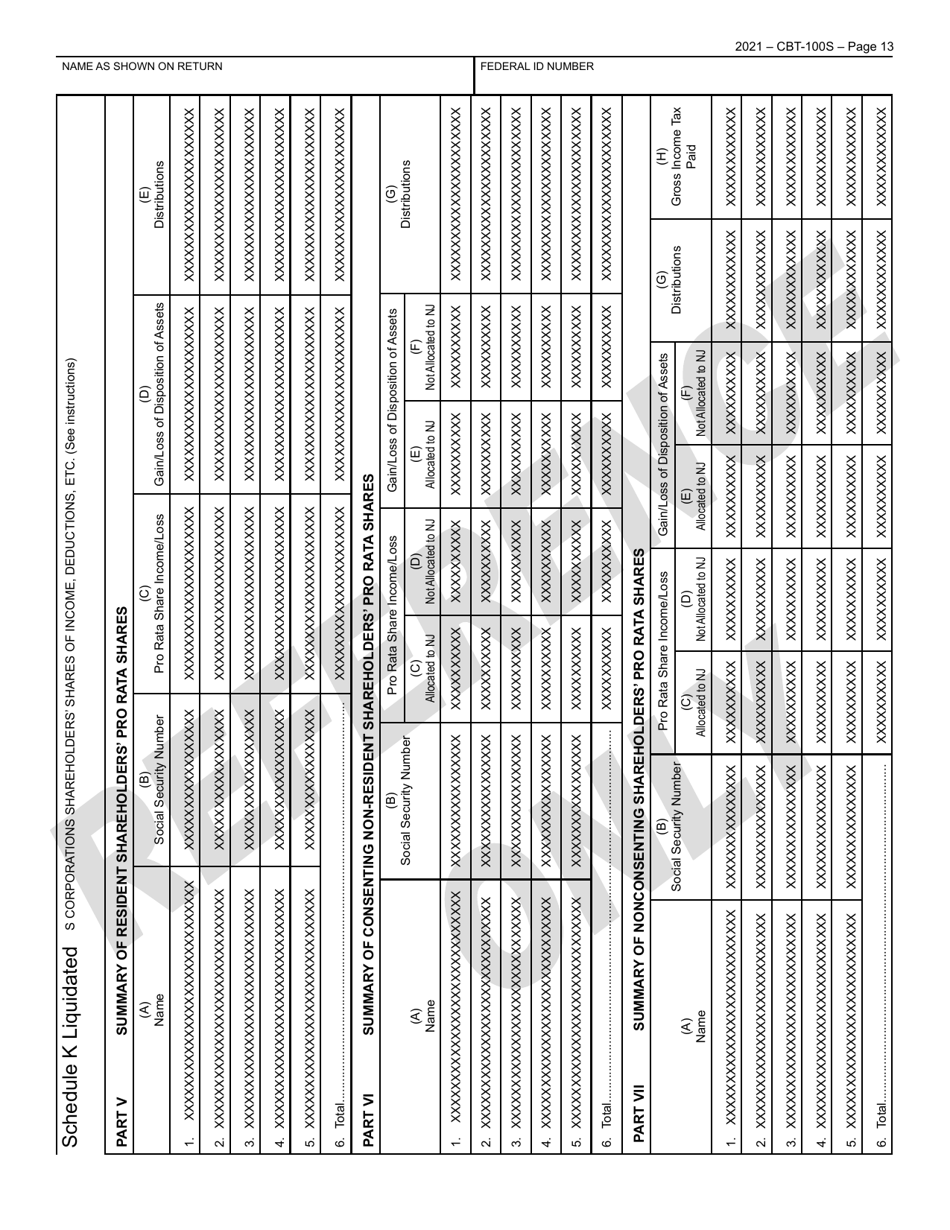

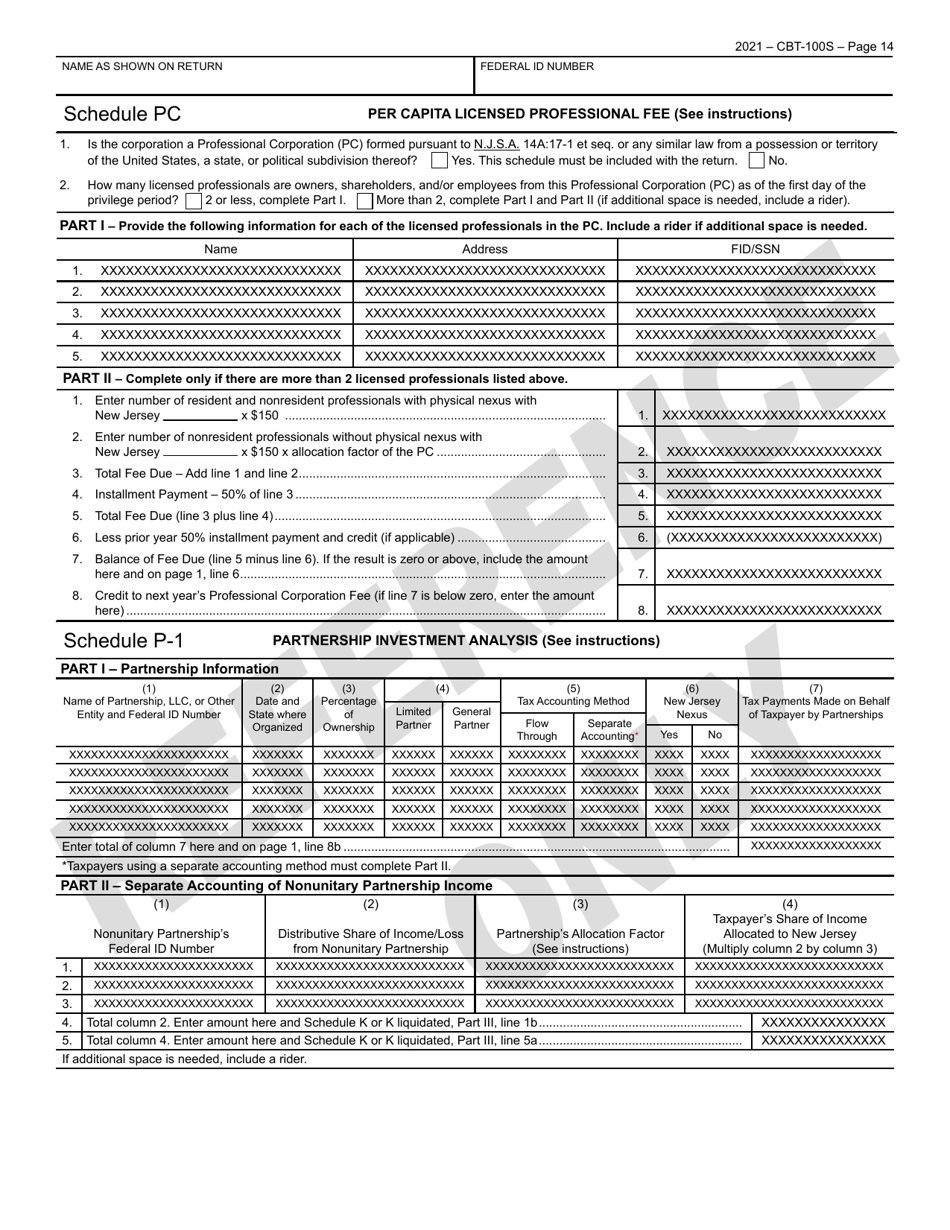

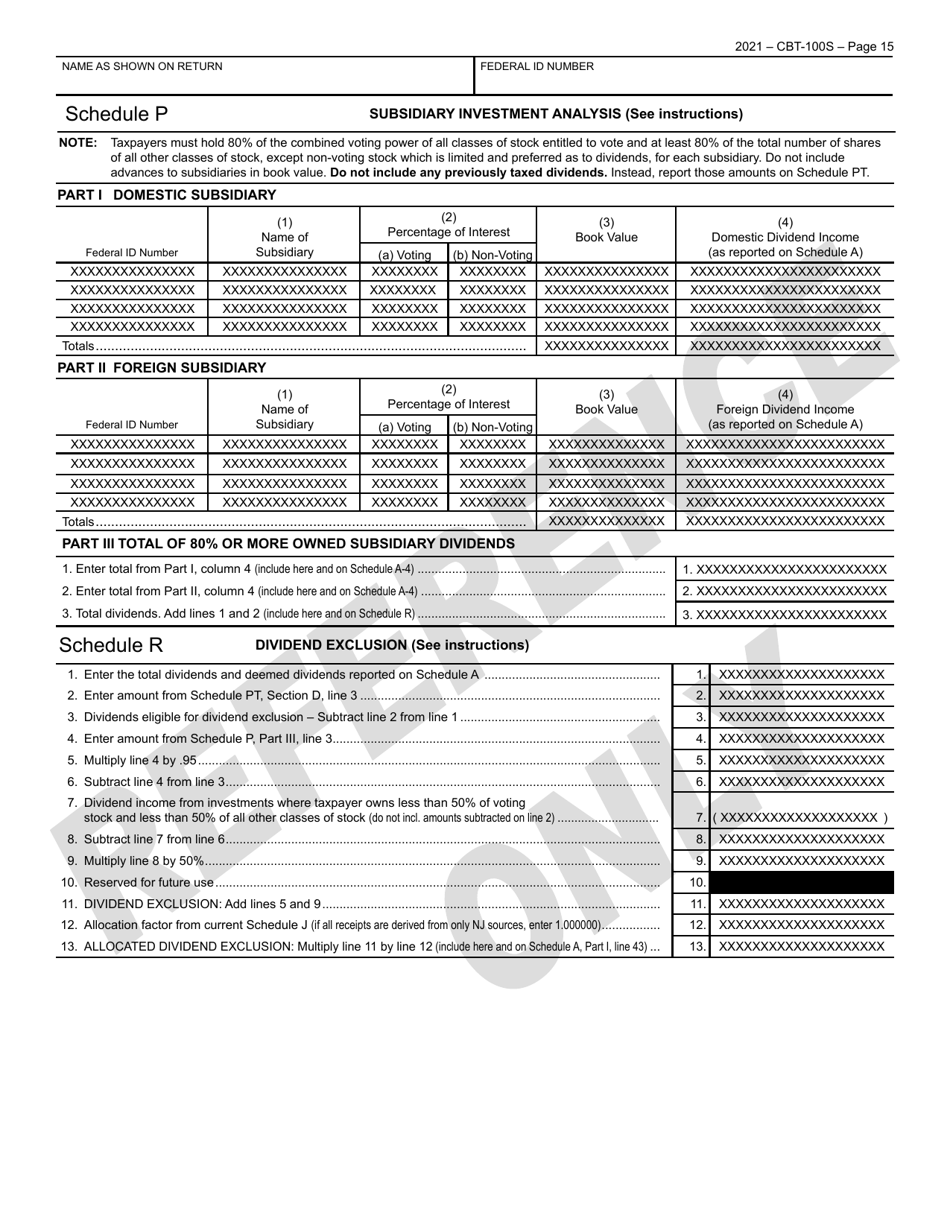

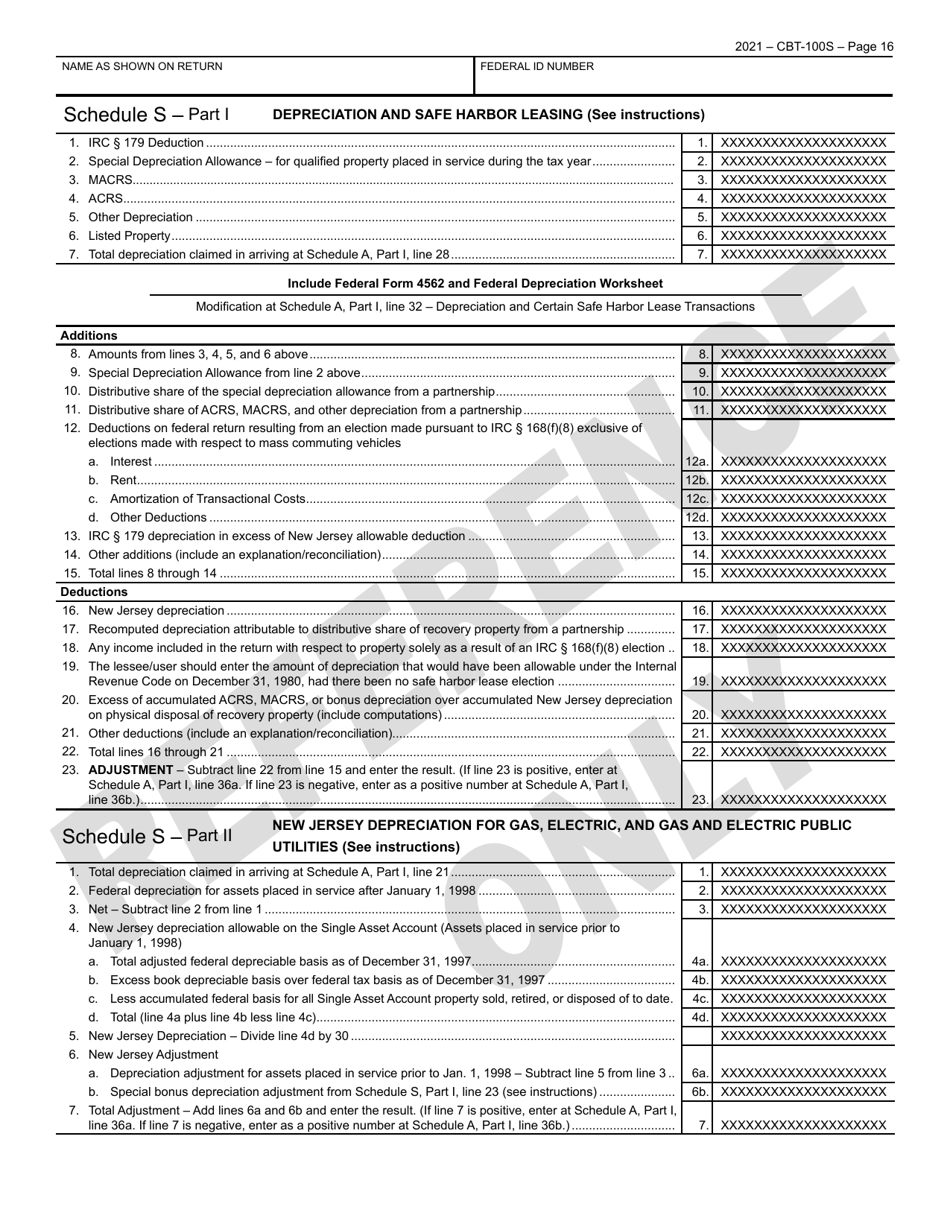

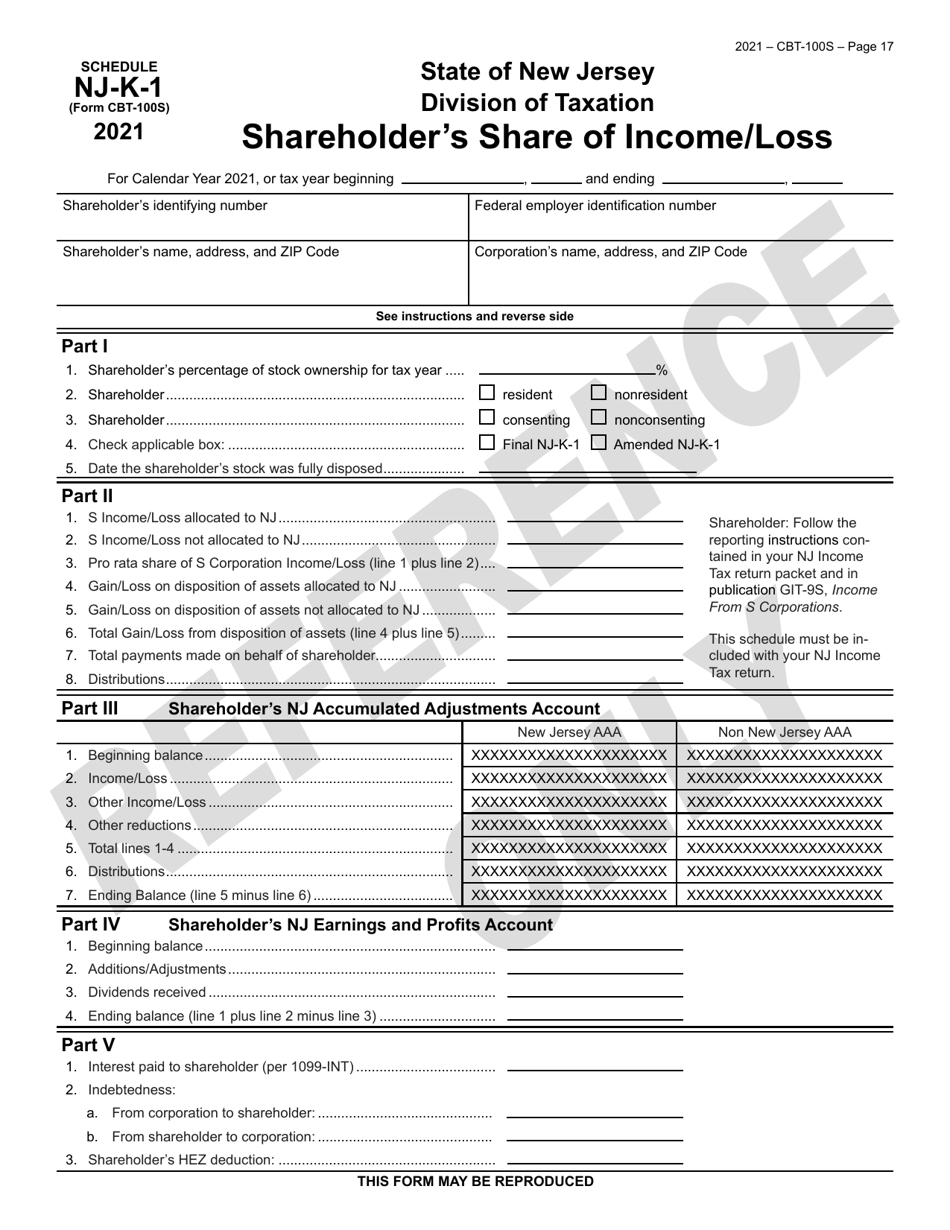

Form CBT-100S

for the current year.

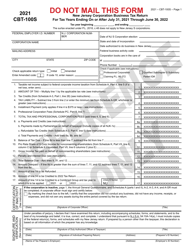

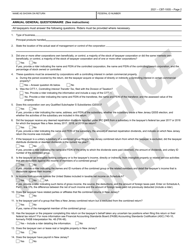

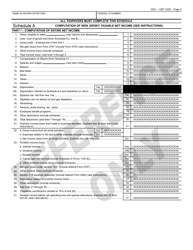

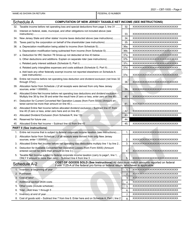

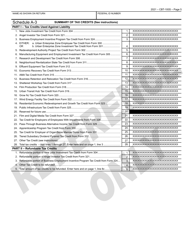

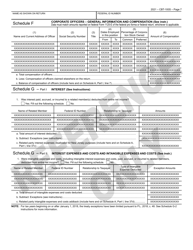

Form CBT-100S New Jersey Corporation Business Tax Return Sample - New Jersey

What Is Form CBT-100S?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

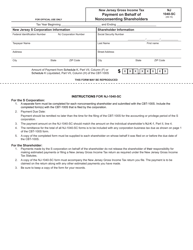

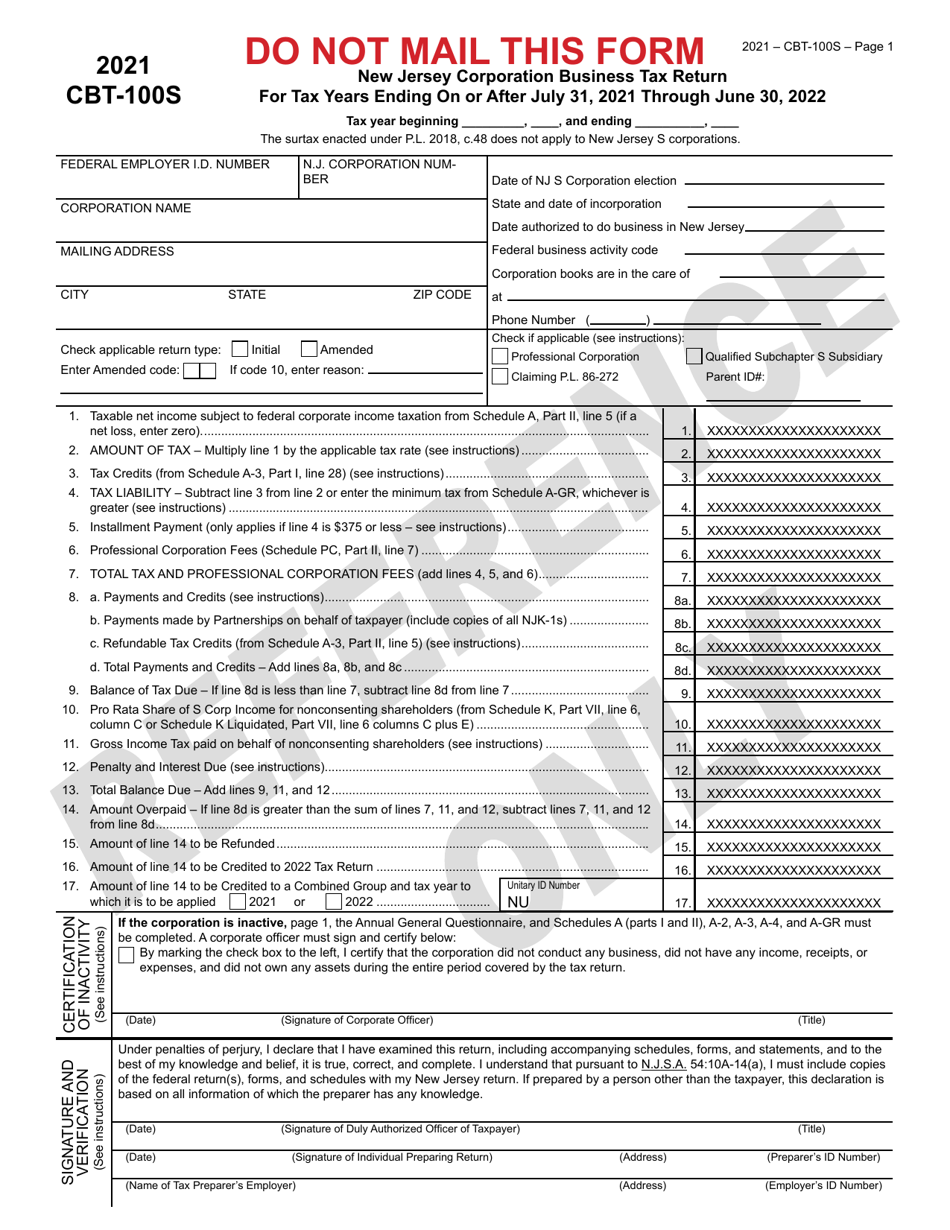

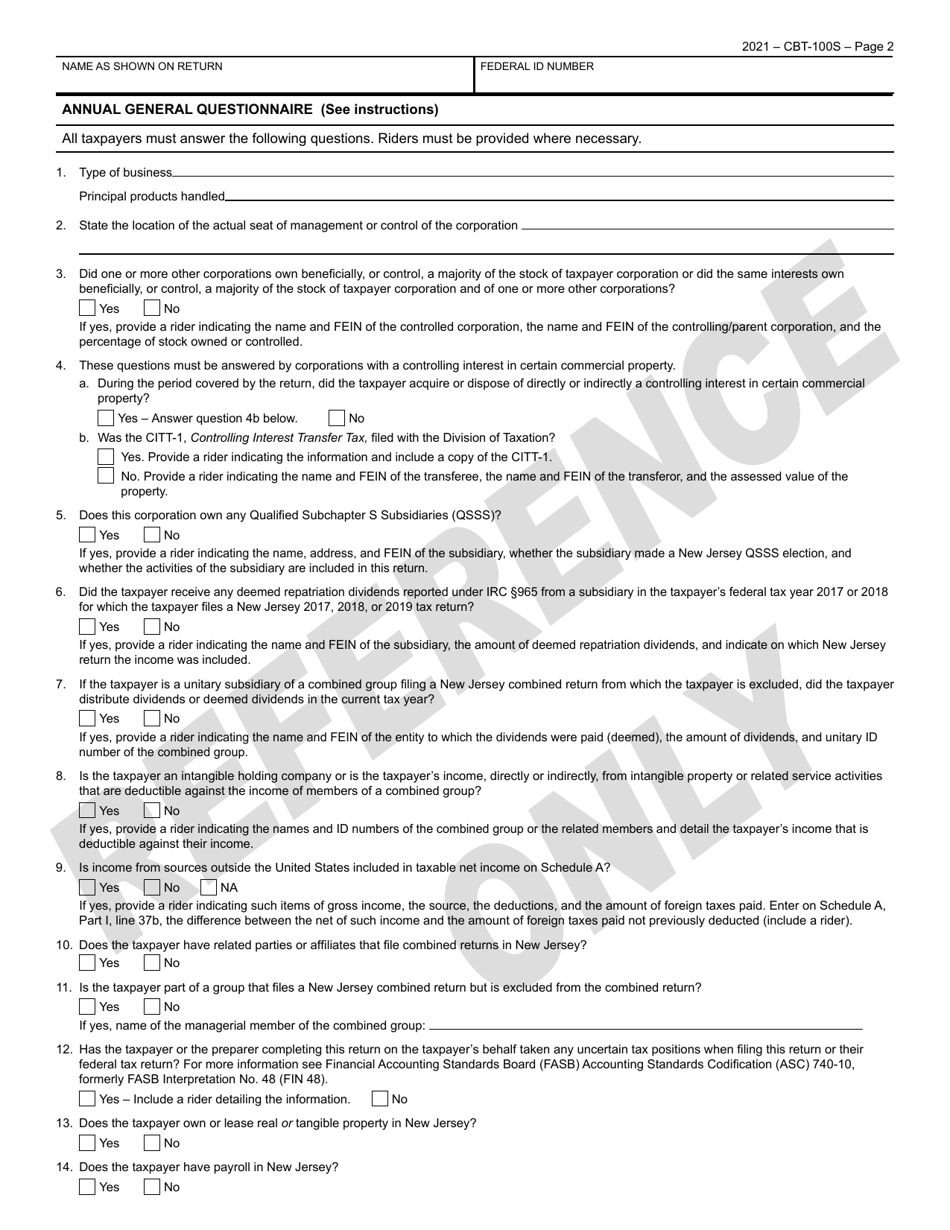

Q: What is Form CBT-100S?

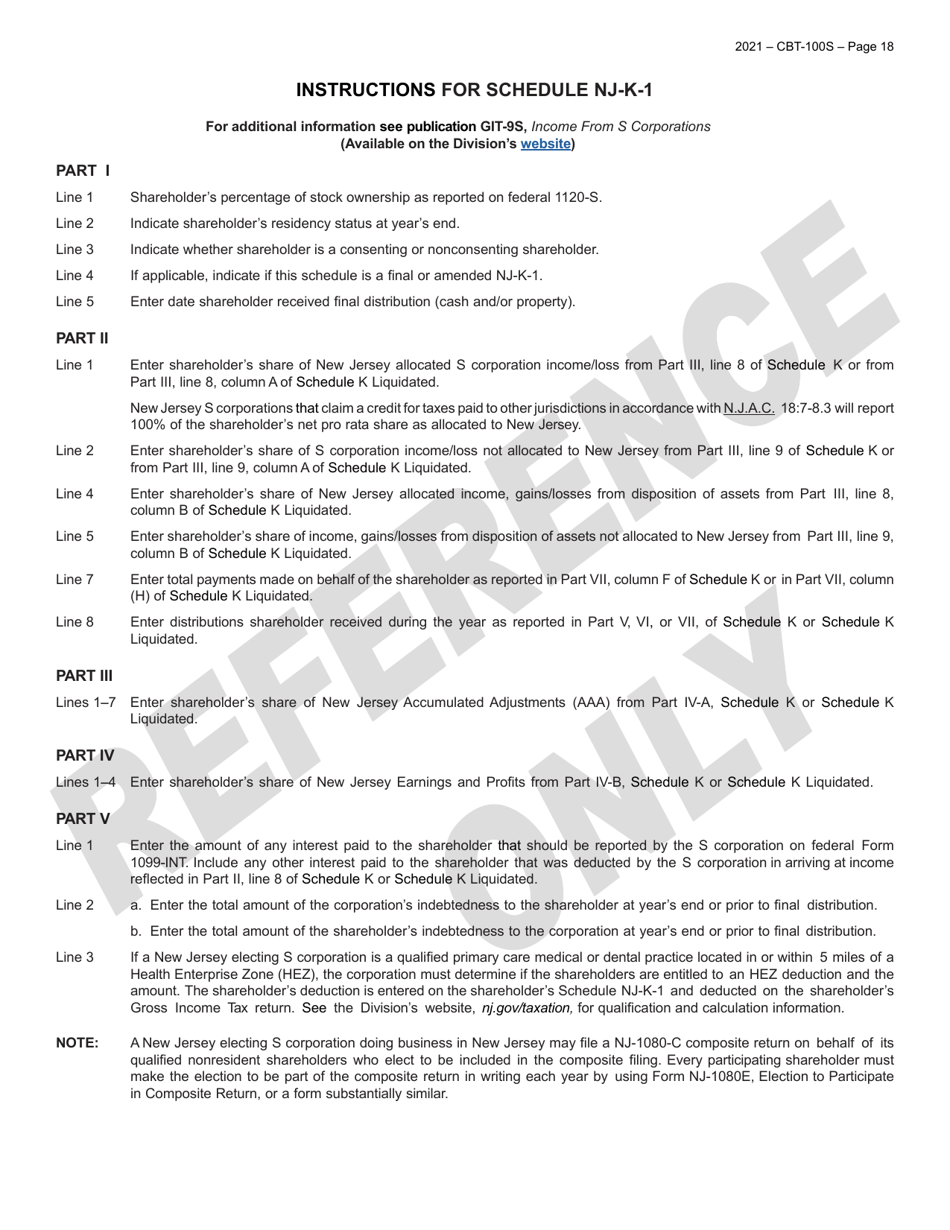

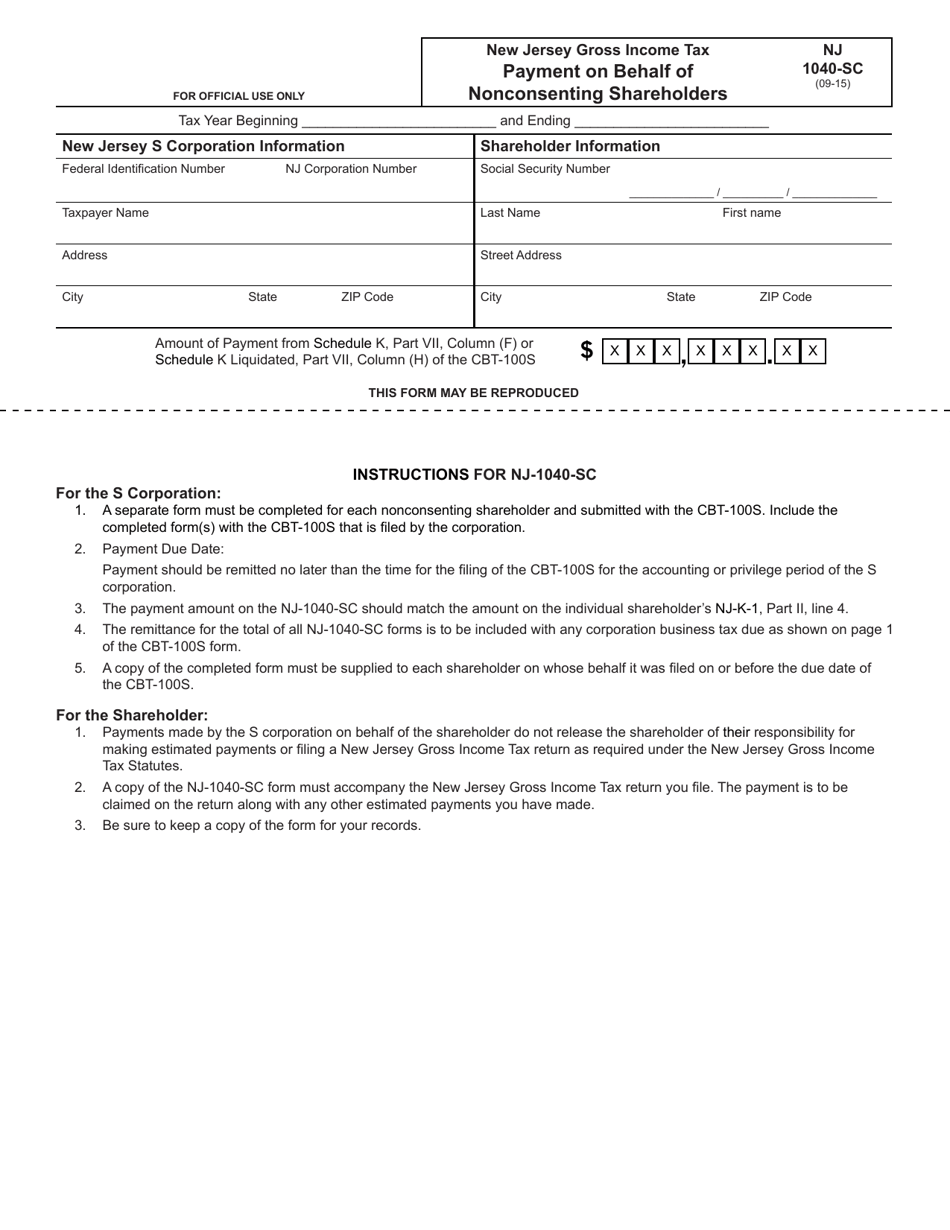

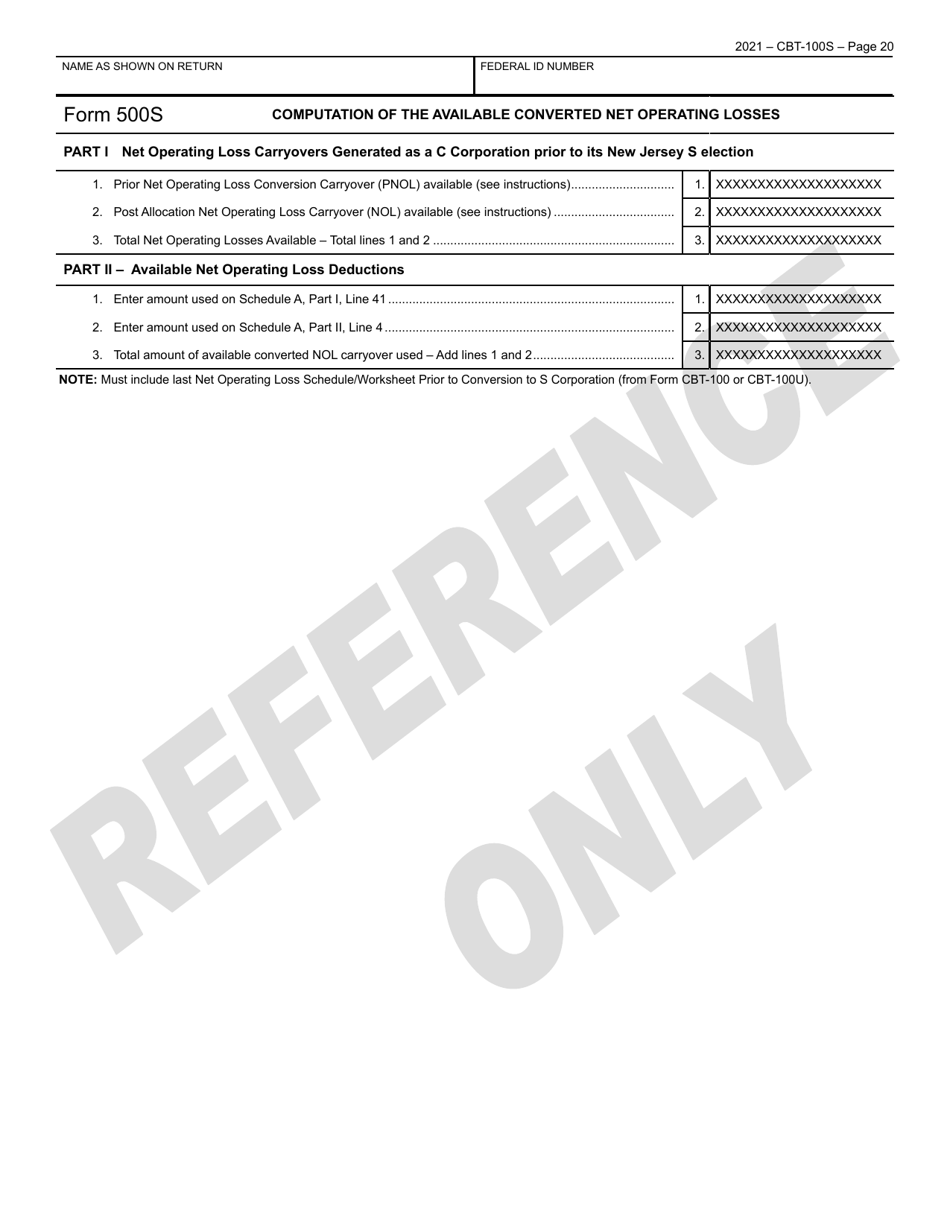

A: Form CBT-100S is the New Jersey Corporation Business Tax Return specifically for S Corporations.

Q: Who needs to file Form CBT-100S?

A: S Corporations that are doing business in New Jersey and have income subject to New Jersey corporation business tax need to file Form CBT-100S.

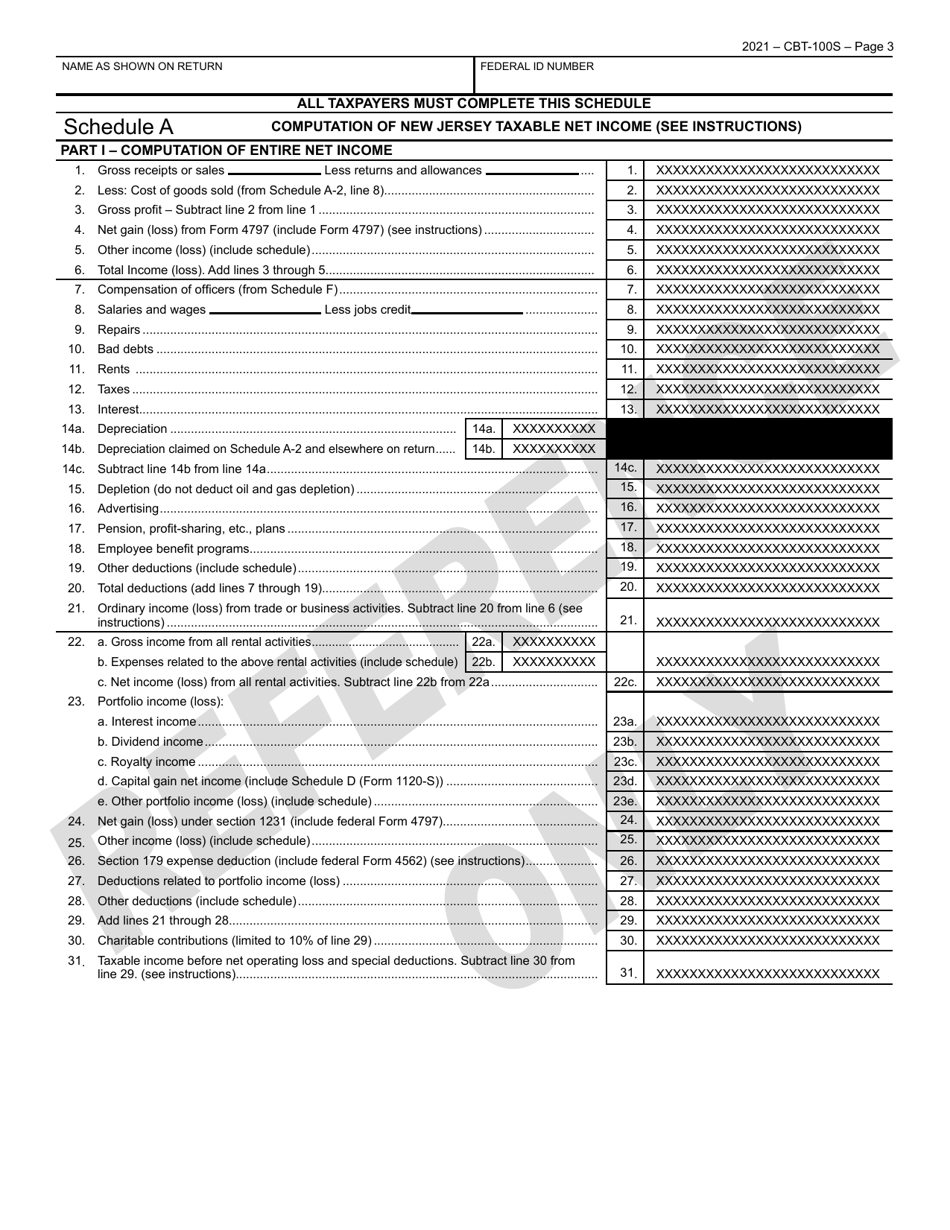

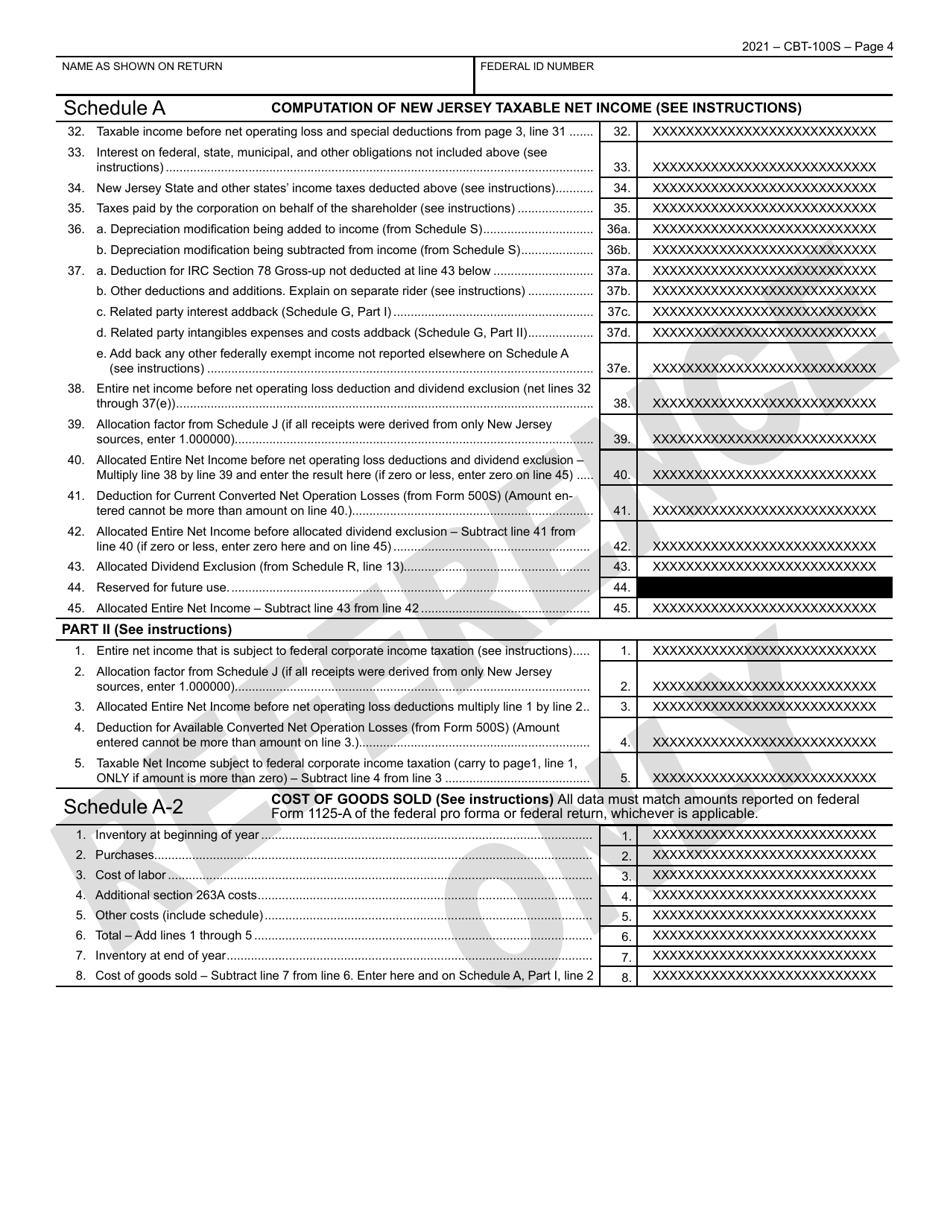

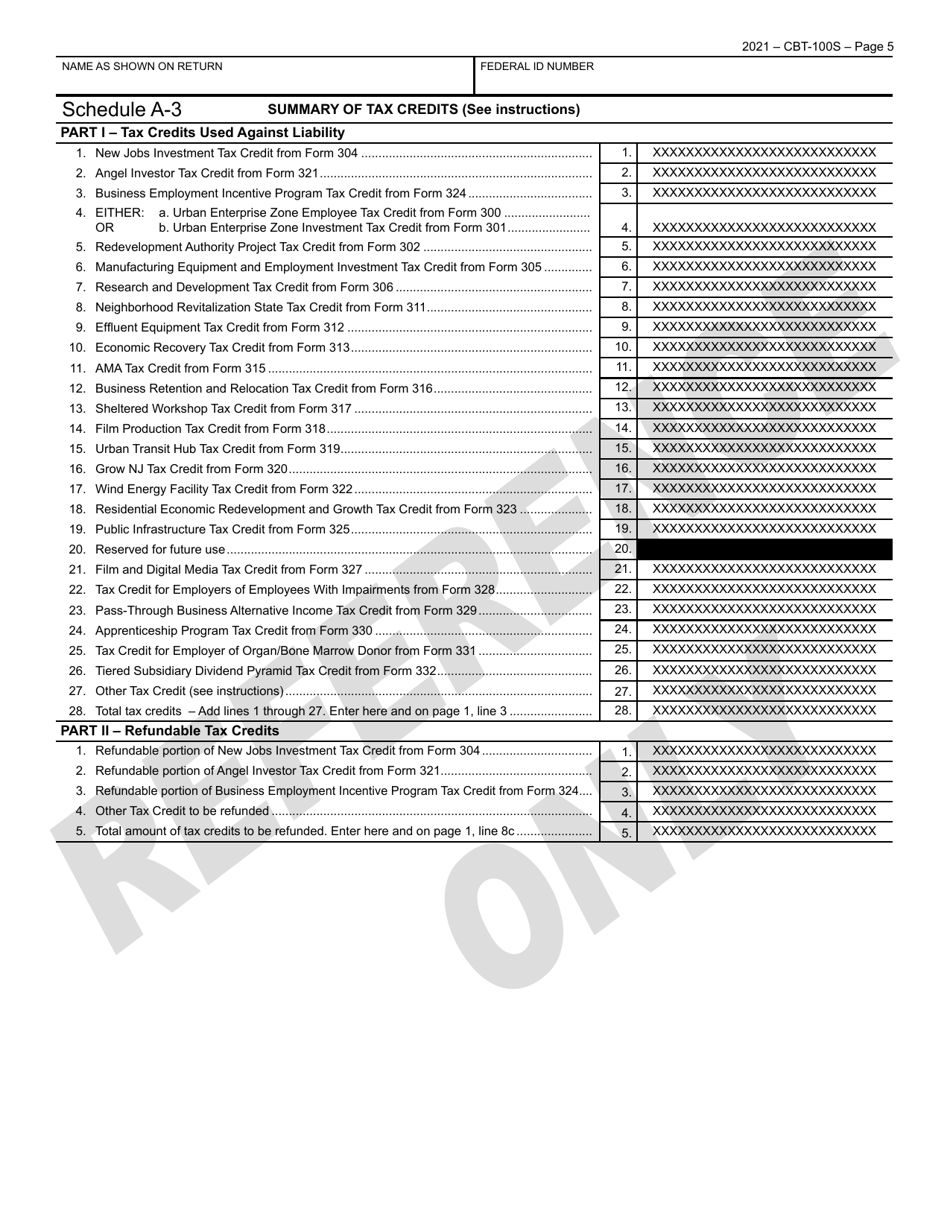

Q: What is the purpose of Form CBT-100S?

A: Form CBT-100S is used to report and calculate the corporation business tax liability for S Corporations in New Jersey.

Q: What information is required on Form CBT-100S?

A: Form CBT-100S requires information about the S Corporation's income, deductions, credits, and tax liability.

Q: When is Form CBT-100S due?

A: Form CBT-100S is due on the 15th day of the 4th month following the close of the tax year, which is usually April 15th for calendar year filers.

Q: Are there any penalties for late filing of Form CBT-100S?

A: Yes, there are penalties for late filing of Form CBT-100S, including interest on any unpaid taxes.

Q: Is there a fee for filing Form CBT-100S?

A: No, there is no fee for filing Form CBT-100S.

Q: What if I have questions about Form CBT-100S?

A: If you have questions about Form CBT-100S, you can contact the New Jersey Division of Taxation for assistance.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CBT-100S by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.