This version of the form is not currently in use and is provided for reference only. Download this version of

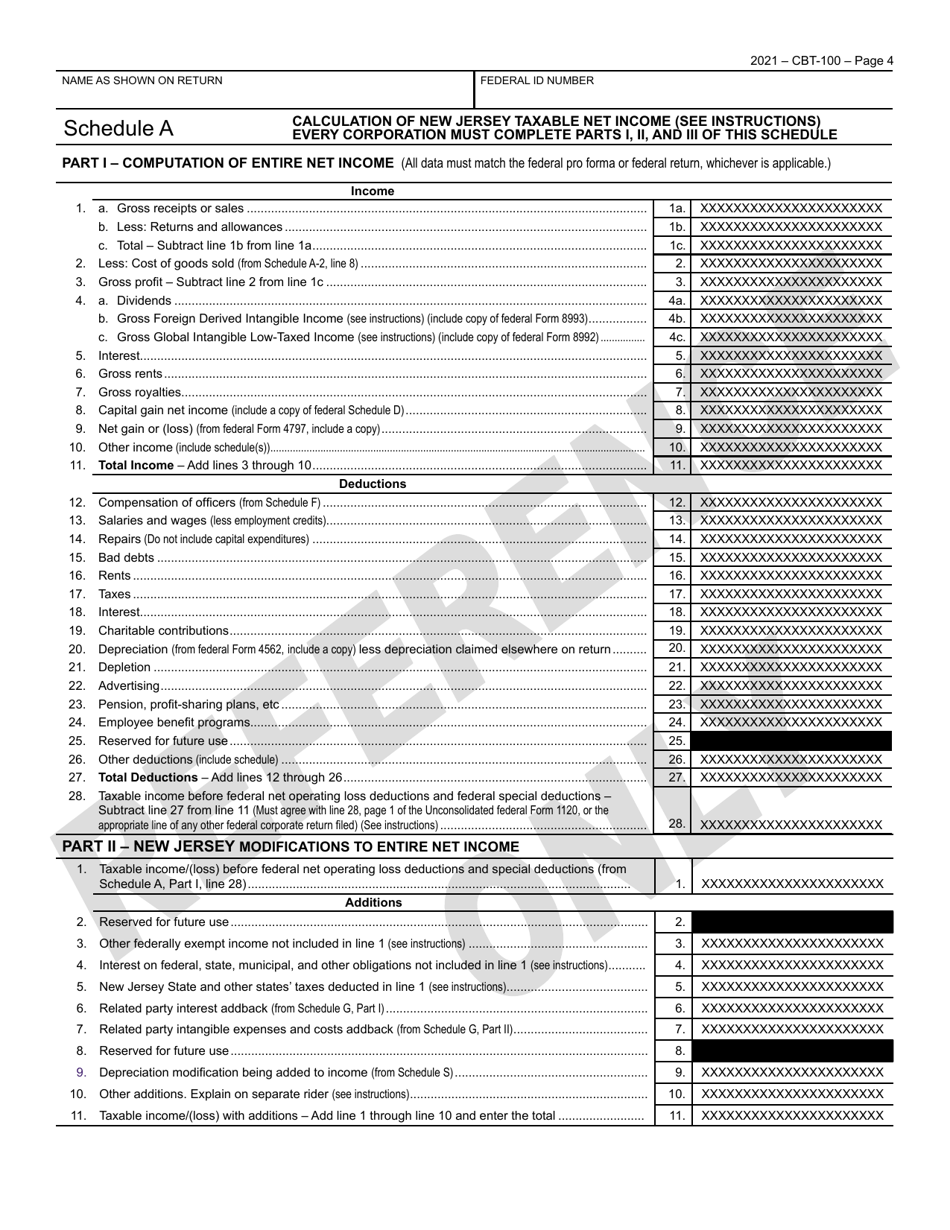

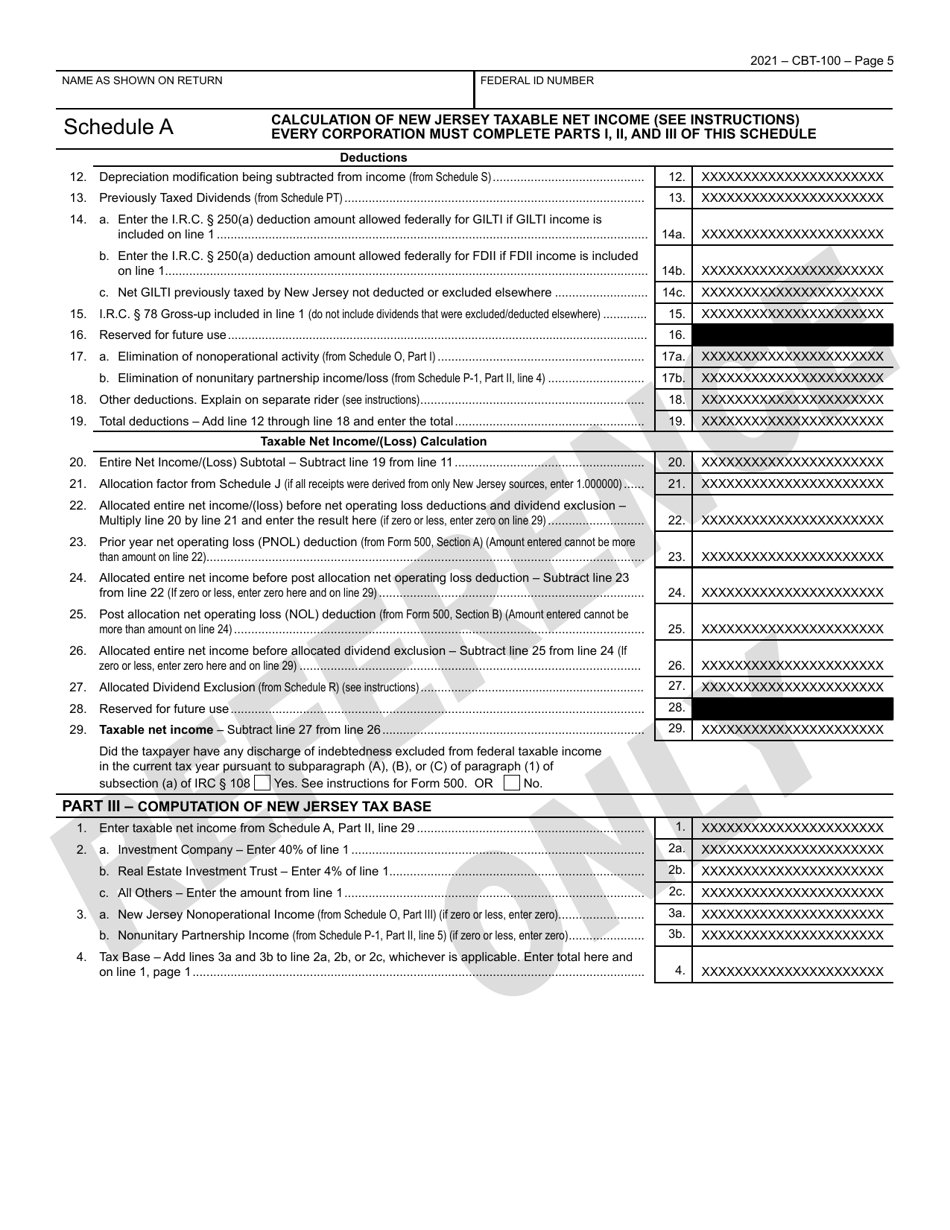

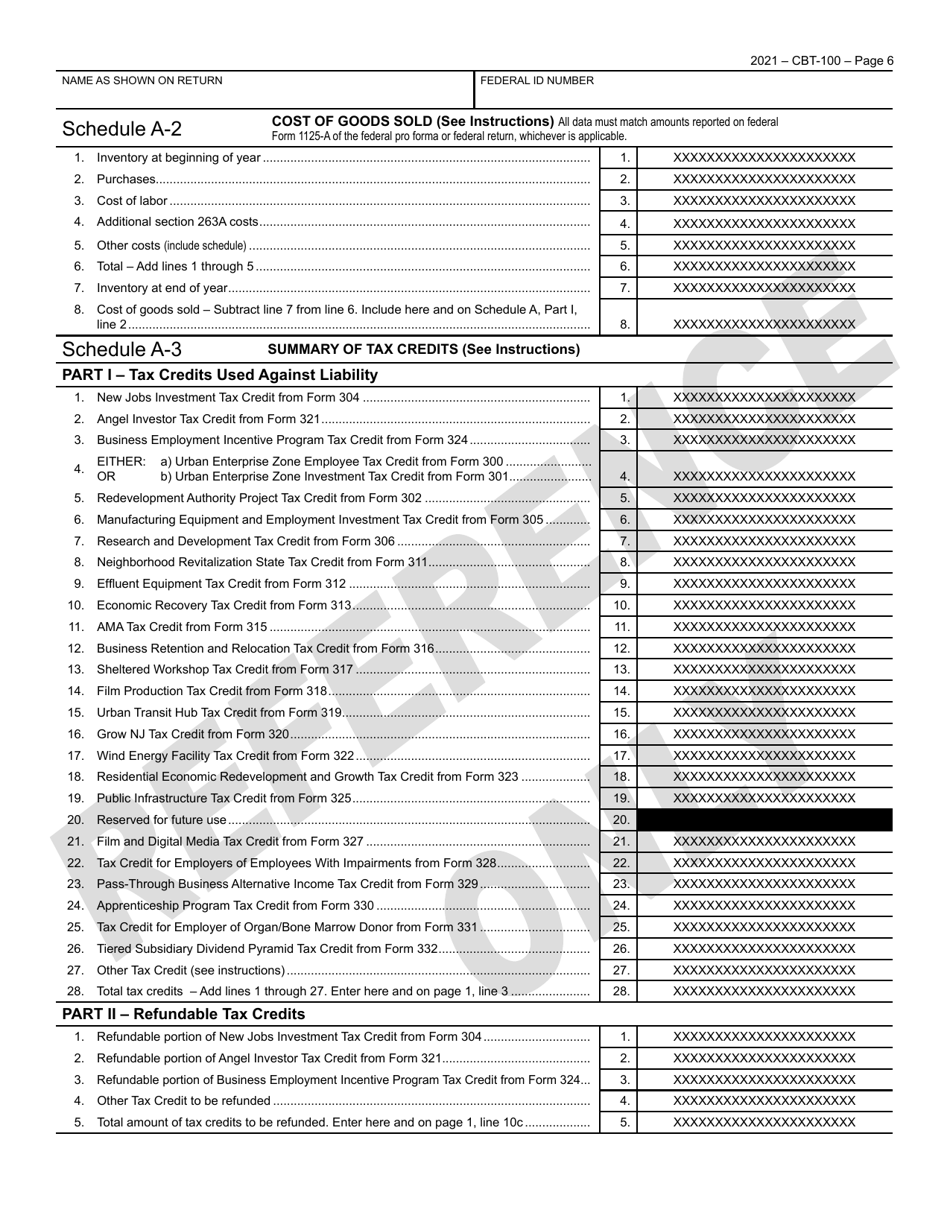

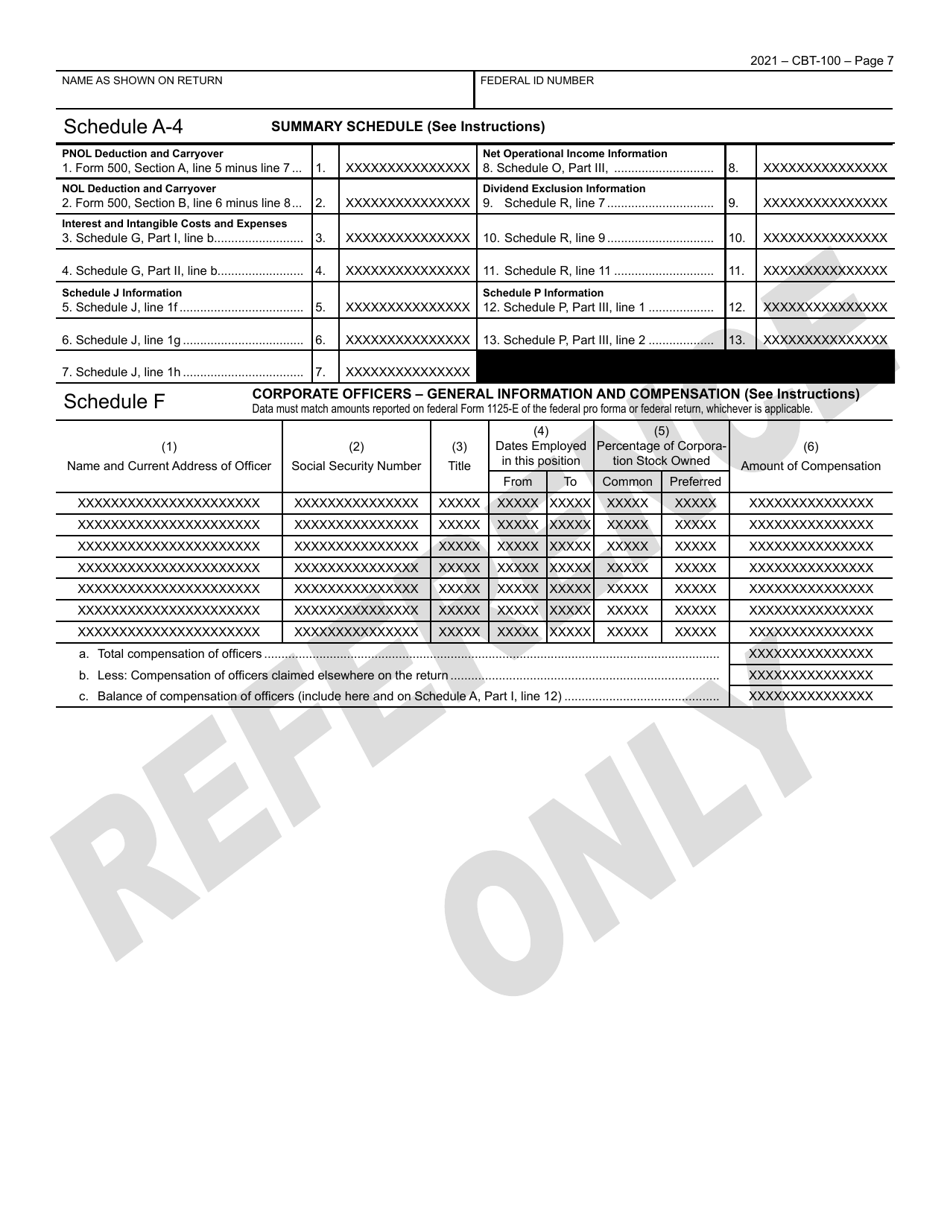

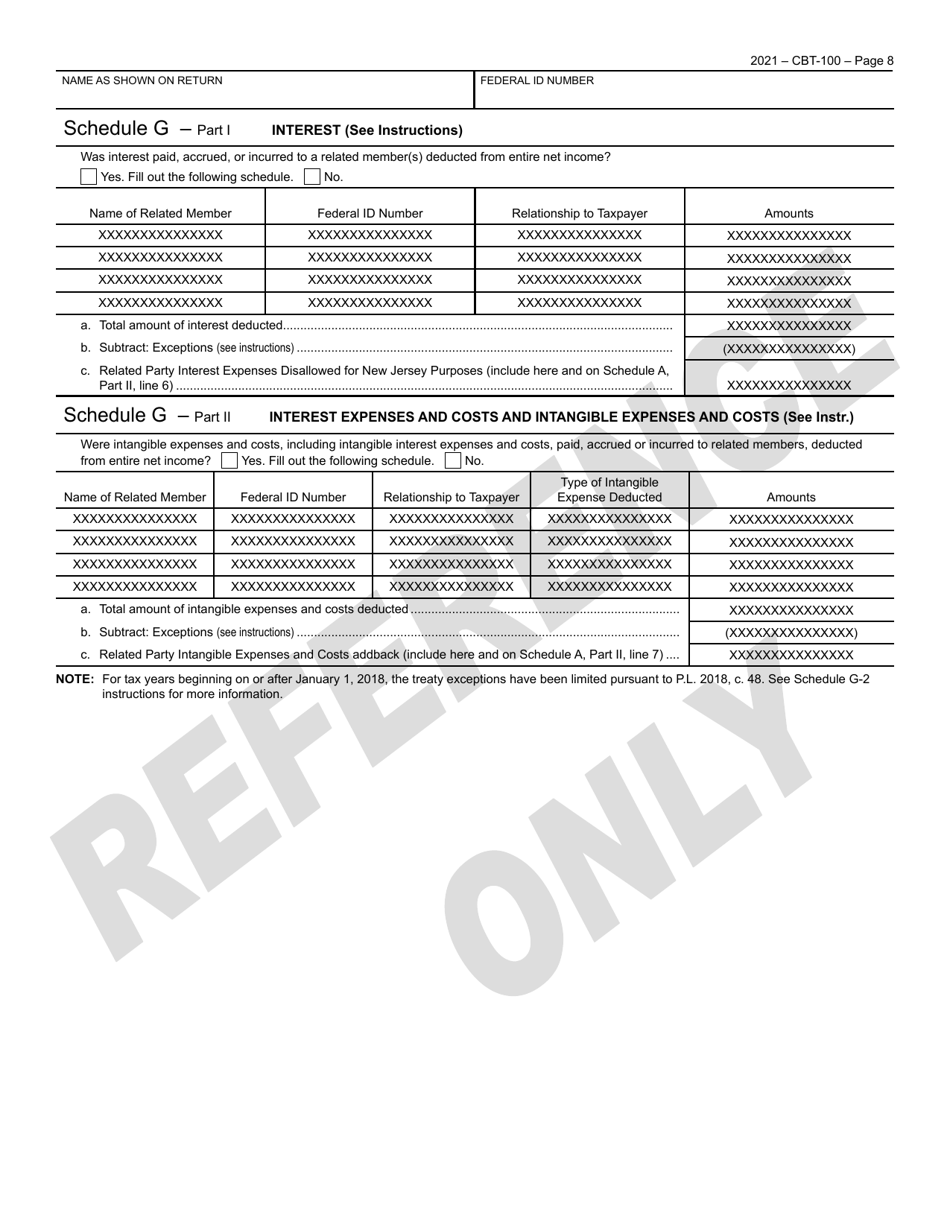

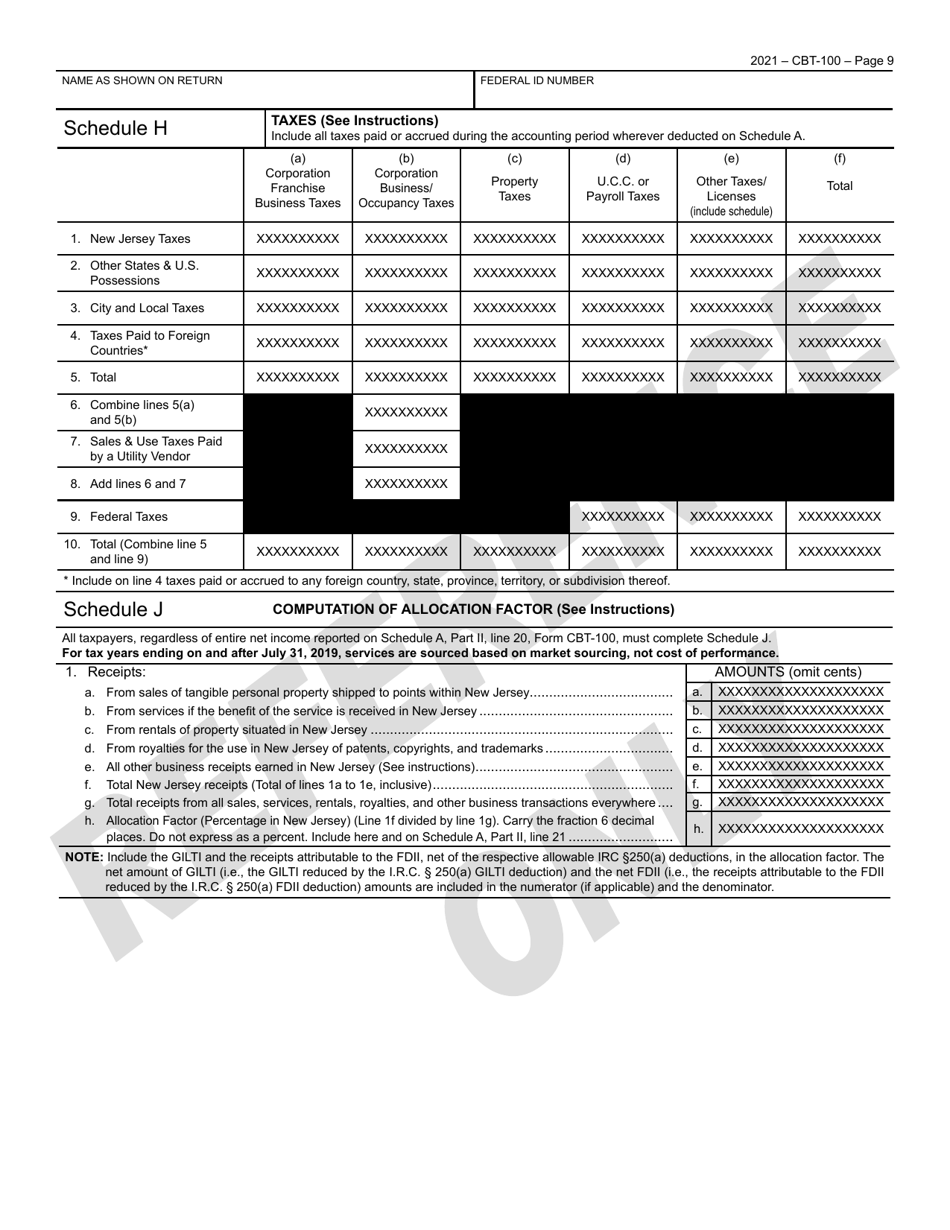

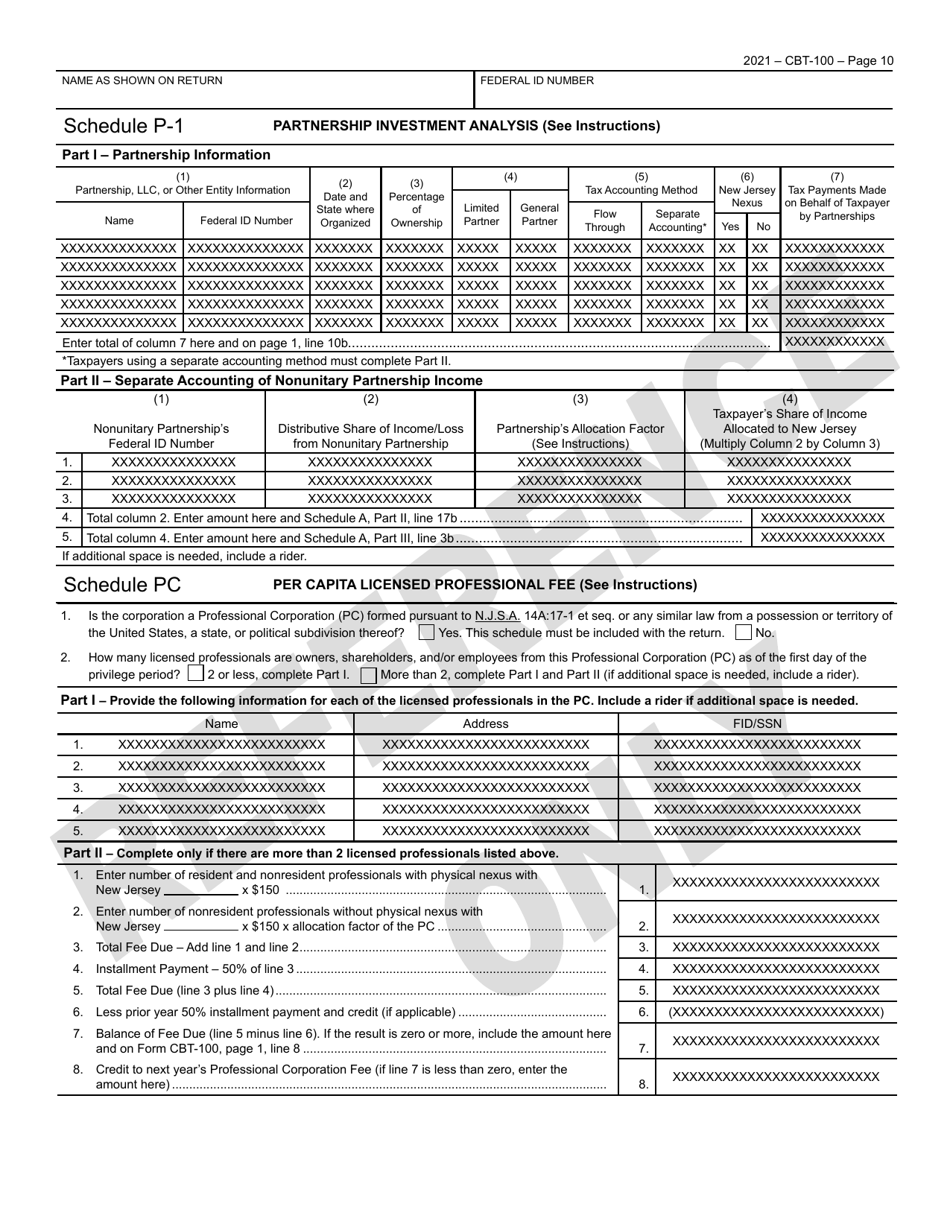

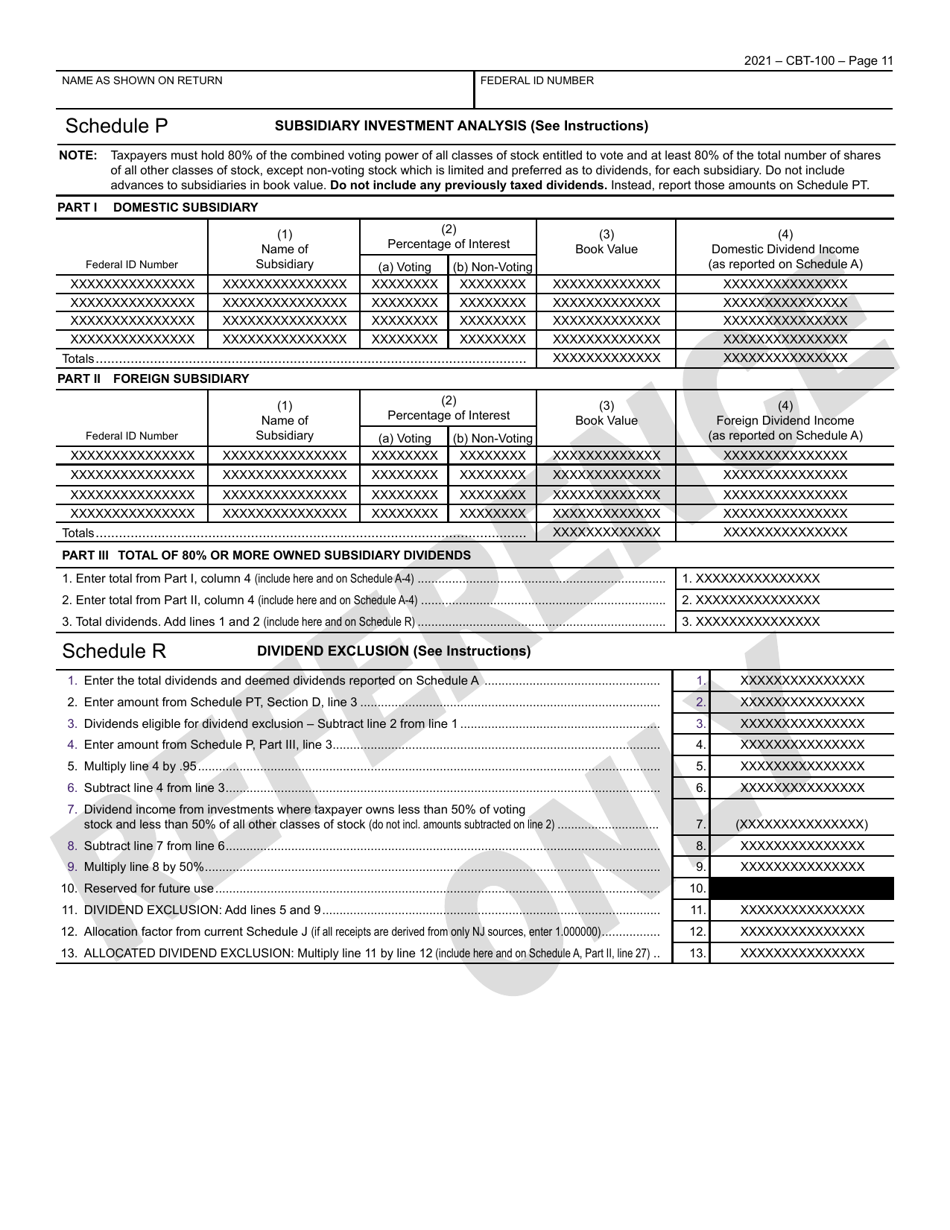

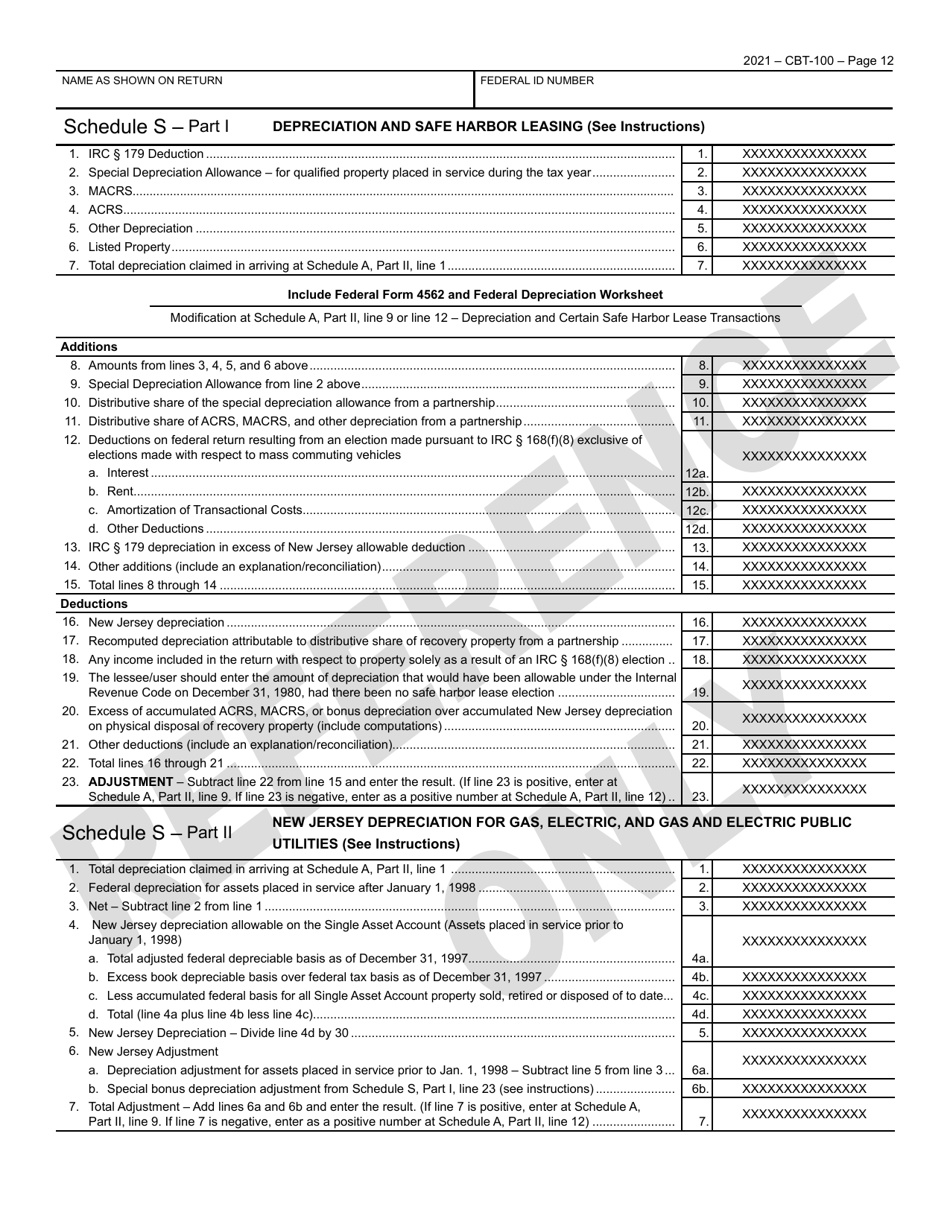

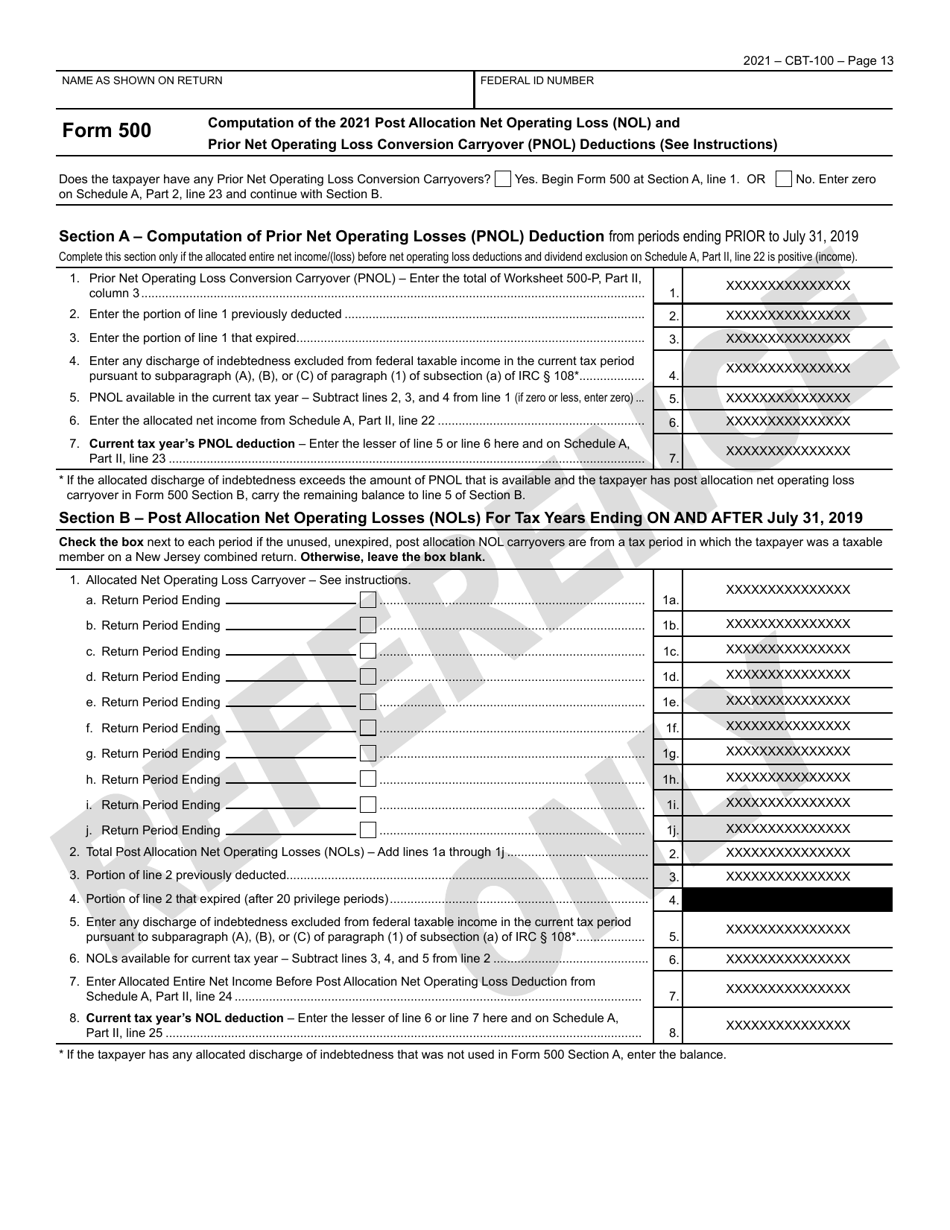

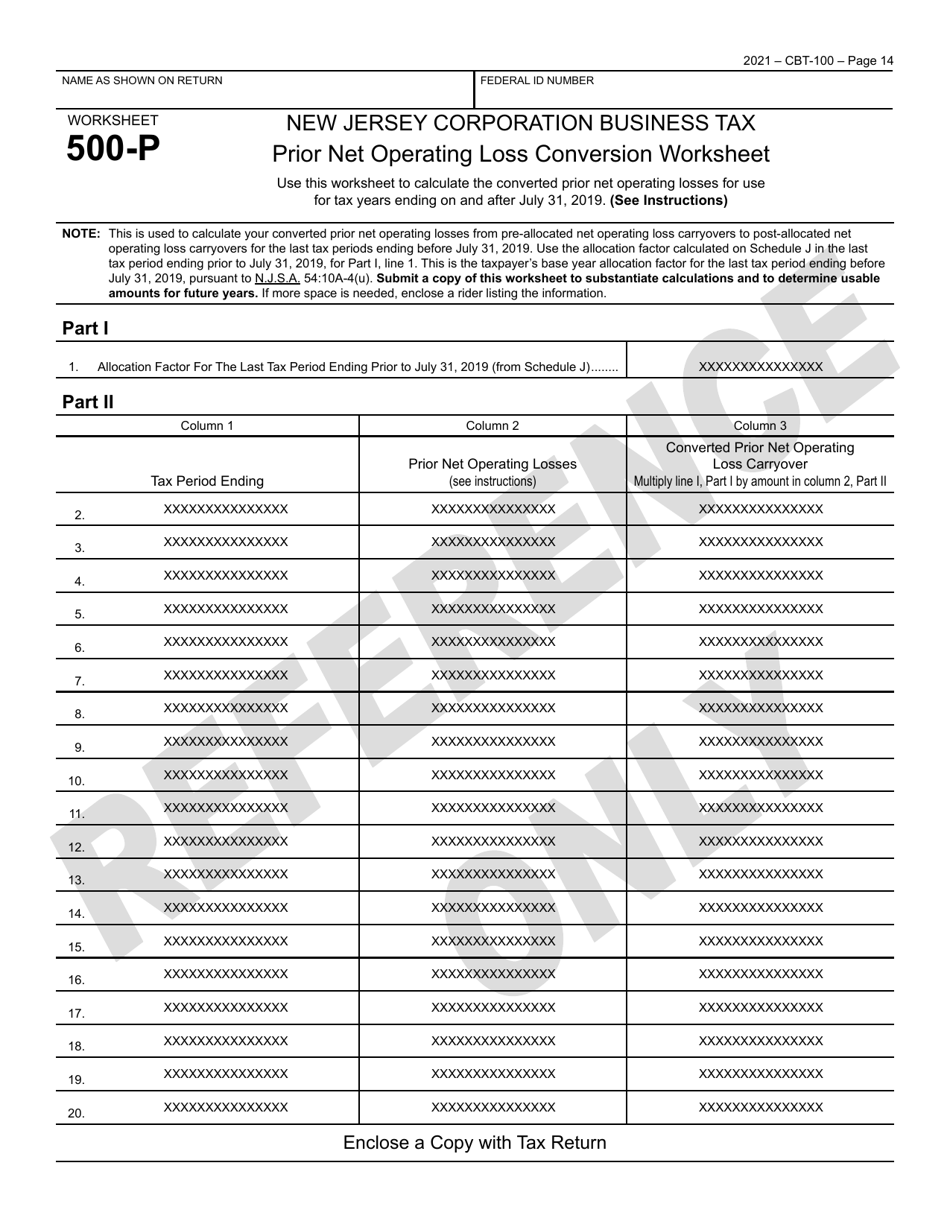

Form CBT-100

for the current year.

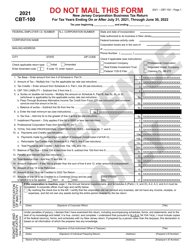

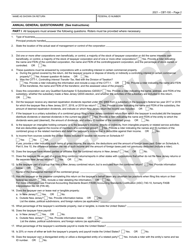

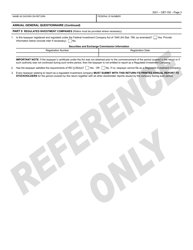

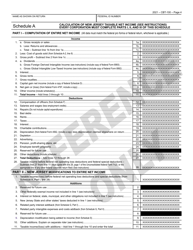

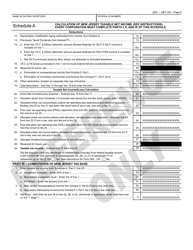

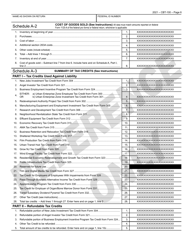

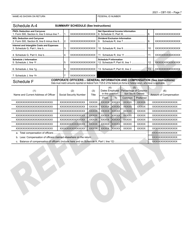

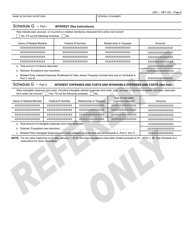

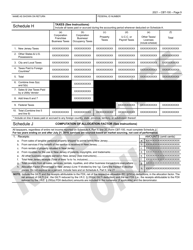

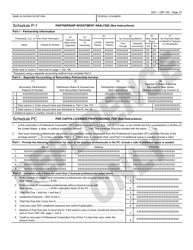

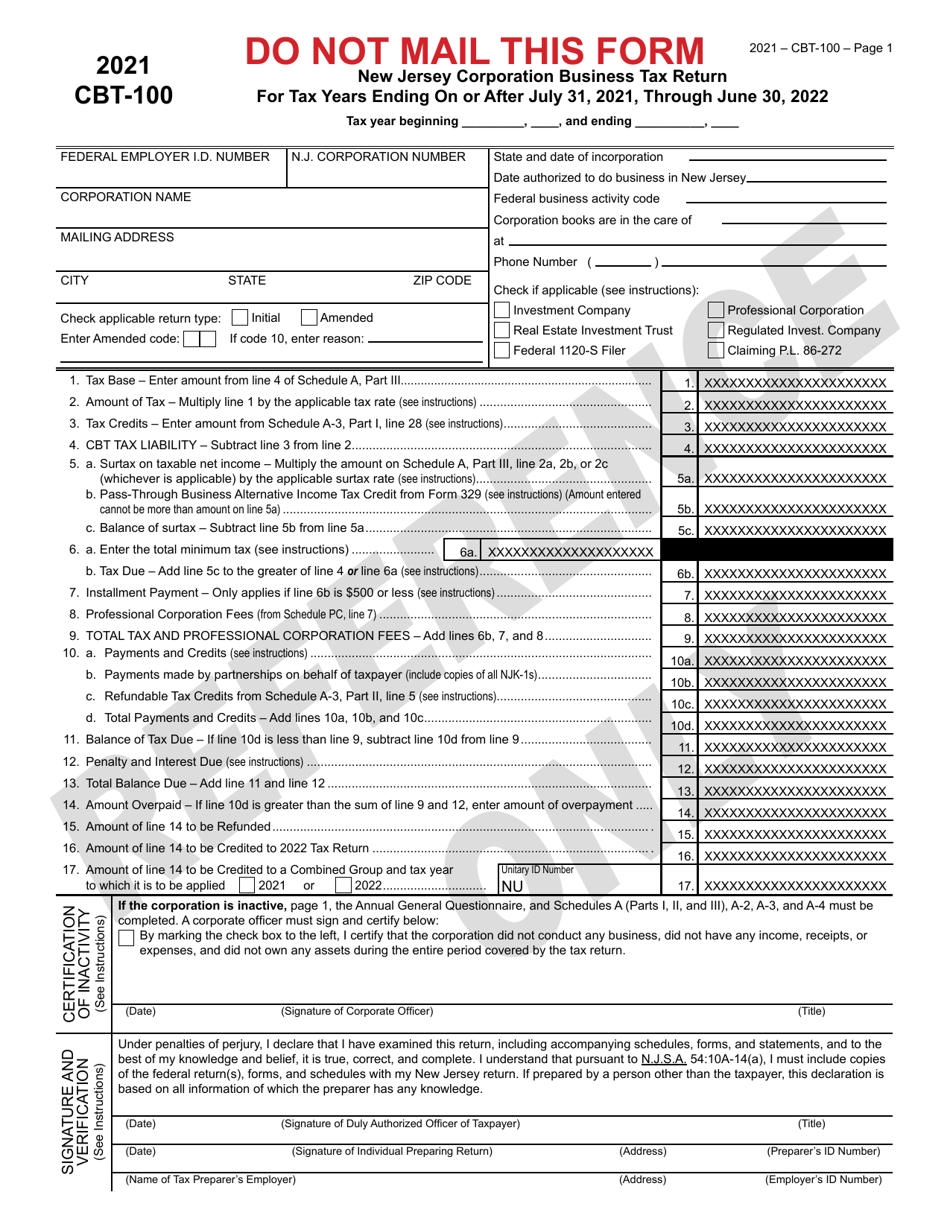

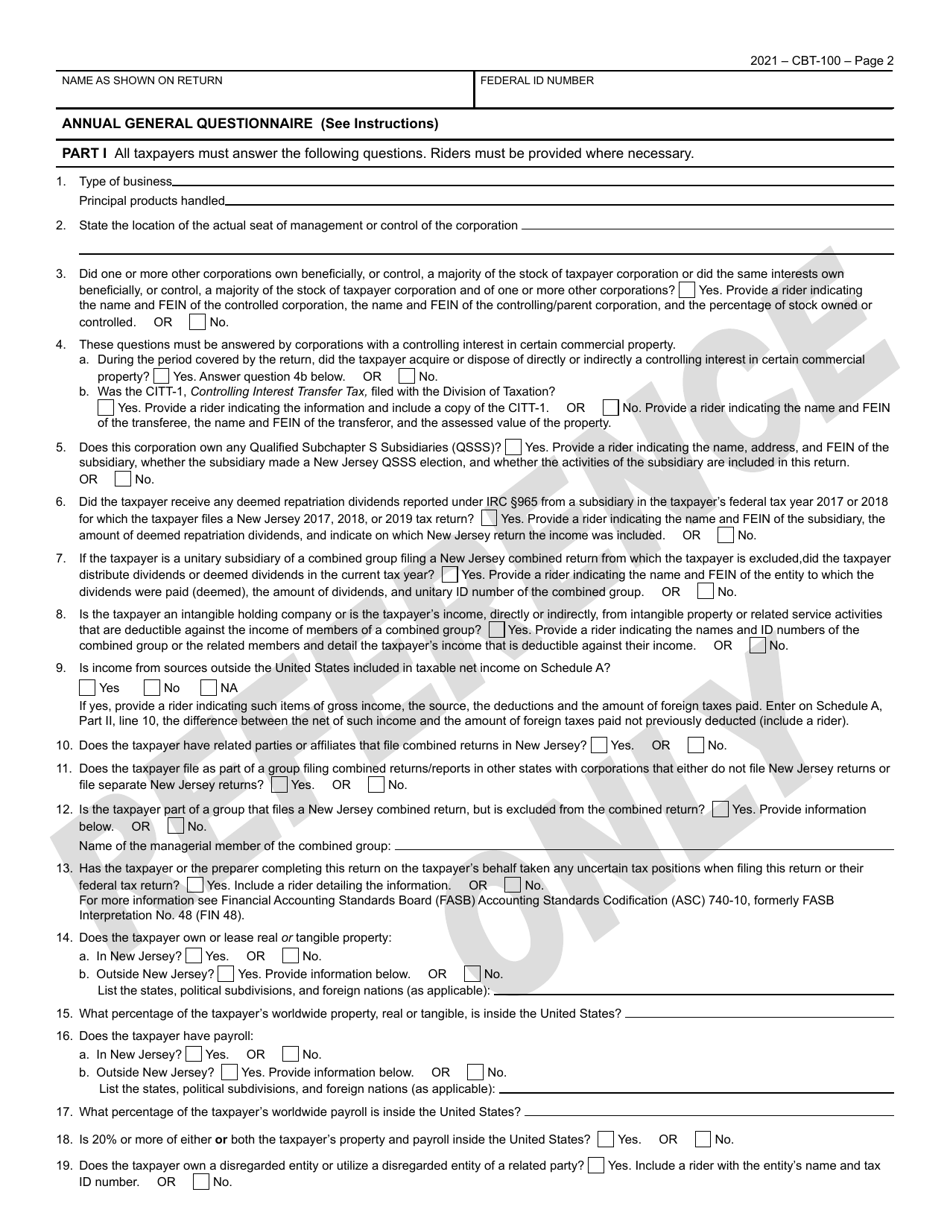

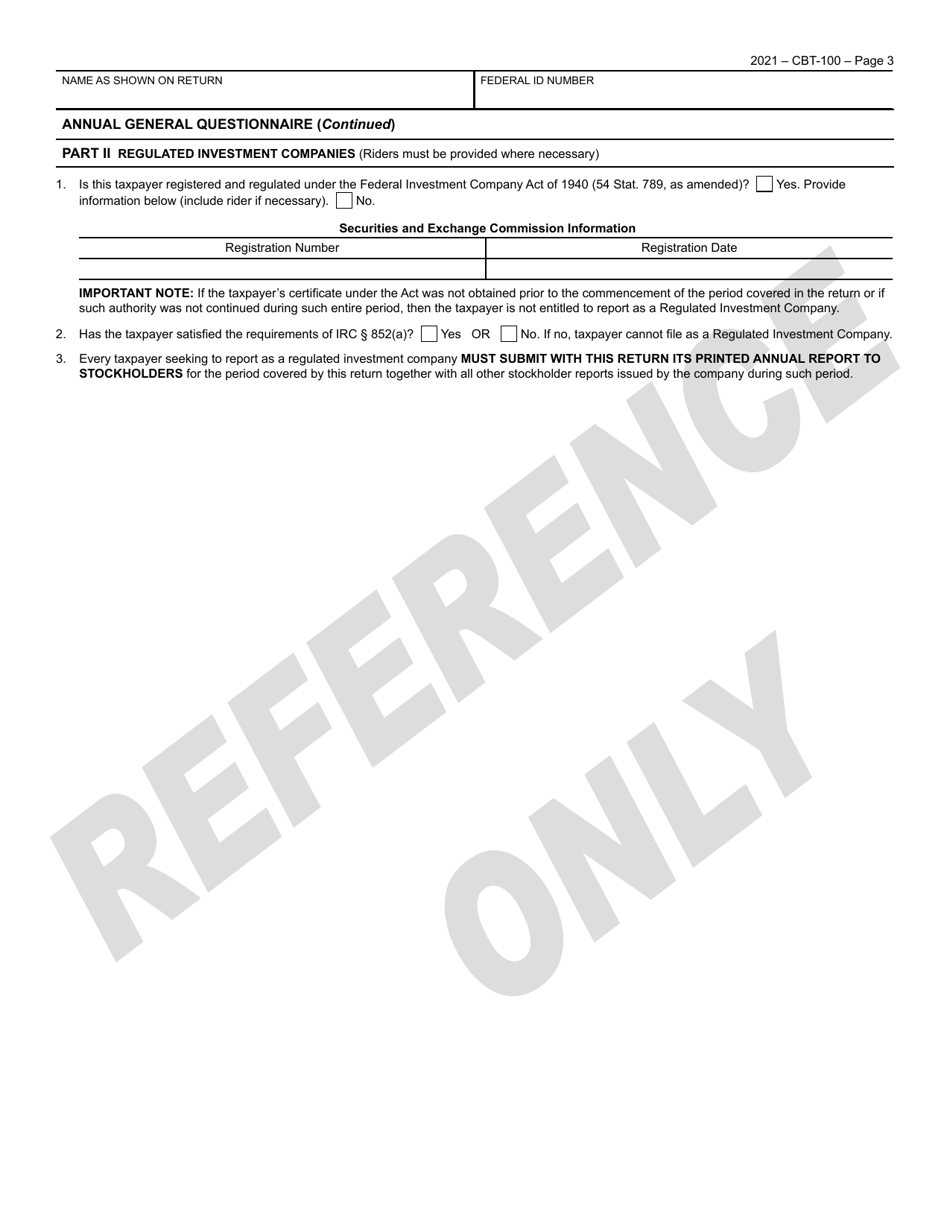

Form CBT-100 New Jersey Corporation Business Tax Return - New Jersey

What Is Form CBT-100?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CBT-100?

A: Form CBT-100 is the New Jersey Corporation Business Tax Return.

Q: Who needs to file Form CBT-100?

A: Corporations doing business in New Jersey need to file Form CBT-100.

Q: What is the purpose of Form CBT-100?

A: The purpose of Form CBT-100 is to report and calculate the Corporation Business Tax owed to the state of New Jersey.

Q: When is the due date for filing Form CBT-100?

A: The due date for filing Form CBT-100 is the 15th day of the fourth month following the close of the corporation's tax year.

Q: Are there any penalties for late filing of Form CBT-100?

A: Yes, there are penalties for late filing of Form CBT-100. It is important to file the return on time to avoid penalties and interest charges.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CBT-100 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.