This version of the form is not currently in use and is provided for reference only. Download this version of

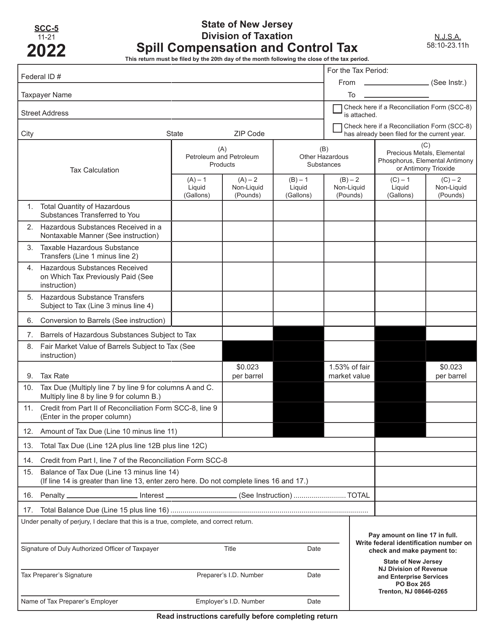

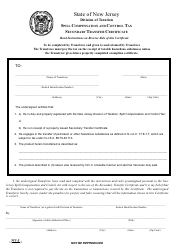

Form SCC-5

for the current year.

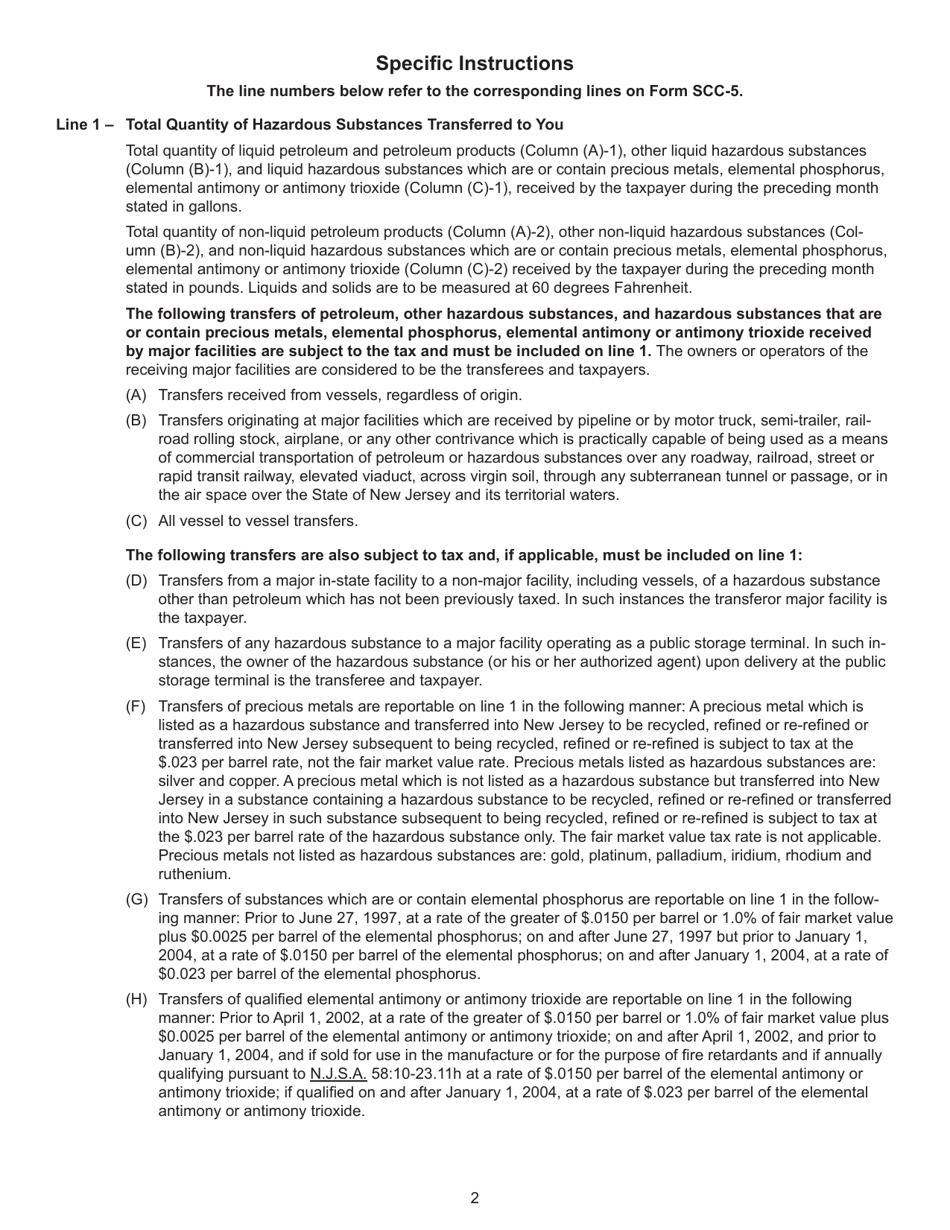

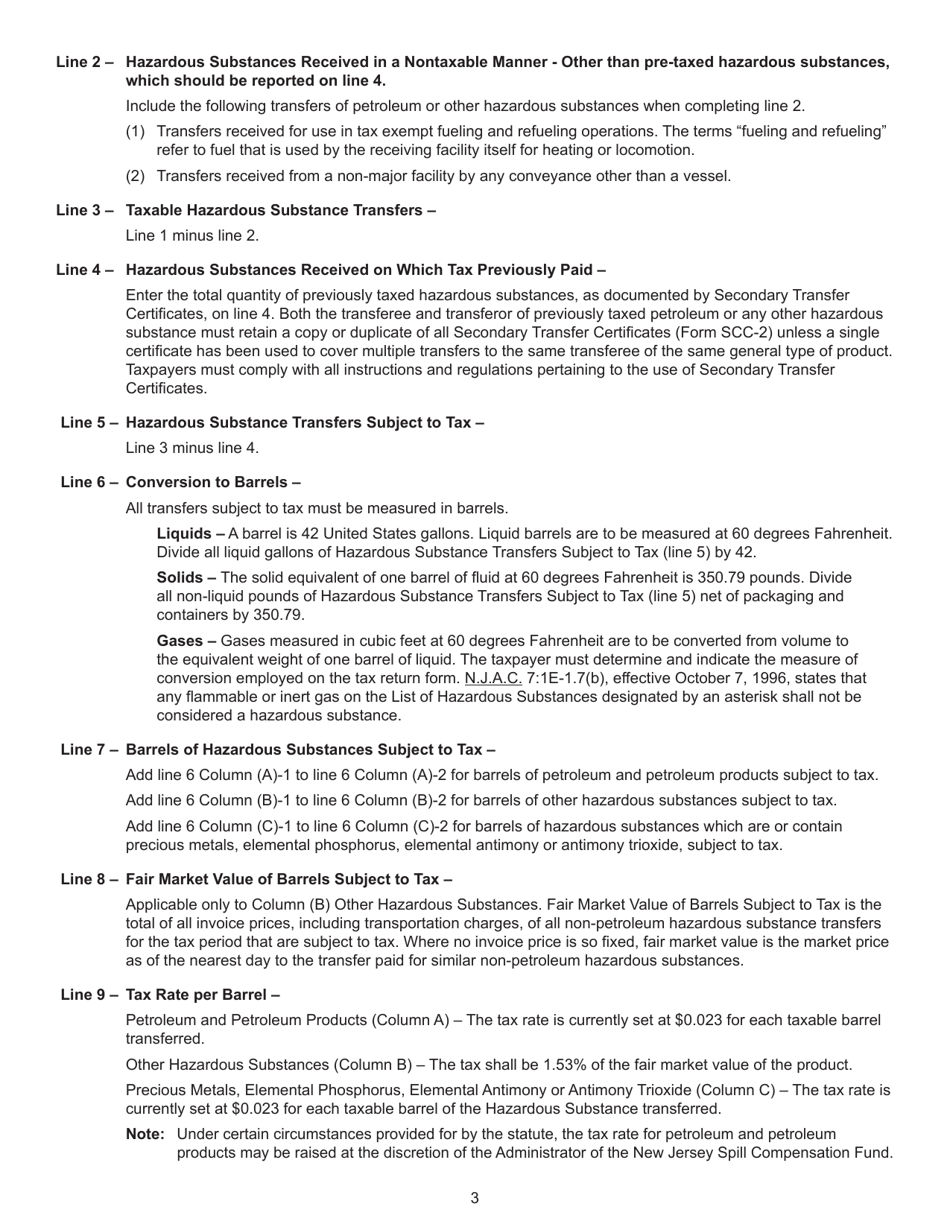

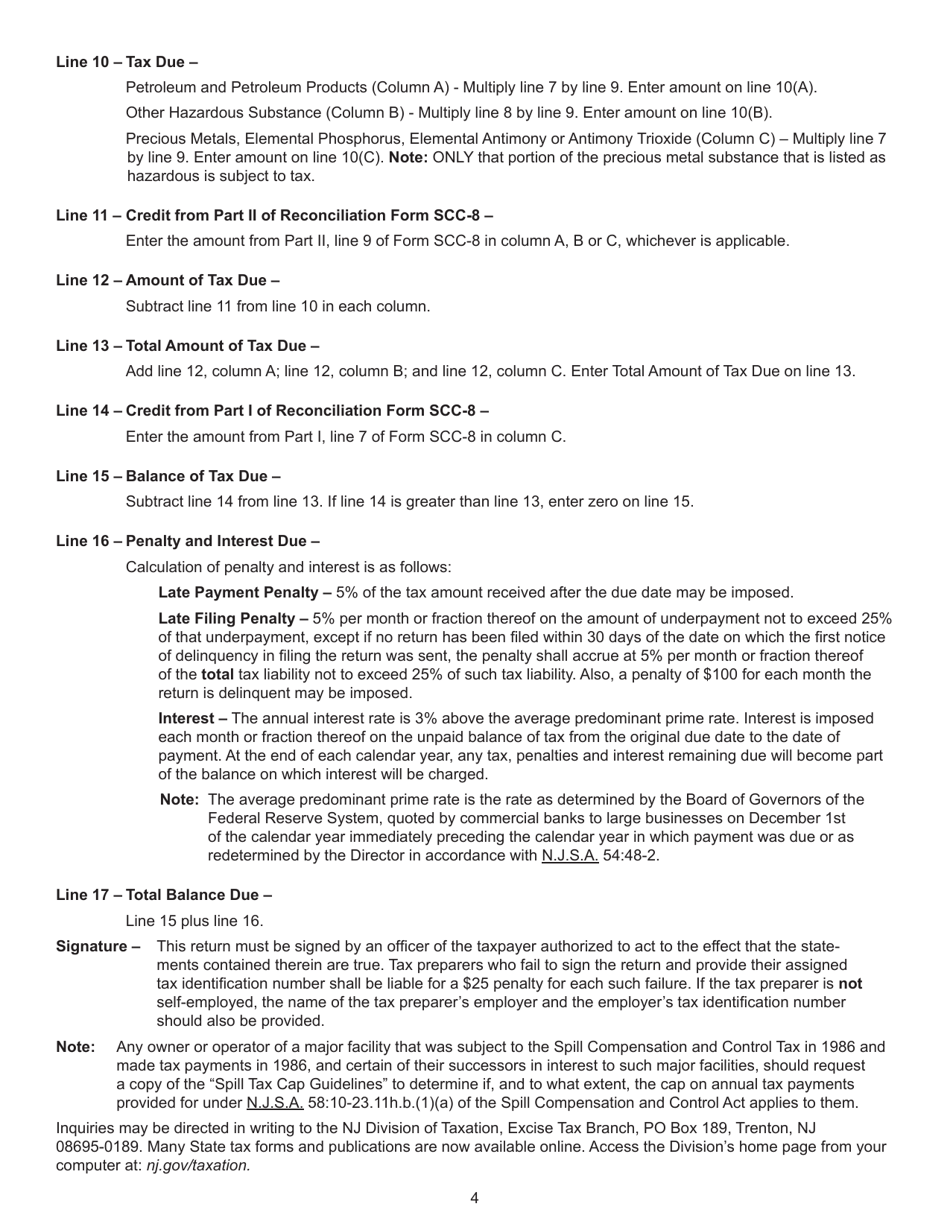

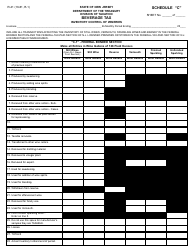

Form SCC-5 Spill Compensation and Control Tax - New Jersey

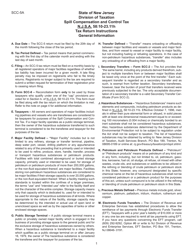

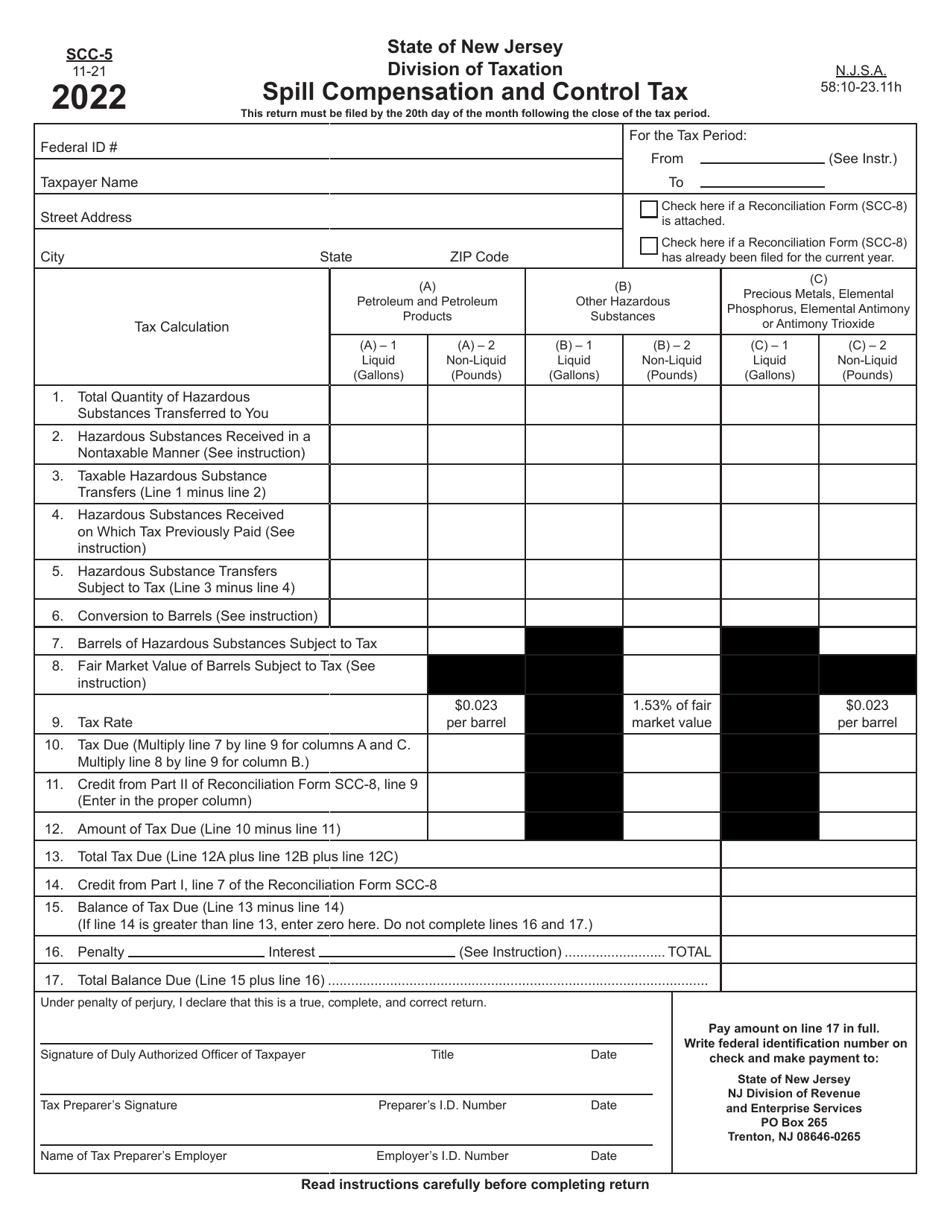

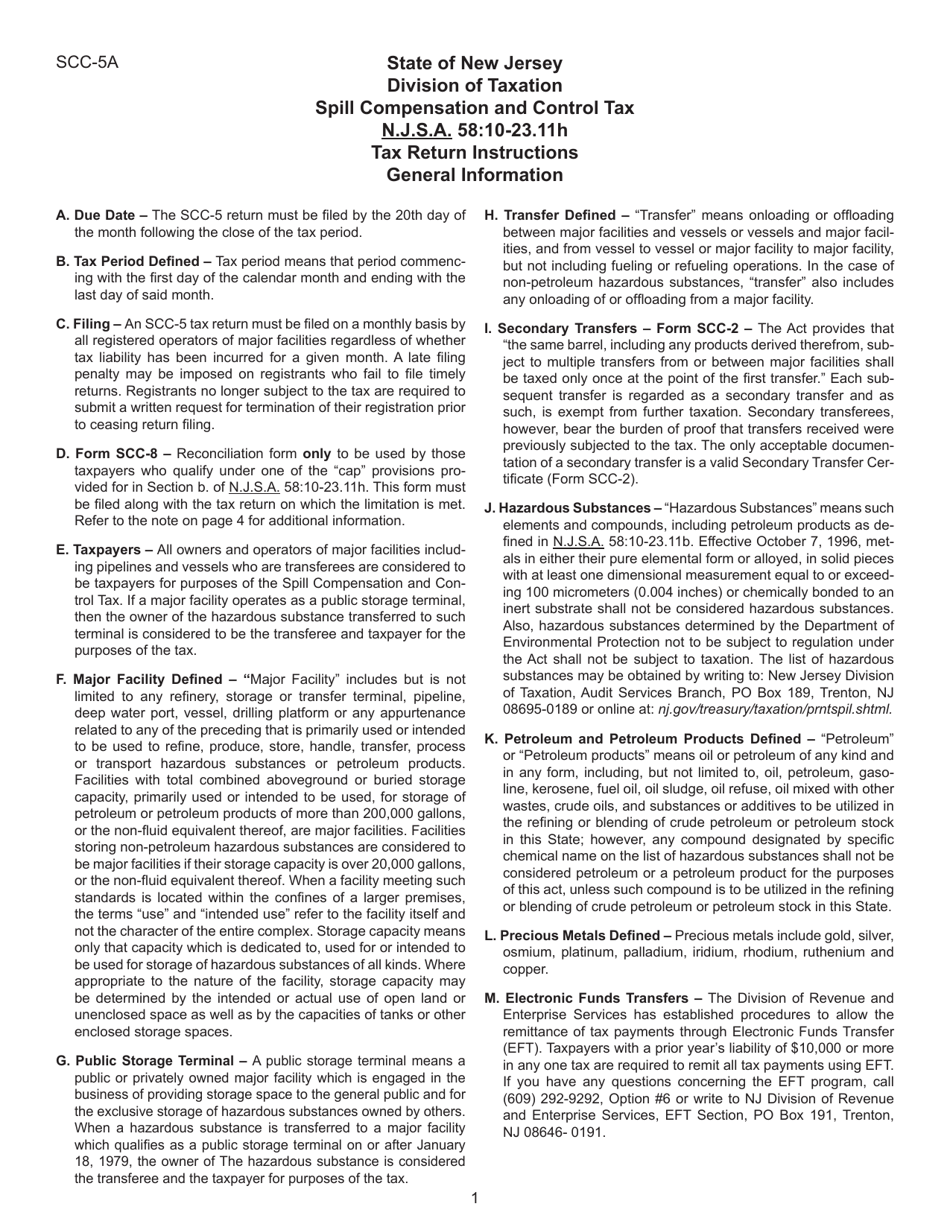

What Is Form SCC-5?

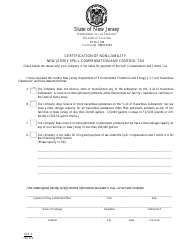

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SCC-5?

A: Form SCC-5 is the Spill Compensation and Control Tax form used in the state of New Jersey.

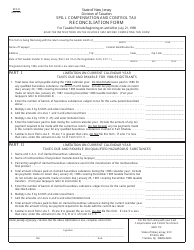

Q: What is the purpose of Form SCC-5?

A: The purpose of Form SCC-5 is to calculate and report the Spill Compensation and Control Tax owed to New Jersey.

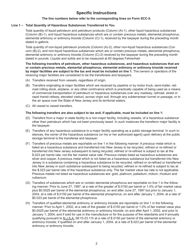

Q: Who is required to file Form SCC-5?

A: Any person or entity that is subject to the Spill Compensation and Control Tax in New Jersey is required to file Form SCC-5.

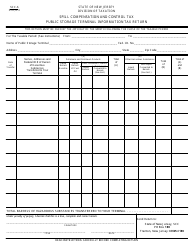

Q: What is the Spill Compensation and Control Tax?

A: The Spill Compensation and Control Tax is a tax imposed on certain petroleum products stored, sold, or used in New Jersey to fund the cleanup of hazardous substance spills.

Q: When is the deadline to file Form SCC-5?

A: The deadline to file Form SCC-5 is usually on or before the last day of the first month following the end of the calendar quarter.

Q: Are there any penalties for late filing of Form SCC-5?

A: Yes, there are penalties for late filing of Form SCC-5. The penalty is $1,000 for each month or part of a month that the return is late, up to a maximum of $25,000.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SCC-5 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.