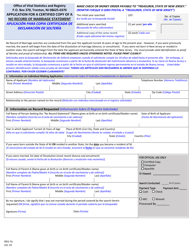

This version of the form is not currently in use and is provided for reference only. Download this version of

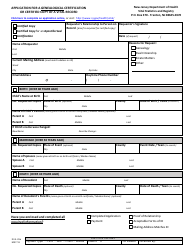

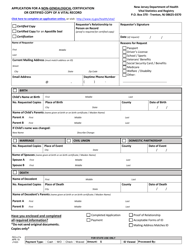

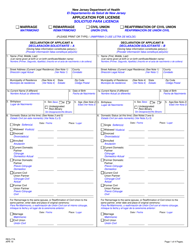

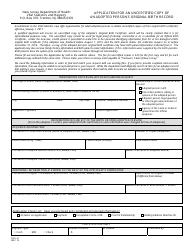

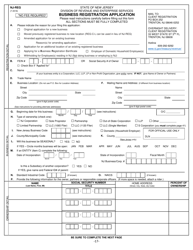

Form REG-1E

for the current year.

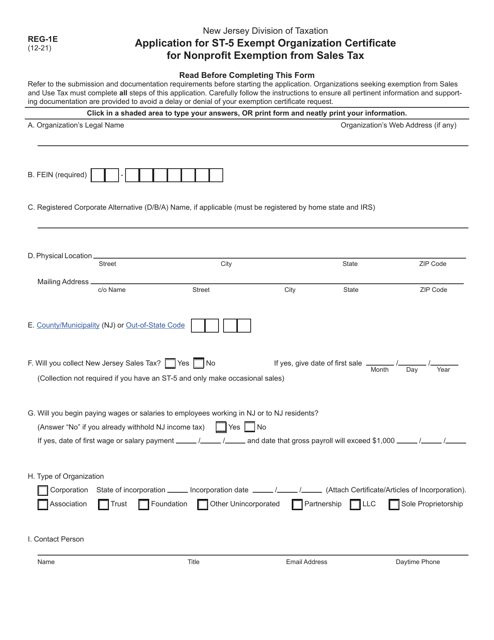

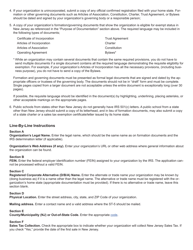

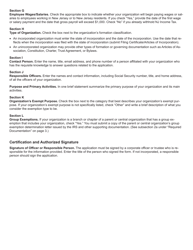

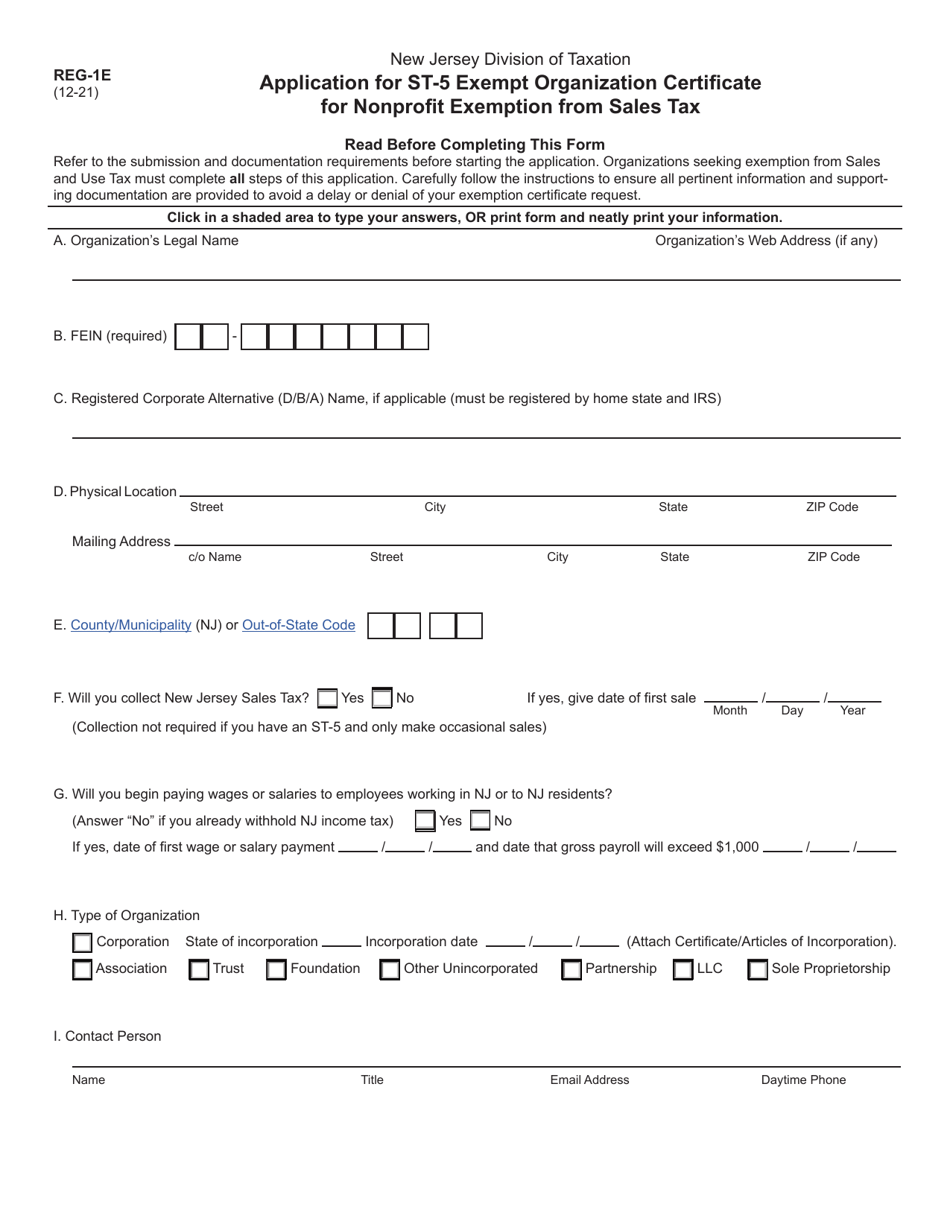

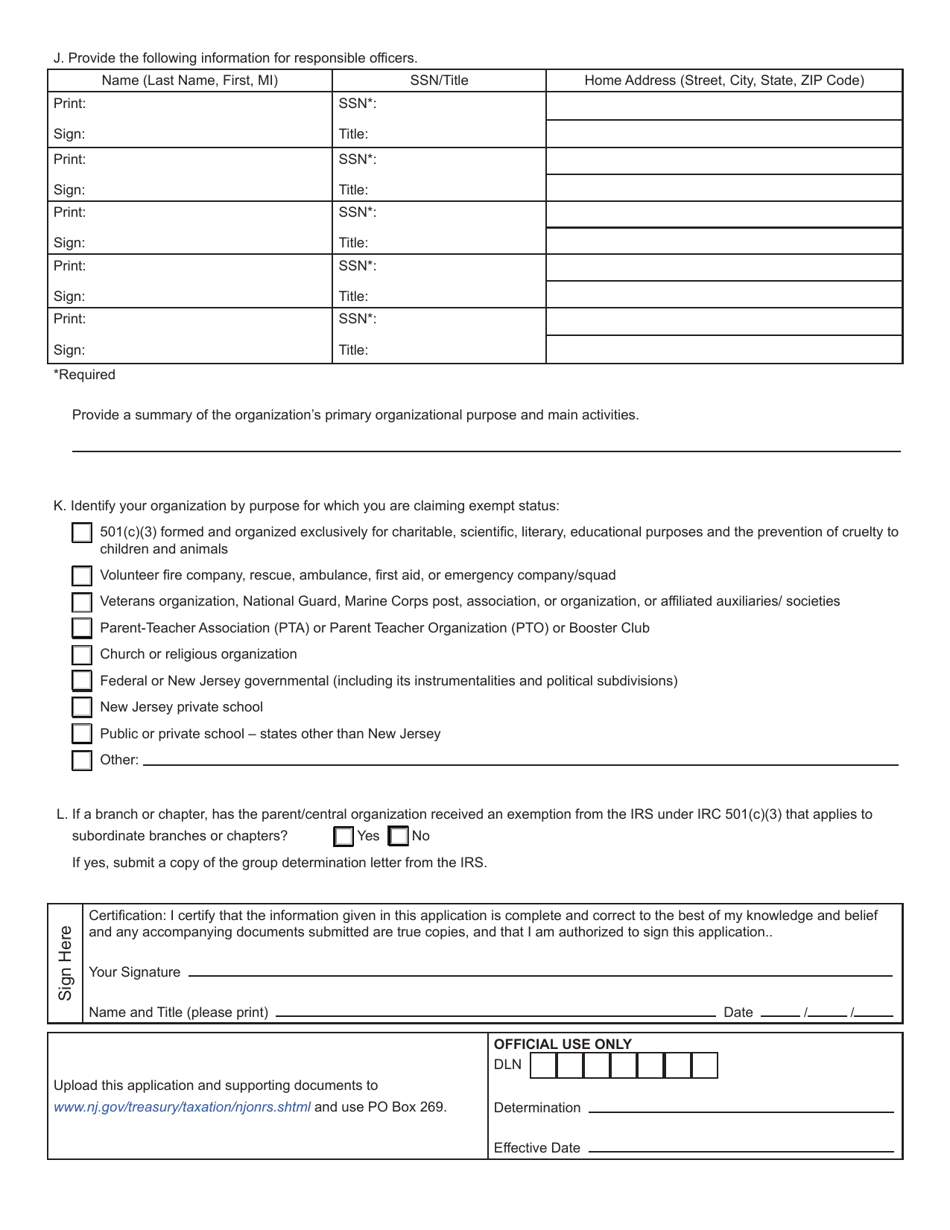

Form REG-1E Application for St-5 Exempt Organization Certificate for Nonprofit Exemption From Sales Tax - New Jersey

What Is Form REG-1E?

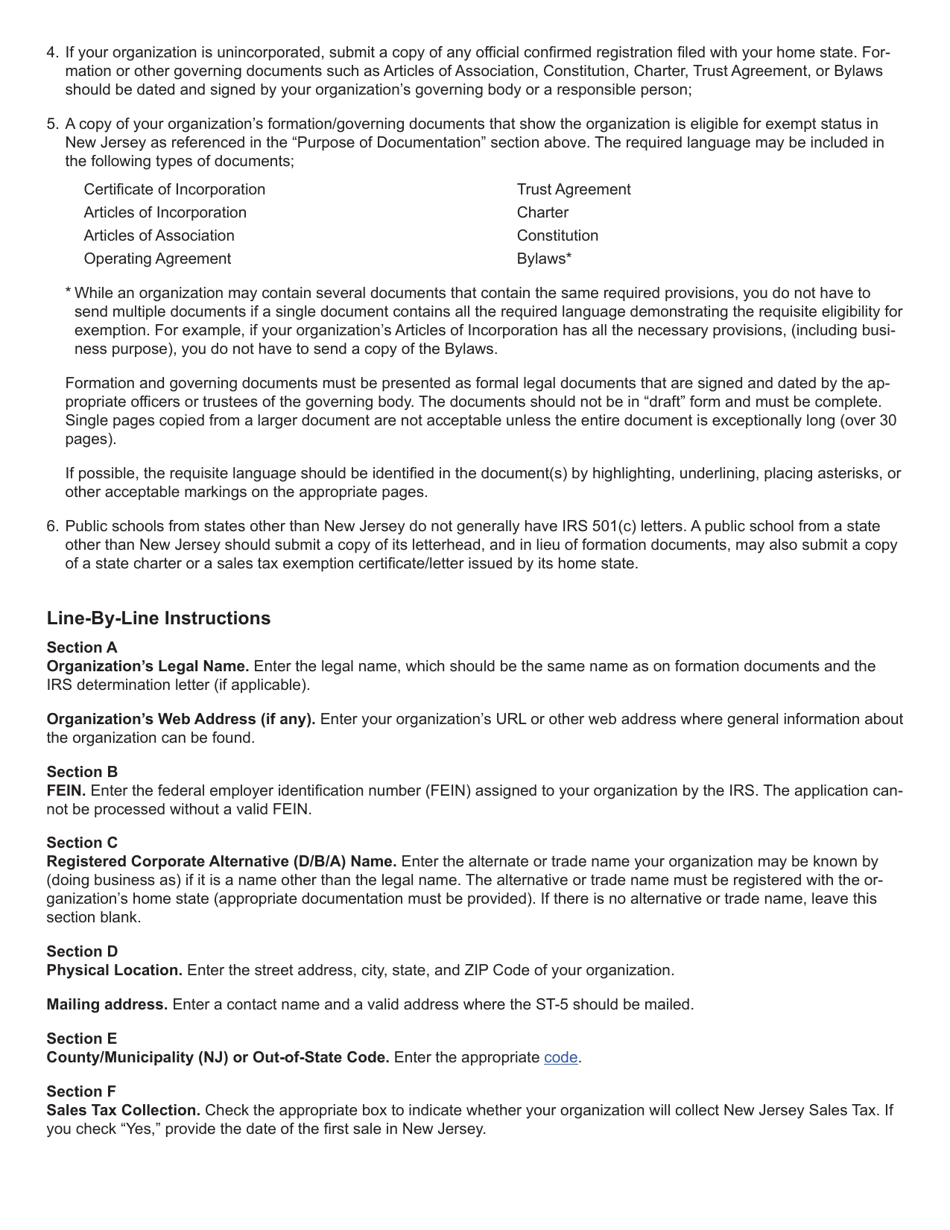

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the REG-1E form?

A: The REG-1E form is an application for the St-5 Exempt Organization Certificate for Nonprofit Exemption from Sales Tax in New Jersey.

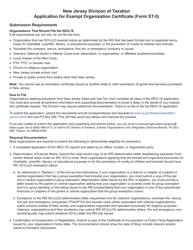

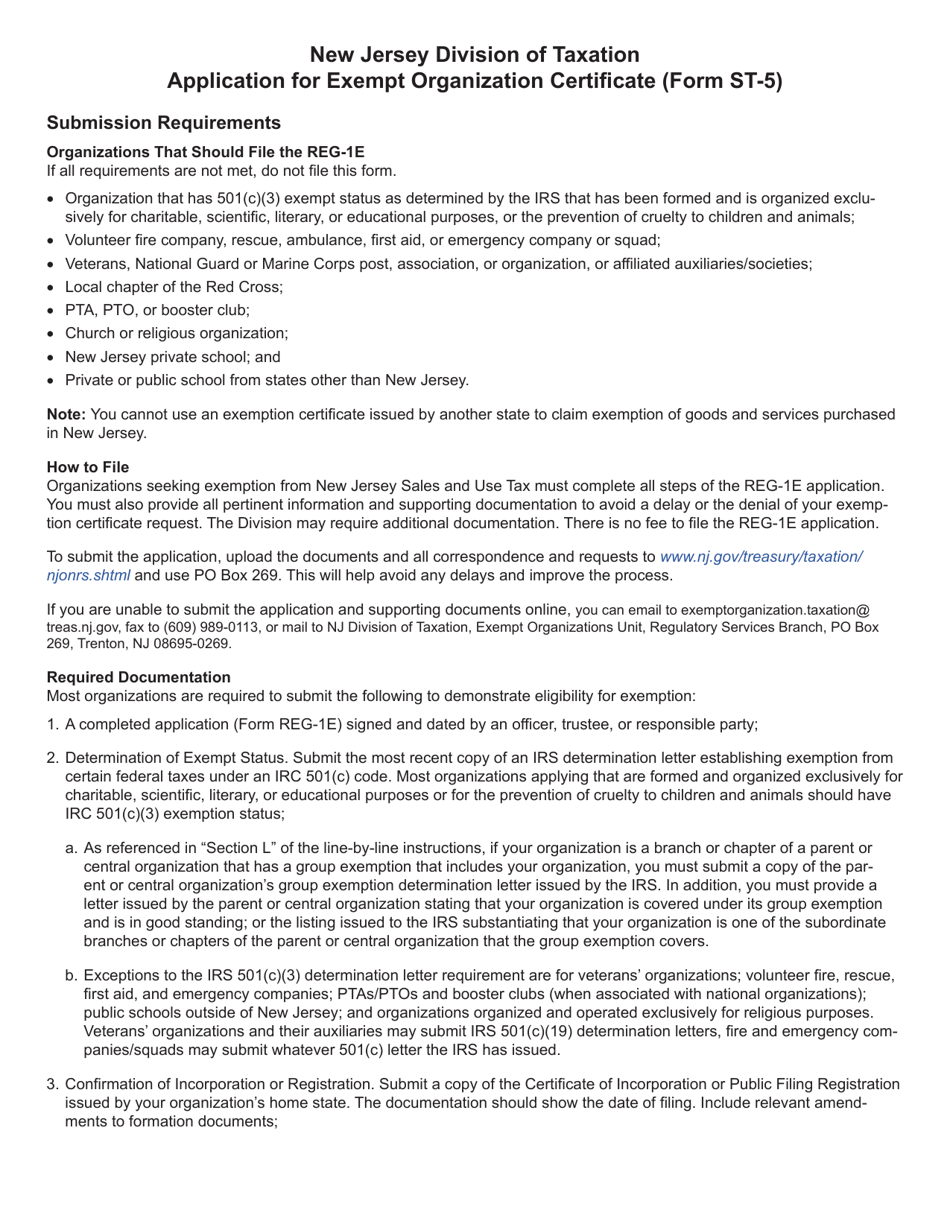

Q: Who should use the REG-1E form?

A: The REG-1E form should be used by non-profit organizations seeking exemption from sales tax in New Jersey.

Q: What is the purpose of the St-5 Exempt Organization Certificate?

A: The St-5 Exempt Organization Certificate is used to certify that a non-profit organization is exempt from sales tax in New Jersey.

Q: How do I apply for the St-5 Exempt Organization Certificate?

A: You can apply for the St-5 Exempt Organization Certificate by completing the REG-1E form and submitting it to the New Jersey Division of Taxation.

Q: Are all non-profit organizations exempt from sales tax in New Jersey?

A: No, not all non-profit organizations are automatically exempt from sales tax in New Jersey. They need to apply for the St-5 Exempt Organization Certificate to obtain the exemption.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REG-1E by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.