This version of the form is not currently in use and is provided for reference only. Download this version of

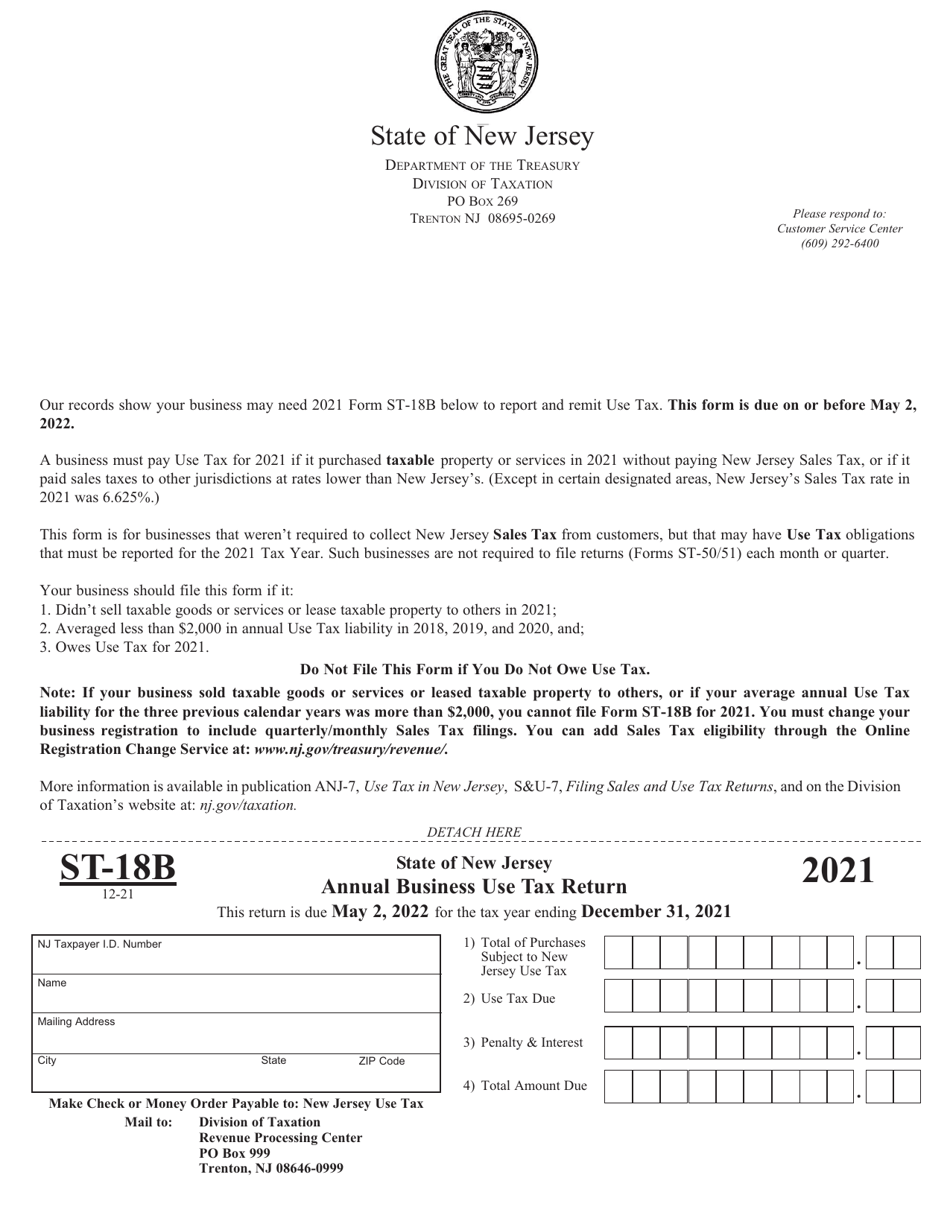

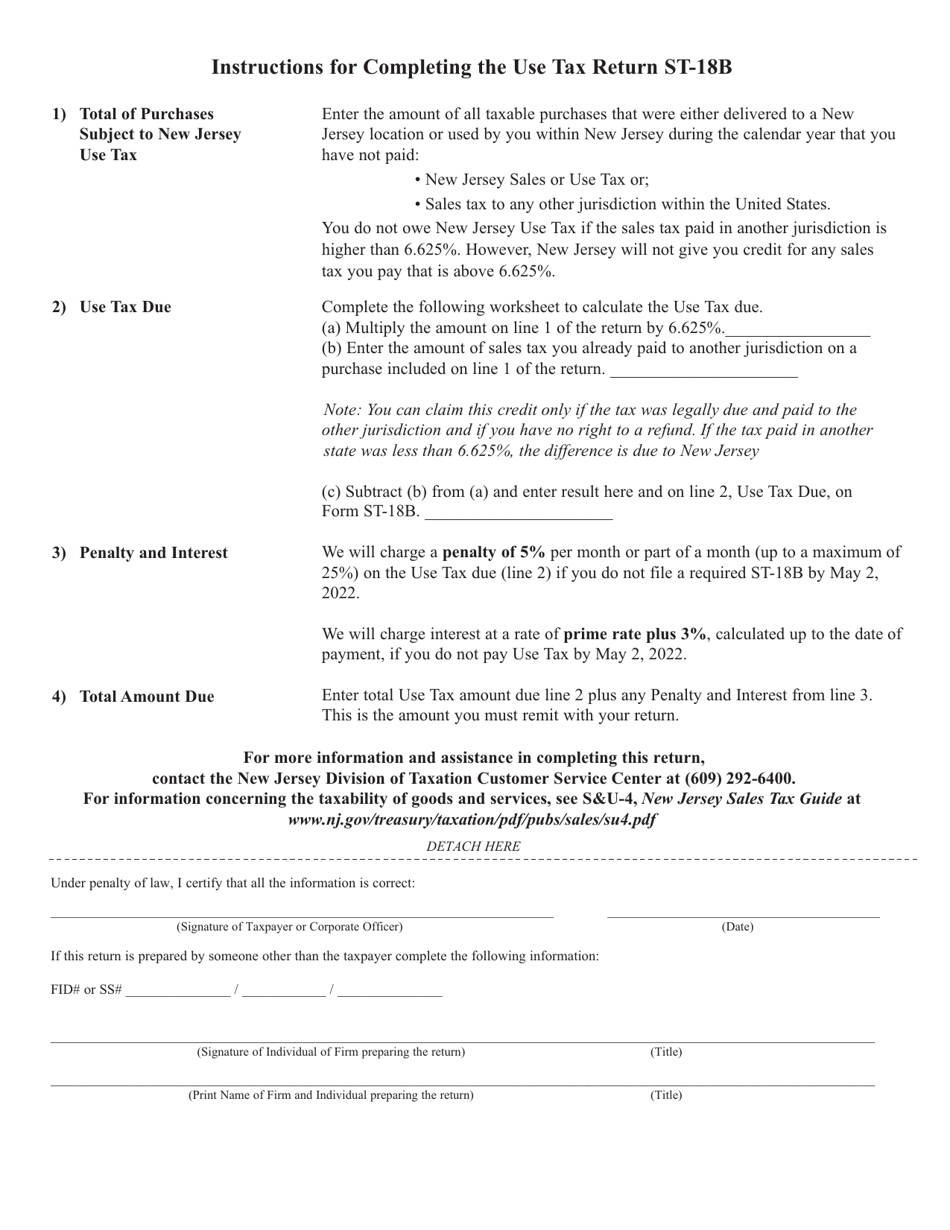

Form ST-18B

for the current year.

Form ST-18B Annual Business Use Tax Return - New Jersey

What Is Form ST-18B?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-18B?

A: Form ST-18B is the Annual Business Use Tax Return used in New Jersey.

Q: Who needs to file Form ST-18B?

A: Businesses in New Jersey that have tangible personal property that was purchased tax-free or by out-of-state purchase and used or stored in the state during the previous year need to file Form ST-18B.

Q: What is the purpose of Form ST-18B?

A: Form ST-18B is used to report and pay the use tax on qualifying taxable purchases made by a business.

Q: When is Form ST-18B due?

A: Form ST-18B is due on or before May 31st of each year.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-18B by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.