This version of the form is not currently in use and is provided for reference only. Download this version of

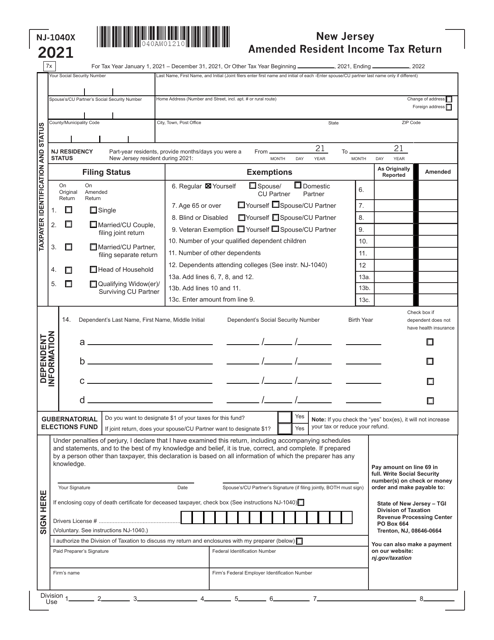

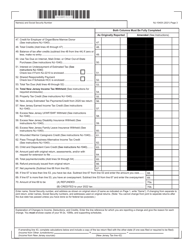

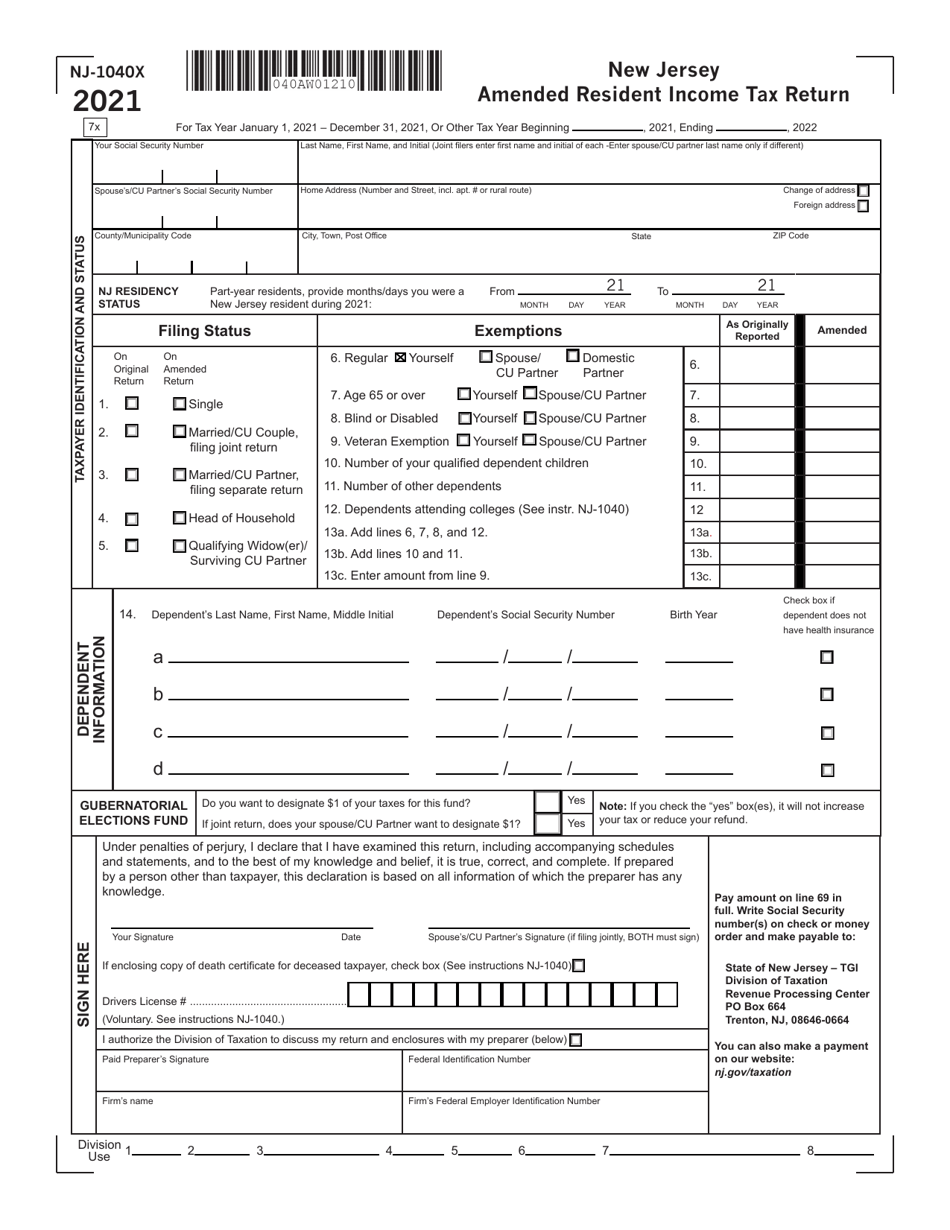

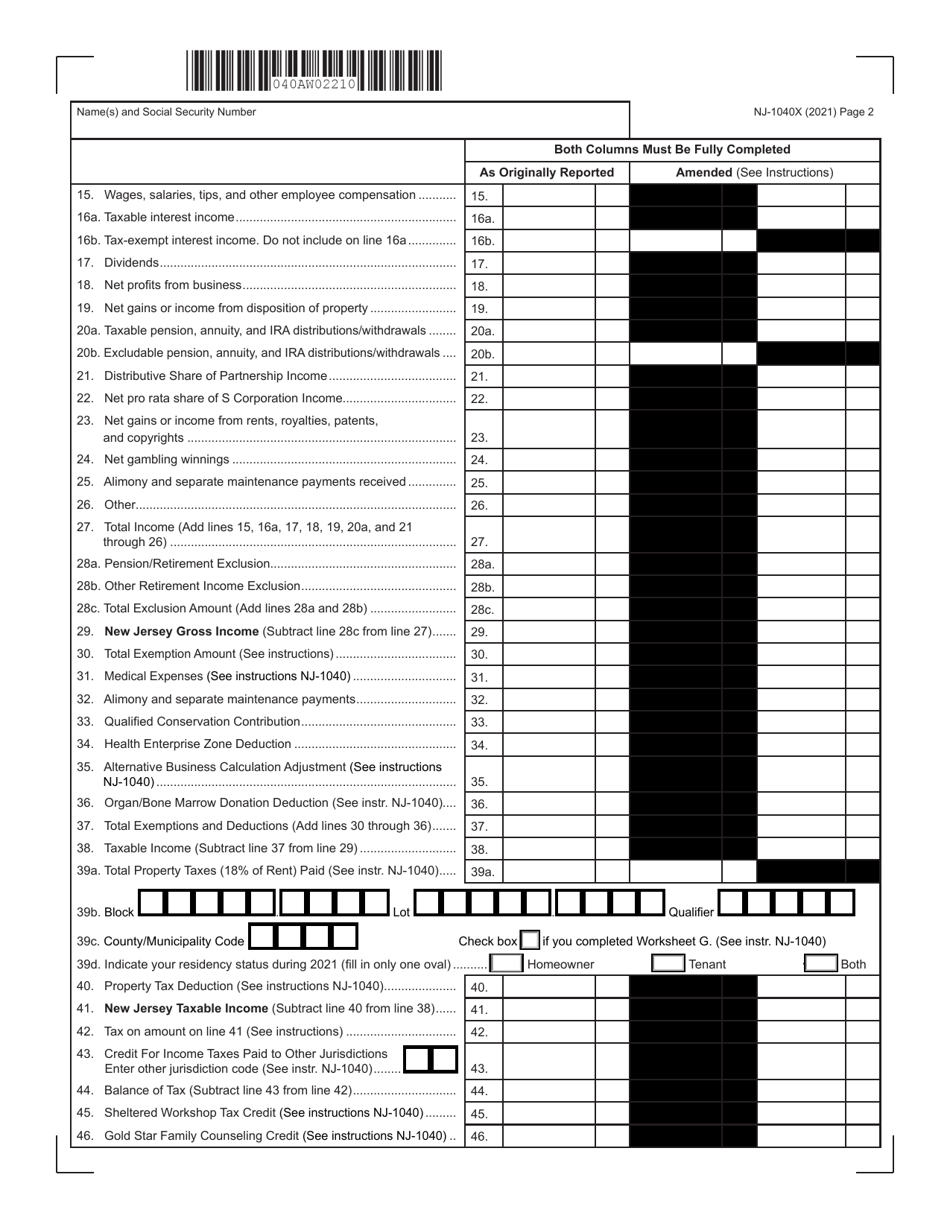

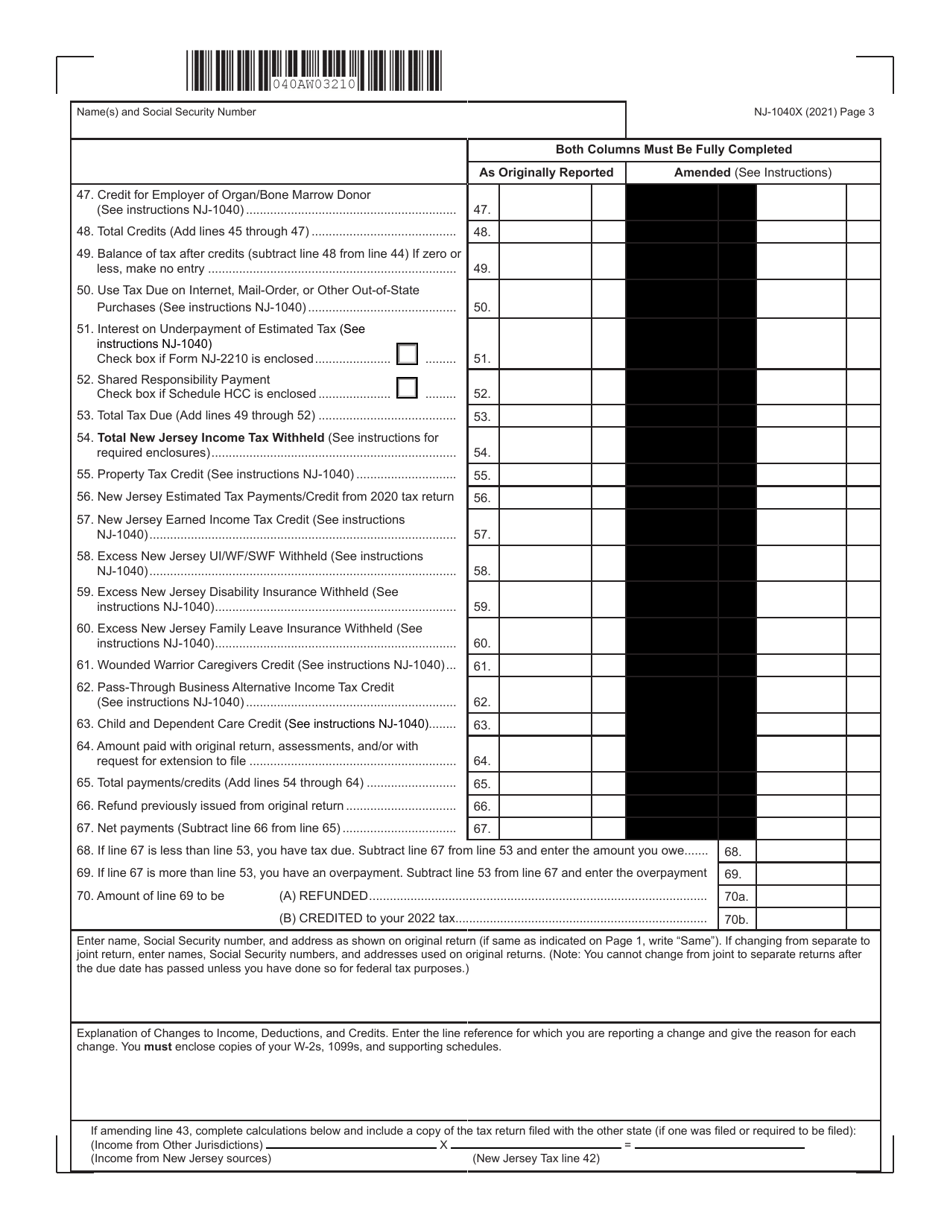

Form NJ-1040X

for the current year.

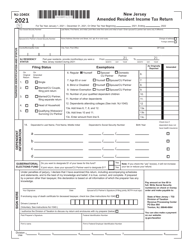

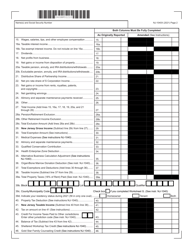

Form NJ-1040X Amended Resident Income Tax Return - New Jersey

What Is Form NJ-1040X?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form NJ-1040X?

A: Form NJ-1040X is the Amended Resident Income Tax Return for the state of New Jersey.

Q: When should I use Form NJ-1040X?

A: You should use Form NJ-1040X to correct errors or make changes to a previously filed New Jersey resident income tax return.

Q: Can I e-file Form NJ-1040X?

A: No, Form NJ-1040X cannot be e-filed. It must be filed by mail.

Q: What do I need to include when filing Form NJ-1040X?

A: You need to include a copy of your original NJ-1040 return, any supporting documents for the changes made, and a completed Form NJ-1040X.

Q: What happens after I file Form NJ-1040X?

A: After you file Form NJ-1040X, you should allow up to 16 weeks for processing. You may receive a refund or owe additional taxes depending on the changes made.

Q: Is there a deadline for filing Form NJ-1040X?

A: Yes, Form NJ-1040X must be filed within 3 years from the original due date of the return or 2 years from the date the tax was paid, whichever is later.

Q: Can I file an amended return for a federal tax return?

A: Yes, you can file an amended federal tax return using Form 1040X. Form NJ-1040X is specifically for amending your New Jersey state tax return.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1040X by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.