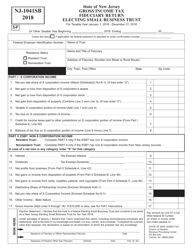

This version of the form is not currently in use and is provided for reference only. Download this version of

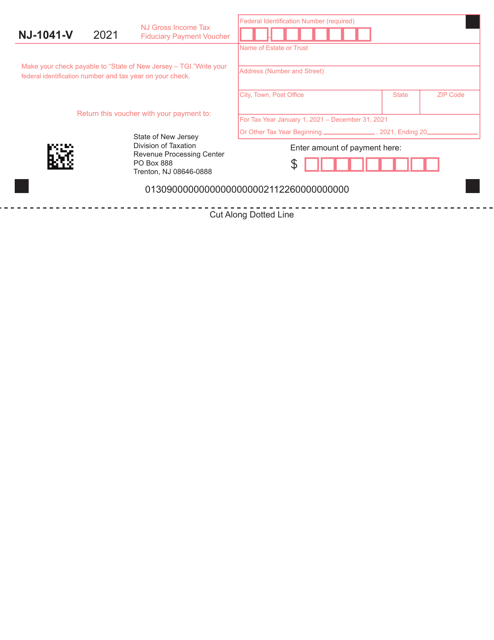

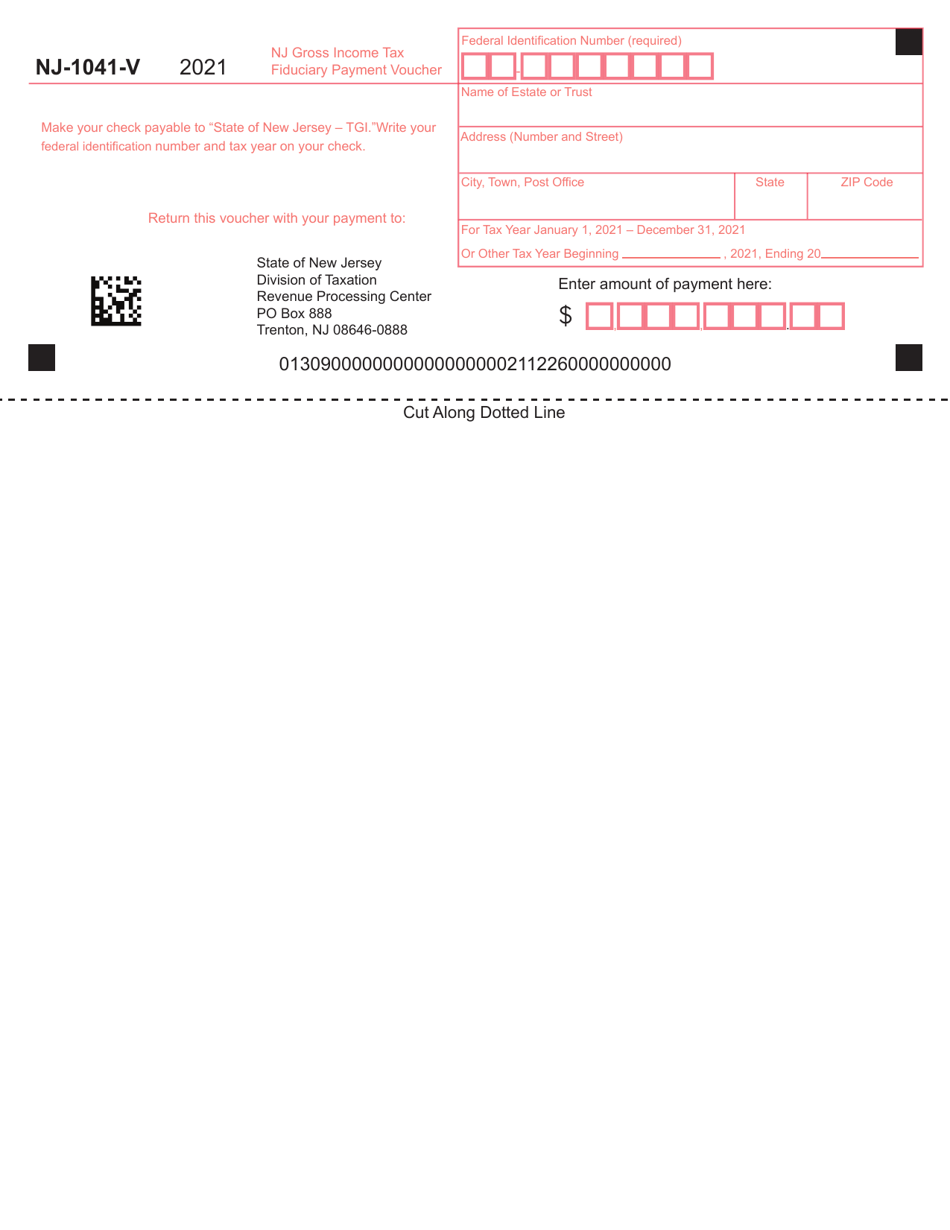

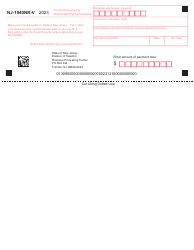

Form NJ-1041-V

for the current year.

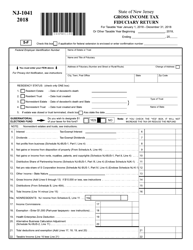

Form NJ-1041-V Fiduciary Income Tax Return Payment Voucher - New Jersey

What Is Form NJ-1041-V?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-1041-V?

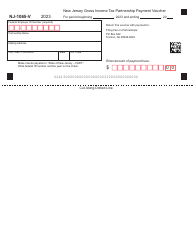

A: Form NJ-1041-V is the payment voucher for the New Jersey Fiduciary Income Tax Return (Form NJ-1041).

Q: Who needs to file Form NJ-1041-V?

A: Form NJ-1041-V should be filed by individuals or entities who are making a payment for their New Jersey Fiduciary Income Tax.

Q: Do I need to attach Form NJ-1041-V to my tax return?

A: No, Form NJ-1041-V should not be attached to your tax return. It is only used for making a payment.

Q: What information do I need to provide on Form NJ-1041-V?

A: On Form NJ-1041-V, you will need to provide your name, address, Social Security number or EIN, and the amount of your payment.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1041-V by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.