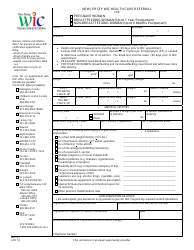

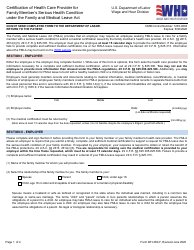

Form NJ-1040 Schedule NJ-HCC Health Care Coverage - New Jersey

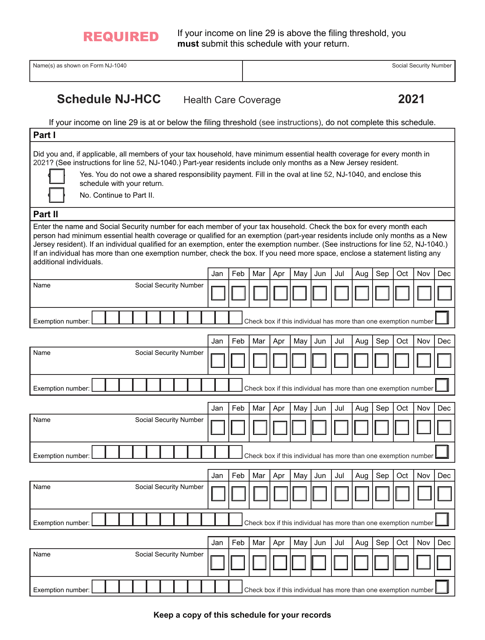

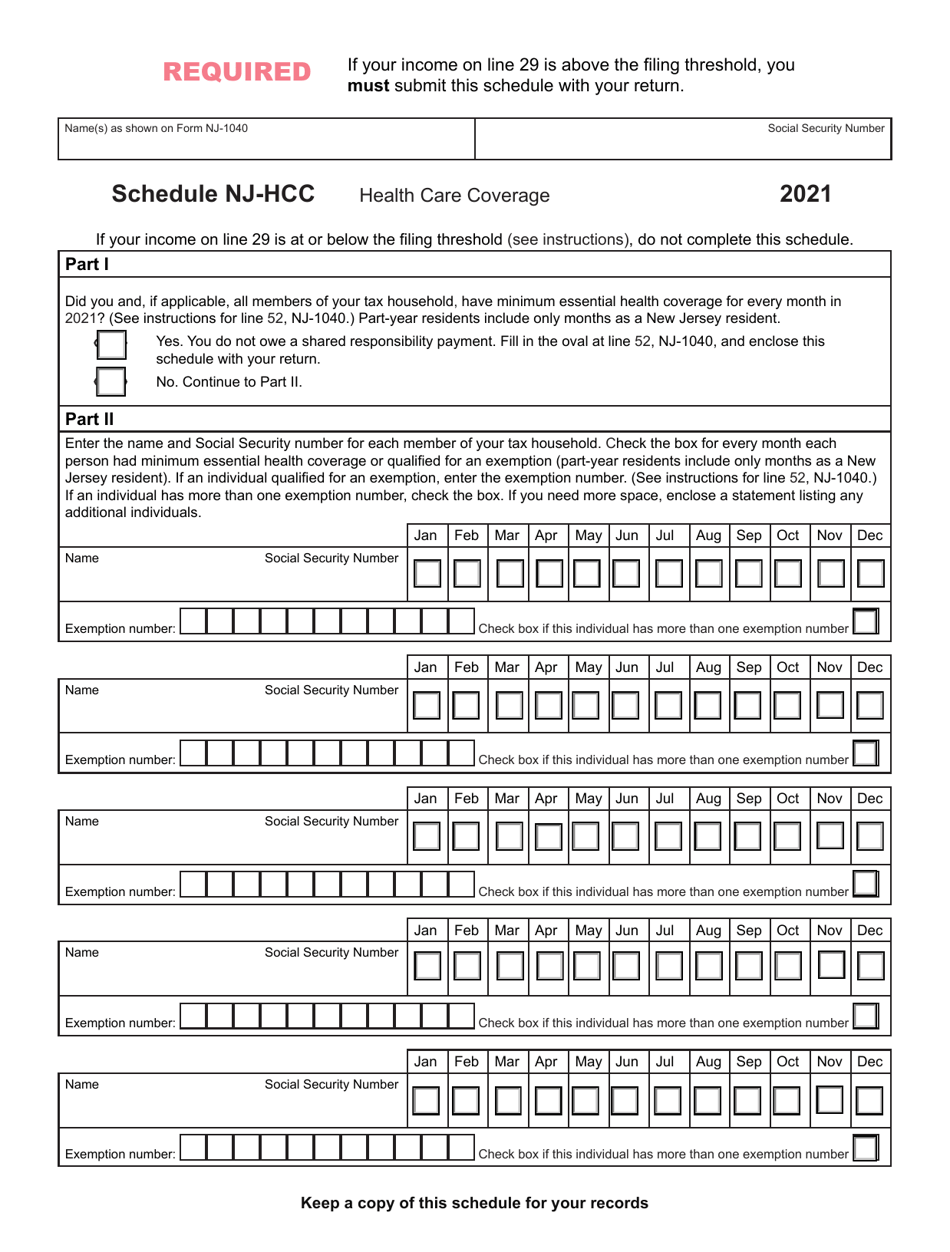

What Is Form NJ-1040 Schedule NJ-HCC?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.The document is a supplement to Form NJ-1040, New Jersey Resident Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-1040 Schedule NJ-HCC?

A: Form NJ-1040 Schedule NJ-HCC is a part of the New Jersey income tax return that taxpayers use to report information about their health care coverage.

Q: Who needs to file Form NJ-1040 Schedule NJ-HCC?

A: New Jersey residents who are required to file a state income tax return and who had health care coverage during the tax year need to file Form NJ-1040 Schedule NJ-HCC.

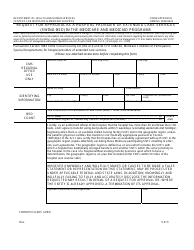

Q: What information is required on Form NJ-1040 Schedule NJ-HCC?

A: On Form NJ-1040 Schedule NJ-HCC, taxpayers need to provide information about their health insurance coverage, including the names of the covered individuals and the months they were covered.

Q: Do I need to attach any documents with Form NJ-1040 Schedule NJ-HCC?

A: No, you do not need to attach any documents with Form NJ-1040 Schedule NJ-HCC. However, you should keep all related documents for your records.

Q: Is there a deadline for filing Form NJ-1040 Schedule NJ-HCC?

A: Yes, Form NJ-1040 Schedule NJ-HCC must be filed along with your New Jersey income tax return by the deadline for filing your state taxes, typically April 15th.

Q: What happens if I don't file Form NJ-1040 Schedule NJ-HCC?

A: If you are required to file Form NJ-1040 Schedule NJ-HCC and fail to do so, you may face penalties or delays in processing your tax return.

Q: Are there any exceptions to filing Form NJ-1040 Schedule NJ-HCC?

A: Yes, there are some exceptions to filing Form NJ-1040 Schedule NJ-HCC, such as if you were not a New Jersey resident during the tax year or if you qualify for a health coverage exemption.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1040 Schedule NJ-HCC by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.