This version of the form is not currently in use and is provided for reference only. Download this version of

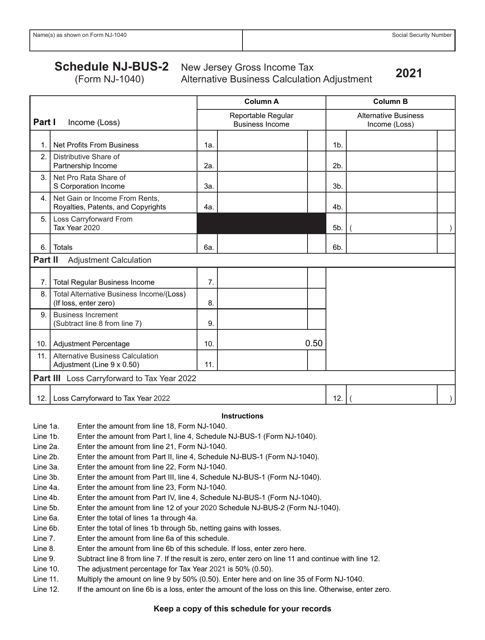

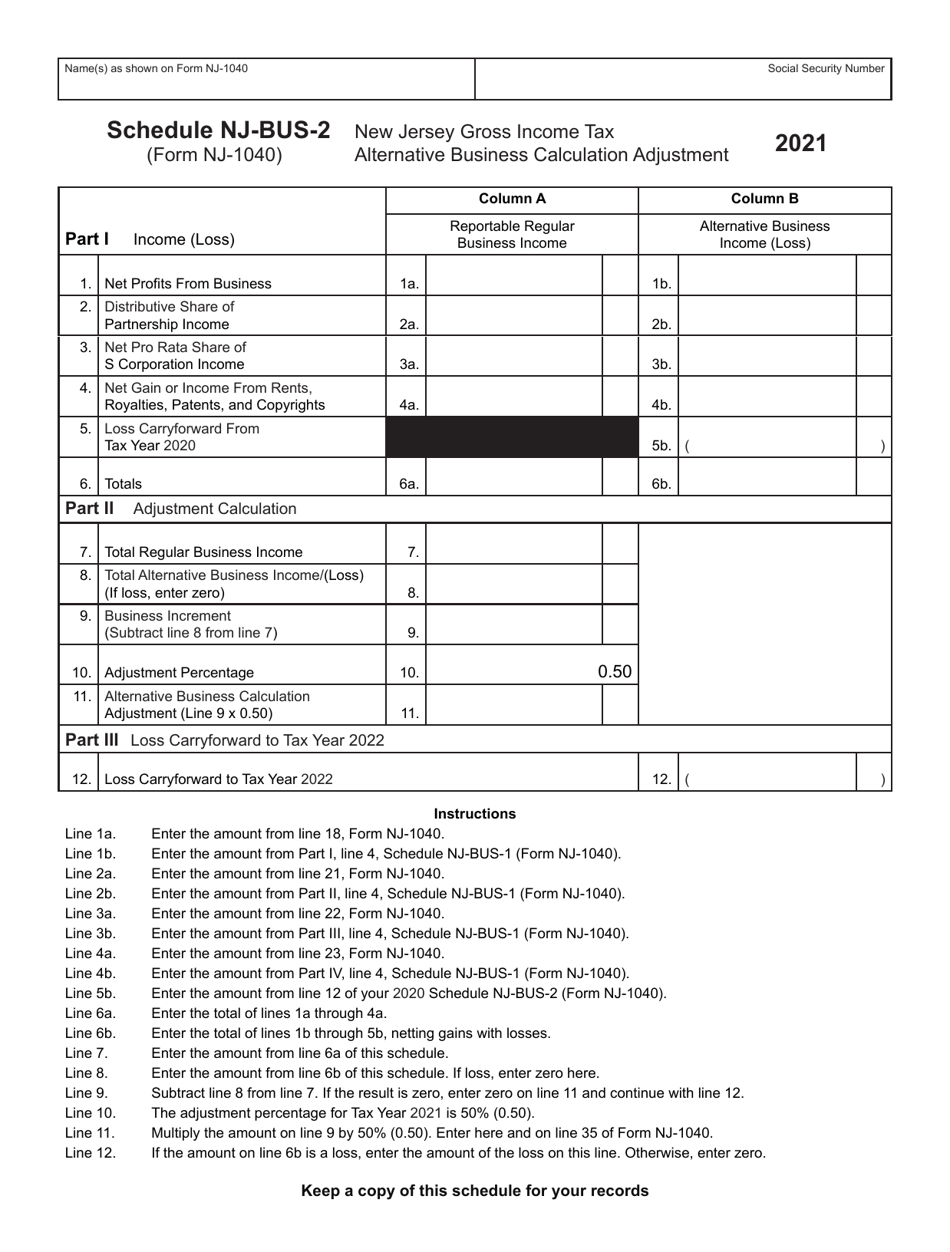

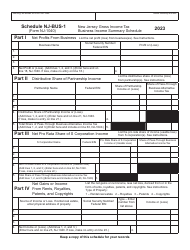

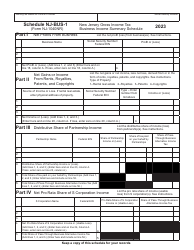

Form NJ-1040 Schedule NJ-BUS-2

for the current year.

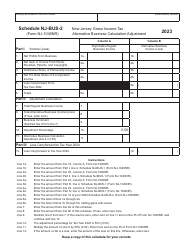

Form NJ-1040 Schedule NJ-BUS-2 New Jersey Gross Income Tax Alternative Business Calculation Adjustment - New Jersey

What Is Form NJ-1040 Schedule NJ-BUS-2?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.The document is a supplement to Form NJ-1040, New Jersey Resident Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-1040 Schedule NJ-BUS-2?

A: Form NJ-1040 Schedule NJ-BUS-2 is a tax form used in New Jersey to calculate the Alternative Business Calculation Adjustment for the Gross Income Tax.

Q: What is the Alternative Business Calculation Adjustment?

A: The Alternative Business Calculation Adjustment is a tax adjustment in New Jersey that allows certain business owners to calculate their taxable income using an alternative method.

Q: Who uses Form NJ-1040 Schedule NJ-BUS-2?

A: Form NJ-1040 Schedule NJ-BUS-2 is used by New Jersey taxpayers who have business income and want to calculate the Alternative Business Calculation Adjustment.

Q: What is the purpose of the Alternative Business Calculation Adjustment?

A: The purpose of the Alternative Business Calculation Adjustment is to provide an alternative method of calculating taxable income for certain business owners in New Jersey.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1040 Schedule NJ-BUS-2 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.