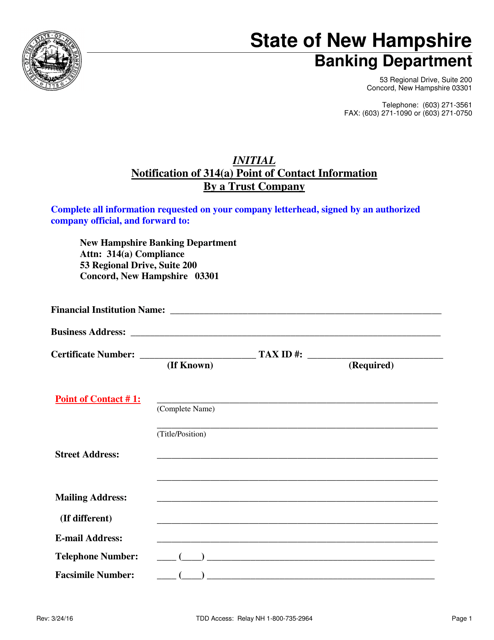

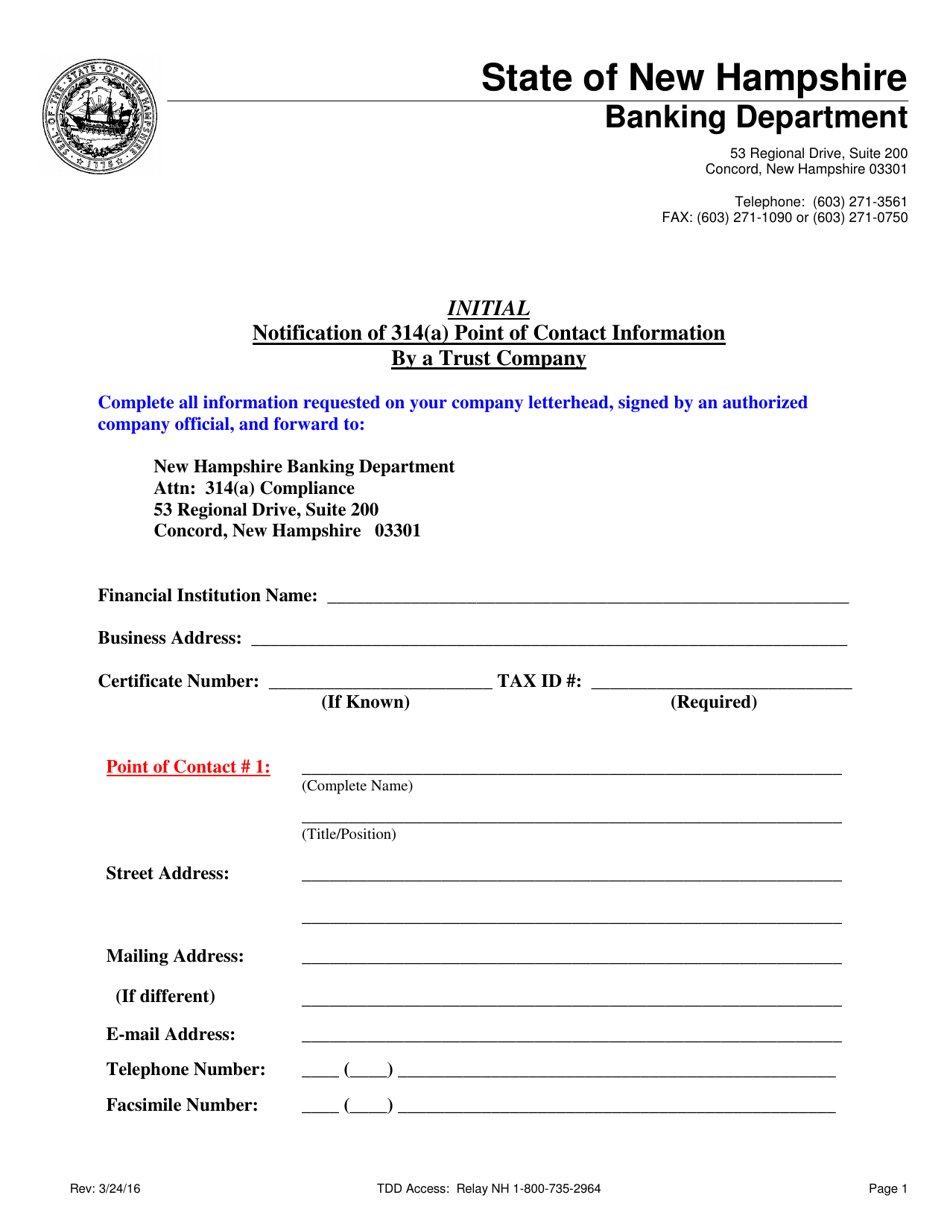

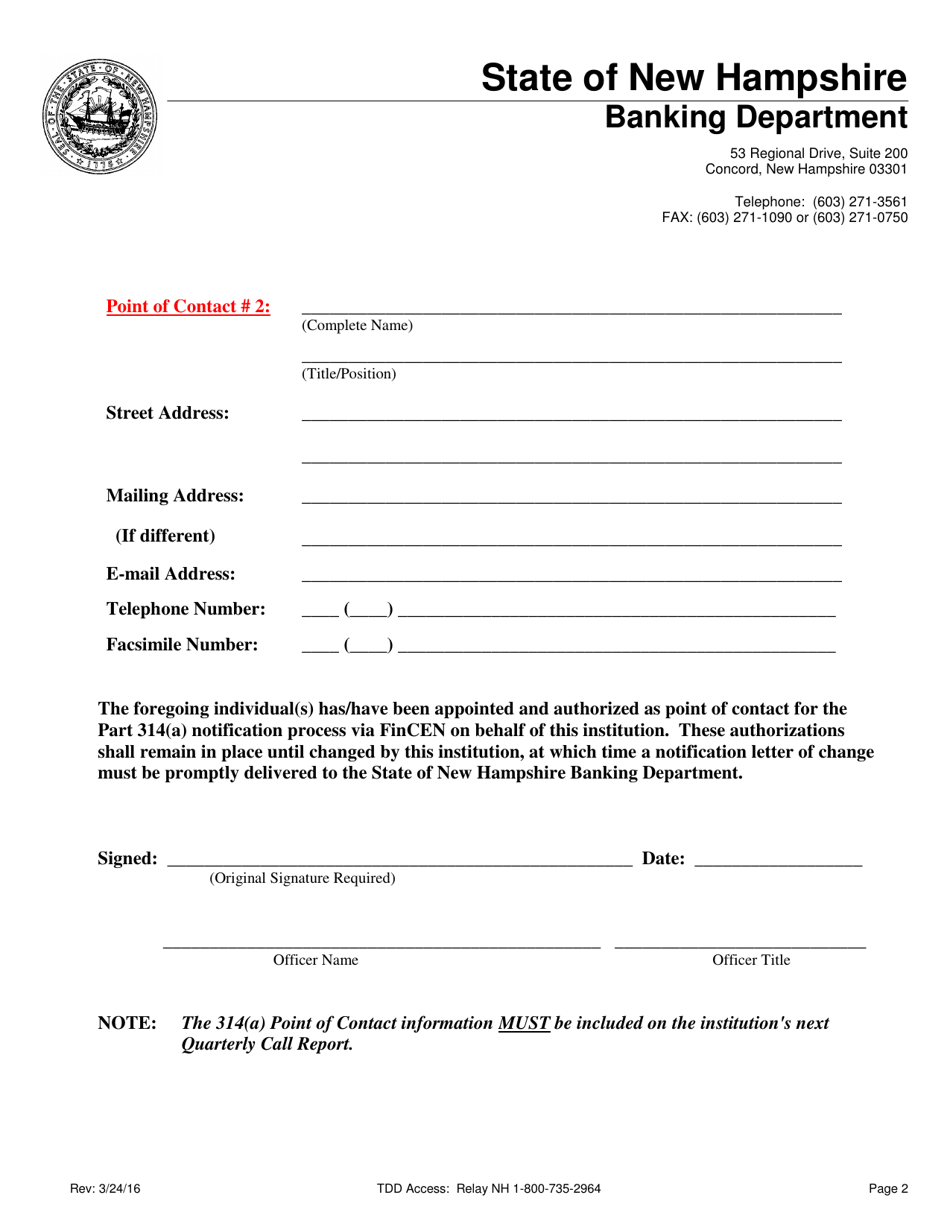

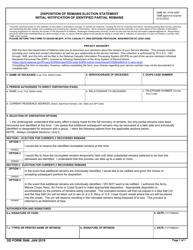

Initial Notification of 314(A) Point of Contact Information by a Trust Company - New Hampshire

Initial Notification of 314(A) Point of Contact Information by a Trust Company is a legal document that was released by the New Hampshire Banking Department - a government authority operating within New Hampshire.

FAQ

Q: What is a 314(A) Point of Contact Information?

A: A 314(A) Point of Contact Information is a requirement for financial institutions to provide a designated contact person for anti-money laundering purposes.

Q: What is a Trust Company?

A: A Trust Company is a financial institution that manages trusts and provides fiduciary services.

Q: Why is a Trust Company required to provide 314(A) Point of Contact Information?

A: Trust Companies are required to provide 314(A) Point of Contact Information to facilitate information sharing and cooperation in the investigation of money laundering and other financial crimes.

Q: Why is this notification important for Trust Companies in New Hampshire?

A: This notification is important for Trust Companies in New Hampshire as it ensures compliance with the regulatory requirements and enhances cooperation with law enforcement agencies.

Q: What should a Trust Company do upon receiving this notification?

A: Upon receiving this notification, a Trust Company should promptly designate a Point of Contact for 314(A) information requests and provide the required contact information to the appropriate authorities.

Q: Is the provision of 314(A) Point of Contact Information optional for Trust Companies?

A: No, the provision of 314(A) Point of Contact Information is mandatory for Trust Companies as per the regulatory requirements.

Q: Are there any penalties for non-compliance with providing 314(A) Point of Contact Information?

A: Yes, non-compliance with providing 314(A) Point of Contact Information may result in regulatory penalties and other legal consequences.

Q: What are the benefits of providing 314(A) Point of Contact Information?

A: Providing 314(A) Point of Contact Information allows for efficient communication and collaboration with law enforcement agencies, helping to combat financial crimes and protect the integrity of the financial system.

Q: Who can request 314(A) information from a Trust Company?

A: Law enforcement agencies, regulatory bodies, and other authorized entities may request 314(A) information from a Trust Company.

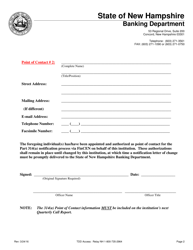

Q: Can Trust Companies designate multiple Point of Contact for 314(A) information?

A: Yes, Trust Companies can designate multiple Points of Contact for 314(A) information, as long as each contact person is adequately informed and capable of responding to information requests.

Form Details:

- Released on March 24, 2016;

- The latest edition currently provided by the New Hampshire Banking Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New Hampshire Banking Department.