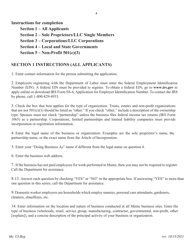

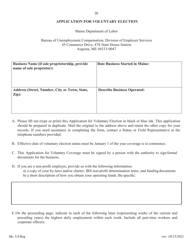

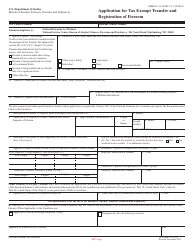

Application for Registration for an Unemployment Compensation Tax Account - Maine

Application for Registration for an Unemployment Compensation Tax Account is a legal document that was released by the Maine Department of Labor - a government authority operating within Maine.

FAQ

Q: What is the Unemployment Compensation Tax?

A: The Unemployment Compensation Tax is a tax paid by employers to provide benefits to workers who are unemployed.

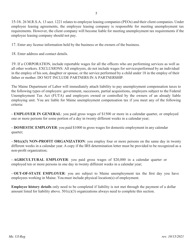

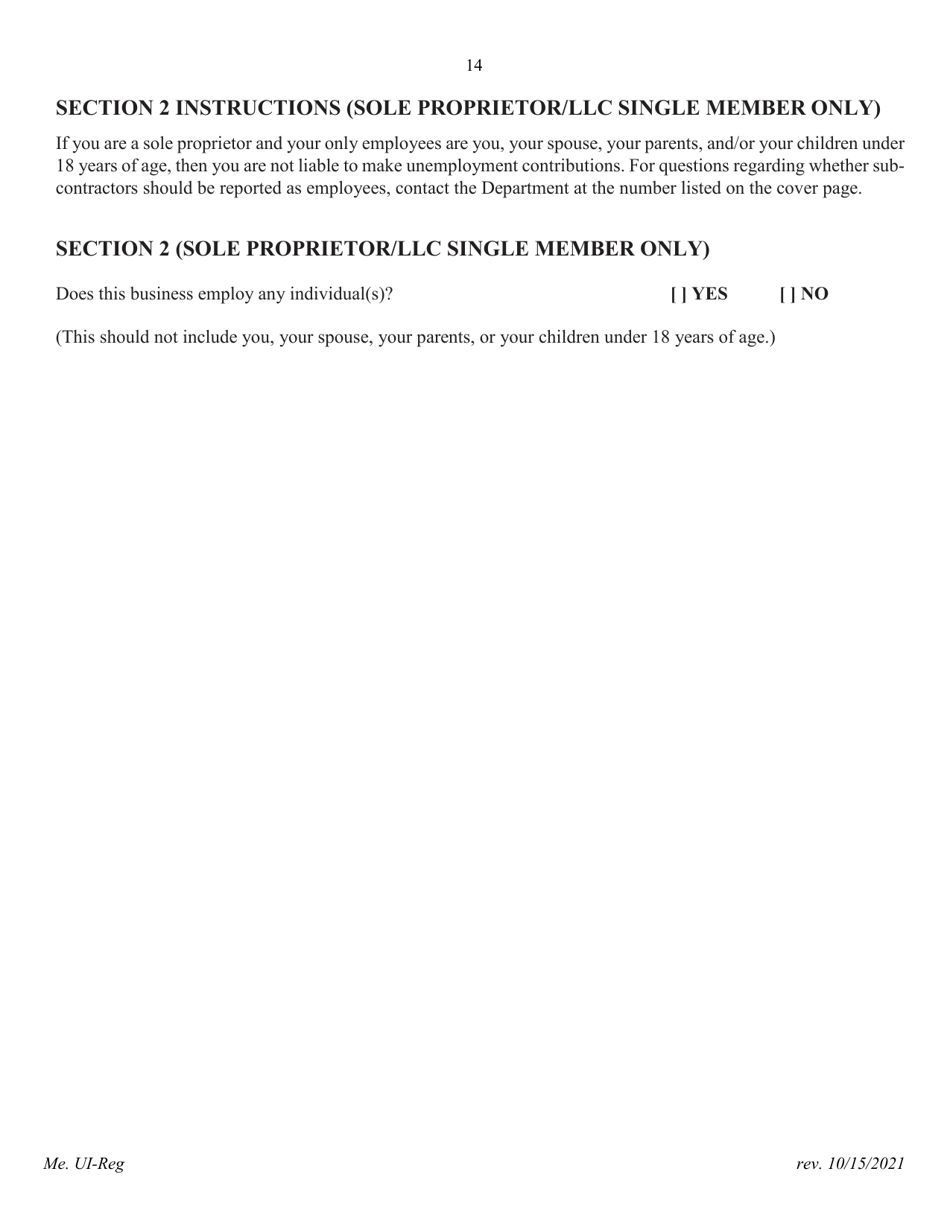

Q: Who needs to apply for a registration for an Unemployment Compensation Tax Account in Maine?

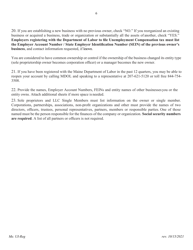

A: Employers who have employees in Maine and are liable for paying unemployment taxes need to apply for a registration.

Q: How can I apply for a registration for an Unemployment Compensation Tax Account in Maine?

A: You can apply for a registration by completing and submitting the Application for Registration for an Unemployment Compensation Tax Account form.

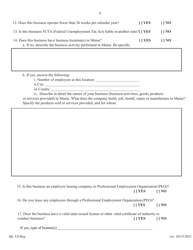

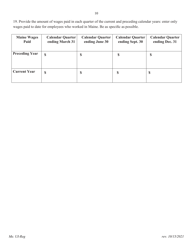

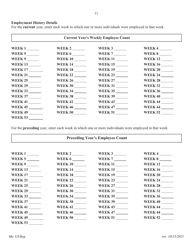

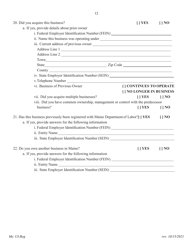

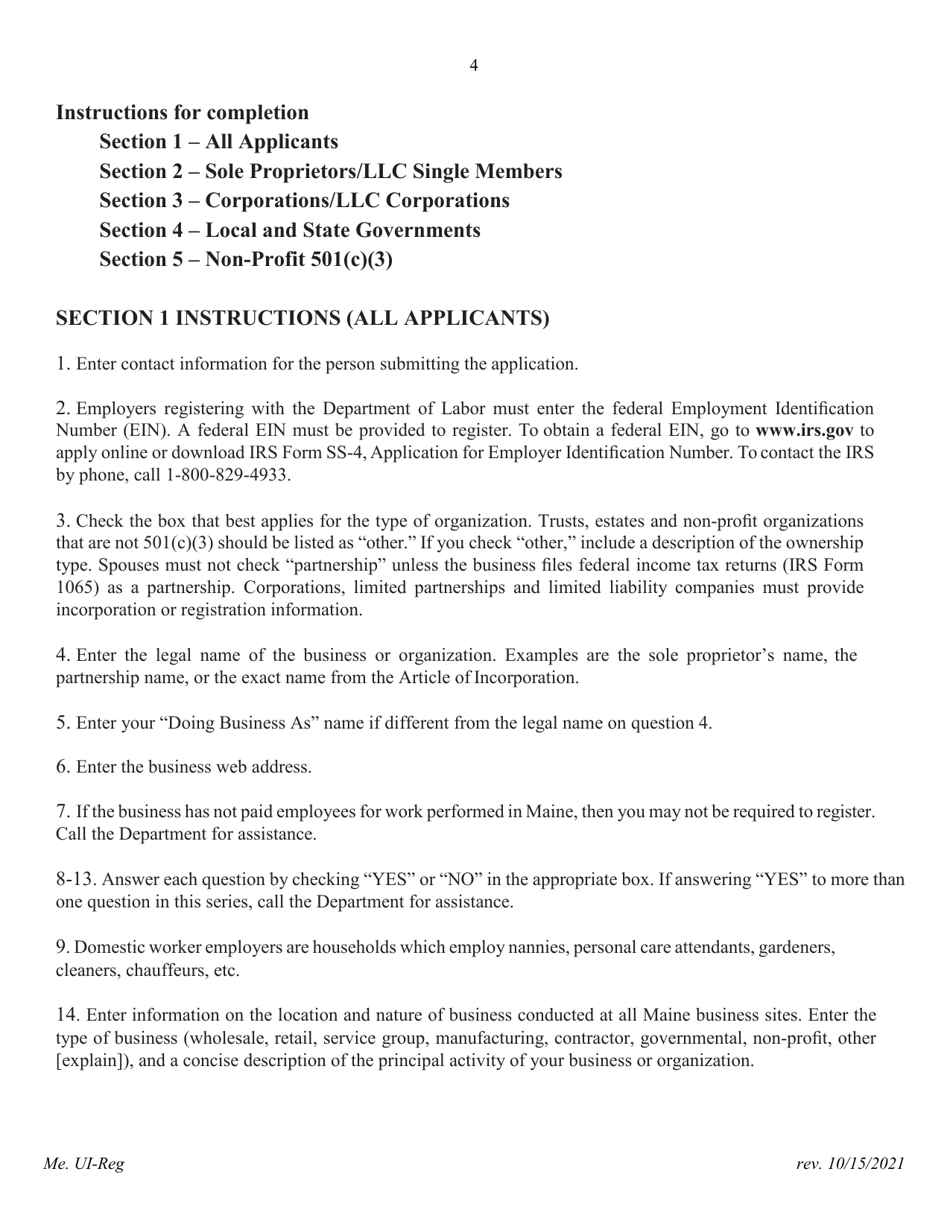

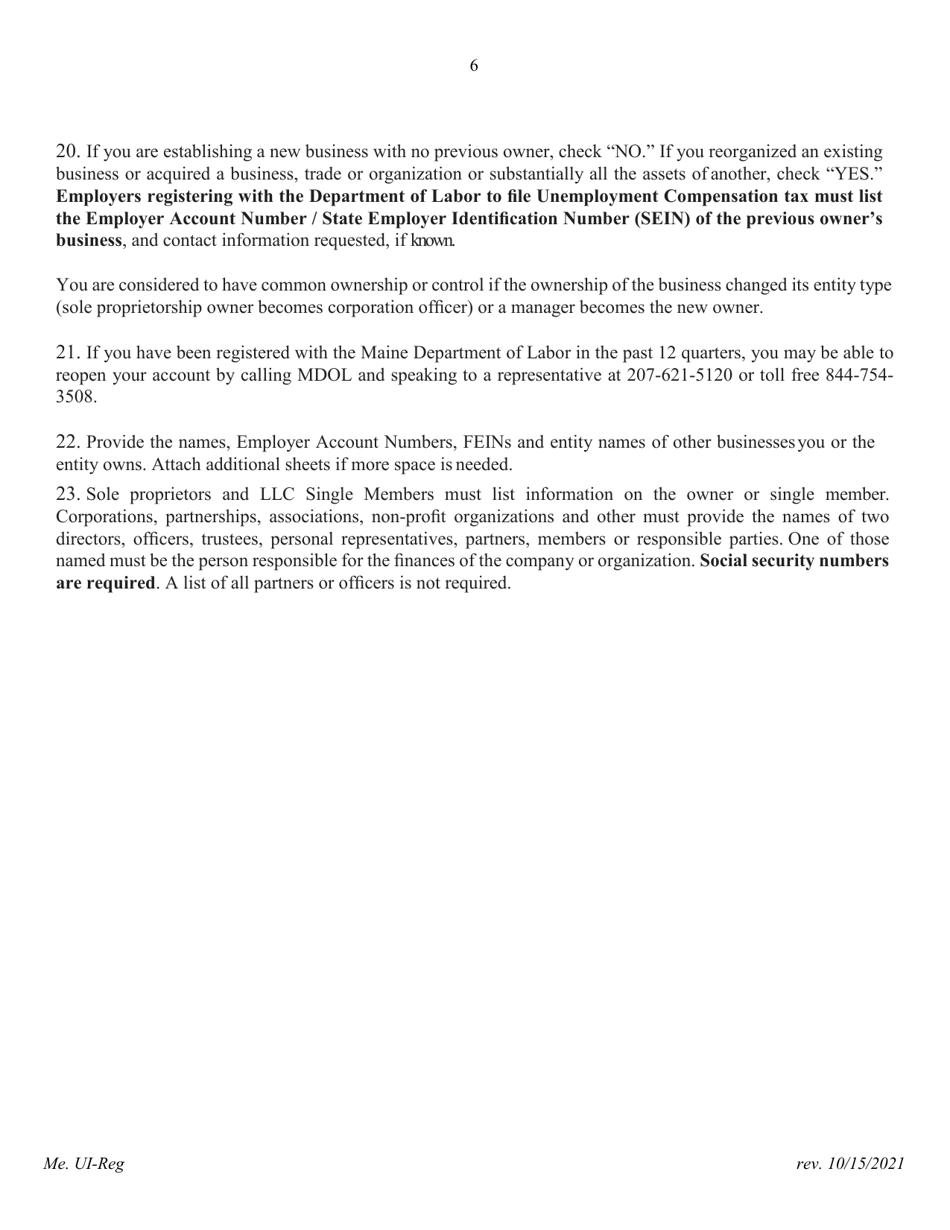

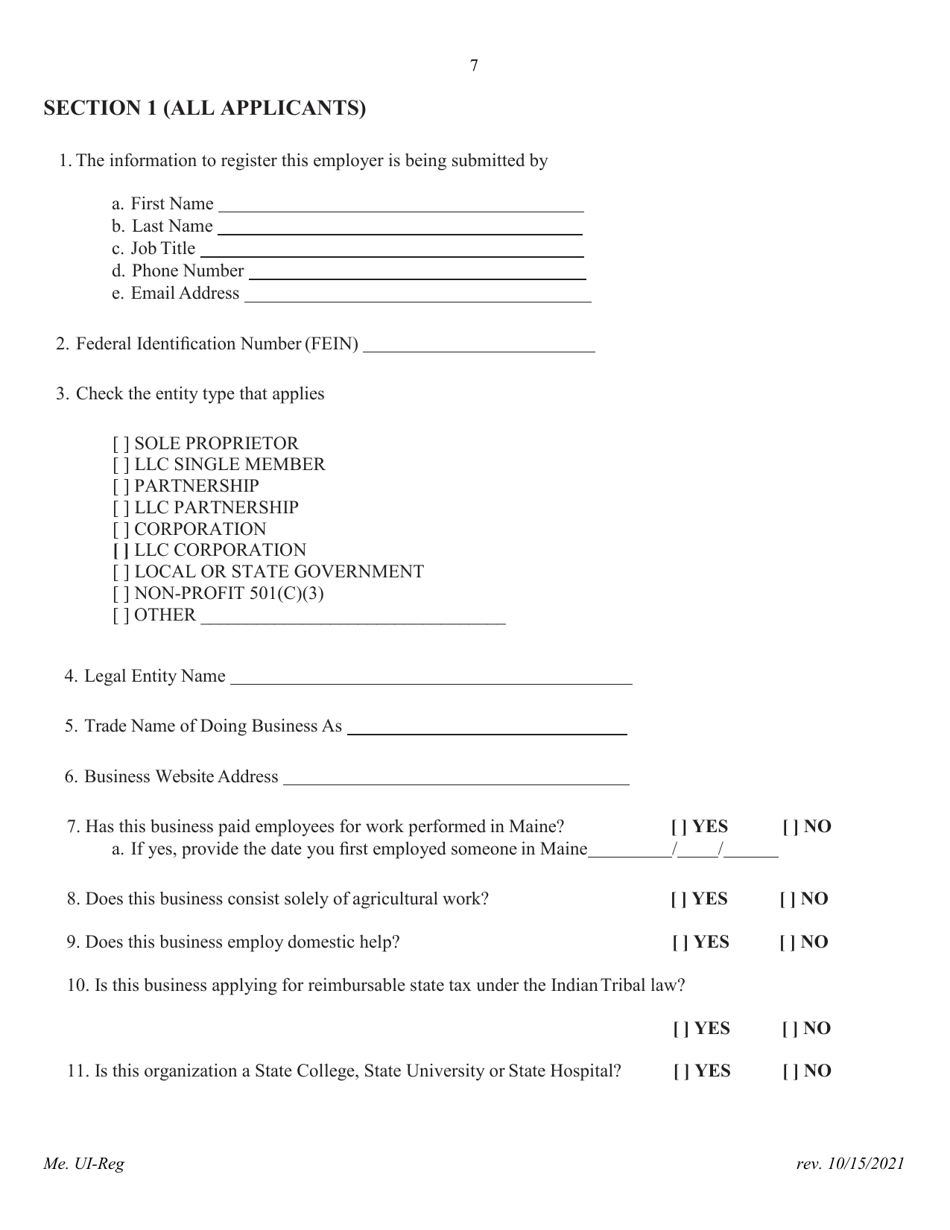

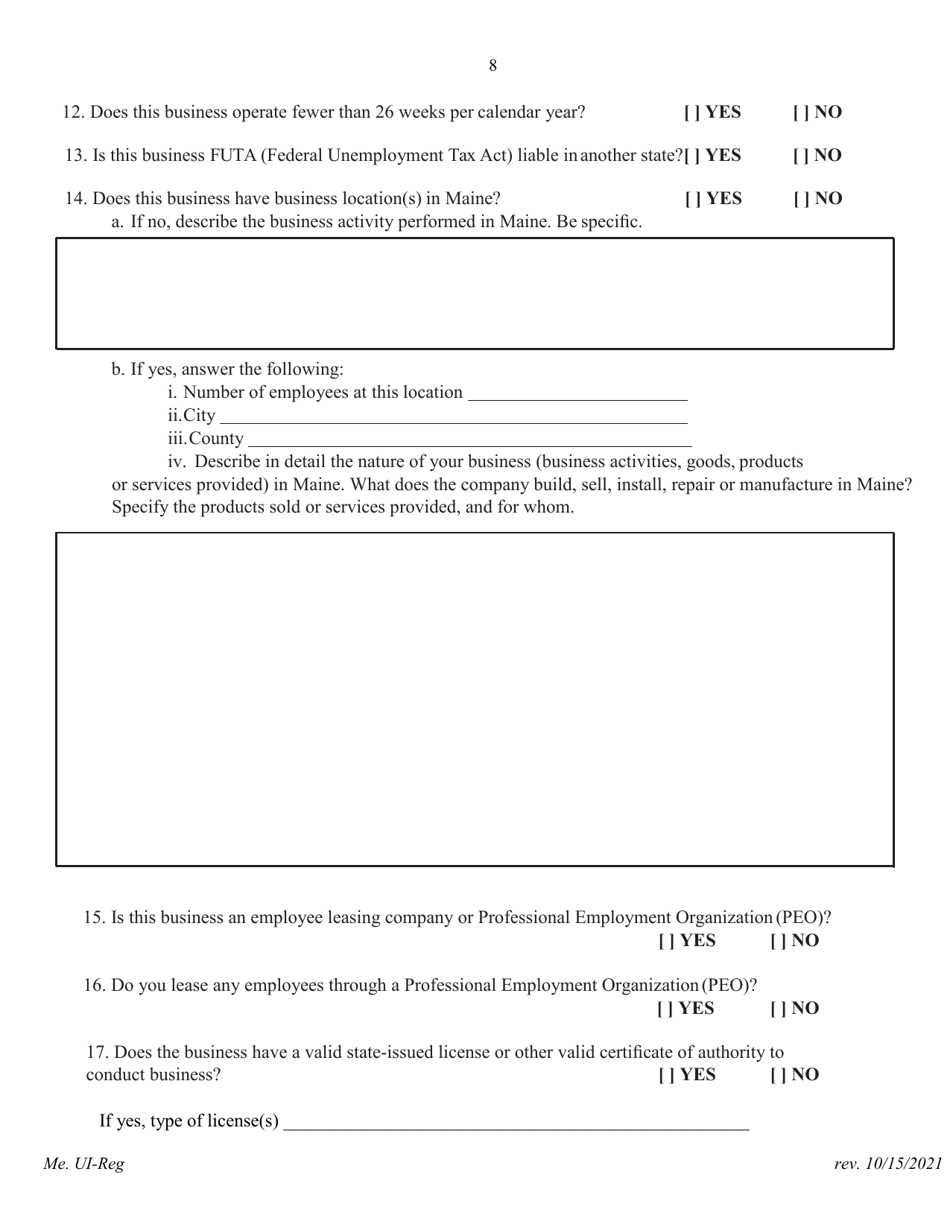

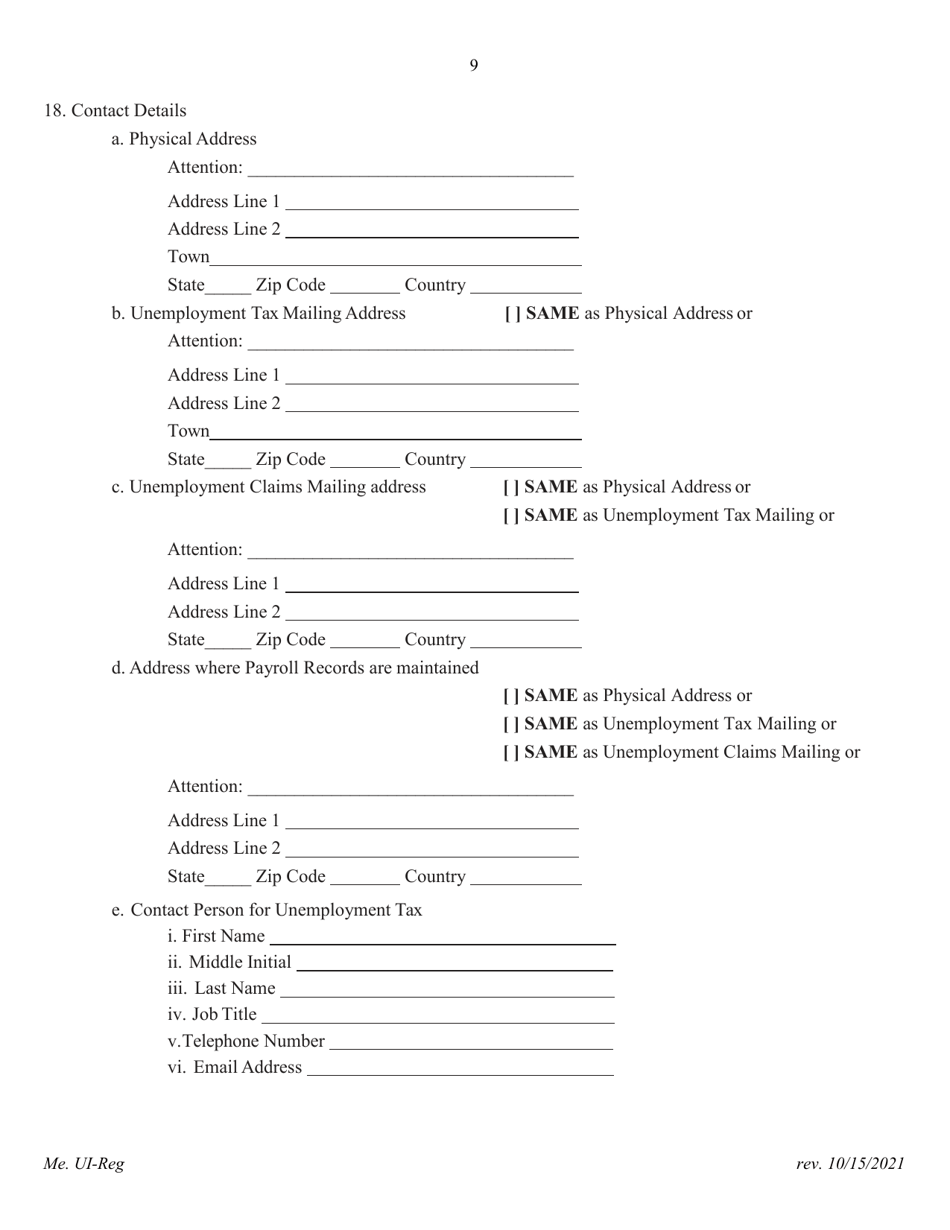

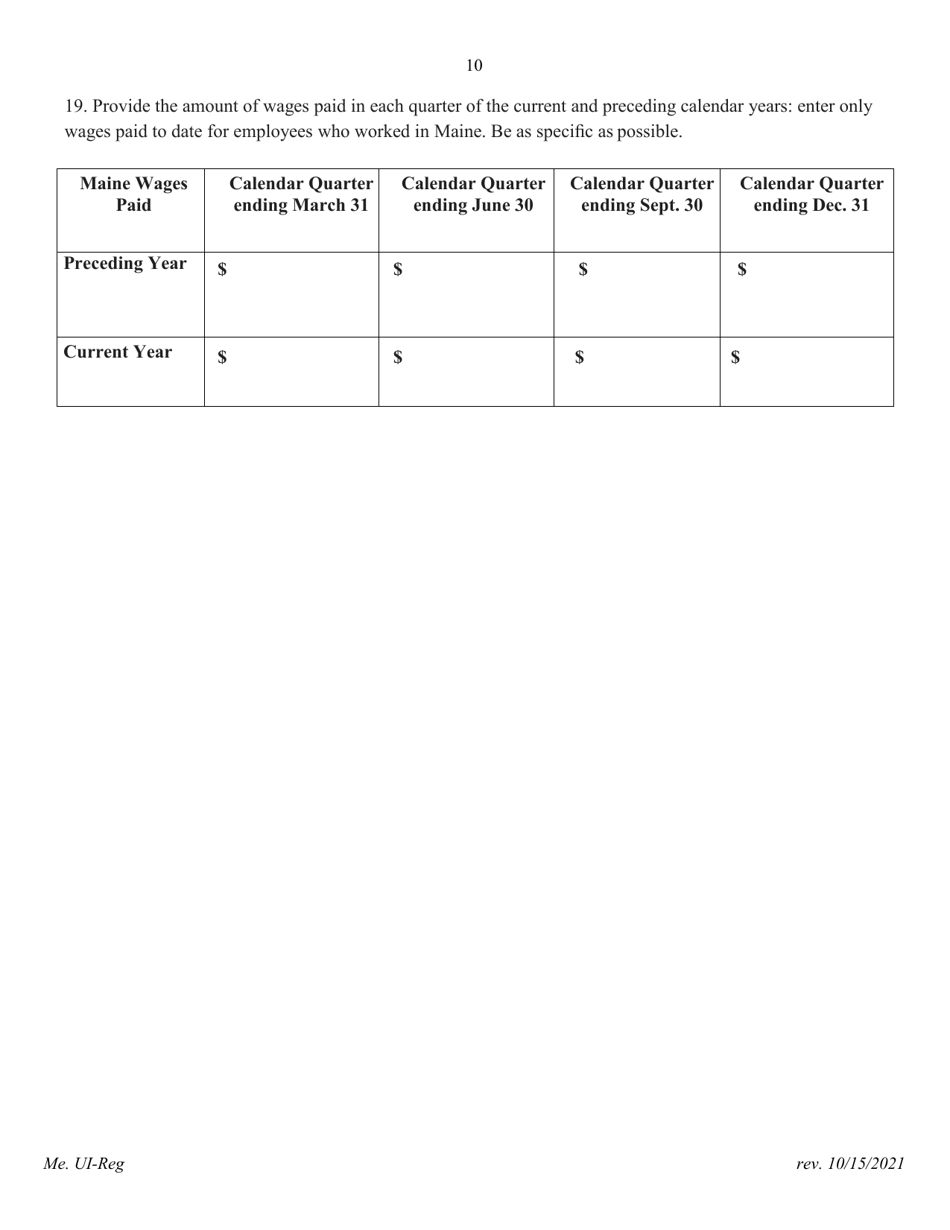

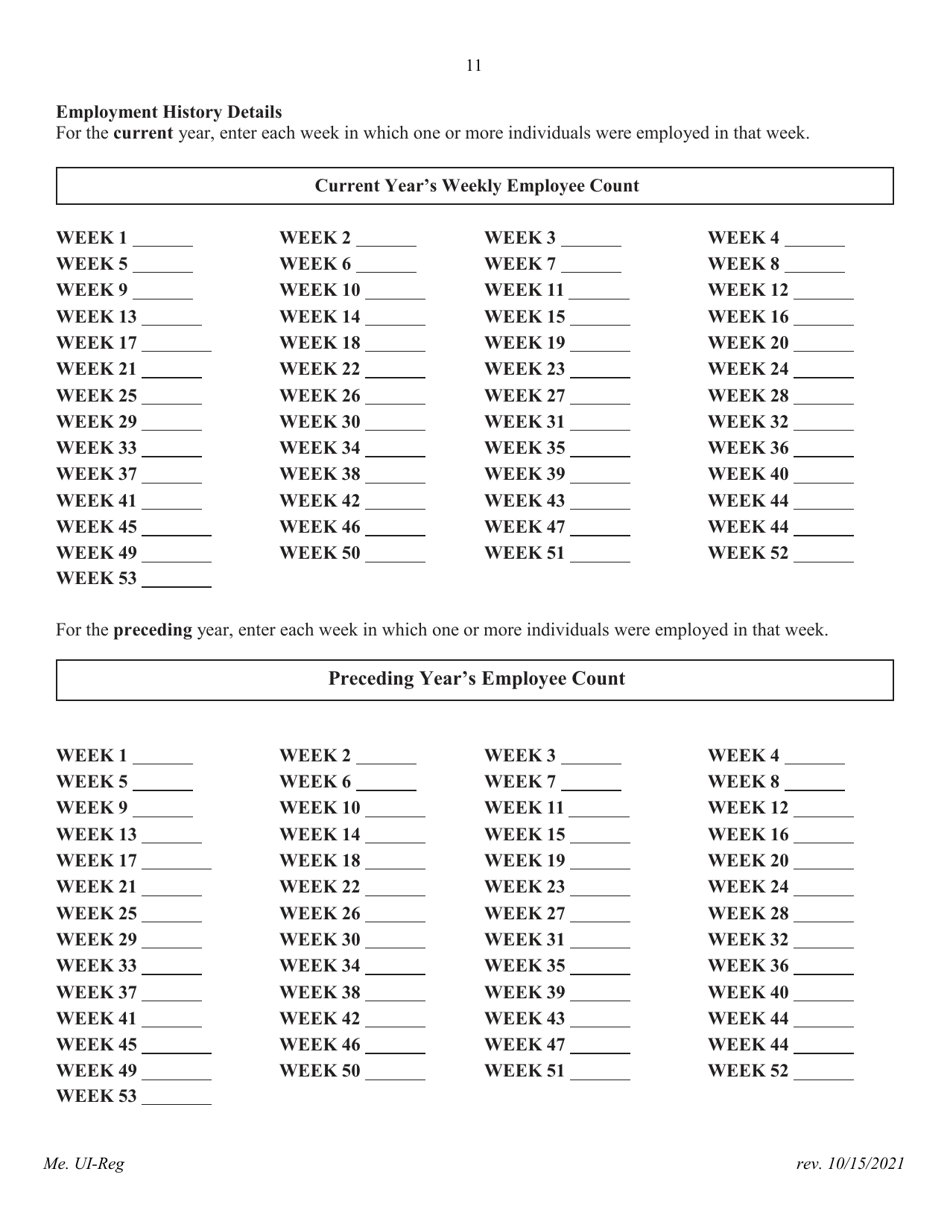

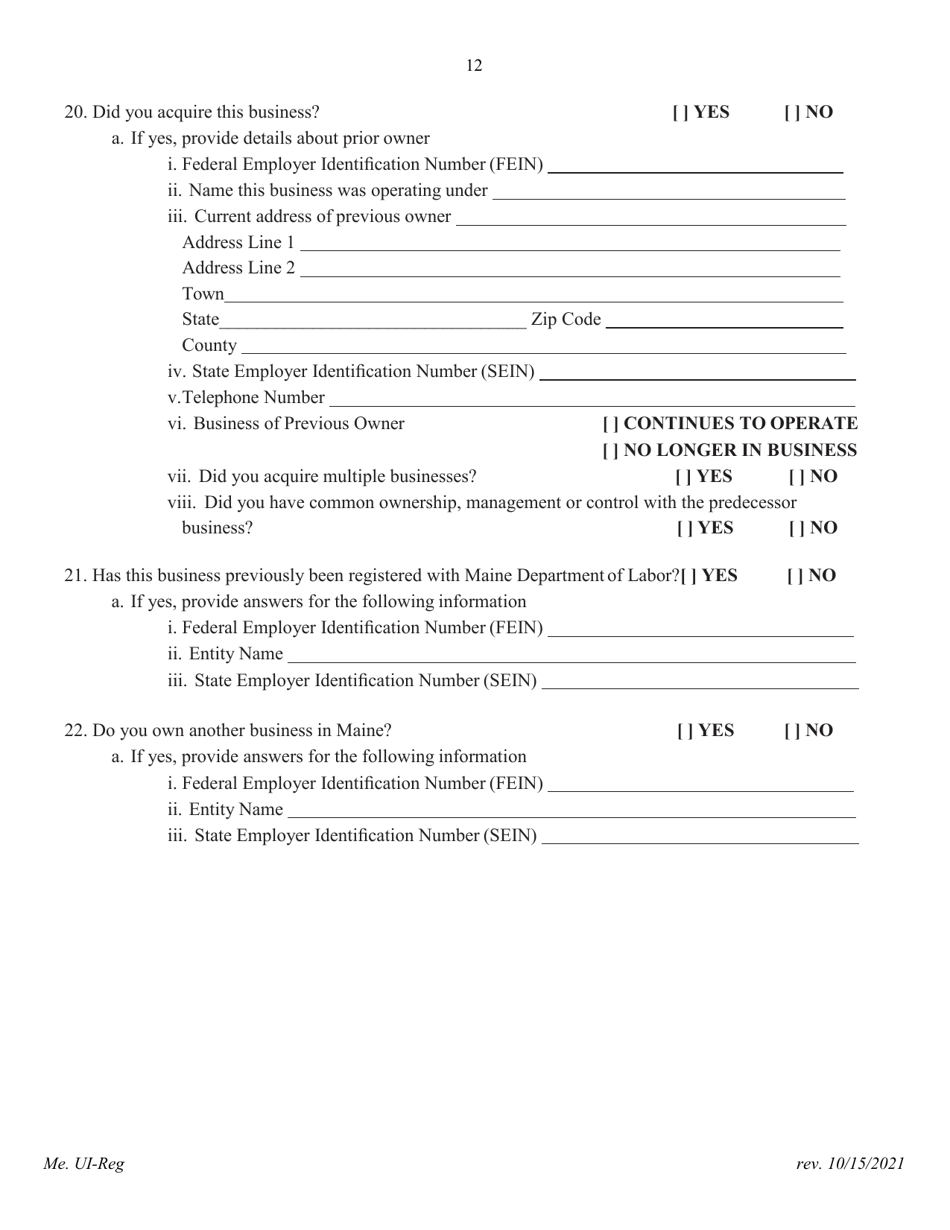

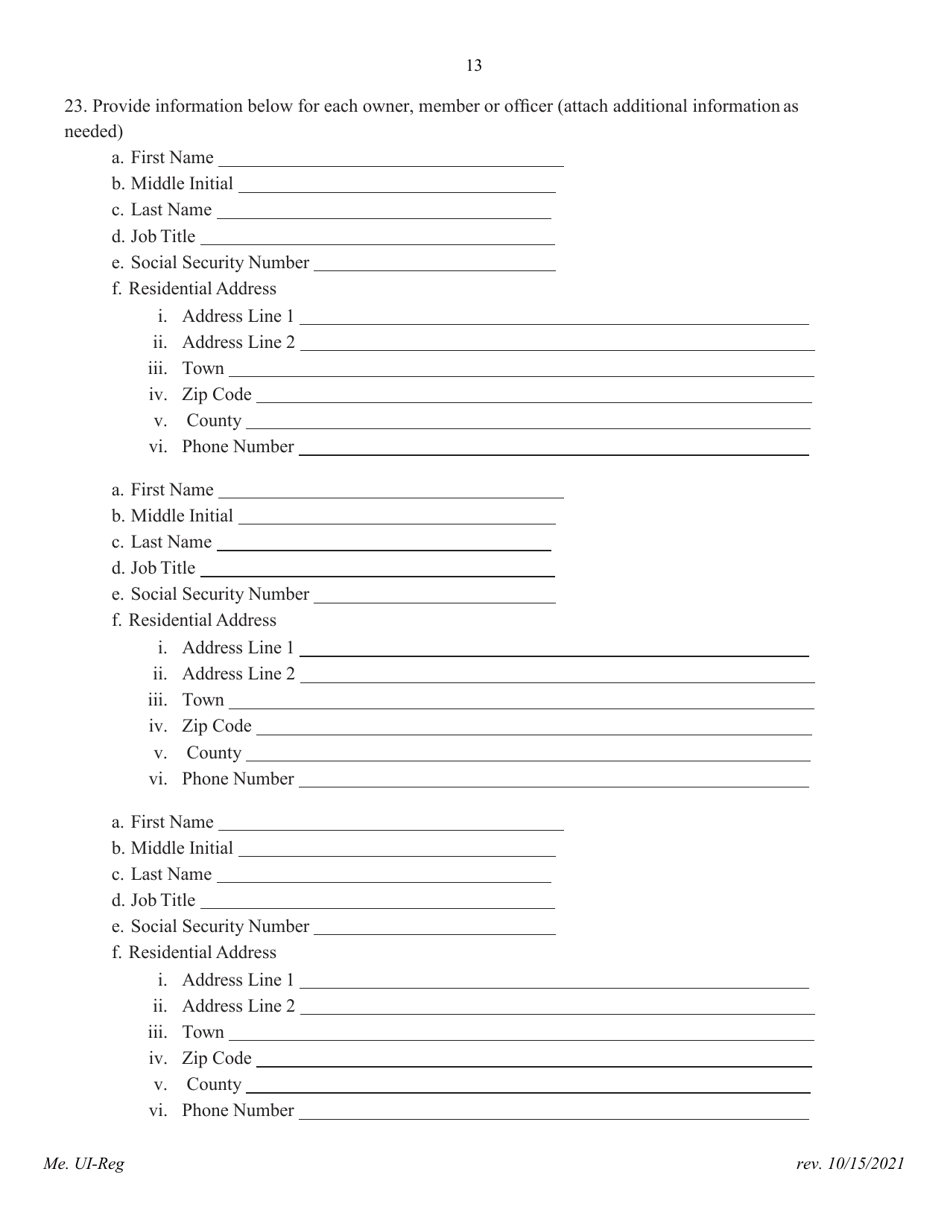

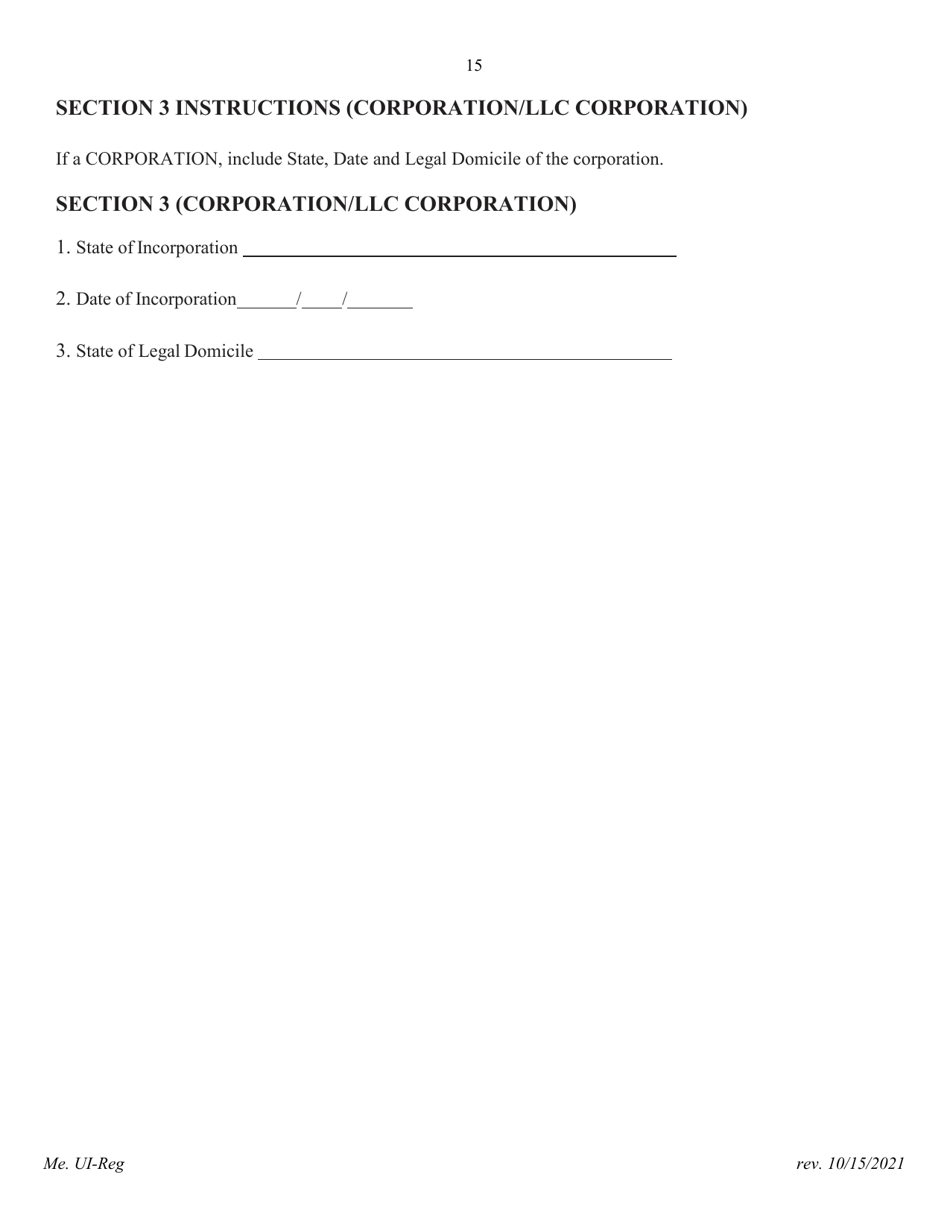

Q: What information do I need to provide on the Application for Registration form?

A: You will need to provide information about your business, such as the business name, address, federal employer identification number, and contact information.

Q: Are there any fees associated with the registration?

A: No, there are no fees for applying for a registration for an Unemployment Compensation Tax Account.

Q: When should I submit the application?

A: You should submit the application as soon as you have employees in Maine and are liable for paying unemployment taxes.

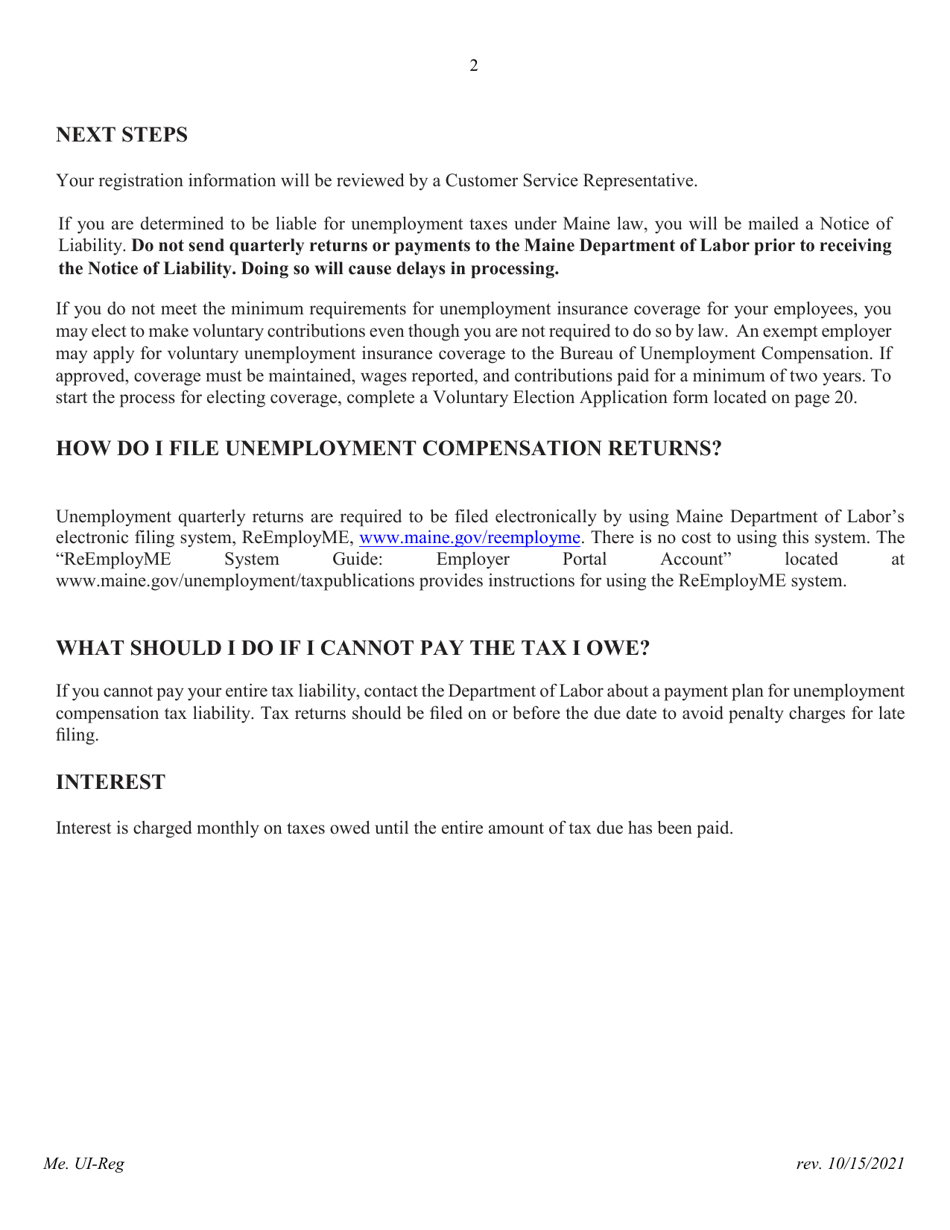

Q: What happens after I submit the application?

A: After you submit the application, you will receive a confirmation of your registration and be assigned an Unemployment Compensation Tax Account number.

Q: Do I need to renew my registration?

A: No, once you have registered for an Unemployment Compensation Tax Account, you do not need to renew it.

Form Details:

- Released on October 15, 2021;

- The latest edition currently provided by the Maine Department of Labor;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Labor.