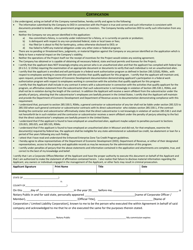

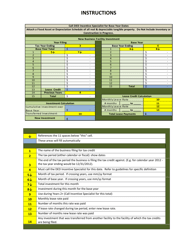

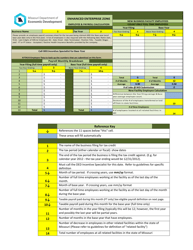

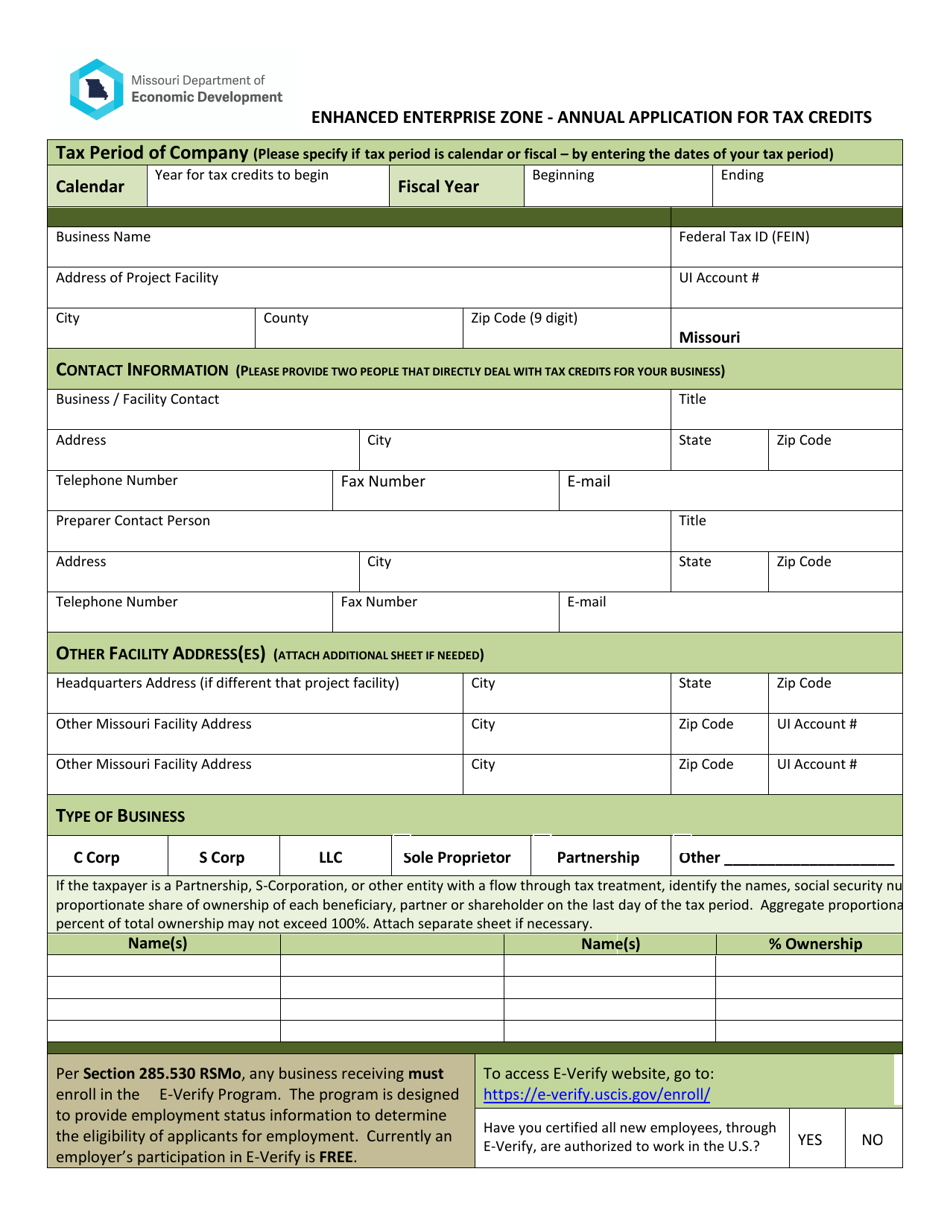

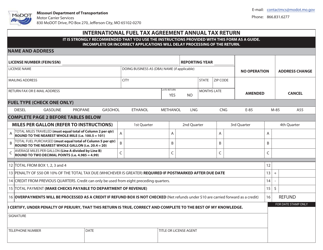

Annual Tax Credit Application - Enhanced Enterprise Zone Tax Credit Program - Missouri

Annual Enterprise Zone Tax Credit Program is a legal document that was released by the Missouri Department of Economic Development - a government authority operating within Missouri.

FAQ

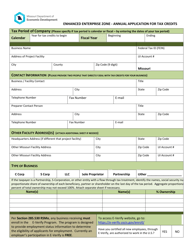

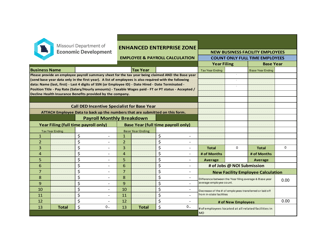

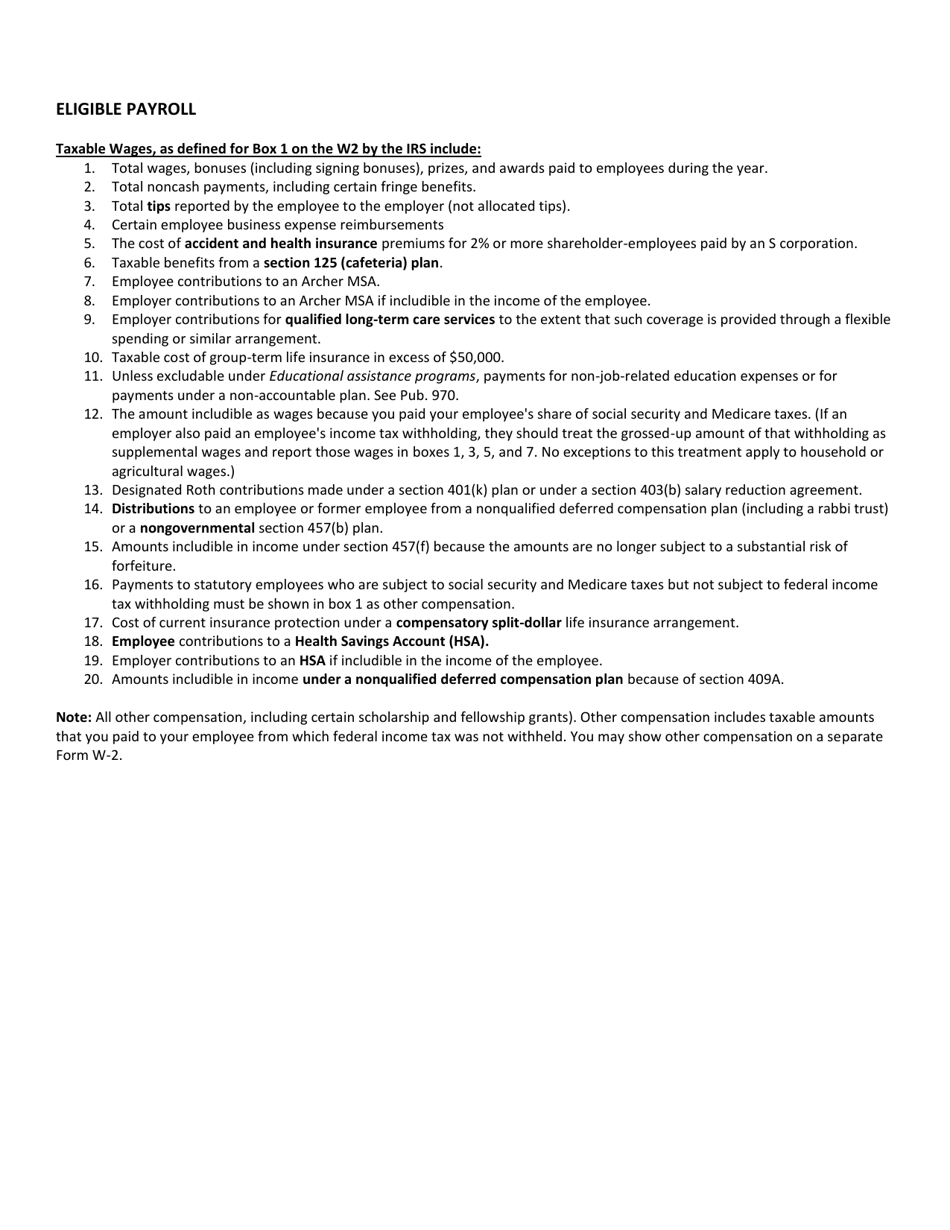

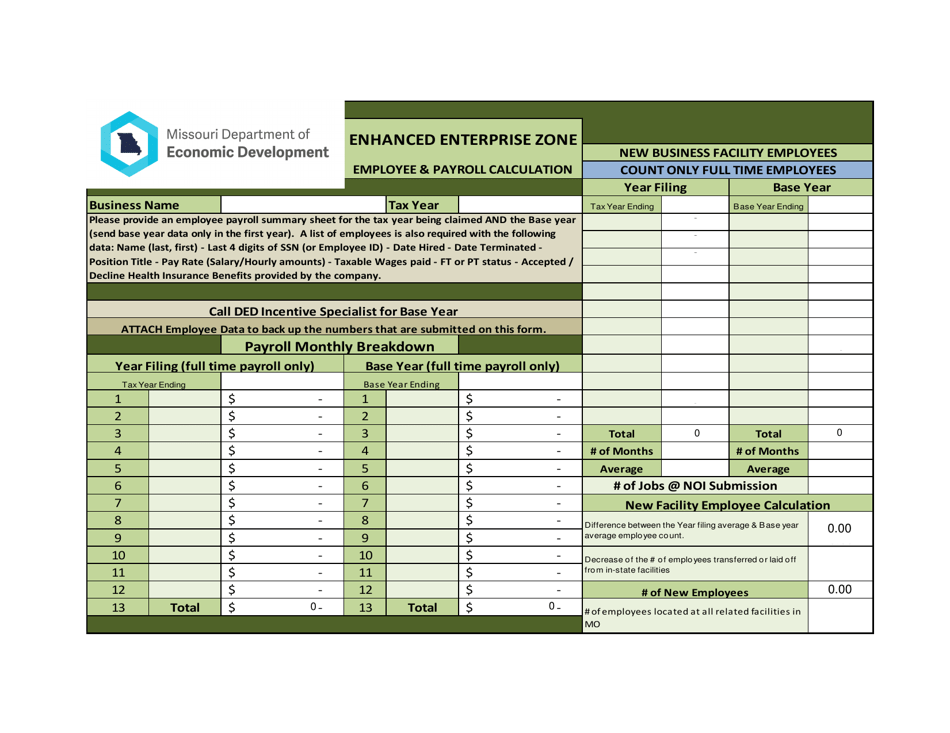

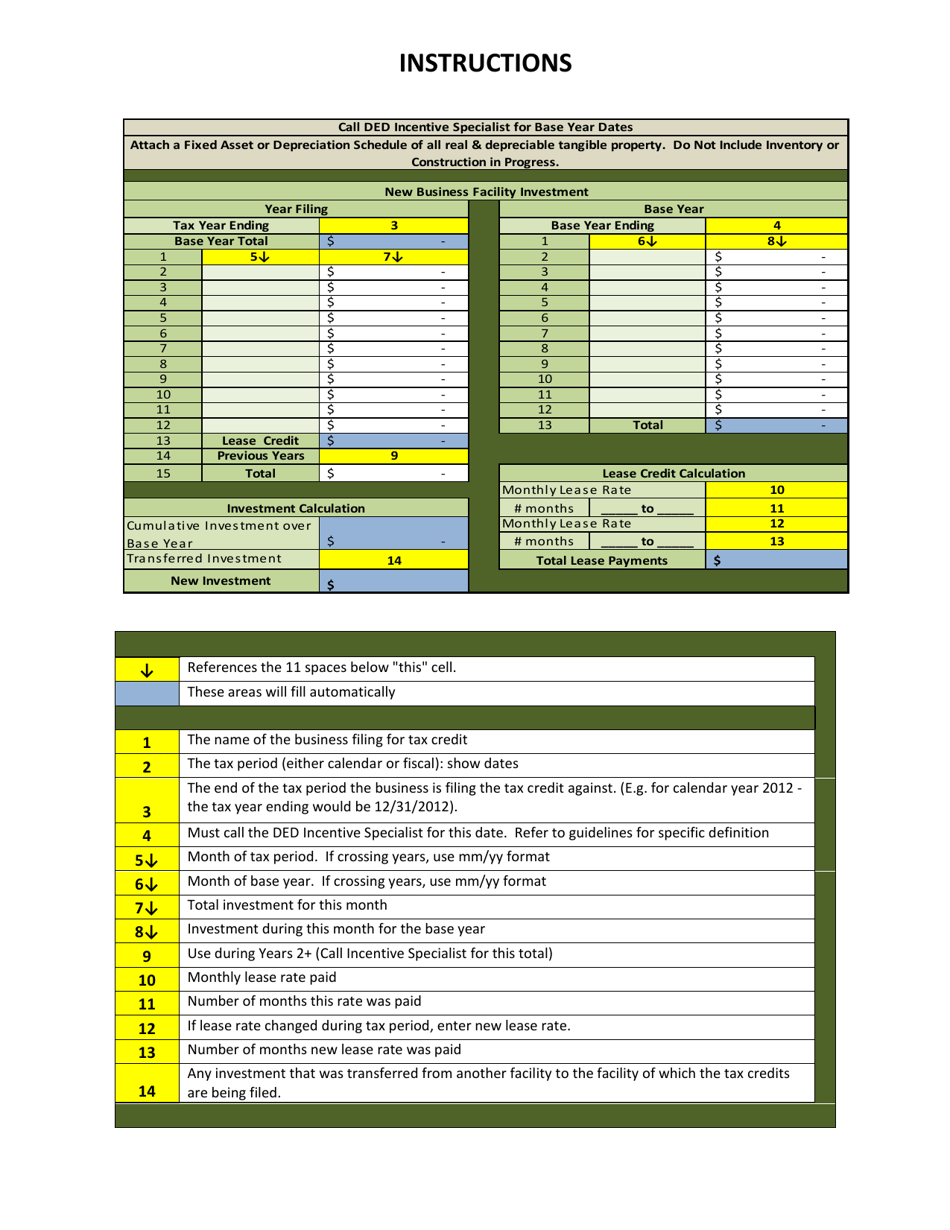

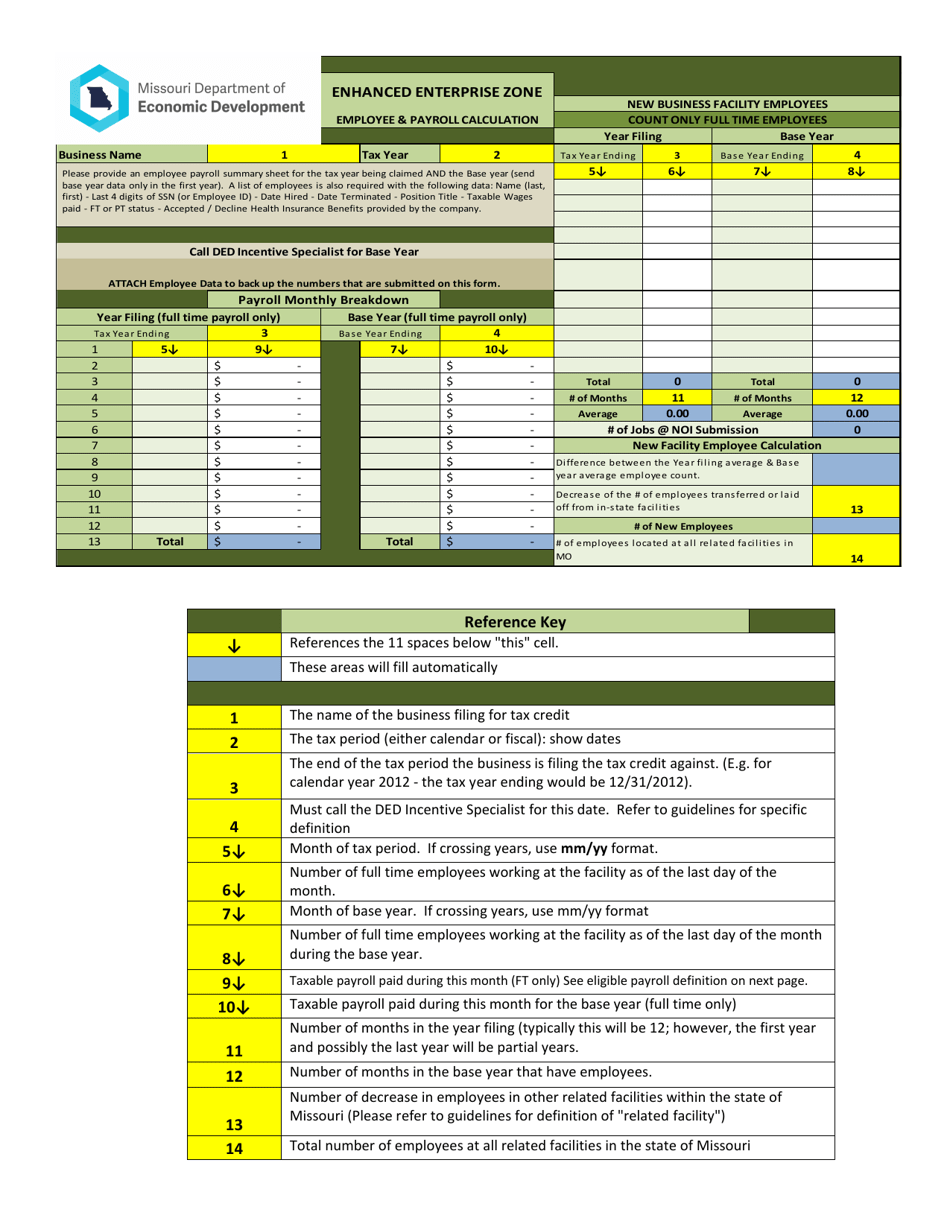

Q: What is the Annual Tax Credit Application?

A: The Annual Tax Credit Application is a form used to apply for the Enhanced Enterprise ZoneTax Credit Program in Missouri.

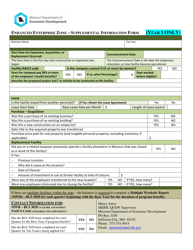

Q: What is the Enhanced Enterprise Zone Tax Credit Program?

A: The Enhanced Enterprise Zone Tax Credit Program is a program in Missouri that provides tax incentives to businesses that locate or expand within certain designated zones.

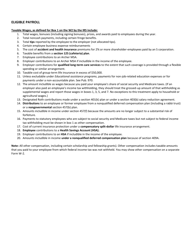

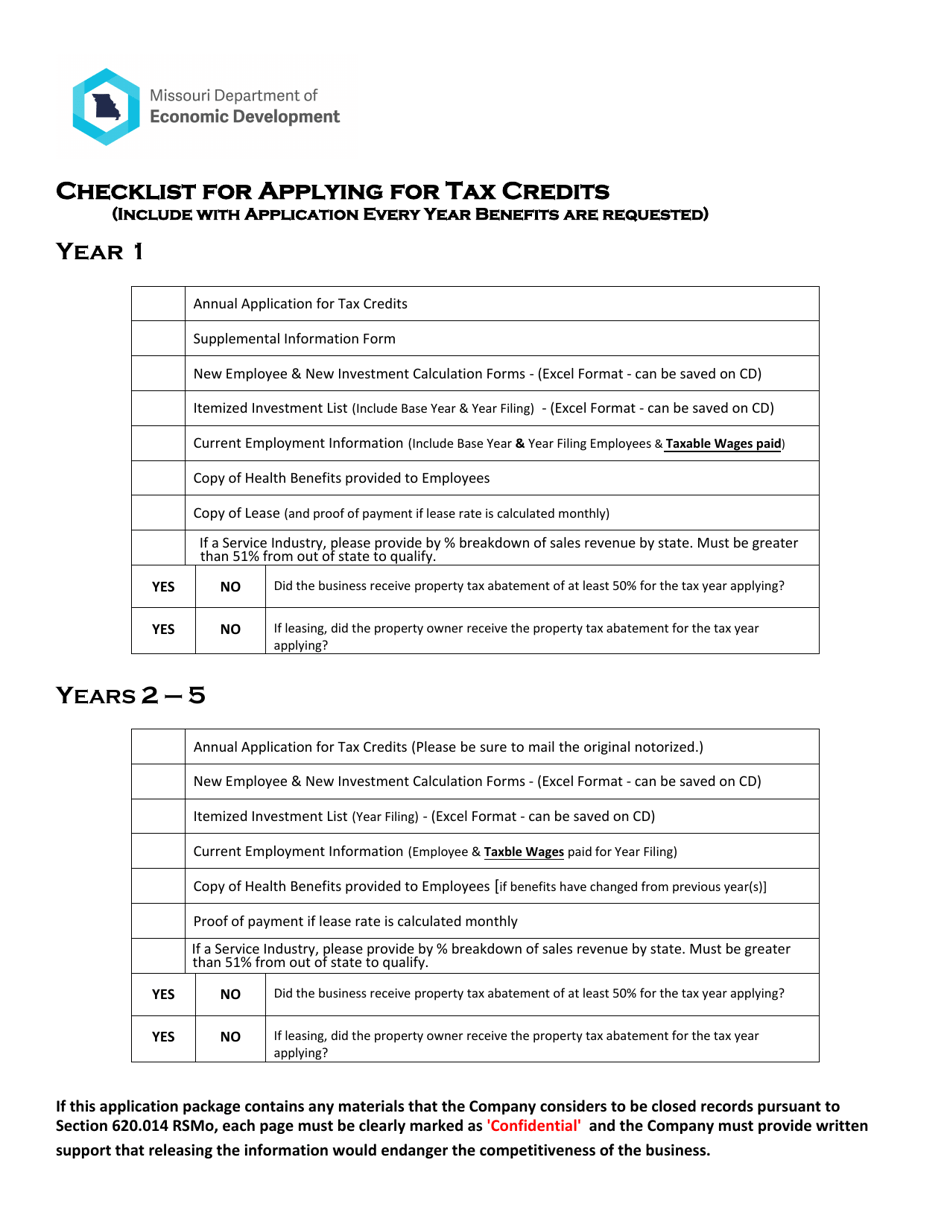

Q: Who is eligible to apply for the tax credit?

A: Businesses that are located within an Enhanced Enterprise Zone and meet certain criteria are eligible to apply for the tax credit.

Q: What are the benefits of the tax credit?

A: The tax credit provides financial incentives to businesses, including tax credits against income tax and sales and use tax exemptions.

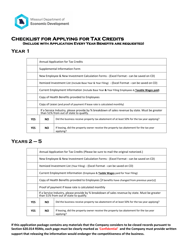

Q: How can I apply for the tax credit?

A: You can apply for the tax credit by completing and submitting the Annual Tax Credit Application form.

Q: Is there a deadline for submitting the application?

A: Yes, there is a deadline for submitting the Annual Tax Credit Application. The specific deadline can be found on the application form or by contacting the relevant authorities.

Form Details:

- The latest edition currently provided by the Missouri Department of Economic Development;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Missouri Department of Economic Development.