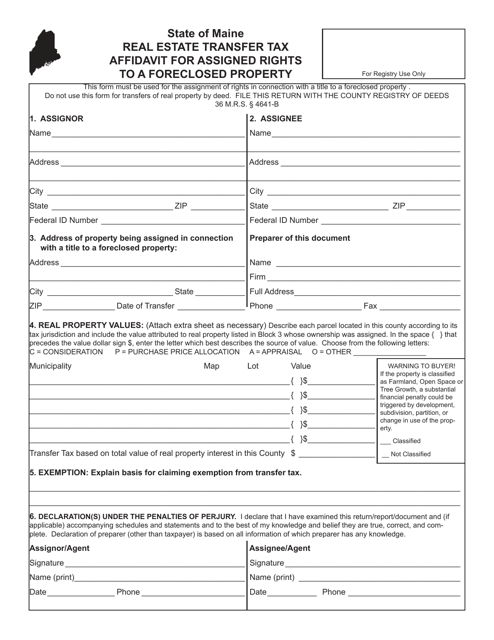

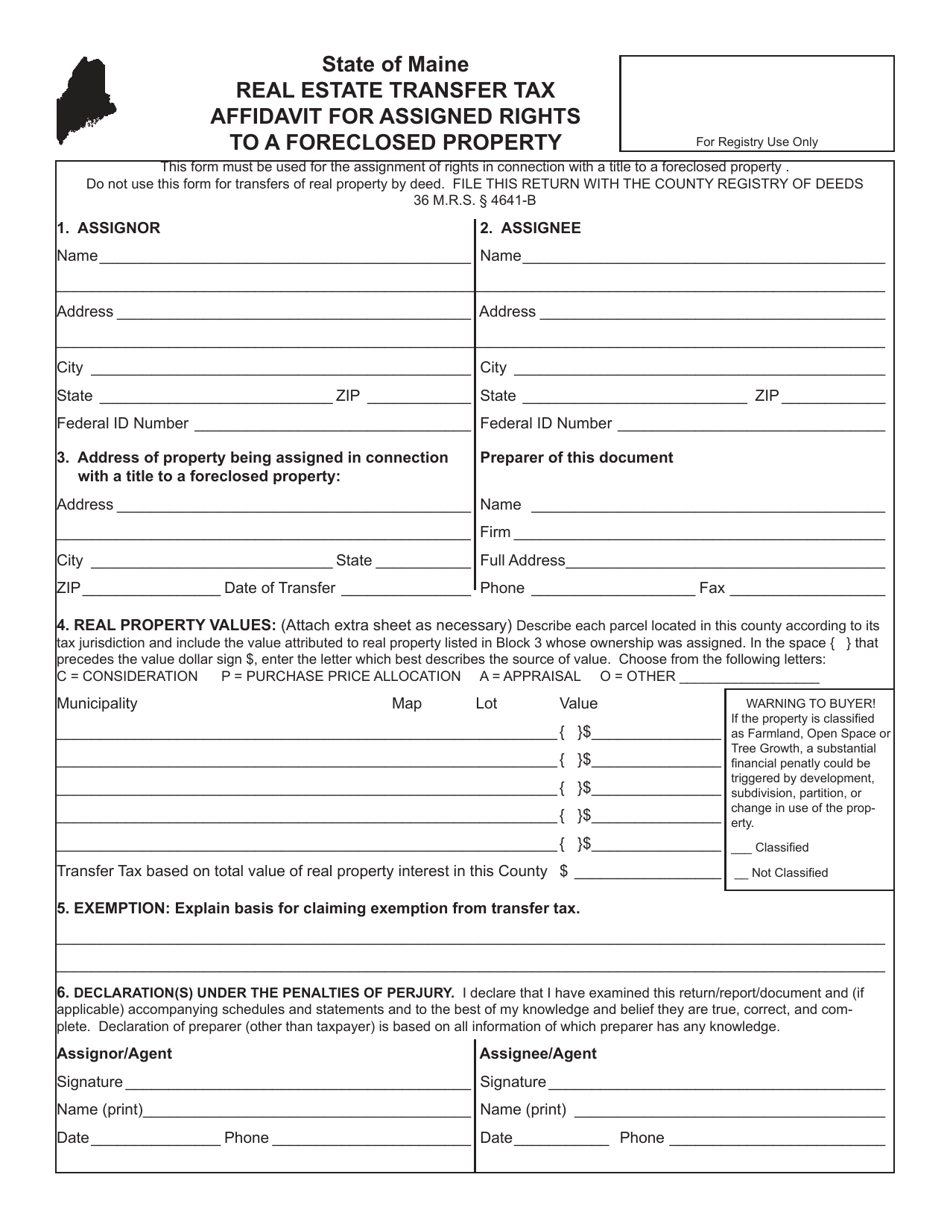

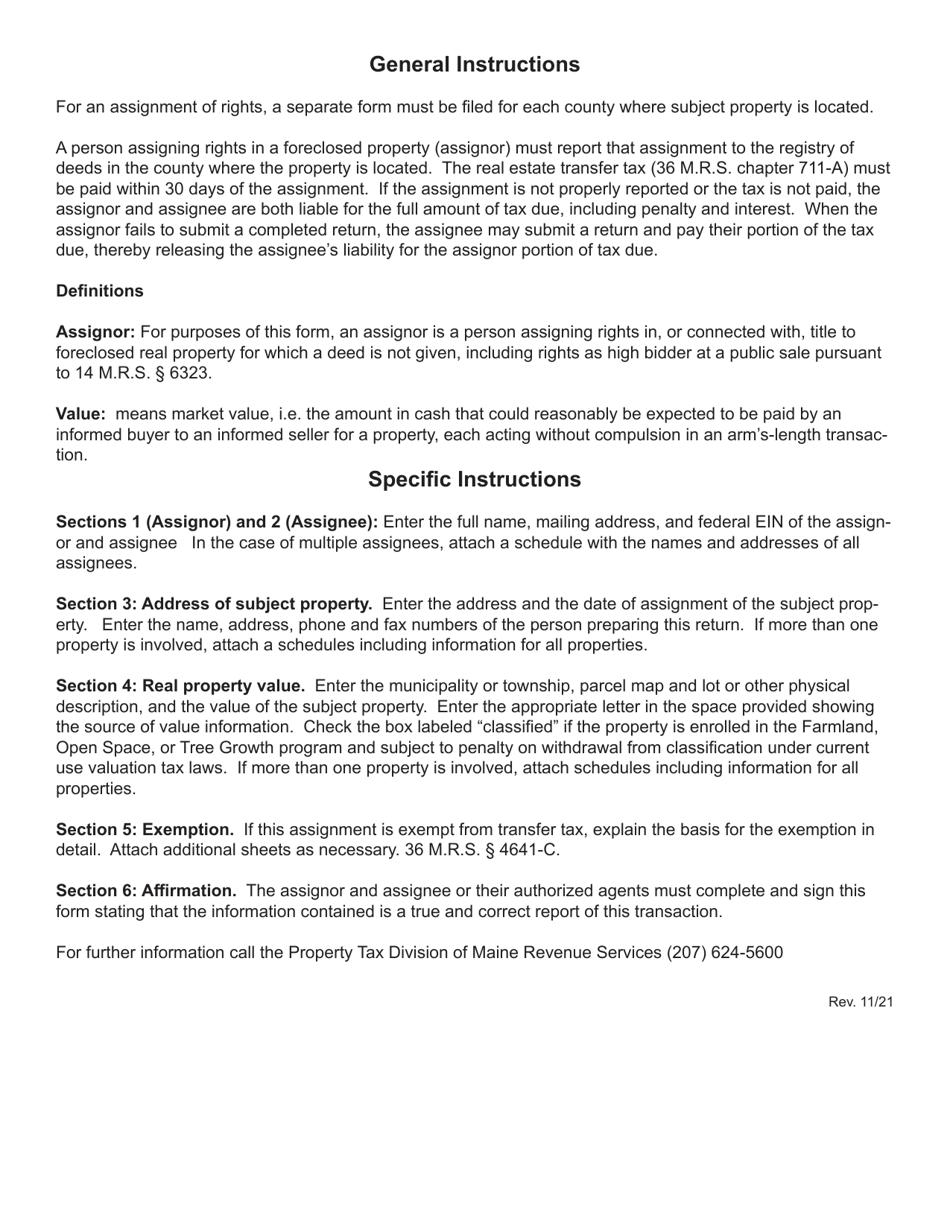

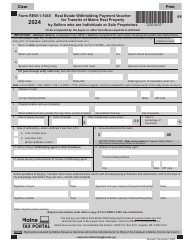

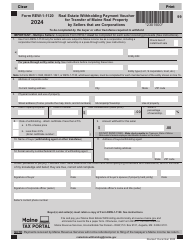

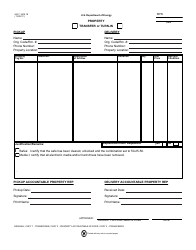

Real Estate Transfer Tax Affidavit for Assigned Rights to a Foreclosed Property - Maine

Real Tax Affidavit for Assigned Rights to a Foreclosed Property is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is a Real Estate Transfer Tax Affidavit?

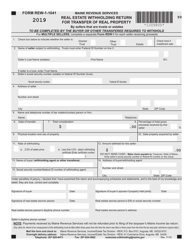

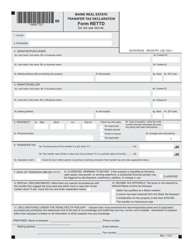

A: A Real Estate Transfer Tax Affidavit is a legal document used to report the transfer of ownership of real property and pay any applicable transfer taxes.

Q: What are Assigned Rights to a Foreclosed Property?

A: Assigned Rights to a Foreclosed Property refer to the transfer of rights to a property that has been foreclosed upon by a lender or bank.

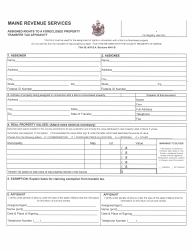

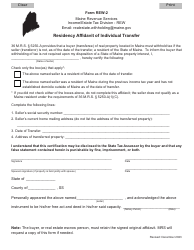

Q: Who needs to fill out a Real Estate Transfer Tax Affidavit for Assigned Rights to a Foreclosed Property in Maine?

A: The buyer or assignee of a foreclosed property in Maine needs to fill out this affidavit.

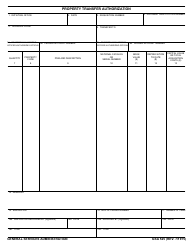

Q: What information is required on the Real Estate Transfer Tax Affidavit?

A: The affidavit requires information about the buyer/assignee and the property, including its location and the price of the assignment.

Q: What is the purpose of the Real Estate Transfer Tax?

A: The Real Estate Transfer Tax is imposed to generate revenue for the state and local governments and to track property transactions for tax purposes.

Q: How much is the Real Estate Transfer Tax in Maine?

A: In Maine, the Real Estate Transfer Tax rate is currently set at $2.20 per $500 of property value.

Q: When should the Real Estate Transfer Tax Affidavit be filed?

A: The affidavit should be filed within 30 days of the transfer of the assigned rights to the foreclosed property.

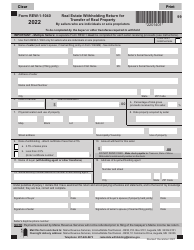

Q: Are there any exemptions or waivers for the Real Estate Transfer Tax in Maine?

A: Yes, certain transfers, such as transfers between spouses or transfers to nonprofit organizations, are exempt from the Real Estate Transfer Tax.

Q: What are the consequences of not filing the Real Estate Transfer Tax Affidavit?

A: Failure to file the affidavit or pay the required transfer tax may result in penalties, interest, and potential legal consequences.

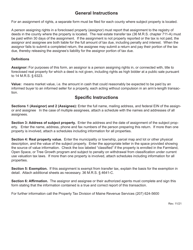

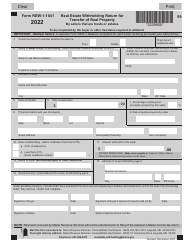

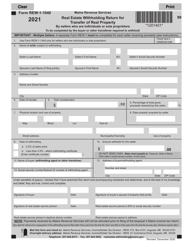

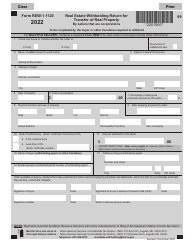

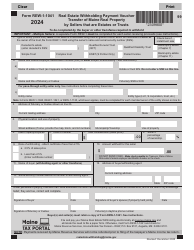

Form Details:

- Released on November 1, 2021;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.