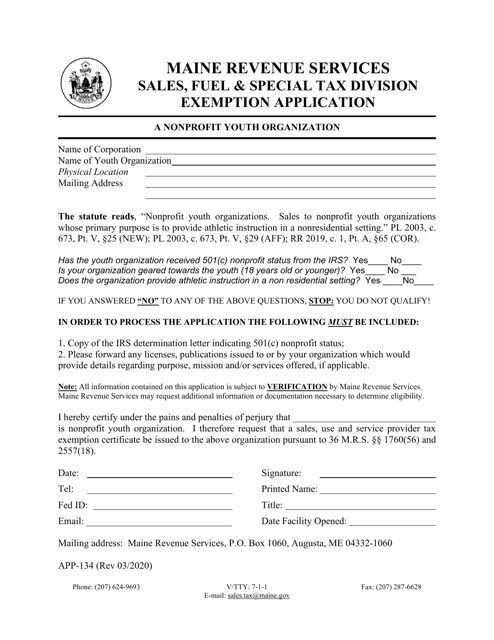

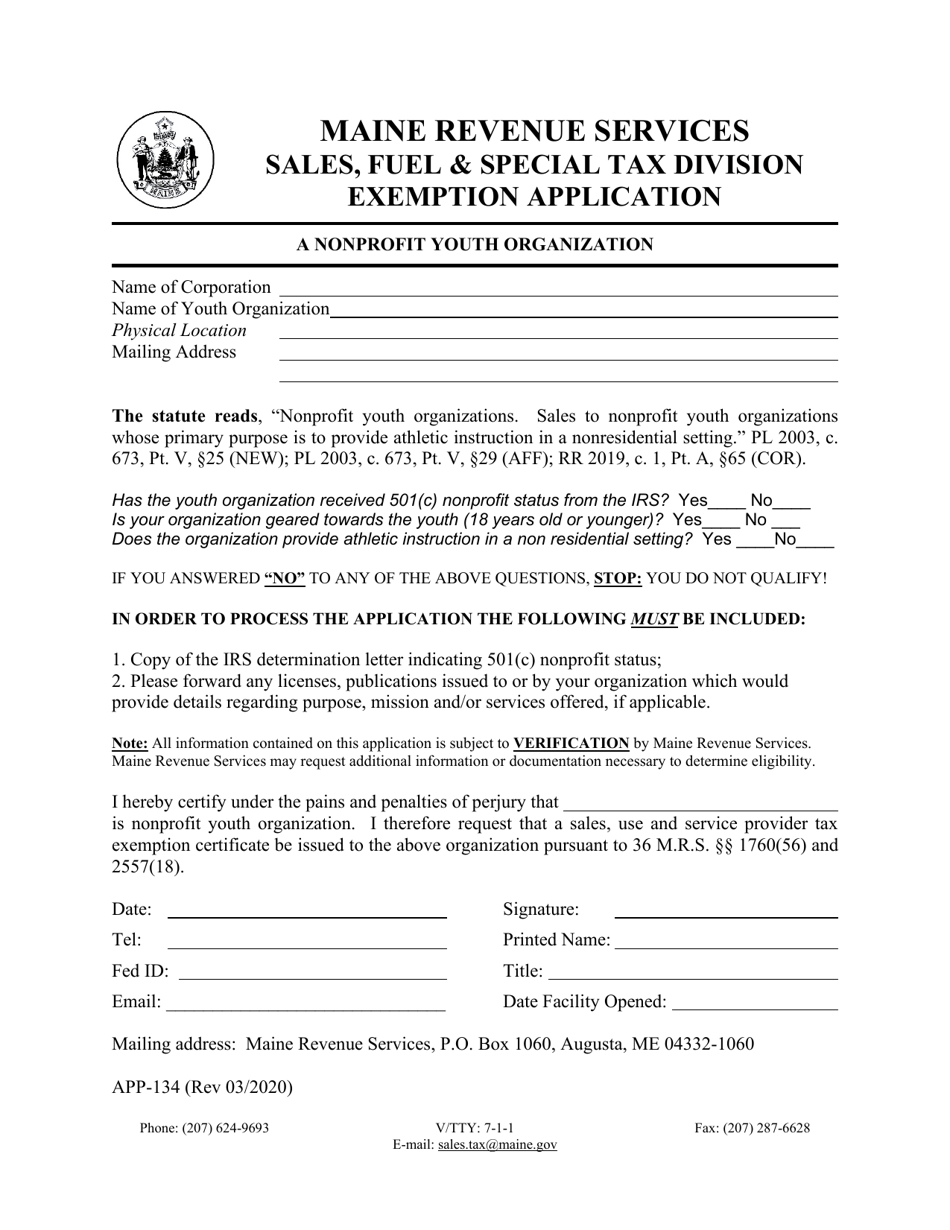

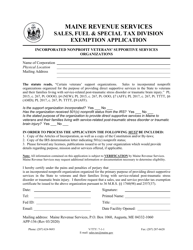

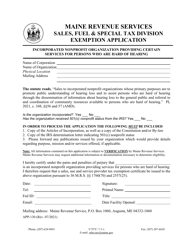

Form APP-134 Exemption Application - a Nonprofit Youth Organization - Maine

What Is Form APP-134?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form APP-134?

A: Form APP-134 is an exemption application for a nonprofit youth organization in Maine.

Q: What is the purpose of form APP-134?

A: The purpose of form APP-134 is to apply for tax exemption for a nonprofit youth organization in Maine.

Q: Who should use form APP-134?

A: Form APP-134 should be used by nonprofit youth organizations in Maine seeking tax exemption.

Q: What information is required on form APP-134?

A: Form APP-134 requires information about the nonprofit youth organization, its activities, and financial details.

Q: Are there any fees associated with submitting form APP-134?

A: No, there are no fees associated with submitting form APP-134.

Q: How long does it take to process form APP-134?

A: The processing time for form APP-134 varies, but it typically takes a few weeks to receive a decision.

Q: What happens after submitting form APP-134?

A: After submitting form APP-134, the Maine Revenue Services will review the application and notify the organization of their tax-exempt status.

Q: Can a nonprofit youth organization in Maine operate without tax exemption?

A: Yes, a nonprofit youth organization in Maine can operate without tax exemption, but it would be subject to paying taxes on its income and activities.

Q: Are there any specific requirements for qualifying for tax exemption as a nonprofit youth organization in Maine?

A: Yes, there are specific requirements such as being organized and operated exclusively for youth-related purposes and providing services to the youth community.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form APP-134 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.