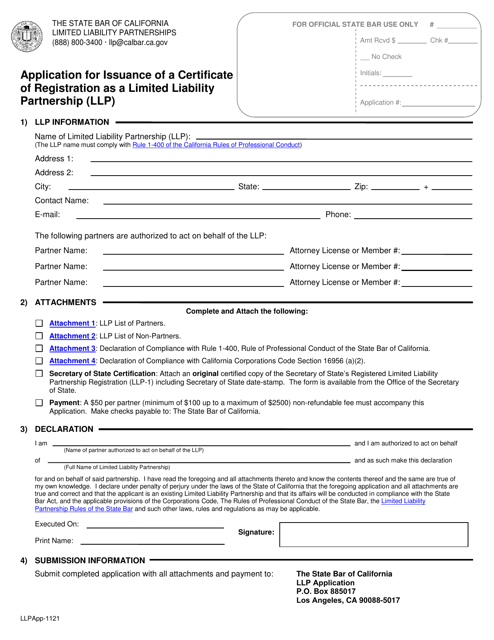

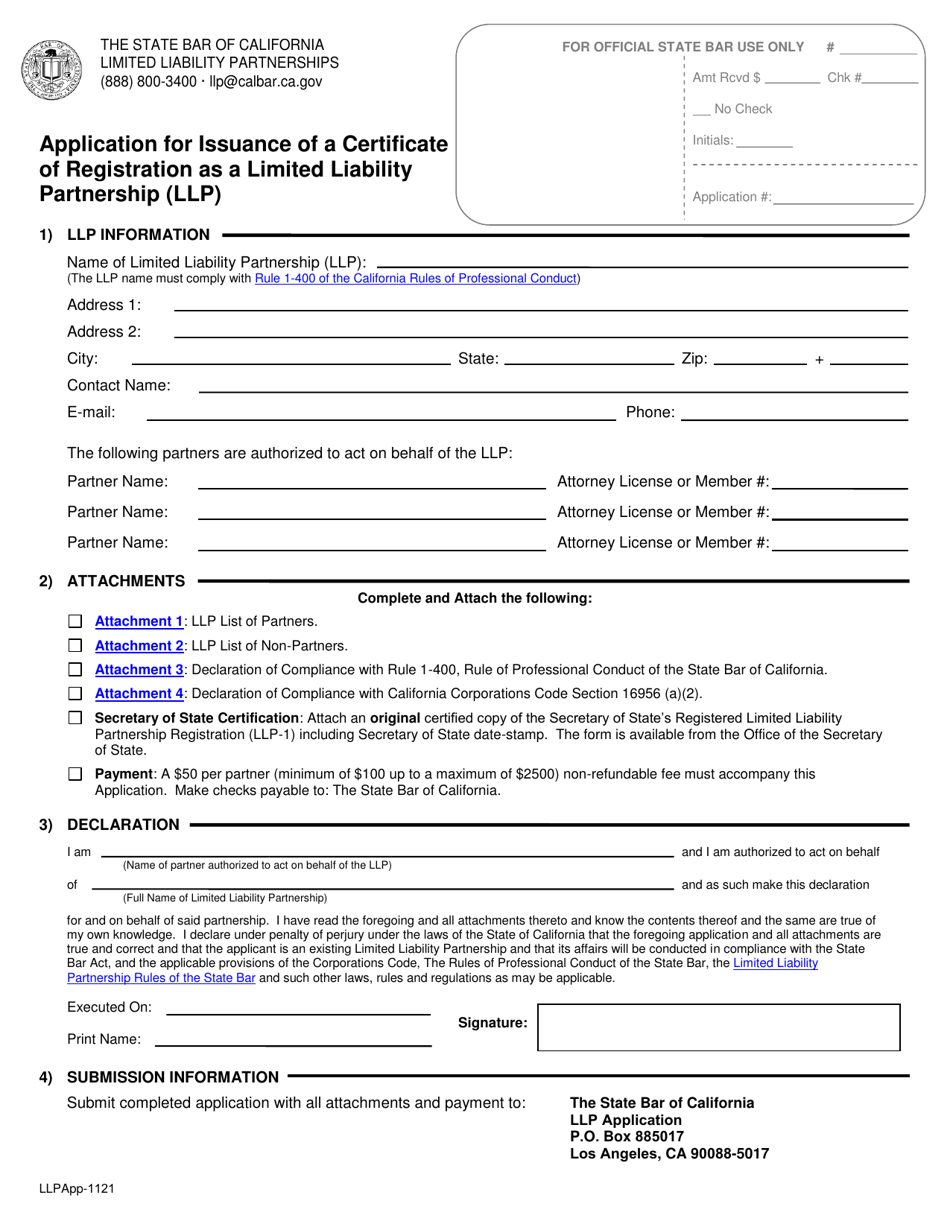

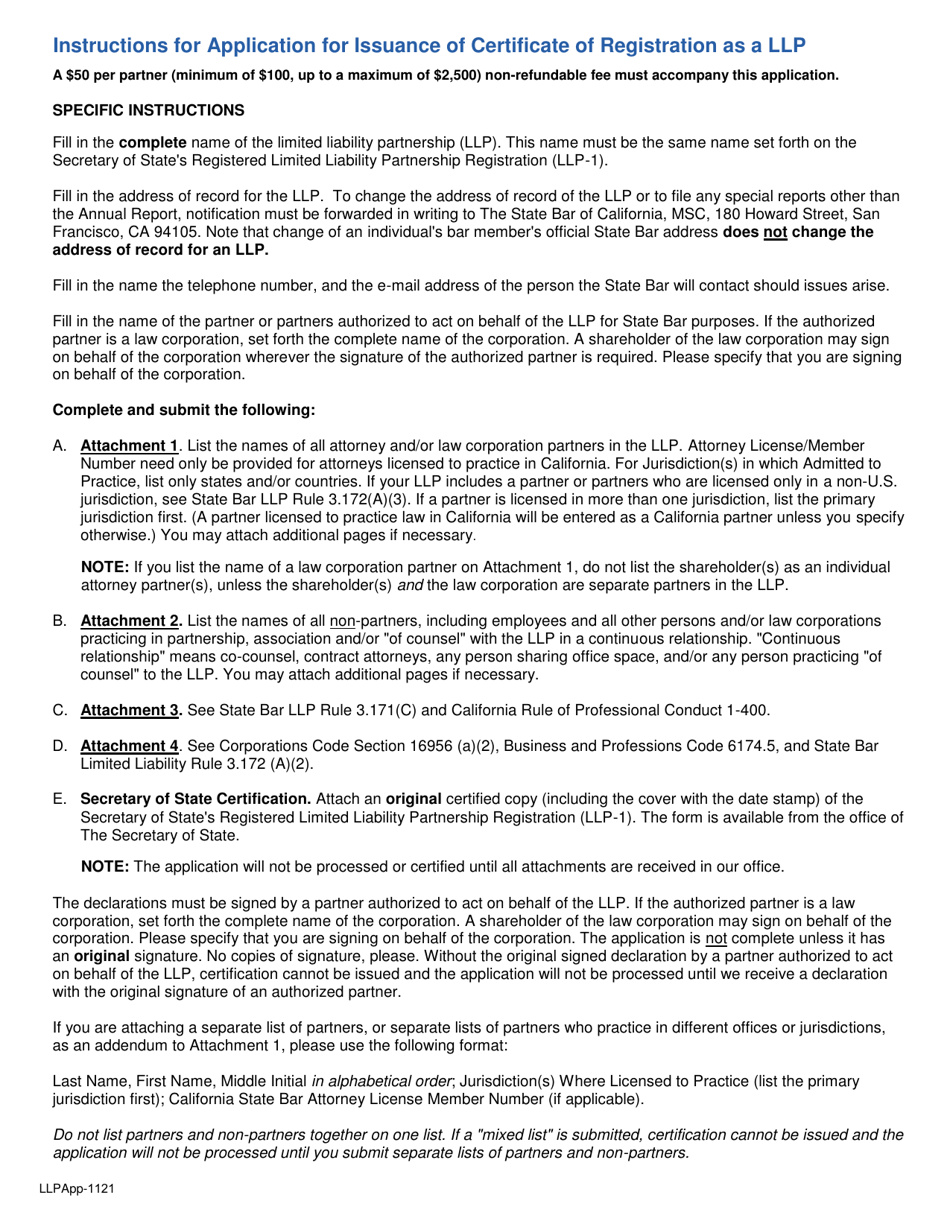

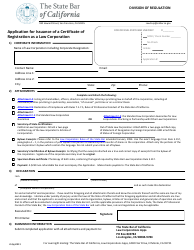

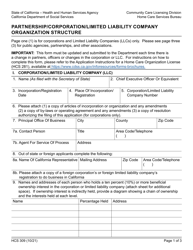

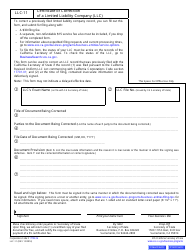

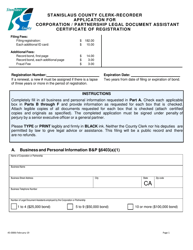

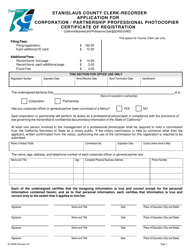

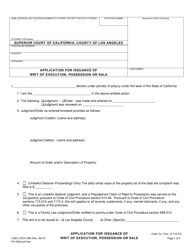

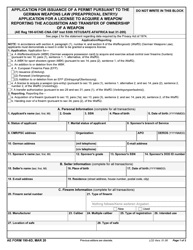

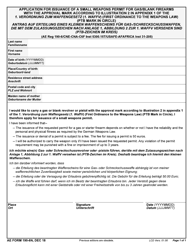

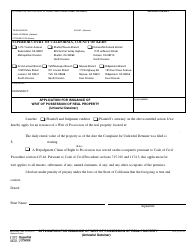

Application for Issuance of a Certificate of Registration as a Limited Liability Partnership (LLP ) - California

Application for Issuance of a Certificate of Registration as a Limited Liability Partnership (LLP ) is a legal document that was released by the State Bar of California - a government authority operating within California.

FAQ

Q: What is a Limited Liability Partnership (LLP)?

A: A Limited Liability Partnership (LLP) is a type of business structure that combines the flexibility and tax benefits of a partnership with the limited liability protection of a corporation.

Q: Why would I need to apply for a Certificate of Registration as an LLP in California?

A: You would need to apply for a Certificate of Registration as an LLP in California if you want to form an LLP and conduct business in the state.

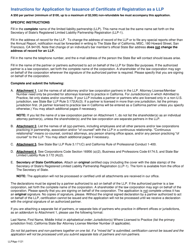

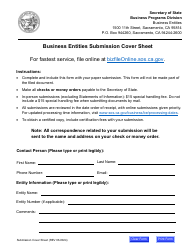

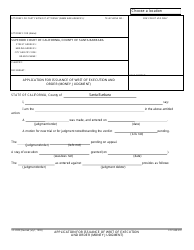

Q: How do I apply for a Certificate of Registration as an LLP in California?

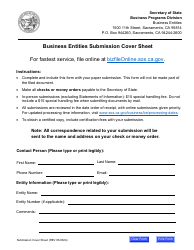

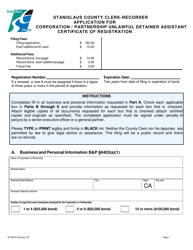

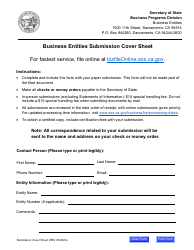

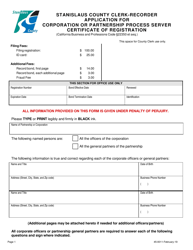

A: You can apply for a Certificate of Registration as an LLP in California by filing the necessary forms and paying the required fees with the California Secretary of State.

Q: Is there a deadline for filing the application for a Certificate of Registration as an LLP in California?

A: There is no specific deadline for filing the application for a Certificate of Registration as an LLP in California, but it is recommended to submit the application as soon as possible.

Q: Can I convert an existing business into an LLP in California?

A: Yes, you may be able to convert an existing business into an LLP in California. However, the specific requirements and process for converting a business into an LLP may vary, so it is best to consult the California Secretary of State or seek legal advice.

Q: Can I operate an LLP in multiple states?

A: Yes, you can operate an LLP in multiple states. However, you would need to comply with the laws and regulations of each state where you conduct business, which may include registering your LLP with the Secretary of State or similar agency in each state.

Q: What are the advantages of forming an LLP?

A: Some advantages of forming an LLP include limited liability protection for the partners, flexible management structure, pass-through taxation, and potential tax benefits.

Q: What are the disadvantages of forming an LLP?

A: Some disadvantages of forming an LLP include potential personal liability for the partners' own actions or negligence, potential difficulty in raising capital compared to a corporation, and potential limitations on the types of businesses that can operate as LLPs in certain states.

Q: Do I need to have a registered agent for my LLP in California?

A: Yes, you are required to have a registered agent for your LLP in California. The registered agent is responsible for receiving legal documents and official correspondence on behalf of the LLP.

Form Details:

- Released on November 1, 2021;

- The latest edition currently provided by the State Bar of California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the State Bar of California.