This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

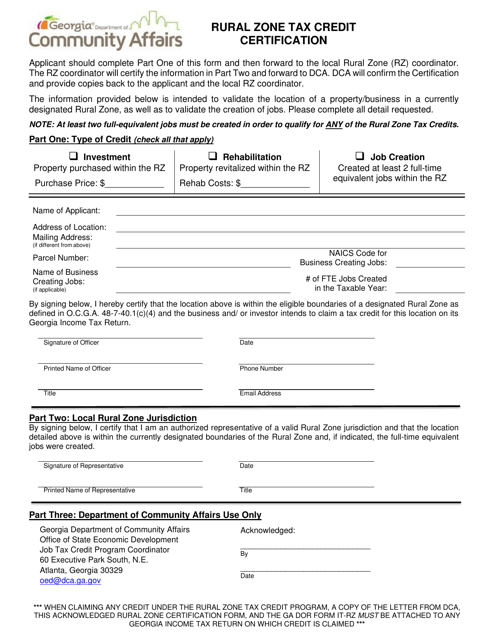

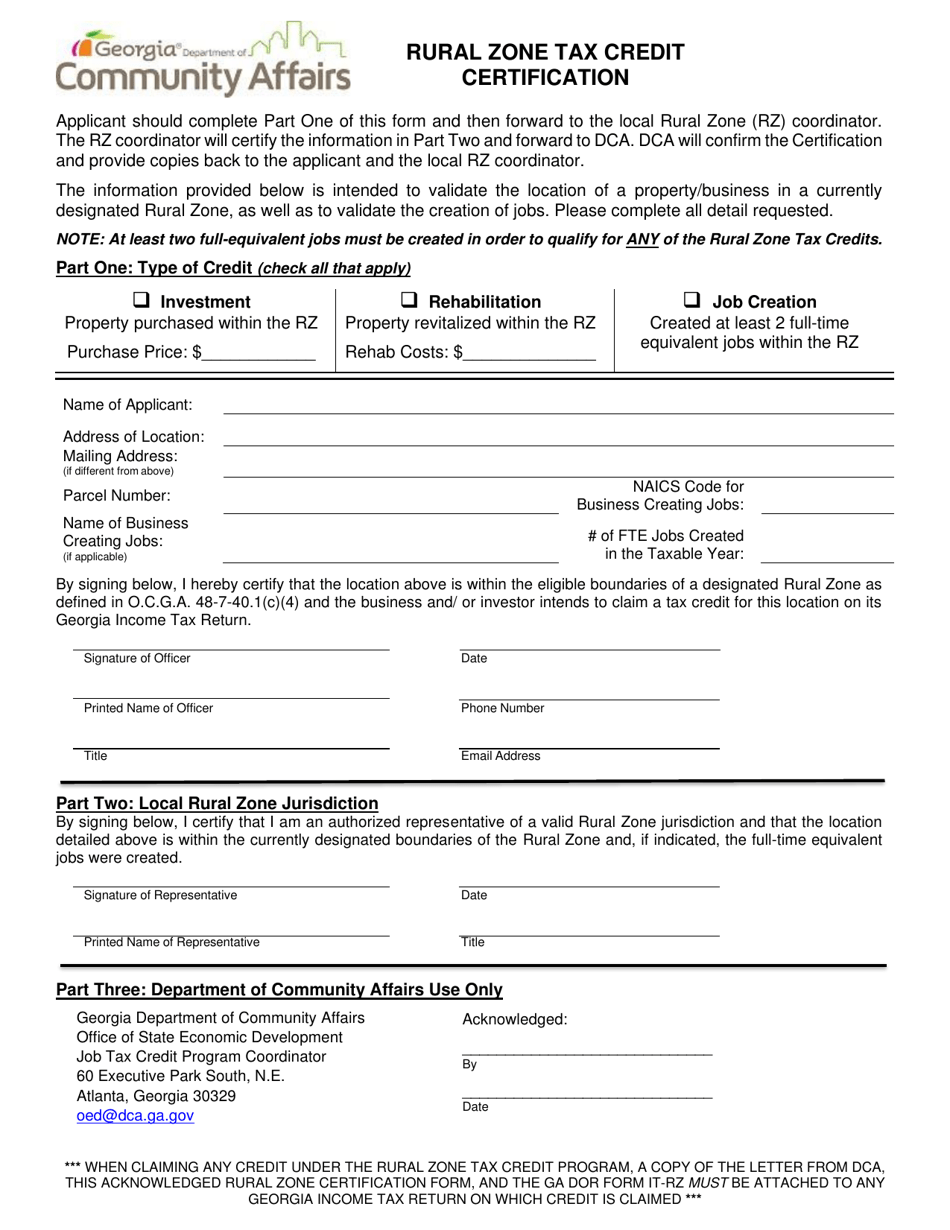

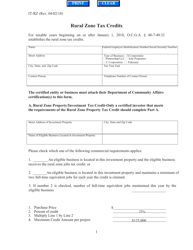

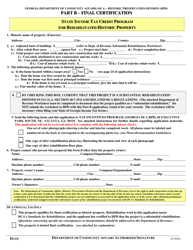

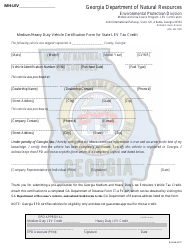

Rural Zone Tax Credit Certification - Georgia (United States)

Rural Zone Tax Credit Certification is a legal document that was released by the Georgia Department of Community Affairs - a government authority operating within Georgia (United States).

FAQ

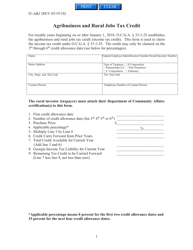

Q: What is the Rural Zone Tax Credit Certification?

A: The Rural Zone Tax Credit Certification is a program in Georgia that provides tax credits for business investments in designated rural zones.

Q: How does the Rural Zone Tax Credit Certification work?

A: Companies that make qualified investments in designated rural zones in Georgia can receive tax credits for a percentage of their investment.

Q: Who is eligible for the Rural Zone Tax Credit Certification?

A: Companies that make qualified investments in designated rural zones in Georgia are eligible for the tax credits.

Q: What are qualified investments?

A: Qualified investments include the purchase, construction, renovation, or expansion of eligible businesses or property in designated rural zones in Georgia.

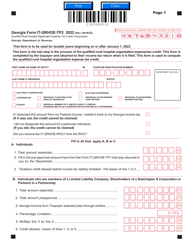

Q: How much tax credit can a company receive?

A: The tax credit amount varies depending on the type and amount of the investment, but can be up to 25% of the qualified investment.

Q: How can a company apply for the Rural Zone Tax Credit Certification?

A: Companies can apply for the certification through the Georgia Department of Community Affairs.

Q: Are there any limitations or restrictions?

A: There are certain limitations and restrictions, such as a maximum tax credit cap and a minimum investment threshold, that apply to the program.

Form Details:

- The latest edition currently provided by the Georgia Department of Community Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Georgia Department of Community Affairs.