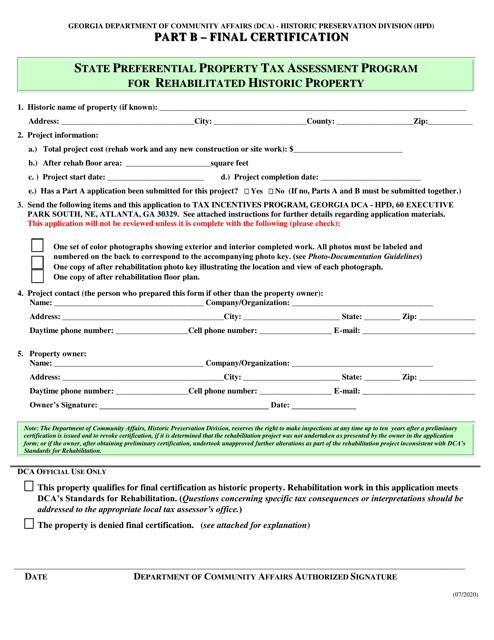

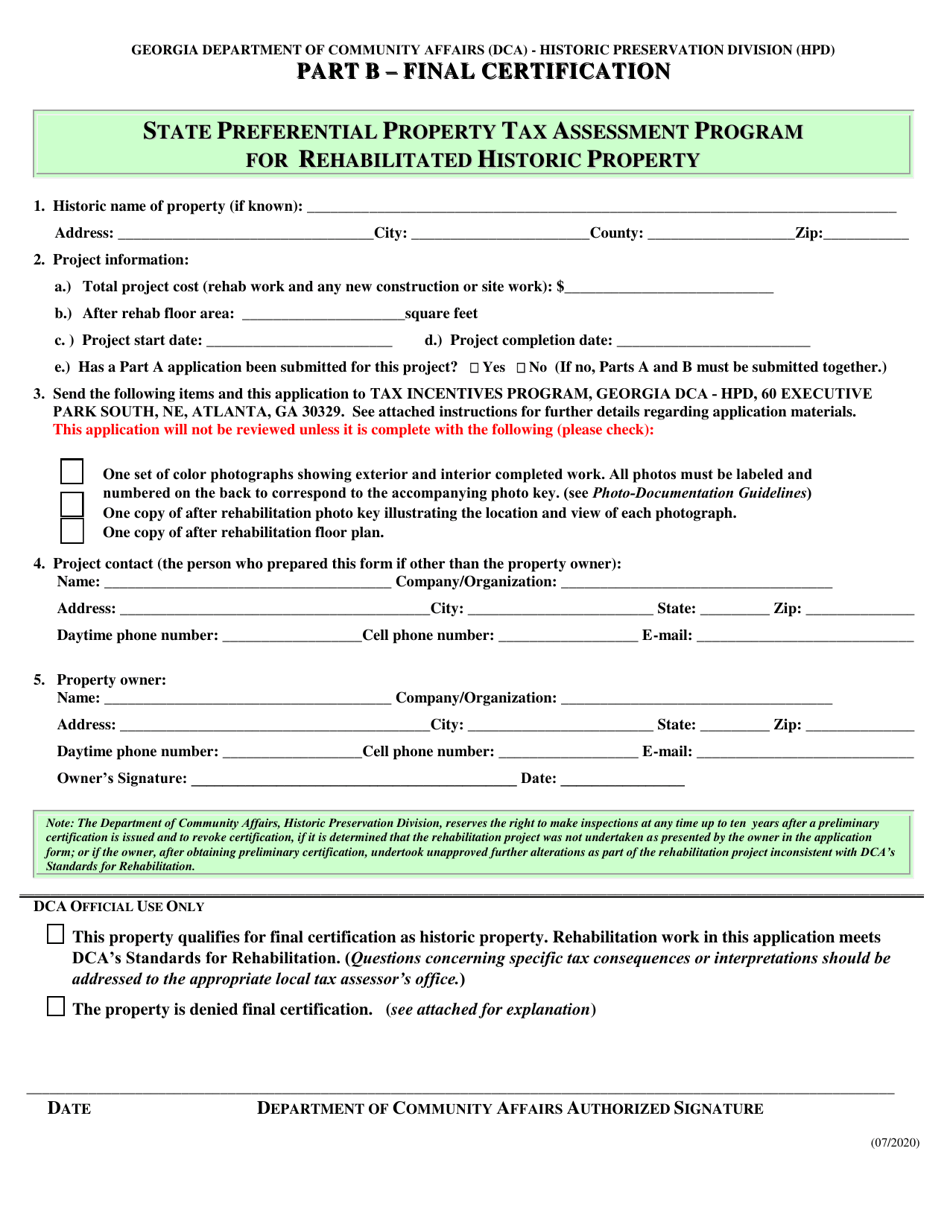

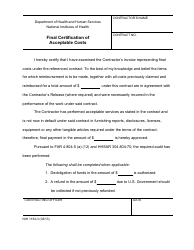

Part B Final Certification - State Preferential Property Tax Assessment Program for Rehabilitated Historic Property - Georgia (United States)

What Is Part B?

This is a legal form that was released by the Georgia Department of Community Affairs - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

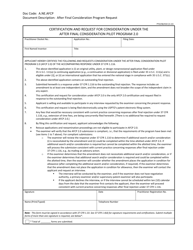

Q: What is the State Preferential Property Tax Assessment Program for Rehabilitated Historic Property?

A: It is a program in Georgia that provides tax incentives for the rehabilitation of historic properties.

Q: What are the benefits of participating in this program?

A: Property owners can receive a significant reduction in property taxes for rehabilitating their historic properties.

Q: Who is eligible to participate in this program?

A: Owners of historic properties in Georgia that are being rehabilitated can apply for this program.

Q: How can I apply for the State Preferential Property Tax Assessment Program?

A: You can apply for the program through the Georgia Department of Natural Resources, Historic Preservation Division.

Q: Are there any requirements for participating in the program?

A: Yes, the property must meet certain criteria for historic significance and the rehabilitation work must follow specific guidelines.

Q: How long does the tax reduction last?

A: The tax reduction is available for a period of 8 to 10 years, depending on the location of the property.

Q: Can I transfer the tax reduction to a new owner if I sell the property?

A: Yes, the tax reduction can be transferred to a new owner if the property is sold.

Q: Are there any limitations to the tax reduction?

A: Yes, there is a cap on the amount of assessed value that is eligible for the tax reduction, which varies depending on the location of the property.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Georgia Department of Community Affairs;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Part B by clicking the link below or browse more documents and templates provided by the Georgia Department of Community Affairs.