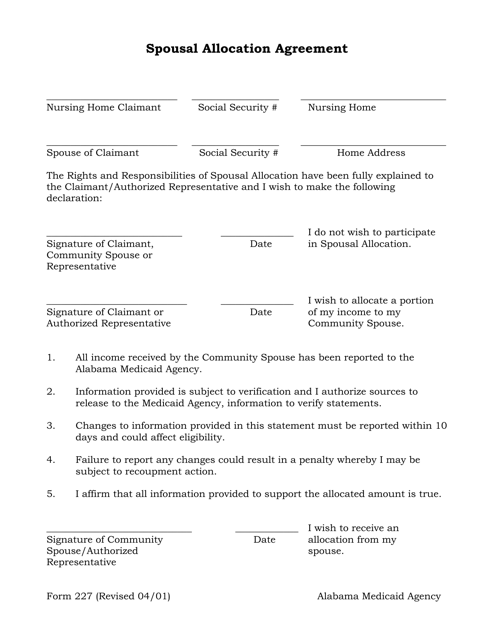

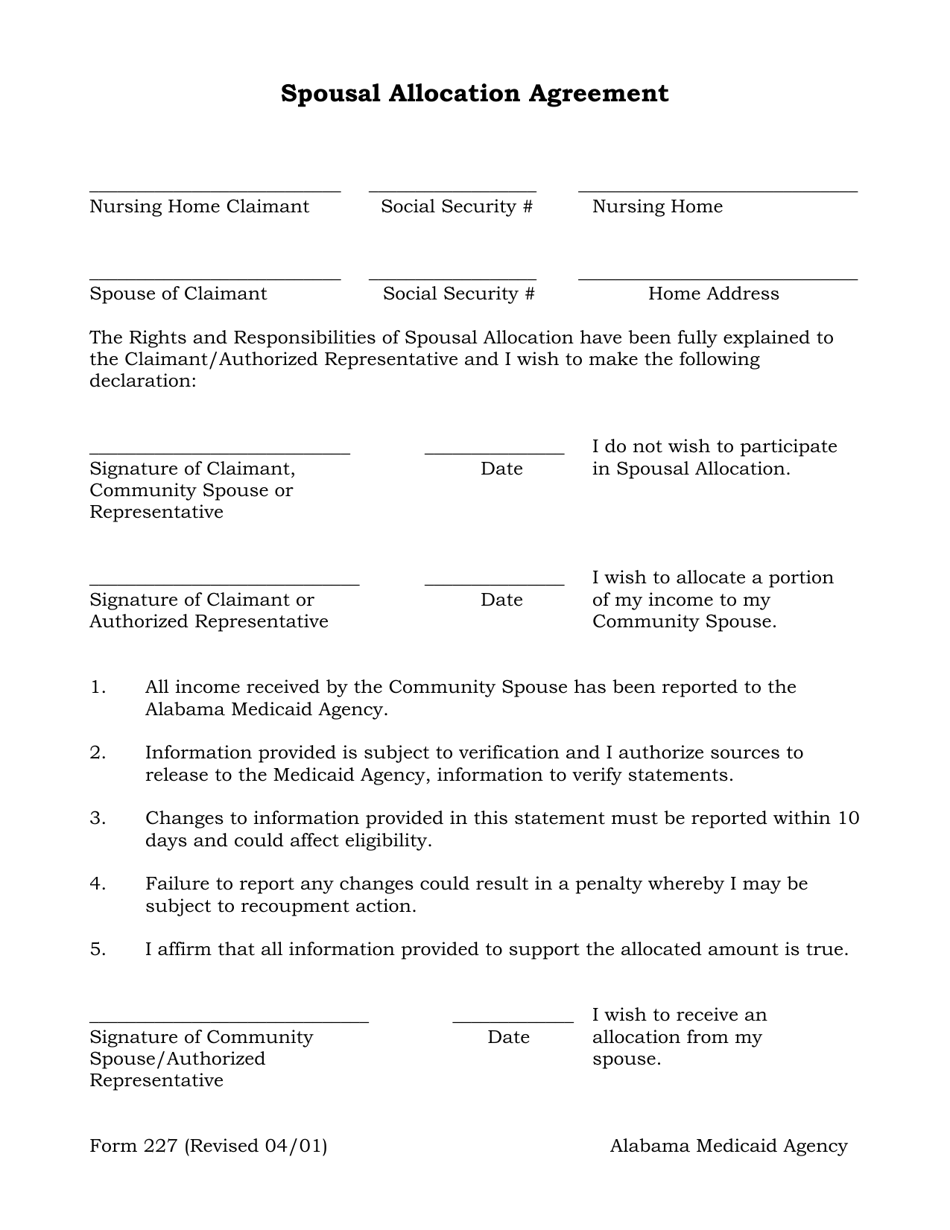

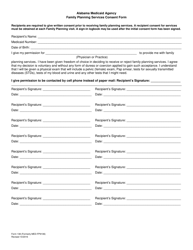

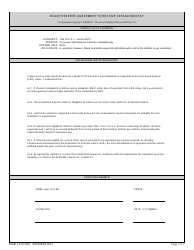

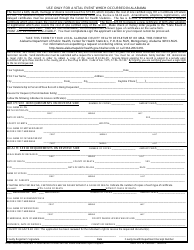

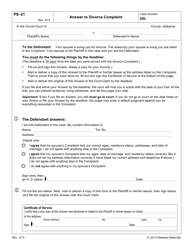

Form 227 Spousal Allocation Agreement - Alabama

What Is Form 227?

This is a legal form that was released by the Alabama Medicaid Agency - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

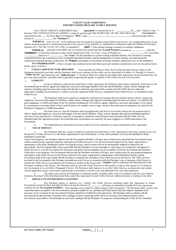

Q: What is Form 227?

A: Form 227 is the Spousal Allocation Agreement.

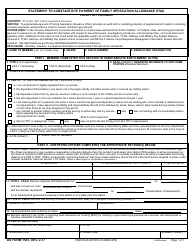

Q: What is the purpose of Form 227?

A: The purpose of Form 227 is to allocate income or deductions between spouses in Alabama.

Q: Who needs to file Form 227?

A: Form 227 is filed by married couples who want to allocate income or deductions differently than the default allocation.

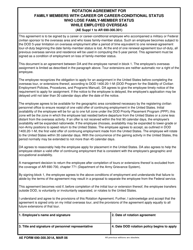

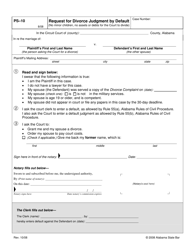

Q: When should Form 227 be filed?

A: Form 227 should be filed with the Alabama Department of Revenue no later than the due date of the tax return for the tax year.

Q: Is there a fee to file Form 227?

A: No, there is no fee to file Form 227.

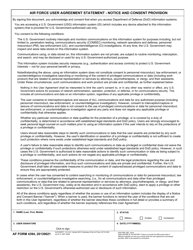

Q: Are there any specific requirements for filling out Form 227?

A: Yes, both spouses must sign the form and provide accurate information regarding their income and deductions.

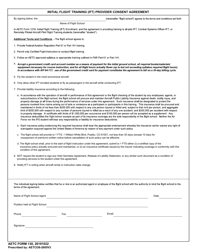

Q: Can Form 227 be filed electronically?

A: No, Form 227 must be filed by mail or in person.

Q: What should I do if there are changes to the allocation after filing Form 227?

A: If there are changes to the allocation after filing Form 227, an amended Form 227 should be filed with the Alabama Department of Revenue.

Q: What happens if Form 227 is not filed?

A: If Form 227 is not filed, the default allocation will be applied for calculating taxes.

Q: Is Form 227 specific to Alabama?

A: Yes, Form 227 is specific to Alabama and is not used in other states.

Form Details:

- Released on April 1, 2001;

- The latest edition provided by the Alabama Medicaid Agency;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 227 by clicking the link below or browse more documents and templates provided by the Alabama Medicaid Agency.