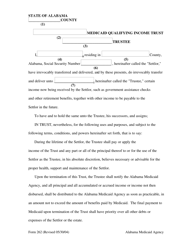

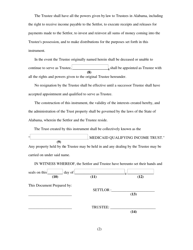

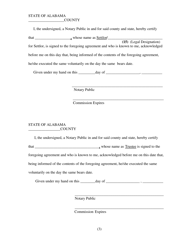

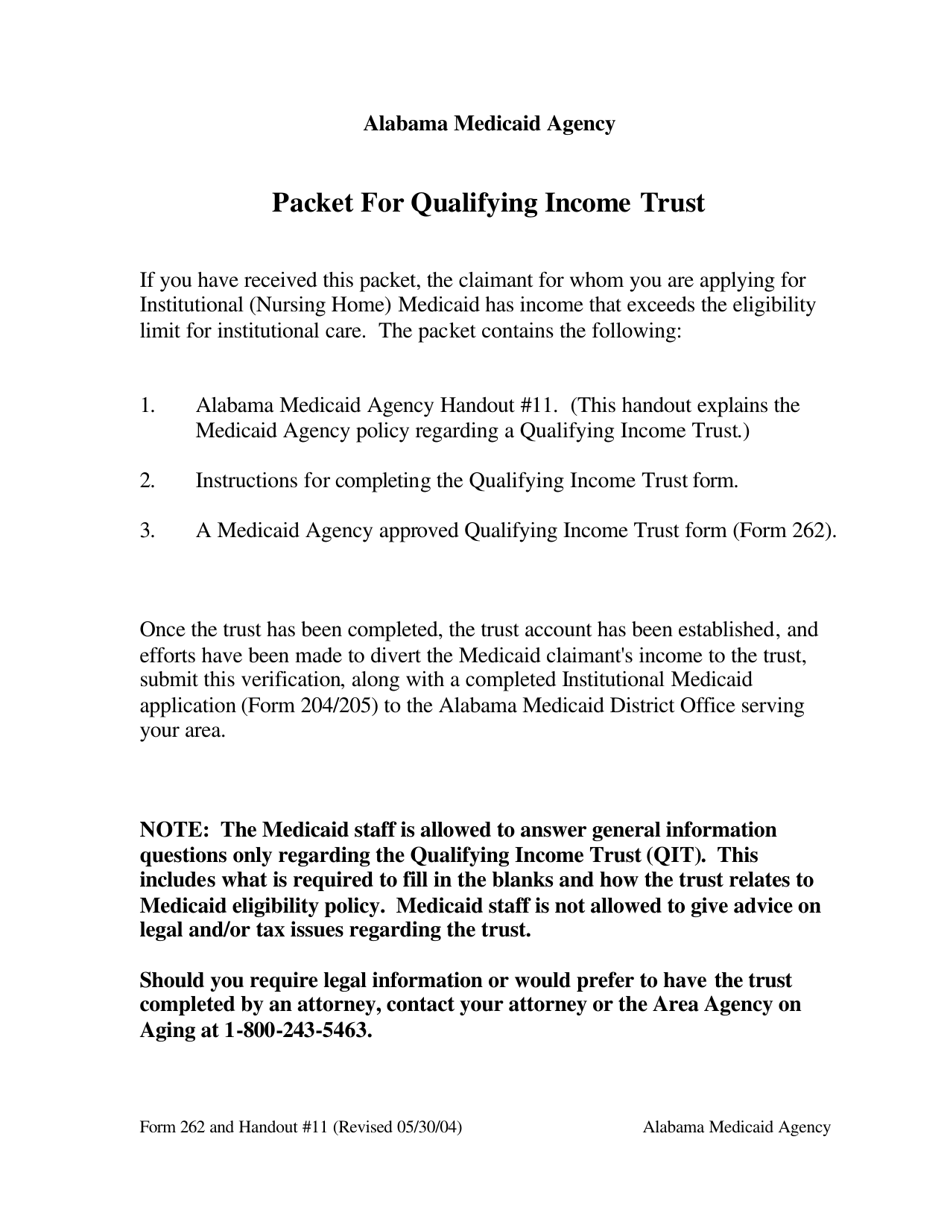

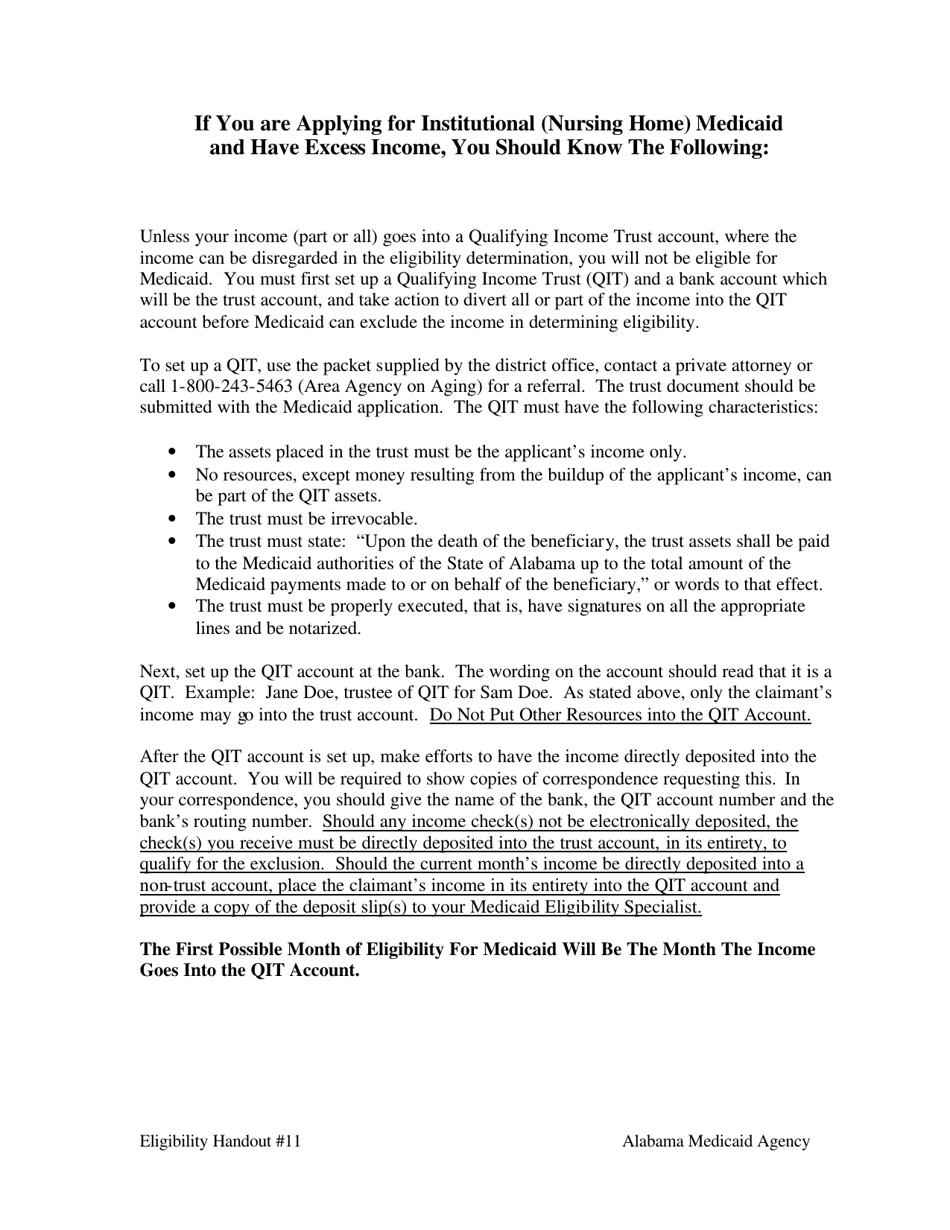

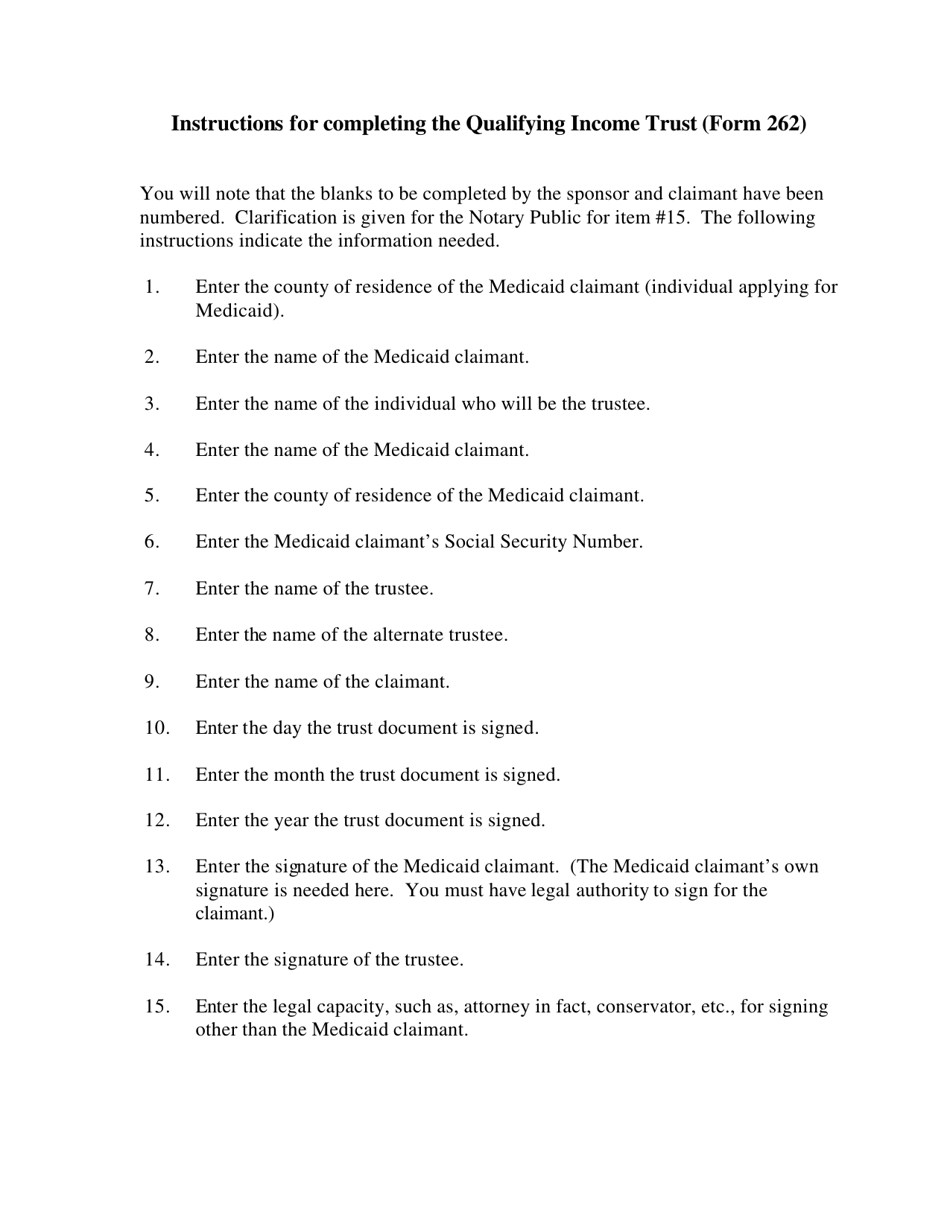

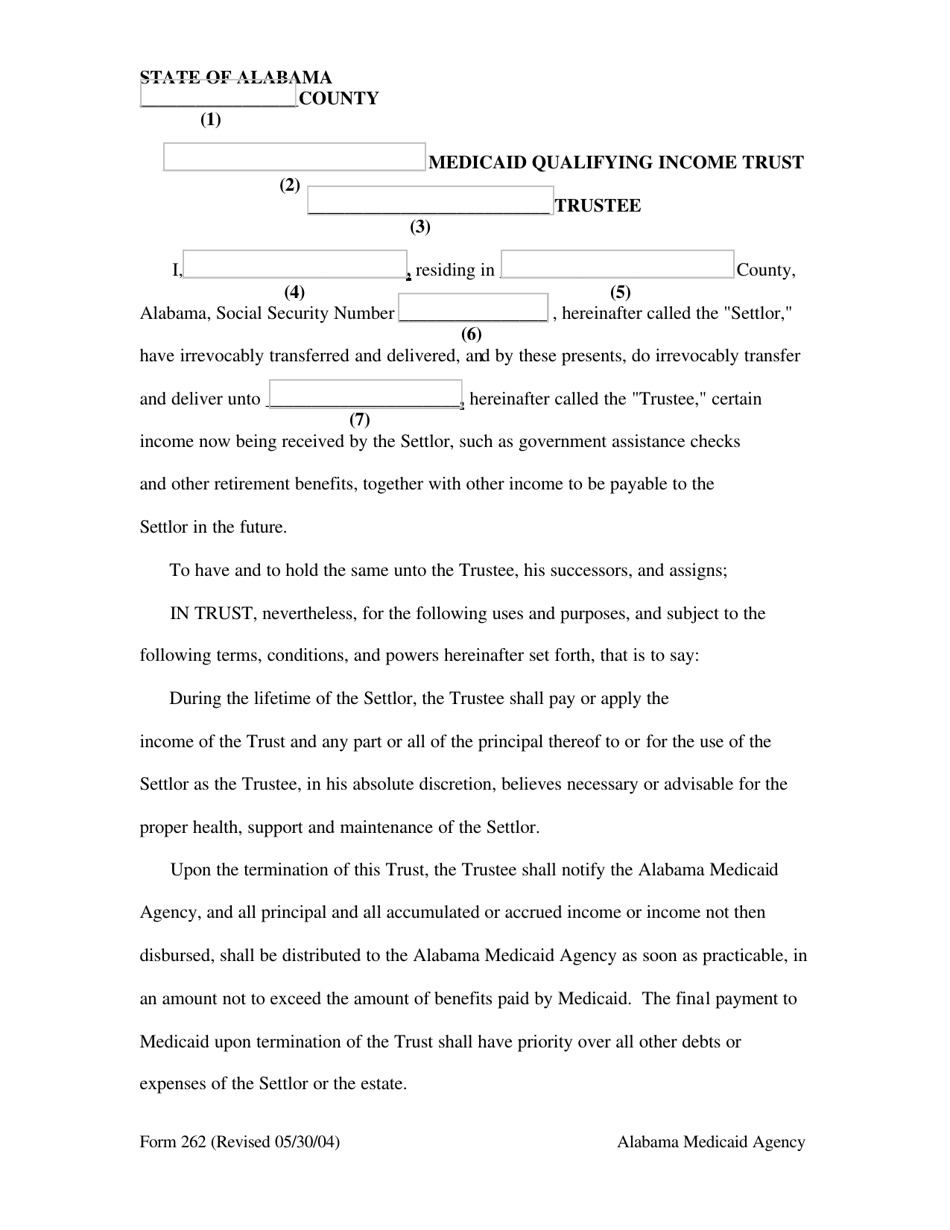

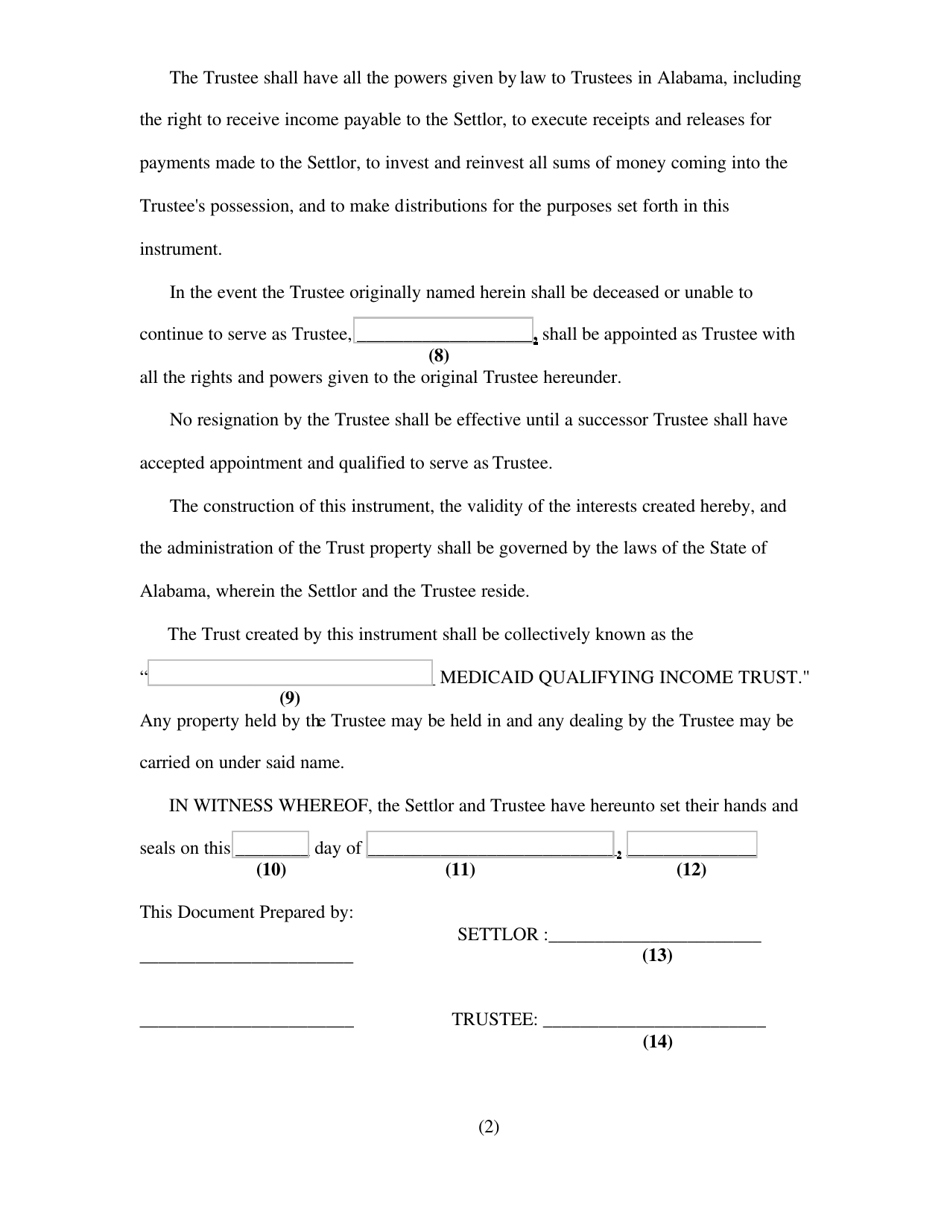

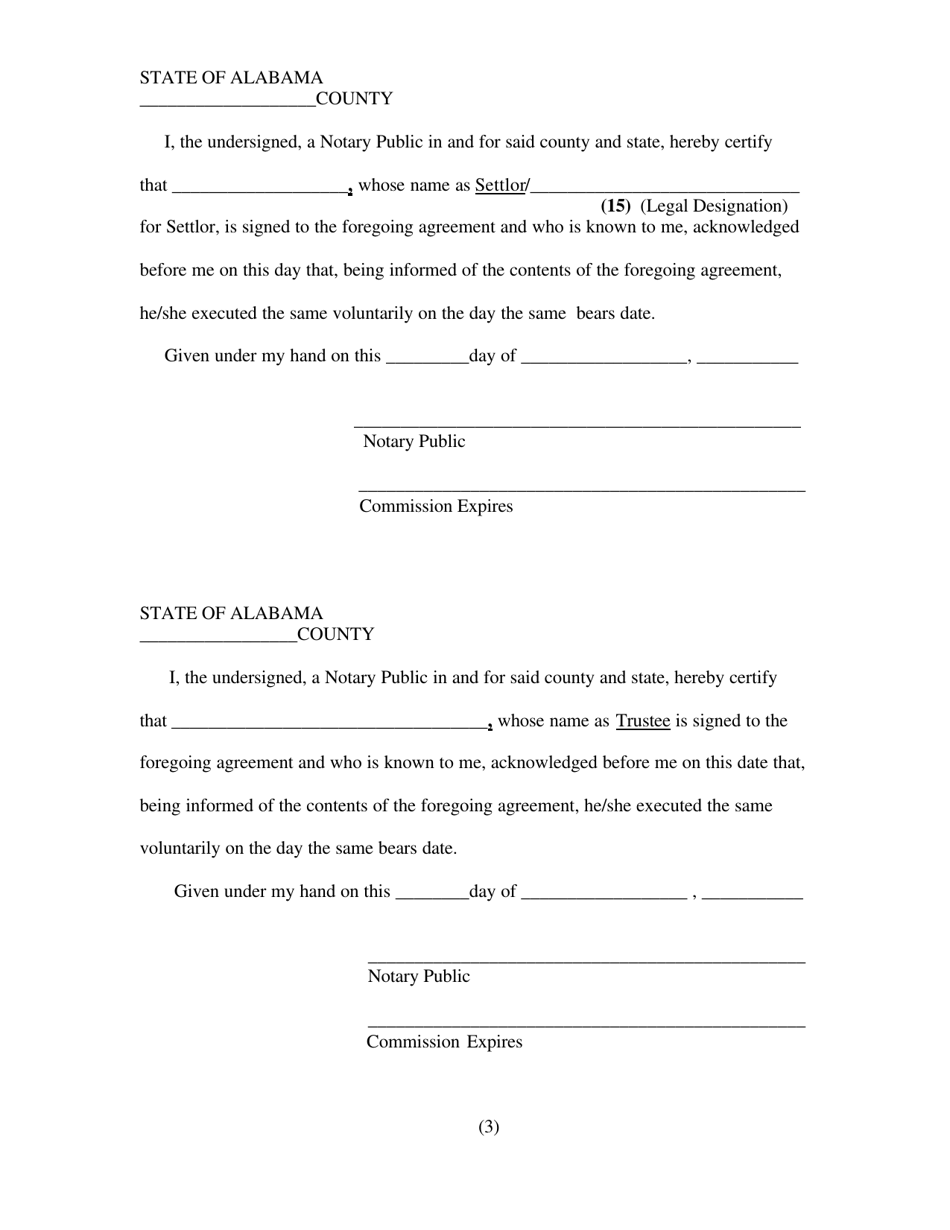

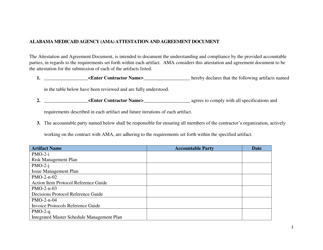

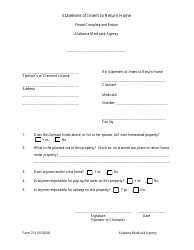

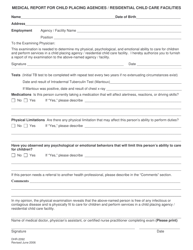

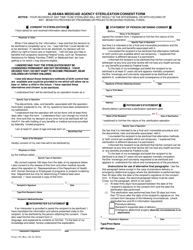

Form 262 Medicaid Agency Approved Qualifying Income Trust Form - Alabama

What Is Form 262?

This is a legal form that was released by the Alabama Medicaid Agency - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

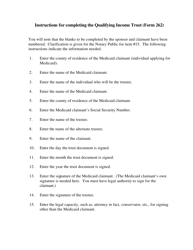

Q: What is Form 262?

A: Form 262 is the Medicaid Agency Approved Qualifying Income Trust Form in Alabama.

Q: What is a Qualifying Income Trust?

A: A Qualifying Income Trust, also known as a Miller Trust, is a legal tool that allows individuals to qualify for Medicaid long-term care benefits even if their income exceeds the allowable limit.

Q: Who is eligible to use Form 262?

A: Individuals in Alabama who have income above the Medicaid eligibility limit for long-term care services can use Form 262 to establish a Qualifying Income Trust.

Q: What is the purpose of Form 262?

A: The purpose of Form 262 is to establish and document the creation of a Qualifying Income Trust in order to qualify for Medicaid long-term care benefits.

Q: Are there any fees associated with Form 262?

A: There may be fees associated with the creation and administration of a Qualifying Income Trust. It is recommended to consult with an attorney or financial advisor for specific information and guidance.

Form Details:

- Released on May 30, 2004;

- The latest edition provided by the Alabama Medicaid Agency;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 262 by clicking the link below or browse more documents and templates provided by the Alabama Medicaid Agency.