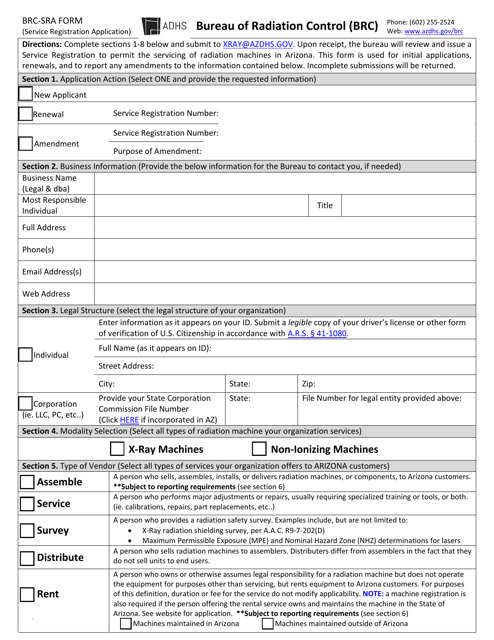

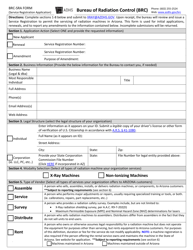

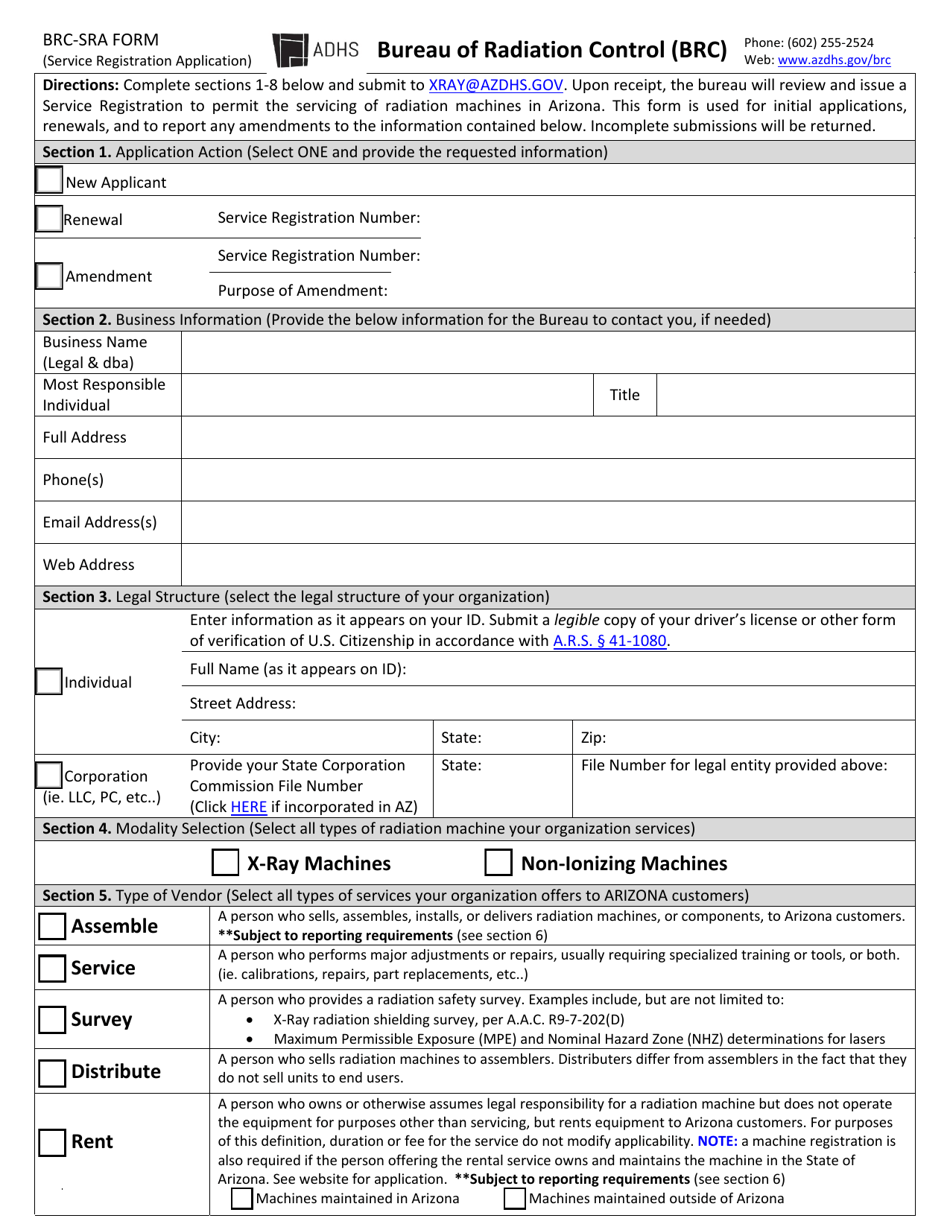

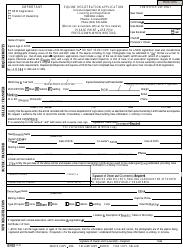

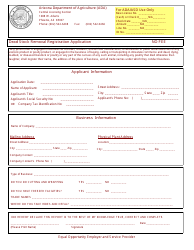

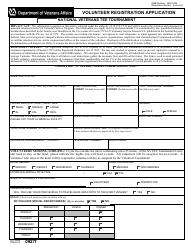

Form BRC-SRA Service Registration Application - Arizona

What Is Form BRC-SRA?

This is a legal form that was released by the Arizona Department of Health Services - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

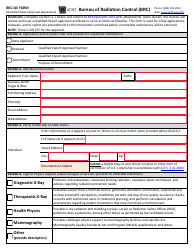

Q: What is the BRC-SRA Service Registration Application?

A: The BRC-SRA Service Registration Application is a form used in Arizona to register for a Business Registration Certificate (BRC) and State withholding tax accounts (SRA).

Q: Who needs to fill out the Form BRC-SRA Service Registration Application?

A: Anyone who is starting a new business in Arizona and needs to register for a BRC and State withholding tax accounts needs to fill out this form.

Q: What is a Business Registration Certificate (BRC)?

A: A Business Registration Certificate (BRC) is a document issued by the Arizona Department of Revenue that shows your business has been registered and is allowed to engage in business activities in the state.

Q: What are State withholding tax accounts (SRA)?

A: State withholding tax accounts (SRA) are accounts that businesses use to report and pay their state withholding taxes on employee wages.

Q: How do I fill out the Form BRC-SRA Service Registration Application?

A: You need to provide information about your business, such as its name, address, and type of business. You also need to provide information about the owners and officers of the business.

Q: Is there a fee to submit the Form BRC-SRA Service Registration Application?

A: Yes, there is a $12 fee to submit the form.

Q: How long does it take to receive the Business Registration Certificate (BRC) and State withholding tax accounts (SRA) after submitting the Form BRC-SRA Service Registration Application?

A: It can take up to two weeks to receive the BRC and SRA after submitting the application.

Q: Can I use the Business Registration Certificate (BRC) and State withholding tax accounts (SRA) to collect sales tax?

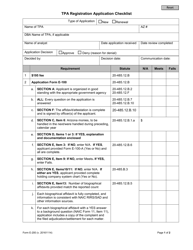

A: No, the BRC and SRA only allow you to engage in business activities and report and pay state withholding taxes. To collect sales tax, you need to register for a Transaction Privilege Tax (TPT) license.

Form Details:

- The latest edition provided by the Arizona Department of Health Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BRC-SRA by clicking the link below or browse more documents and templates provided by the Arizona Department of Health Services.