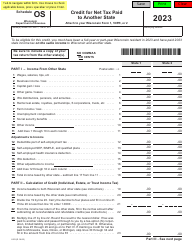

This version of the form is not currently in use and is provided for reference only. Download this version of

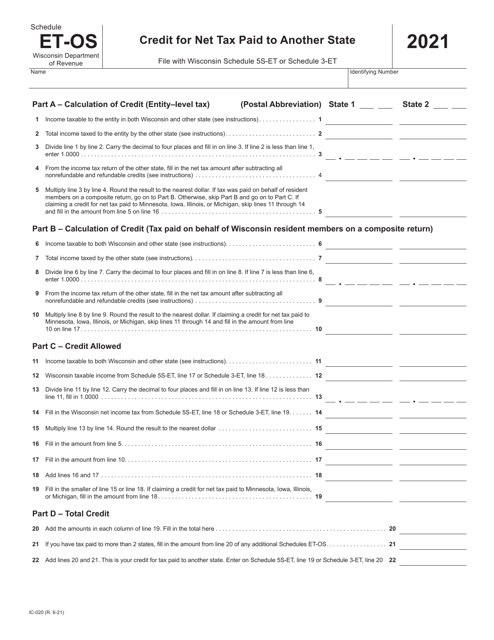

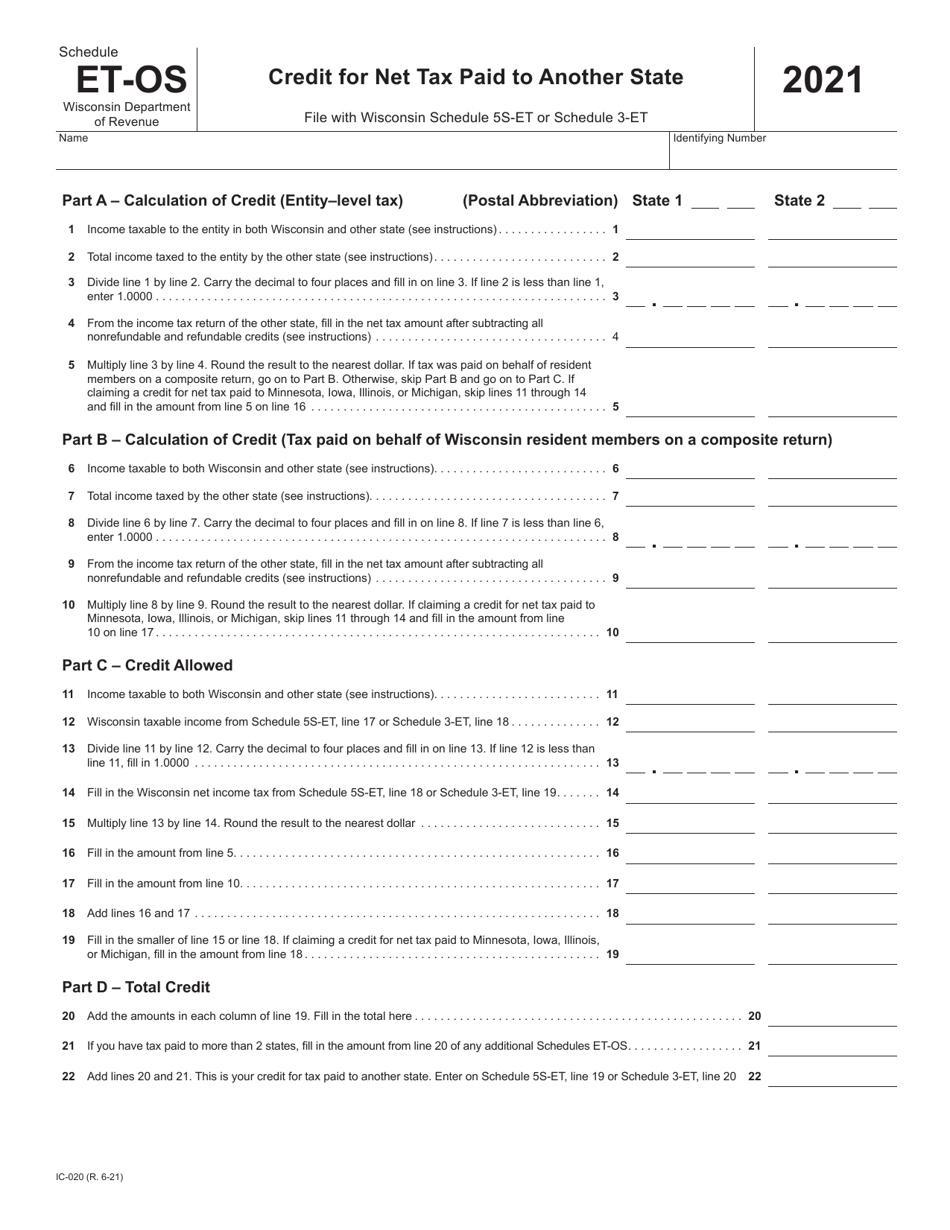

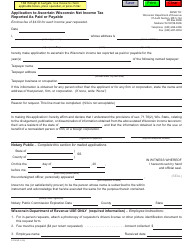

Form IC-020 Schedule ET-OS

for the current year.

Form IC-020 Schedule ET-OS Credit for Net Tax Paid to Another State - Wisconsin

What Is Form IC-020 Schedule ET-OS?

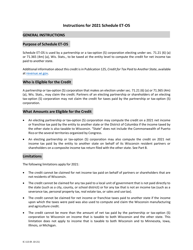

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IC-020 Schedule ET-OS?

A: Form IC-020 Schedule ET-OS is a tax form used in Wisconsin to claim a credit for net tax paid to another state.

Q: Who uses Form IC-020 Schedule ET-OS?

A: Individuals residing in Wisconsin who have paid income tax to another state can use this form.

Q: What is the purpose of Form IC-020 Schedule ET-OS?

A: The purpose of Form IC-020 Schedule ET-OS is to calculate and claim a credit for income tax paid to another state.

Q: Can I claim a credit for taxes paid to any state?

A: Yes, you can claim a credit for taxes paid to any state, as long as you meet the eligibility requirements.

Q: How do I complete Form IC-020 Schedule ET-OS?

A: You need to provide information about your income and taxes paid to another state. Follow the form instructions for guidance.

Q: When is the deadline to file Form IC-020 Schedule ET-OS?

A: The deadline to file Form IC-020 Schedule ET-OS is the same as the deadline for filing your Wisconsin income tax return.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IC-020 Schedule ET-OS by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.