This version of the form is not currently in use and is provided for reference only. Download this version of

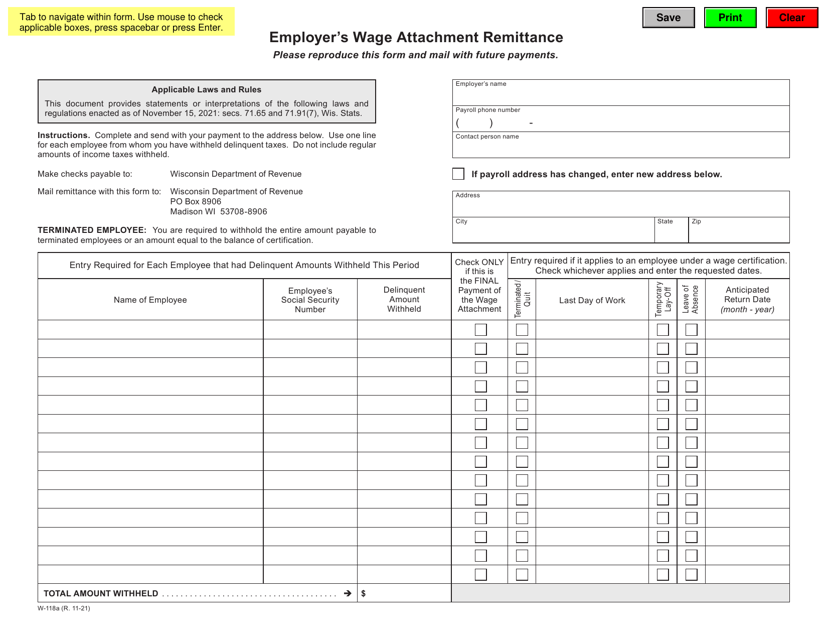

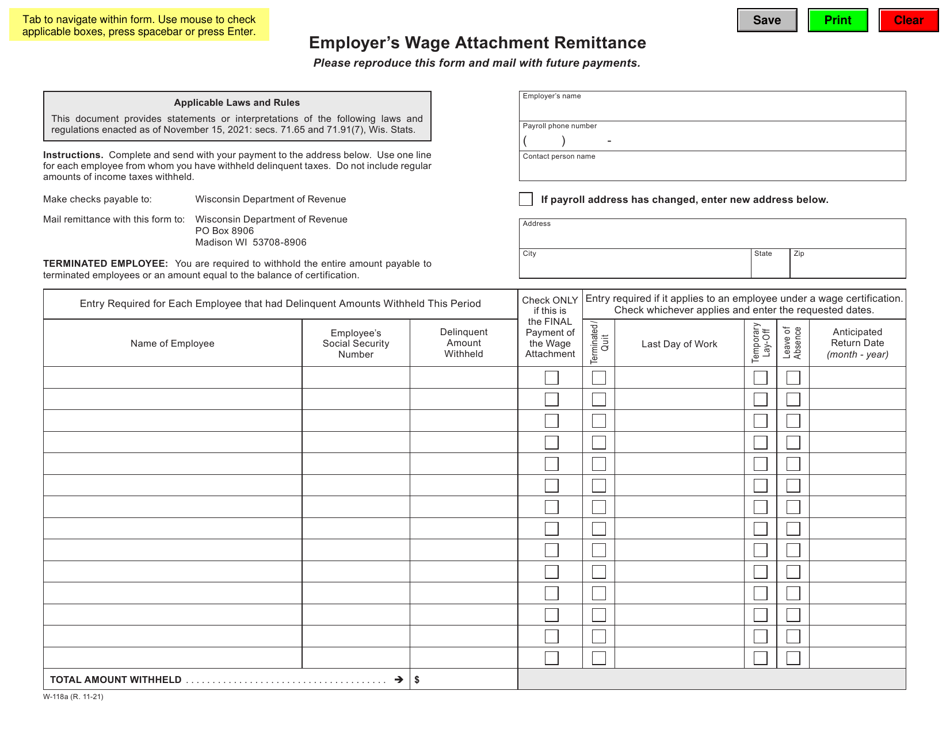

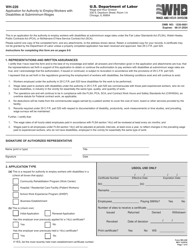

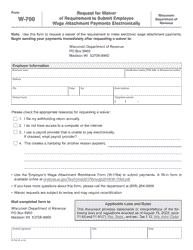

Form W-118A

for the current year.

Form W-118A Employer's Wage Attachment Remittance - Wisconsin

What Is Form W-118A?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W-118A?

A: Form W-118A is the Employer's Wage Attachment Remittance form used in the state of Wisconsin.

Q: Who uses Form W-118A?

A: Employers in Wisconsin use Form W-118A to remit wage attachments to the appropriate agency.

Q: What is a wage attachment?

A: A wage attachment is a legal process that allows a creditor to deduct money from an employee's wages to satisfy a debt.

Q: When should Form W-118A be filed?

A: Form W-118A should be filed as soon as possible after the wage attachment is made, but no later than the due date of the first payment.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-118A by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.