This version of the form is not currently in use and is provided for reference only. Download this version of

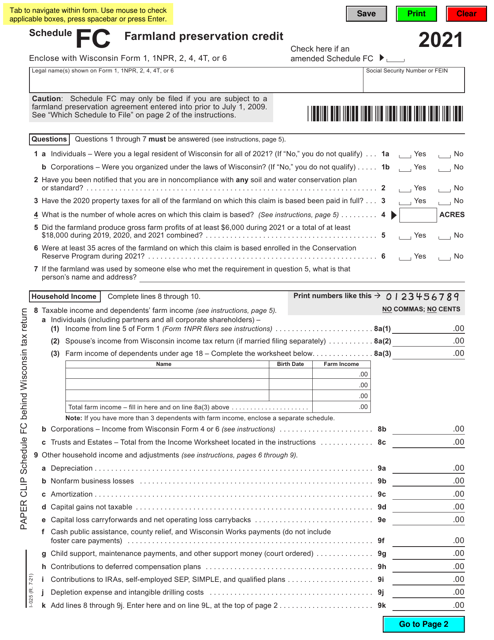

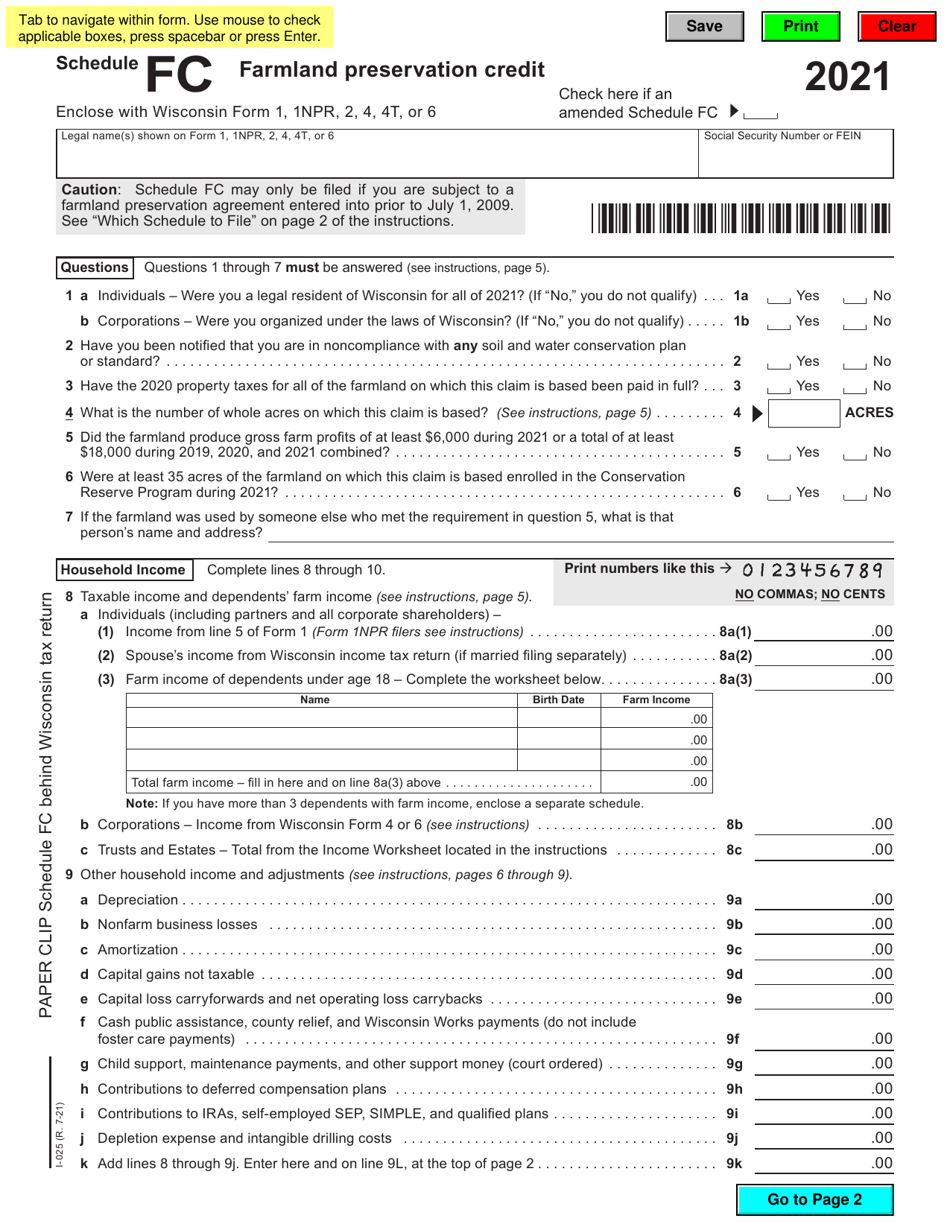

Form I-025 Schedule FC

for the current year.

Form I-025 Schedule FC Farmland Preservation Credit - Wisconsin

What Is Form I-025 Schedule FC?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form I-025 Schedule FC?

A: Form I-025 Schedule FC is a specific form used in Wisconsin for claiming the Farmland Preservation Credit.

Q: What is the Farmland Preservation Credit?

A: The Farmland Preservation Credit is a tax credit available to Wisconsin taxpayers who own farmland.

Q: Who can file Form I-025 Schedule FC?

A: Form I-025 Schedule FC can be filed by Wisconsin taxpayers who own farmland and want to claim the Farmland Preservation Credit.

Q: What information is required on Form I-025 Schedule FC?

A: Form I-025 Schedule FC requires information about the taxpayer's farmland, such as its location, size, and use.

Q: Is the Farmland Preservation Credit available in other states?

A: No, the Farmland Preservation Credit is specific to Wisconsin and is not available in other states.

Q: What is the deadline for filing Form I-025 Schedule FC?

A: The deadline for filing Form I-025 Schedule FC is typically the same as the deadline for filing your Wisconsin state income tax return.

Q: Are there any eligibility requirements for the Farmland Preservation Credit?

A: Yes, there are eligibility requirements for the Farmland Preservation Credit, including owning qualifying farmland and meeting certain income limits.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-025 Schedule FC by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.