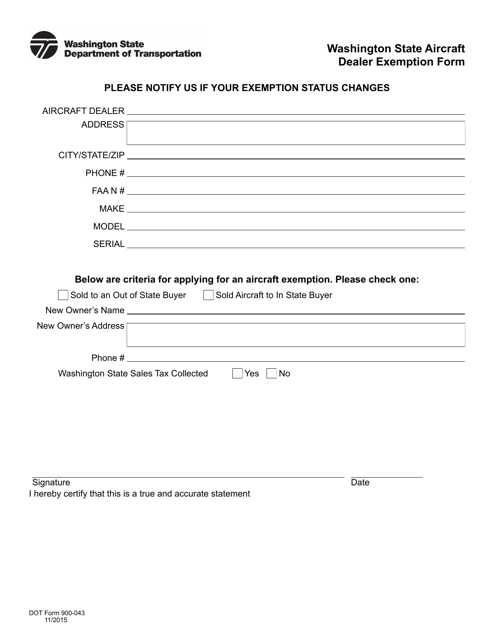

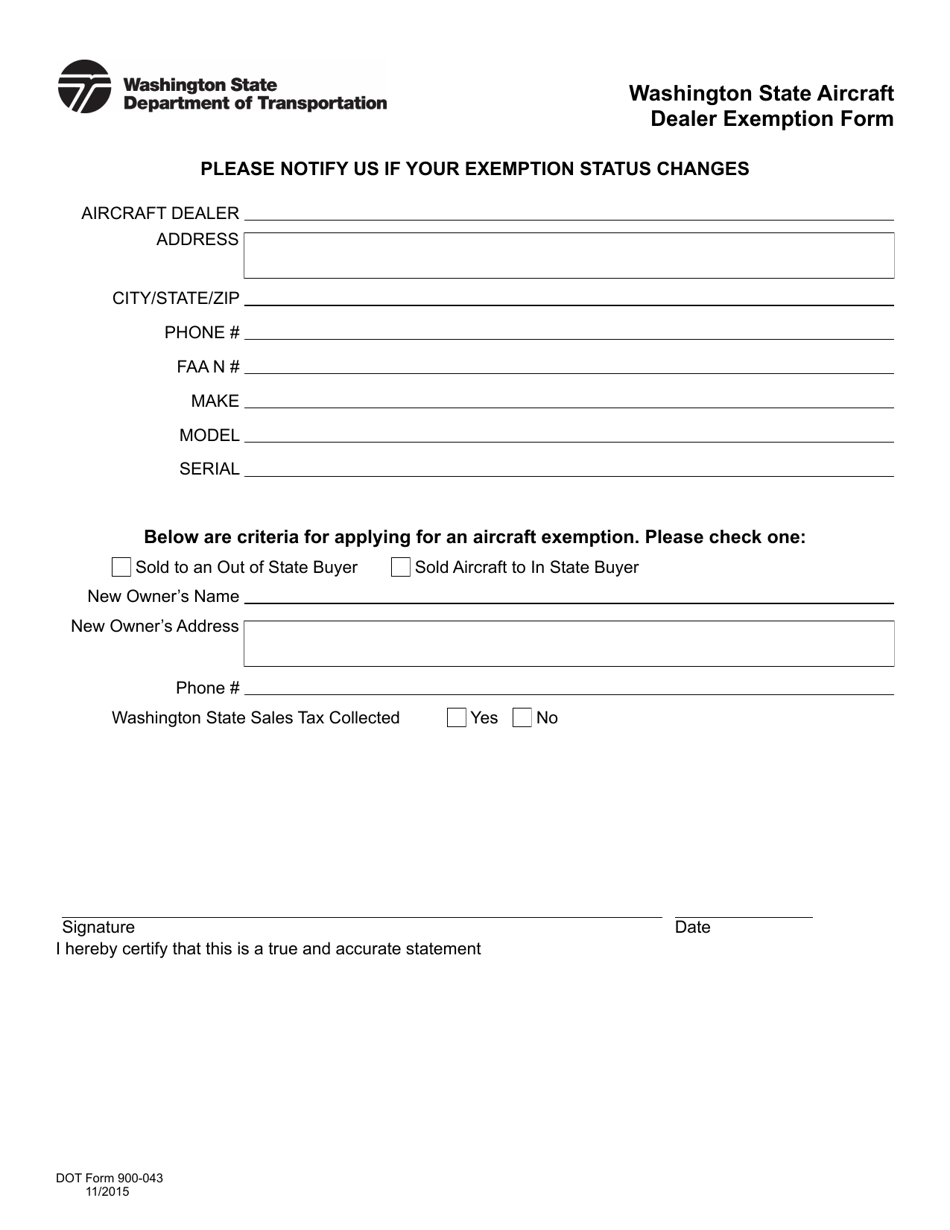

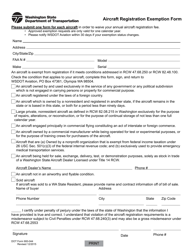

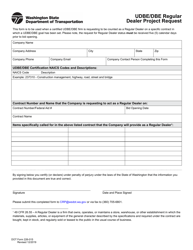

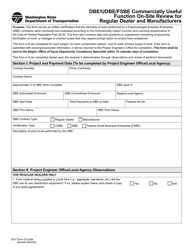

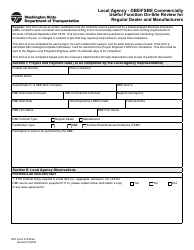

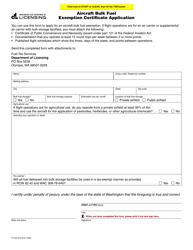

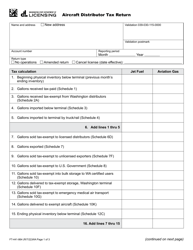

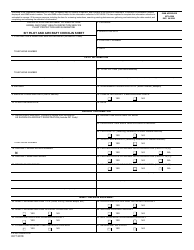

DOT Form 900-043 Washington State Aircraft Dealer Exemption Form - Washington

What Is DOT Form 900-043?

This is a legal form that was released by the Washington State Department of Transportation - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

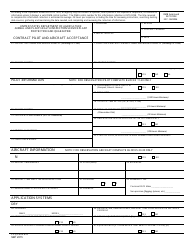

Q: What is DOT Form 900-043?

A: DOT Form 900-043 is the Washington State Aircraft Dealer Exemption Form.

Q: What is the purpose of DOT Form 900-043?

A: The purpose of DOT Form 900-043 is to apply for an exemption from aircraft dealer taxes in the state of Washington.

Q: Who needs to fill out DOT Form 900-043?

A: Aircraft dealers in the state of Washington need to fill out DOT Form 900-043.

Q: What does the exemption form exempt from?

A: The exemption form exempts aircraft dealers from paying certain taxes in Washington.

Q: Is DOT Form 900-043 specific to Washington State?

A: Yes, DOT Form 900-043 is specific to Washington State.

Q: What should I do if I have questions about DOT Form 900-043?

A: If you have questions about DOT Form 900-043, you should contact the Washington State Department of Transportation for assistance.

Q: Is there a fee for submitting DOT Form 900-043?

A: No, there is no fee for submitting DOT Form 900-043.

Q: What are the consequences of not submitting DOT Form 900-043?

A: Failure to submit DOT Form 900-043 may result in the aircraft dealer being responsible for paying the applicable taxes in Washington.

Form Details:

- Released on November 1, 2015;

- The latest edition provided by the Washington State Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of DOT Form 900-043 by clicking the link below or browse more documents and templates provided by the Washington State Department of Transportation.