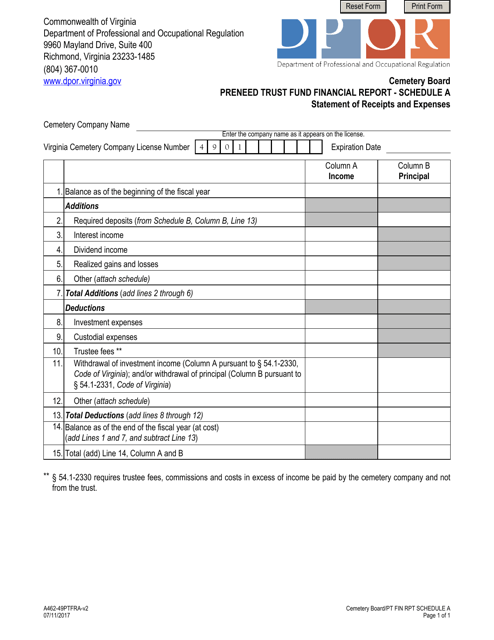

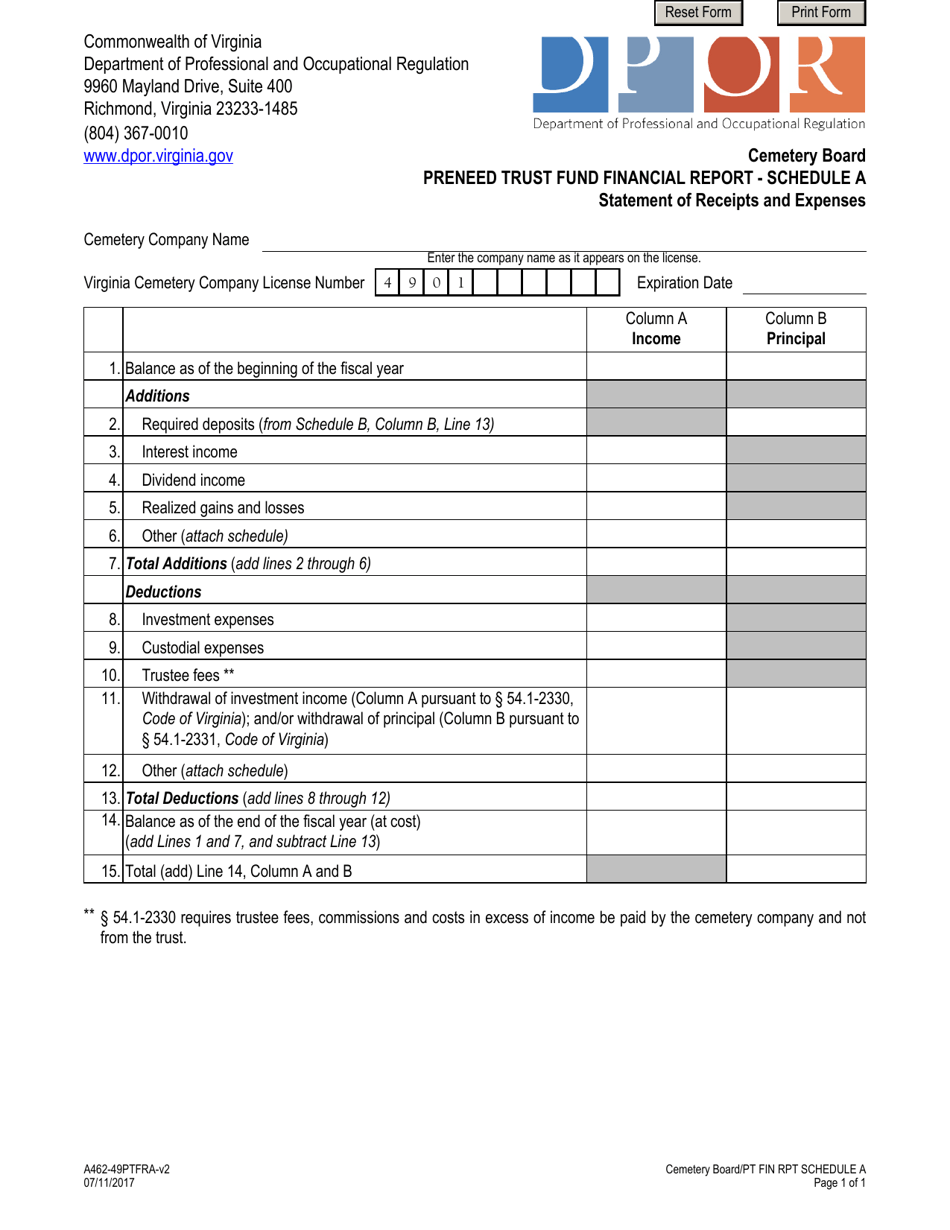

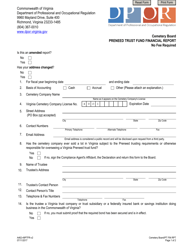

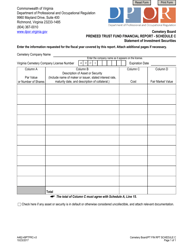

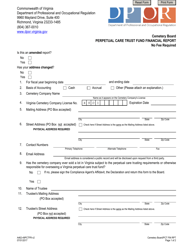

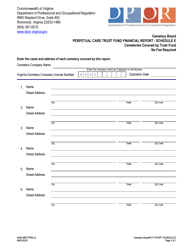

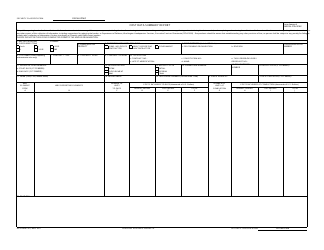

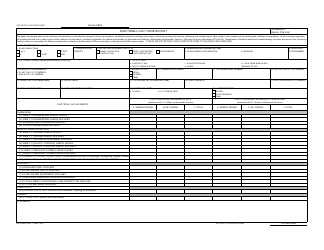

Form A462-49PTFRA Schedule A Preneed Trust Fund Financial Report - Statement of Receipts and Expenses - Virginia

What Is Form A462-49PTFRA Schedule A?

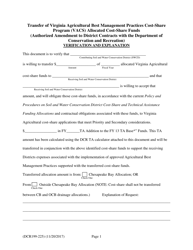

This is a legal form that was released by the Virginia Department of Professional and Occupational Regulation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the A462-49PTFRA Schedule A Preneed Trust Fund Financial Report?

A: The A462-49PTFRA Schedule A Preneed Trust Fund Financial Report is a form used in Virginia to report the receipts and expenses of a preneed trust fund.

Q: What is a preneed trust fund?

A: A preneed trust fund is a fund set up to hold money or assets that have been pre-paid by individuals for their funeral expenses.

Q: Who is required to file the A462-49PTFRA Schedule A Preneed Trust Fund Financial Report?

A: Funeral establishments in Virginia that have a preneed trust fund are required to file this report.

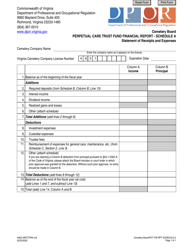

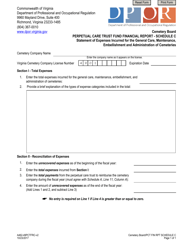

Q: What information is included in the report?

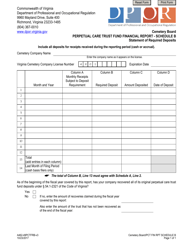

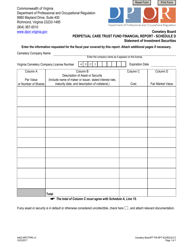

A: The report includes details of the receipts and expenses of the preneed trust fund, such as deposits, earnings, disbursements, and administrative expenses.

Q: When is the report due?

A: The report is due annually, within 90 days of the end of the preneed trust fund's fiscal year.

Q: Are there any penalties for not filing the report?

A: Yes, failure to file the report or filing a false report can result in penalties, including fines and possible suspension or revocation of the funeral establishment's license.

Form Details:

- Released on July 11, 2017;

- The latest edition provided by the Virginia Department of Professional and Occupational Regulation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A462-49PTFRA Schedule A by clicking the link below or browse more documents and templates provided by the Virginia Department of Professional and Occupational Regulation.