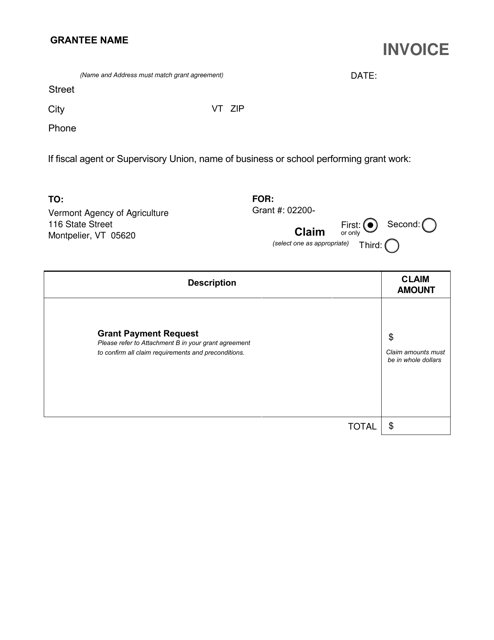

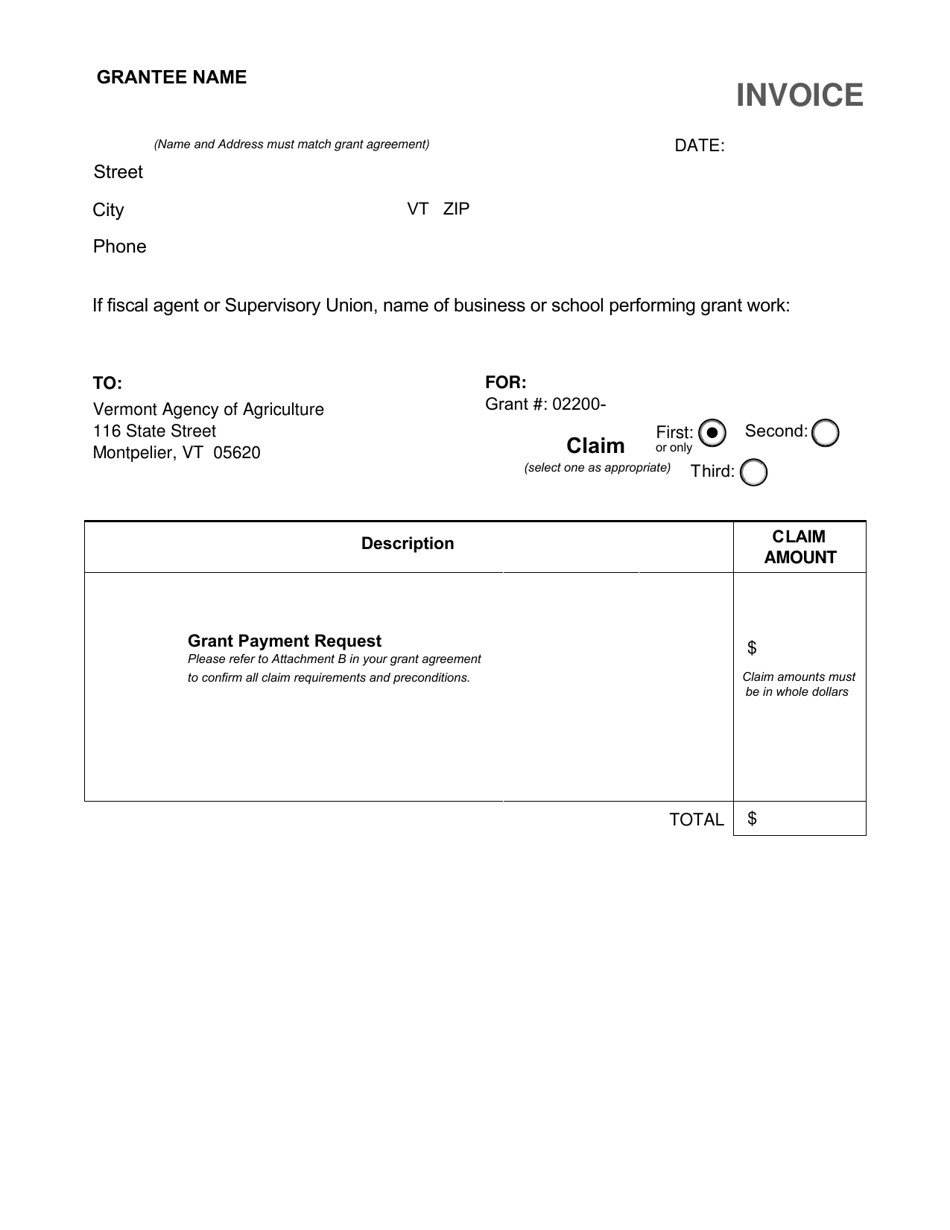

Grantee Invoice - Vermont

Grantee Invoice is a legal document that was released by the Vermont Agency of Agriculture Food and Markets - a government authority operating within Vermont.

FAQ

Q: What is a grantee invoice?

A: A grantee invoice is a document submitted by an organization or individual who has received a grant, requesting payment for expenses incurred.

Q: Who can submit a grantee invoice?

A: Only the organization or individual who has received the grant can submit a grantee invoice.

Q: What expenses can be included in a grantee invoice?

A: Expenses that are directly related to the grant project can be included in a grantee invoice, such as materials, salaries, travel costs, and other project-related expenses.

Q: What information should be included in a grantee invoice?

A: A grantee invoice should include the organization's or individual's name, address, contact information, the grant reference number, the invoice date, a detailed description of the expenses, the amount due, and any supporting documentation.

Q: What is the payment process for a grantee invoice?

A: The payment process for a grantee invoice varies depending on the granting agency or organization. Typically, the invoice will be reviewed for accuracy and completeness, and then processed for payment.

Q: Are there any deadlines for submitting a grantee invoice?

A: Yes, there may be deadlines for submitting a grantee invoice. It is important to review the grant agreement and any instructions provided by the granting agency or organization to ensure timely submission.

Q: Can a grantee invoice be amended or revised?

A: Yes, a grantee invoice can often be amended or revised if there are errors or changes in the expenses reported. It is important to communicate with the granting agency or organization regarding any necessary amendments.

Q: What happens if a grantee invoice is denied or disputed?

A: If a grantee invoice is denied or disputed, it is important to follow the dispute resolution process outlined in the grant agreement or contact the granting agency or organization for further guidance.

Q: Is there any documentation required to support expenses in a grantee invoice?

A: Yes, supporting documentation such as receipts, invoices, or timesheets may be required to verify the expenses claimed in a grantee invoice. It is important to review the grant agreement and any specific requirements regarding documentation.

Form Details:

- The latest edition currently provided by the Vermont Agency of Agriculture Food and Markets;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Vermont Agency of Agriculture Food and Markets.