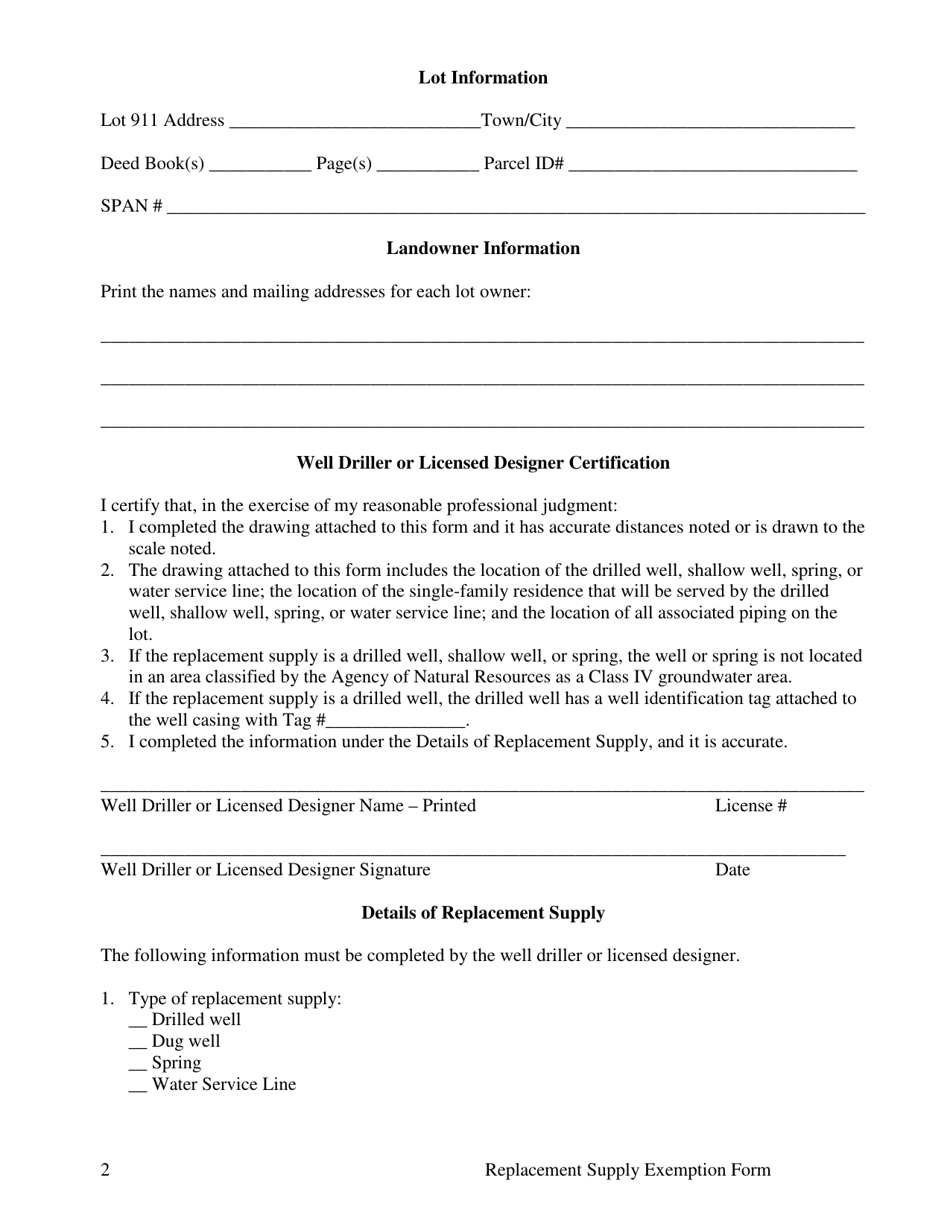

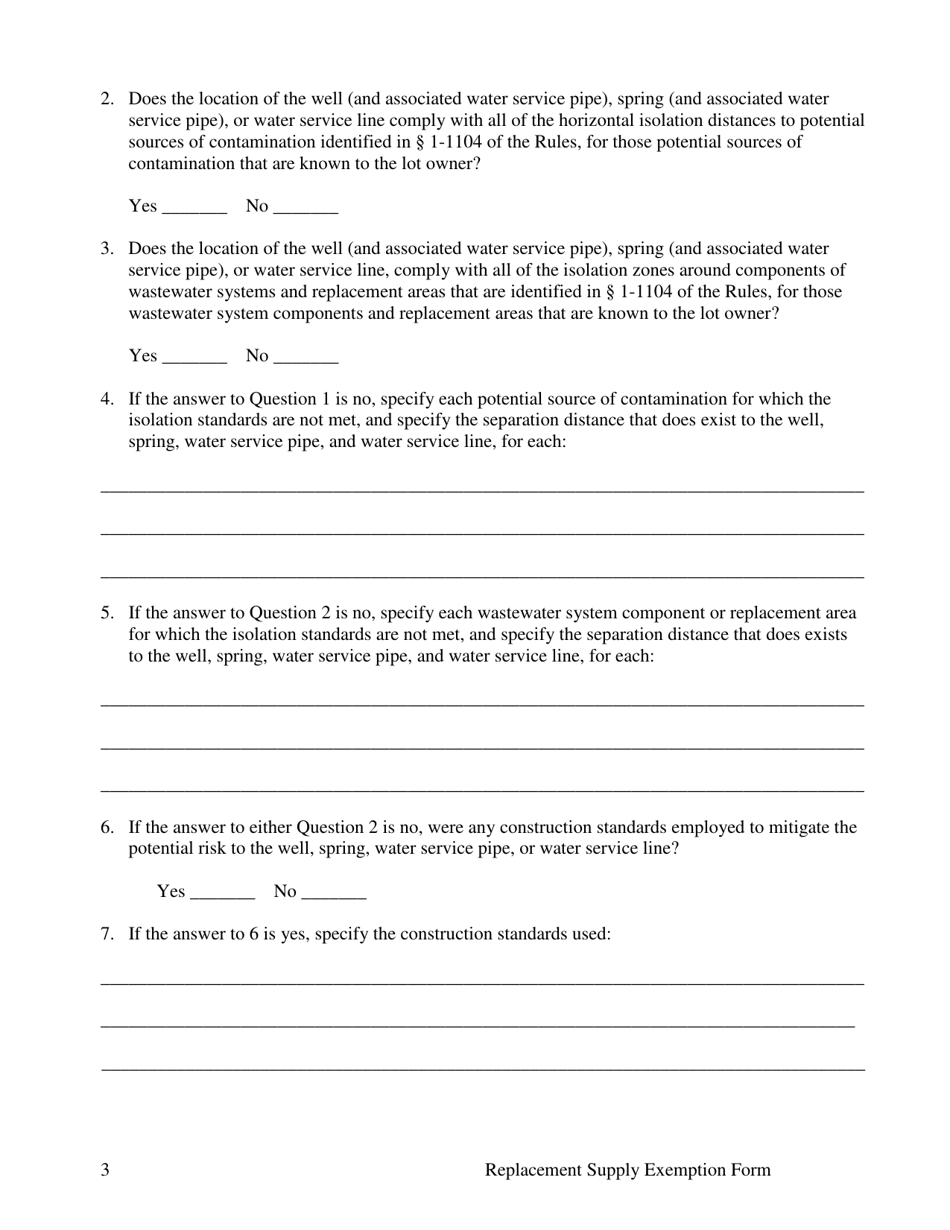

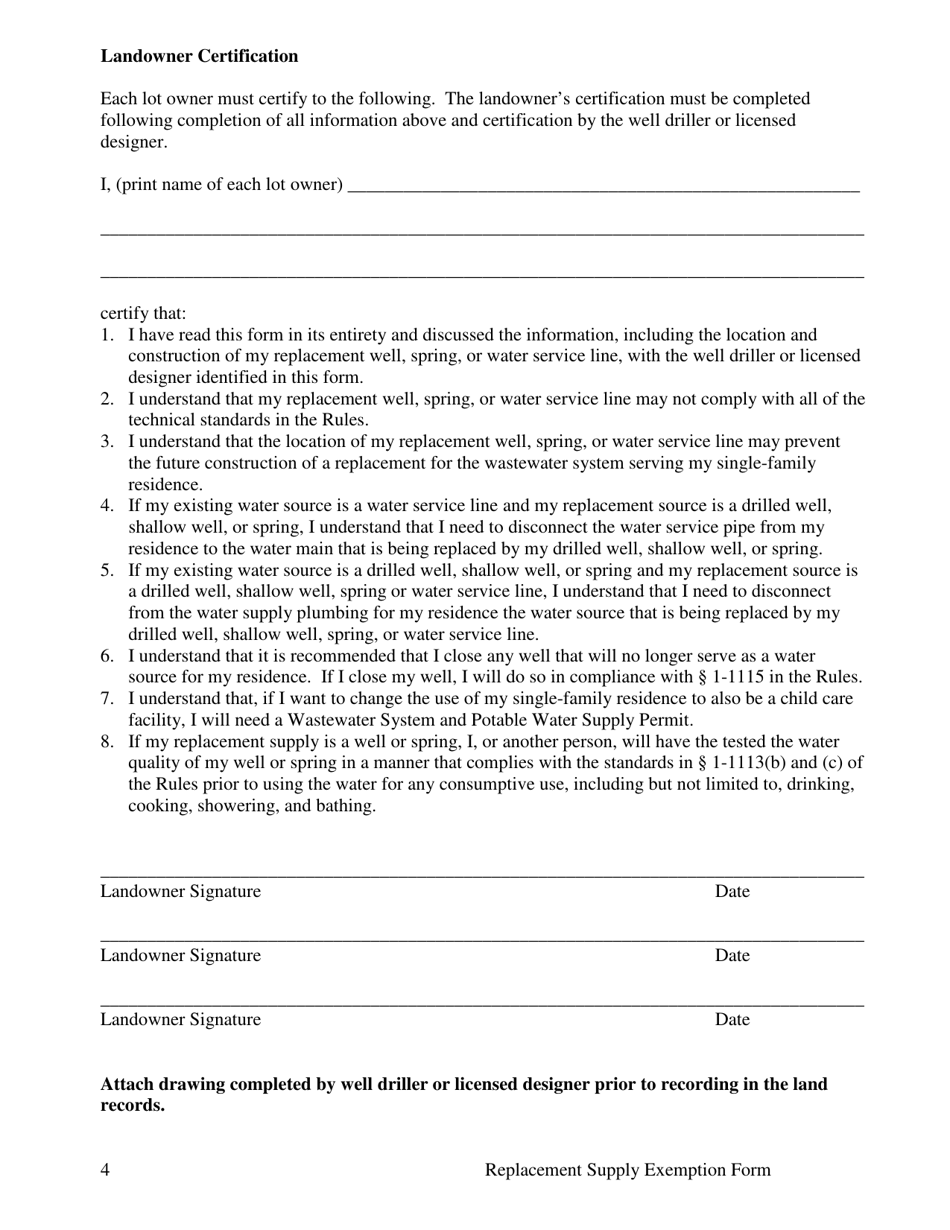

Replacement Supply Exemption Form - Vermont

Replacement Supply Exemption Form is a legal document that was released by the Vermont Department of Environmental Conservation - a government authority operating within Vermont.

FAQ

Q: What is the Replacement Supply Exemption Form in Vermont?

A: The Replacement Supply Exemption Form in Vermont is a document that allows an individual or business to claim an exemption from paying sales tax on certain replacement supplies.

Q: Who is eligible to use the Replacement Supply Exemption Form in Vermont?

A: Any individual or business in Vermont that is purchasing replacement supplies may be eligible to use the Replacement Supply Exemption Form.

Q: What are replacement supplies?

A: Replacement supplies refer to items that are purchased to replace or repair existing items that have been damaged, worn out, or lost.

Q: How do I apply for the Replacement Supply Exemption in Vermont?

A: To apply for the Replacement Supply Exemption in Vermont, you need to fill out the Replacement Supply Exemption Form and submit it to the Vermont Department of Taxes.

Q: What is the purpose of the Replacement Supply Exemption Form?

A: The purpose of the Replacement Supply Exemption Form is to provide individuals and businesses with a way to claim an exemption from sales tax when purchasing replacement supplies.

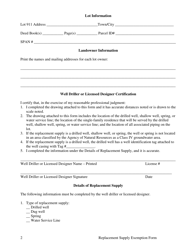

Form Details:

- Released on April 18, 2019;

- The latest edition currently provided by the Vermont Department of Environmental Conservation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Vermont Department of Environmental Conservation.