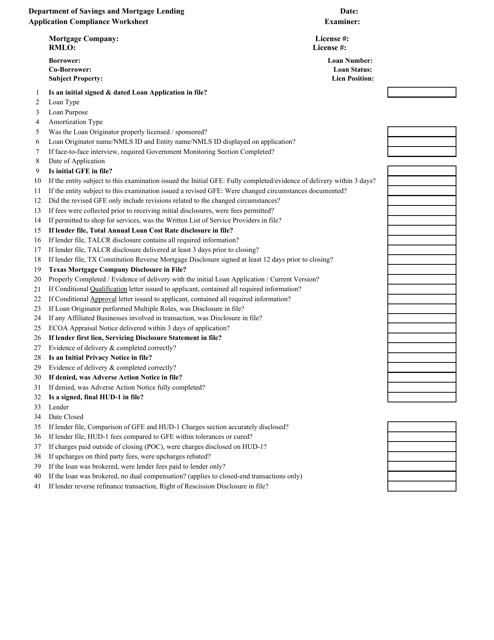

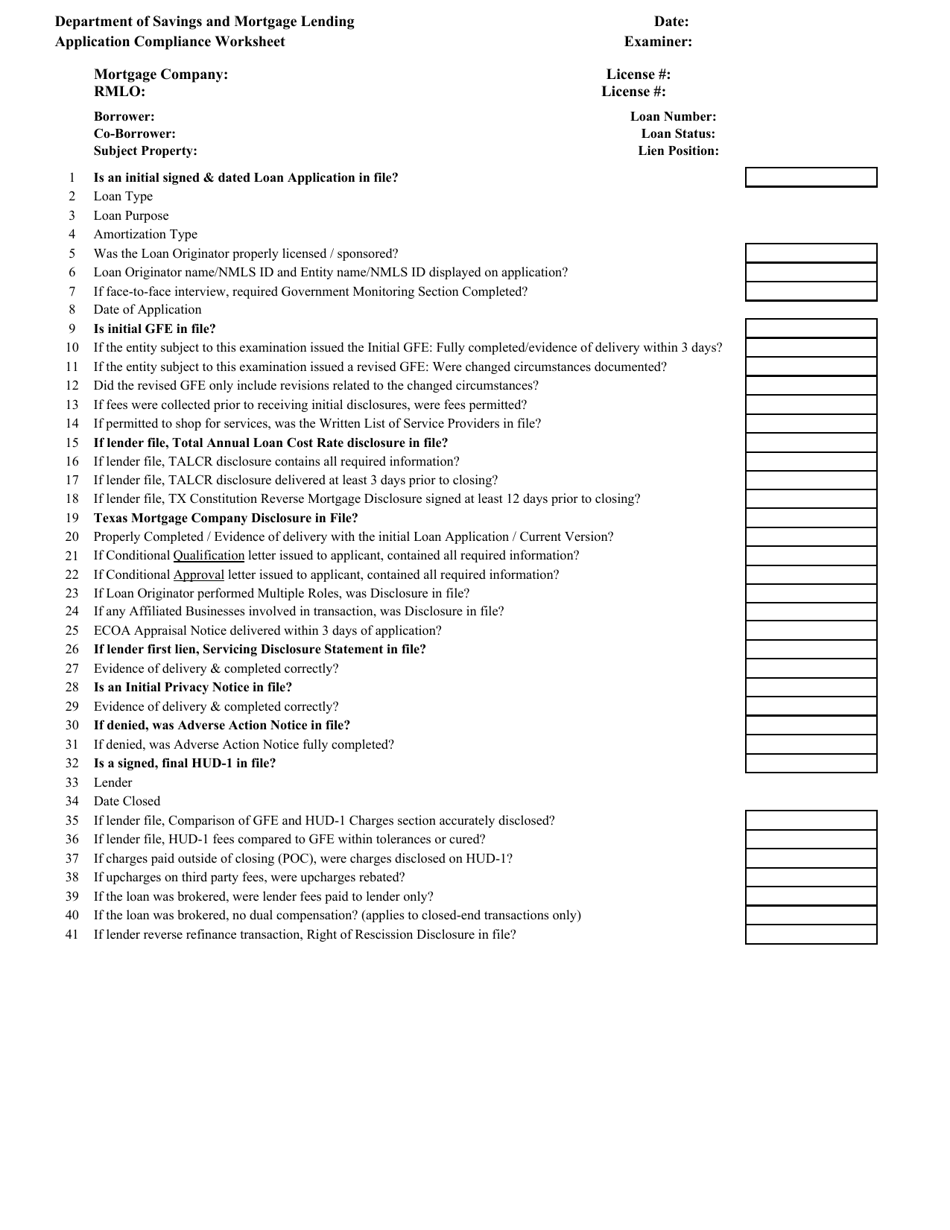

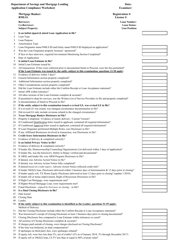

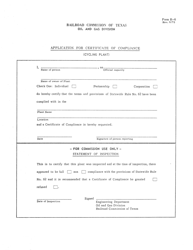

Application Compliance Worksheet (Reverse Mortgages) - Mortgage Company - Texas

Application Compliance Worksheet (Reverse Mortgages) - Mortgage Company is a legal document that was released by the Texas Department of Savings and Mortgage Lending - a government authority operating within Texas.

FAQ

Q: What is a reverse mortgage?

A: A reverse mortgage is a loan that allows homeowners to convert a portion of their home equity into cash.

Q: How does a reverse mortgage work?

A: With a reverse mortgage, the homeowner receives payments from the lender instead of making payments to the lender. The loan only needs to be repaid when the homeowner no longer lives in the home.

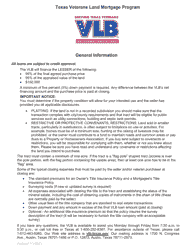

Q: Who is eligible for a reverse mortgage?

A: To be eligible for a reverse mortgage, you must be at least 62 years old and have enough equity in your home.

Q: What are the benefits of a reverse mortgage?

A: The benefits of a reverse mortgage include providing additional income, allowing homeowners to stay in their homes, and not having to make monthly mortgage payments.

Q: Are there any risks associated with a reverse mortgage?

A: Yes, there are risks associated with a reverse mortgage. Some risks include accruing interest on the loan, potentially decreasing home equity, and the possibility of losing the home if loan obligations are not met.

Q: Is counseling required for a reverse mortgage?

A: Yes, counseling is required for a reverse mortgage. The purpose of counseling is to ensure that homeowners fully understand the terms and implications of the loan.

Q: Can the reverse mortgage be used to pay off an existing mortgage?

A: Yes, one of the uses of a reverse mortgage is to pay off an existing mortgage. This can free up monthly cash flow for homeowners.

Q: What happens if the homeowner no longer lives in the home?

A: If the homeowner no longer lives in the home, the reverse mortgage loan must be repaid. This can be done by selling the home or using other funds.

Q: Can a reverse mortgage affect inheritance?

A: Yes, a reverse mortgage can potentially affect inheritance. If the loan is not repaid, the home may need to be sold to satisfy the loan, reducing the inheritance amount.

Q: Is a reverse mortgage available in Texas?

A: Yes, reverse mortgages are available in Texas. However, there may be specific regulations and requirements that vary from other states.

Q: Should I consider a reverse mortgage?

A: Whether or not to consider a reverse mortgage depends on your individual financial situation and goals. It is recommended to consult with a mortgage professional to determine if it is the right option for you.

Q: How can I find a reputable reverse mortgage lender?

A: To find a reputable reverse mortgage lender, you can research and compare lenders, read customer reviews, and seek recommendations from trusted sources.

Q: Are there alternatives to a reverse mortgage?

A: Yes, there are alternatives to a reverse mortgage. Some alternatives include downsizing to a smaller home, renting out a portion of your home, or exploring other types of loans.

Q: What are the costs involved in a reverse mortgage?

A: The costs involved in a reverse mortgage can include closing costs, loan origination fees, mortgage insurance premiums, and interest rates. It is important to understand and consider these costs before proceeding with a reverse mortgage.

Q: How long does it take to process a reverse mortgage?

A: The time it takes to process a reverse mortgage can vary. It may take several weeks to a few months to complete the application, appraisal, and underwriting process.

Q: Can a reverse mortgage be refinanced?

A: Yes, a reverse mortgage can be refinanced. Refinancing may be an option to obtain better terms or access additional funds.

Q: What happens if the homeowner outlives the reverse mortgage?

A: If the homeowner outlives the reverse mortgage, the loan does not need to be repaid until the homeowner no longer lives in the home, as specified in the loan agreement.

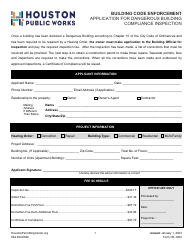

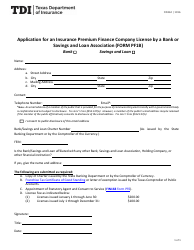

Form Details:

- The latest edition currently provided by the Texas Department of Savings and Mortgage Lending;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Texas Department of Savings and Mortgage Lending.