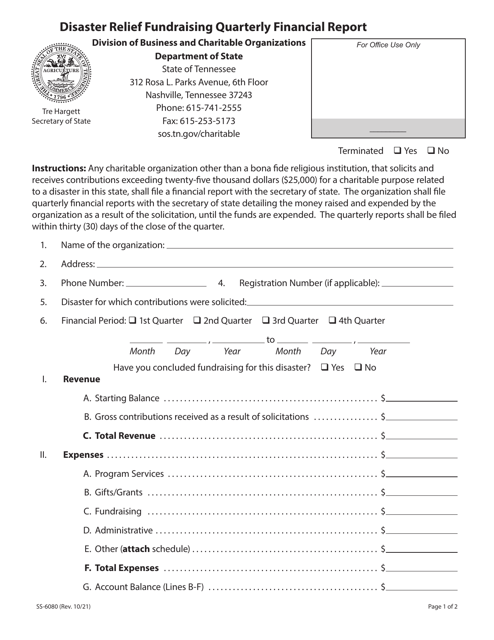

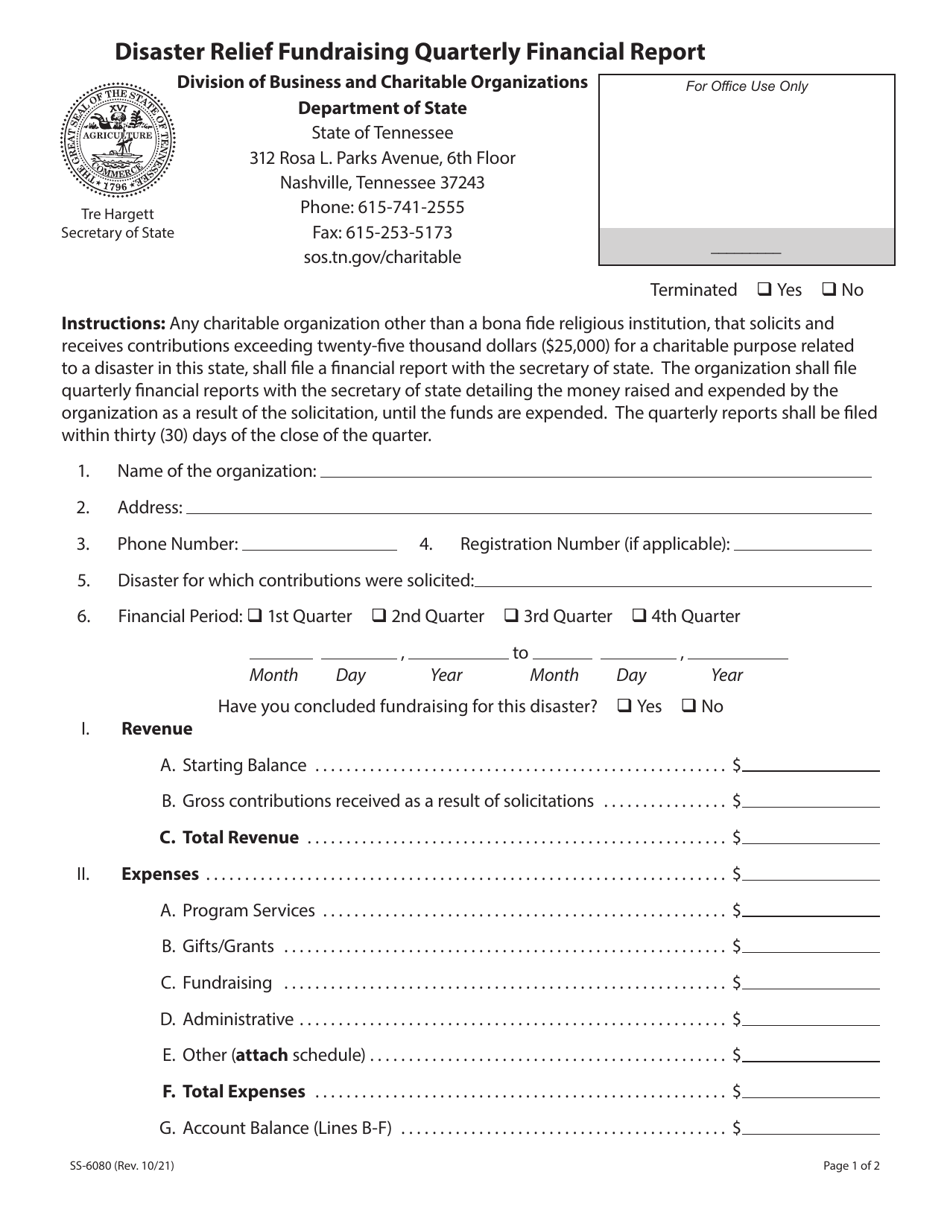

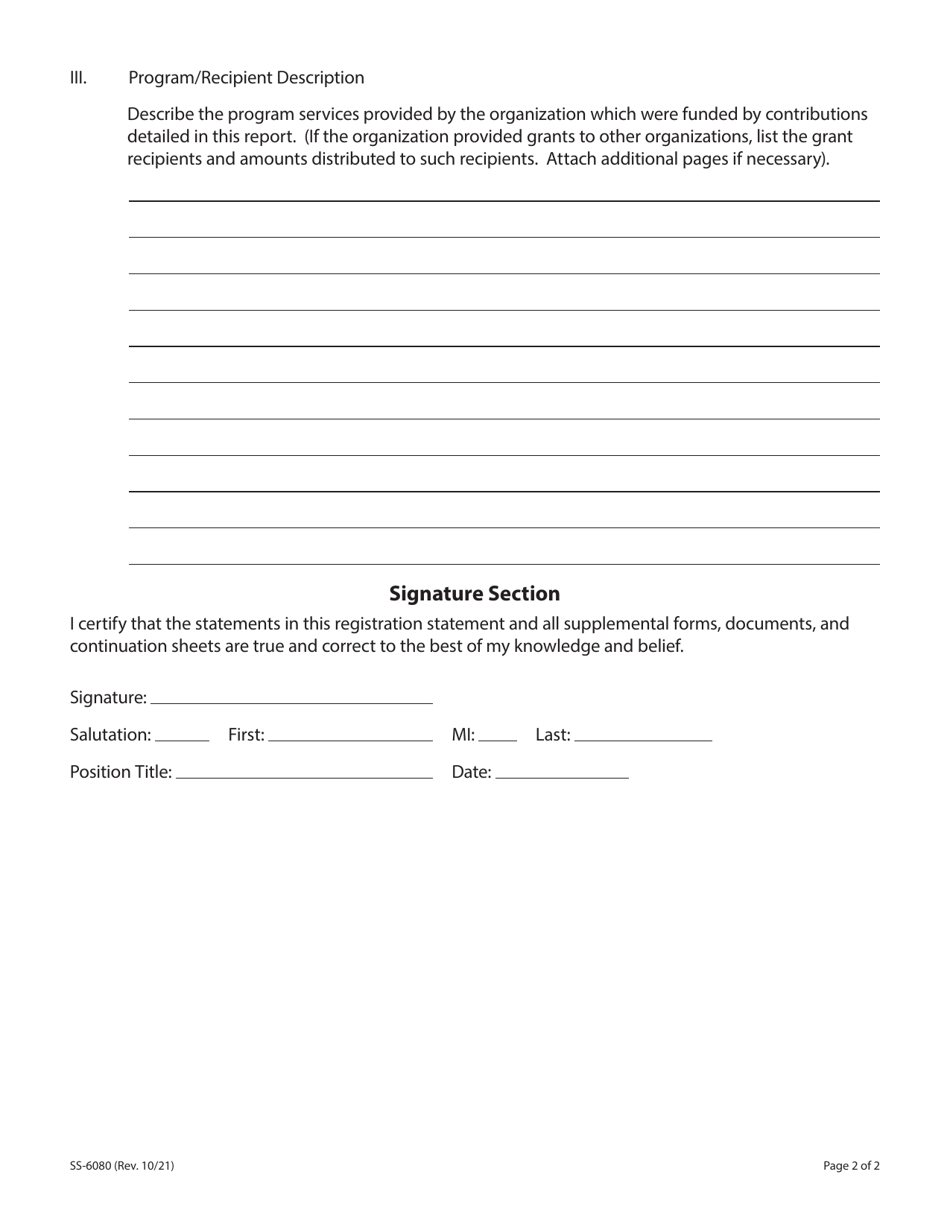

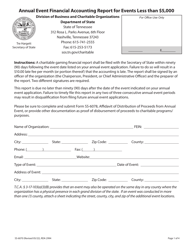

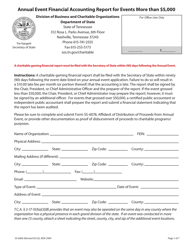

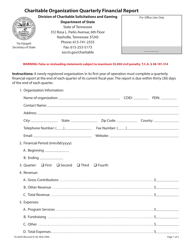

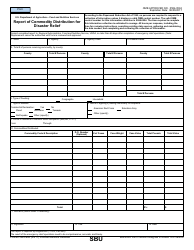

Form SS-6080 Disaster Relief Fundraising Quarterly Financial Report - Tennessee

What Is Form SS-6080?

This is a legal form that was released by the Tennessee Secretary of State - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SS-6080?

A: Form SS-6080 is the Disaster Relief Fundraising Quarterly Financial Report.

Q: Who is required to file Form SS-6080?

A: Non-profit organizations that engage in disaster relief fundraising in Tennessee are required to file Form SS-6080.

Q: What is the purpose of Form SS-6080?

A: The purpose of Form SS-6080 is to report the financial activities and fundraising efforts of non-profit organizations engaged in disaster relief.

Q: How often should Form SS-6080 be filed?

A: Form SS-6080 should be filed quarterly, for each quarter of the calendar year.

Q: Who is responsible for filing Form SS-6080?

A: The authorized officer or representative of the non-profit organization is responsible for filing Form SS-6080.

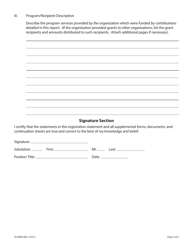

Q: What information is required on Form SS-6080?

A: Form SS-6080 requires information such as the organization's name, address, EIN, total gross contributions received, total program expenses, and more.

Q: When is the deadline for filing Form SS-6080?

A: Form SS-6080 must be filed within 15 days after the end of each quarter.

Q: Are there any penalties for not filing Form SS-6080?

A: Yes, failure to file Form SS-6080 or providing false or misleading information can result in penalties, including fines and loss of tax-exempt status.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Tennessee Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SS-6080 by clicking the link below or browse more documents and templates provided by the Tennessee Secretary of State.