This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

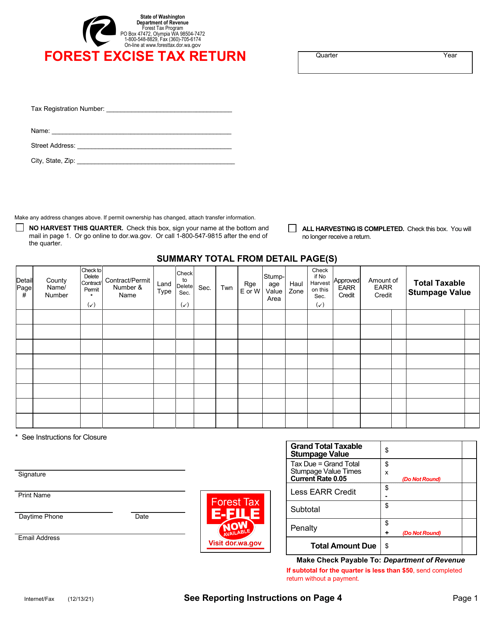

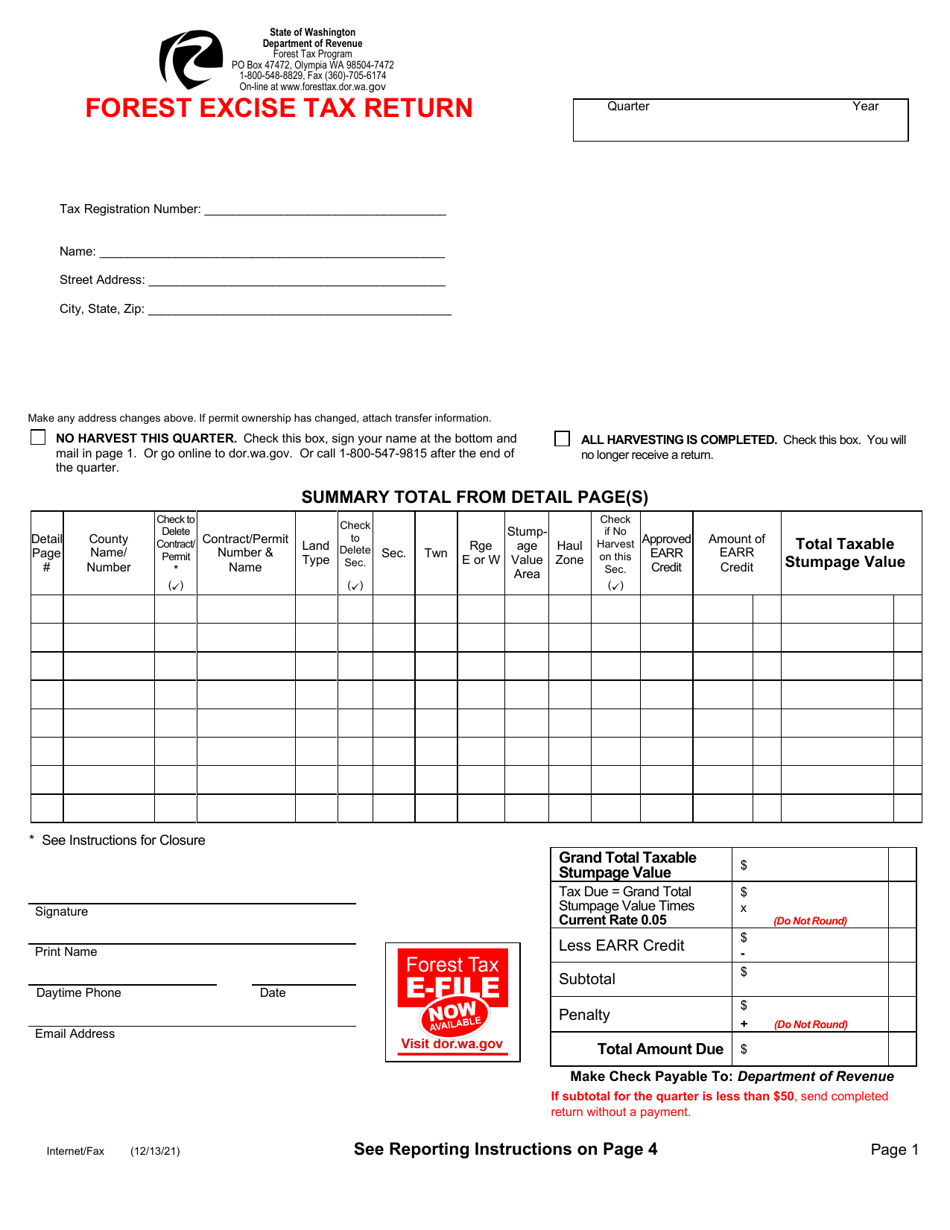

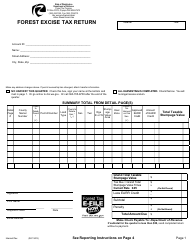

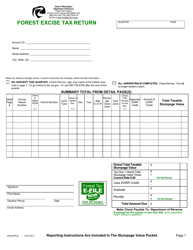

Public Harvester Forest Excise Tax Return - Washington

Public Harvester Forest Excise Tax Return is a legal document that was released by the Washington State Department of Revenue - a government authority operating within Washington.

FAQ

Q: What is the Public Harvester Forest Excise Tax Return?

A: The Public Harvester Forest Excise Tax Return is a tax return form that individuals or entities engaged in public harvesting of timber must file in the state of Washington.

Q: Who needs to file the Public Harvester Forest Excise Tax Return?

A: Individuals or entities engaged in public harvesting of timber in Washington need to file the tax return.

Q: What is public harvesting of timber?

A: Public harvesting of timber refers to the commercial cutting or removal of timber from publicly owned forest lands.

Q: Why do I need to file this tax return?

A: Filing the Public Harvester Forest Excise Tax Return is a requirement for individuals or entities engaged in public harvesting of timber in Washington to report and pay the applicable forest excise taxes.

Q: How often do I need to file this tax return?

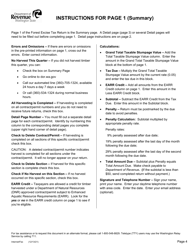

A: The Public Harvester Forest Excise Tax Return needs to be filed annually.

Q: Are there any exemptions or deductions available for this tax return?

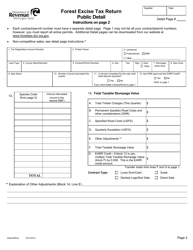

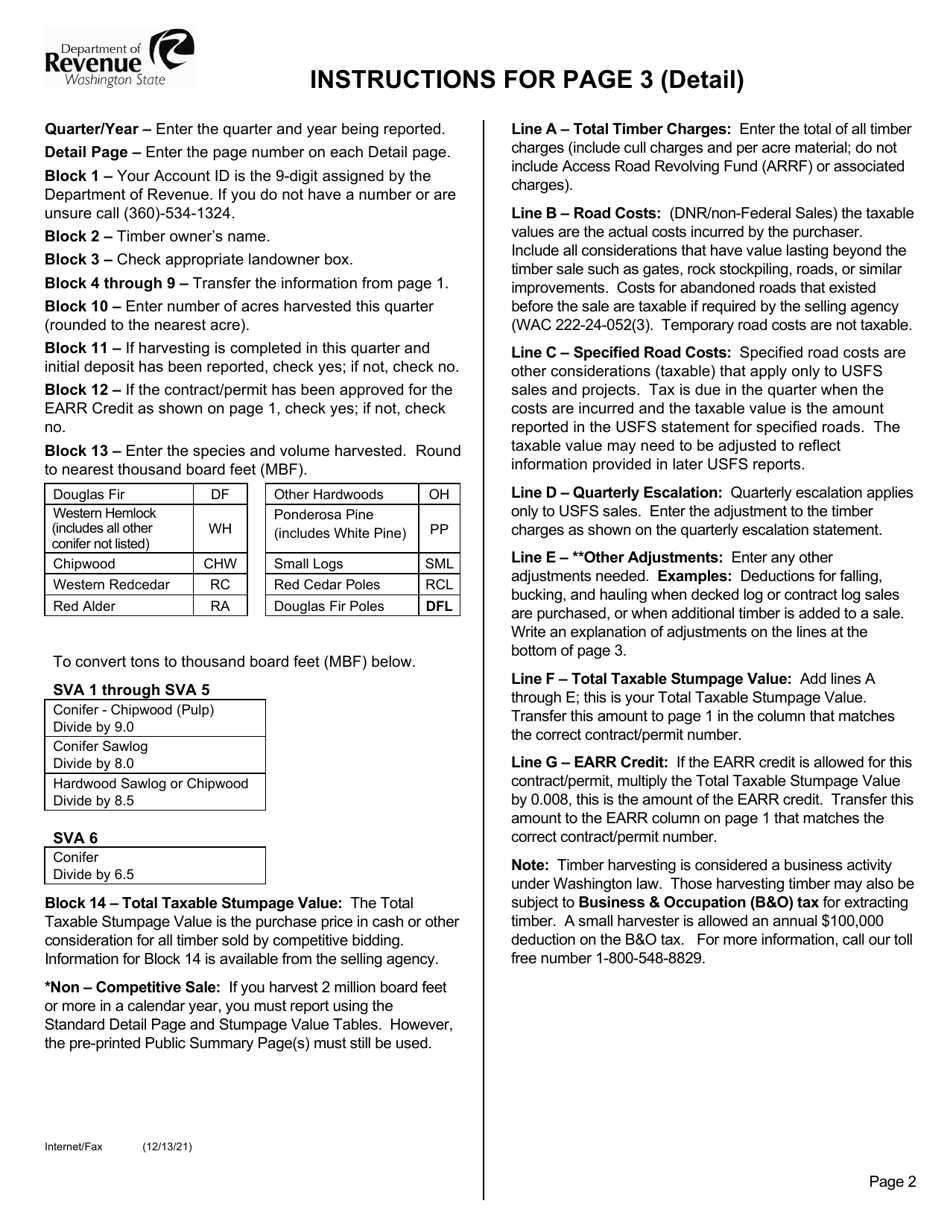

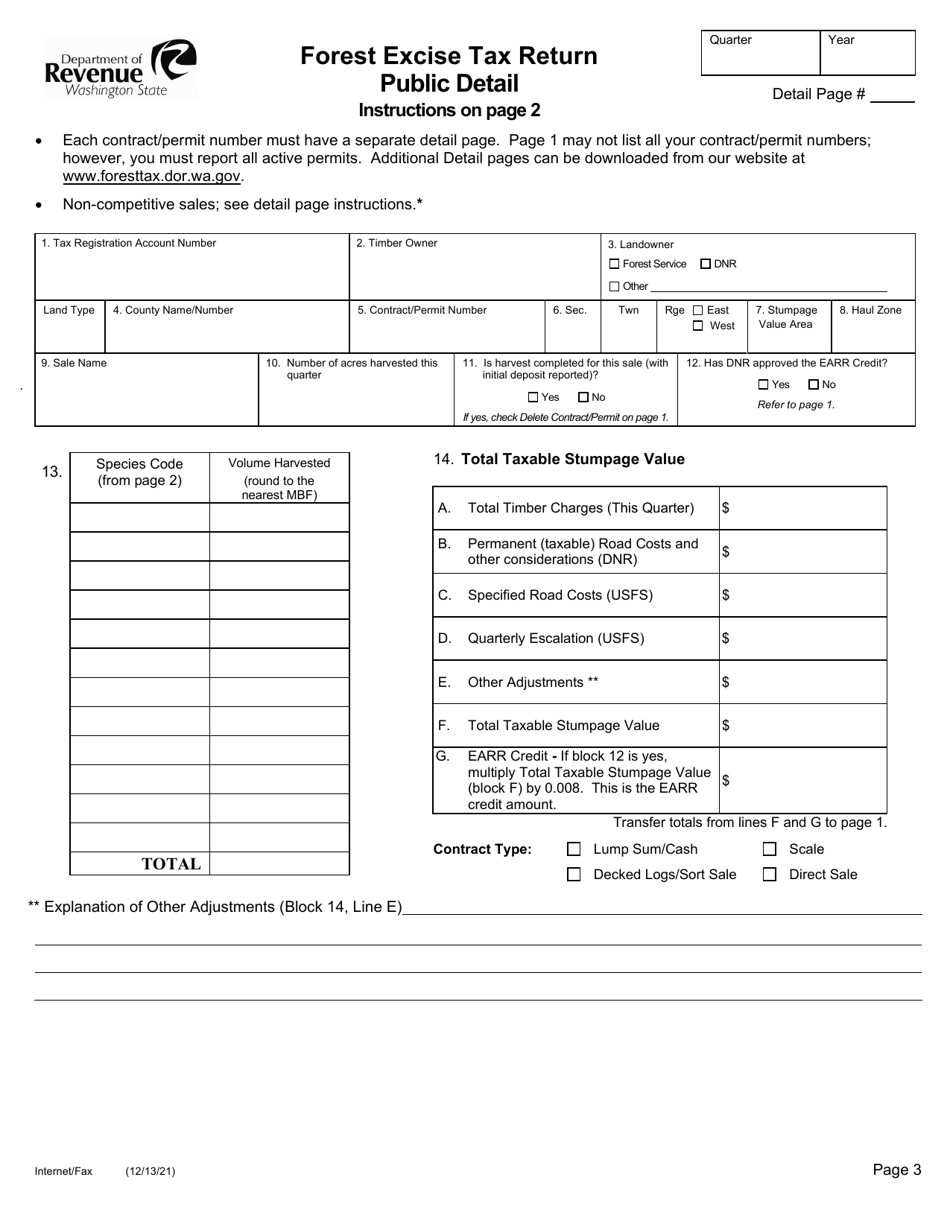

A: Yes, there are certain exemptions and deductions available for the Public Harvester Forest Excise Tax Return. It's recommended to consult the instructions and guidelines provided with the tax return form or seek professional tax advice.

Q: What are the penalties for not filing or late filing of this tax return?

A: Penalties for not filing or late filing of the Public Harvester Forest Excise Tax Return may include monetary fines and interest charges. It's important to file the tax return within the prescribed deadline to avoid penalties.

Q: What is the deadline for filing the Public Harvester Forest Excise Tax Return?

A: The deadline for filing the Public Harvester Forest Excise Tax Return is typically on or before April 30th of the year following the harvest period.

Form Details:

- Released on December 13, 2021;

- The latest edition currently provided by the Washington State Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.