This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

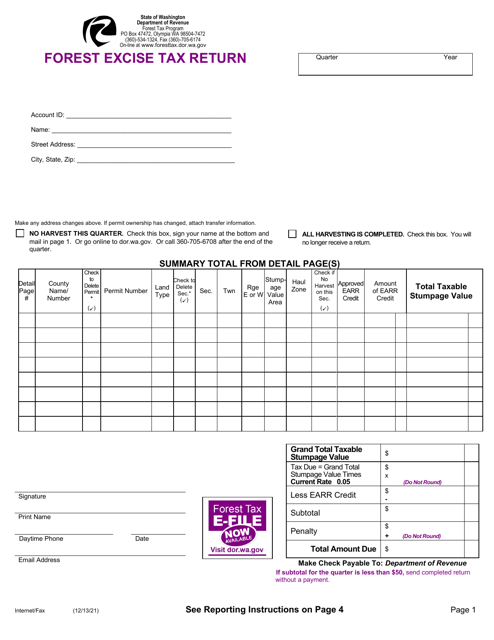

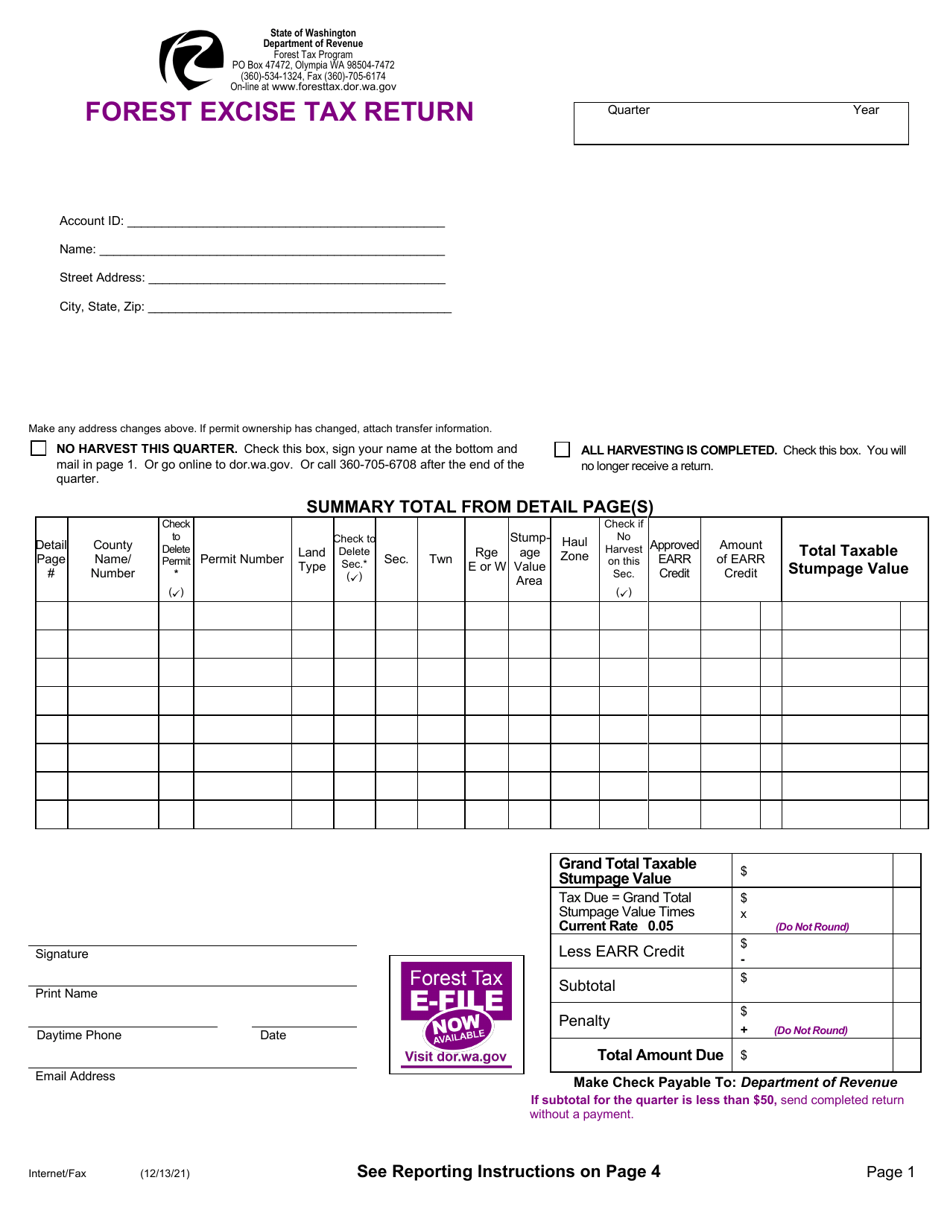

Small Harvester Forest Excise Tax Return - Washington

Small Harvester Forest Excise Tax Return is a legal document that was released by the Washington State Department of Revenue - a government authority operating within Washington.

FAQ

Q: What is the Small Harvester Forest Excise Tax Return?

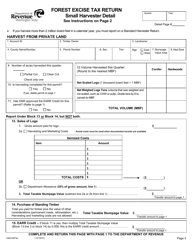

A: The Small Harvester Forest Excise Tax Return is a tax return form specifically designed for small harvesters in Washington State.

Q: Who needs to file the Small Harvester Forest Excise Tax Return?

A: Small harvesters who own or operate less than 5,000 acres of forest land in Washington State need to file this tax return.

Q: What is the purpose of the Small Harvester Forest Excise Tax?

A: The purpose of the Small Harvester Forest Excise Tax is to generate revenue for the state and support forest management and conservation efforts.

Q: How often do I need to file the Small Harvester Forest Excise Tax Return?

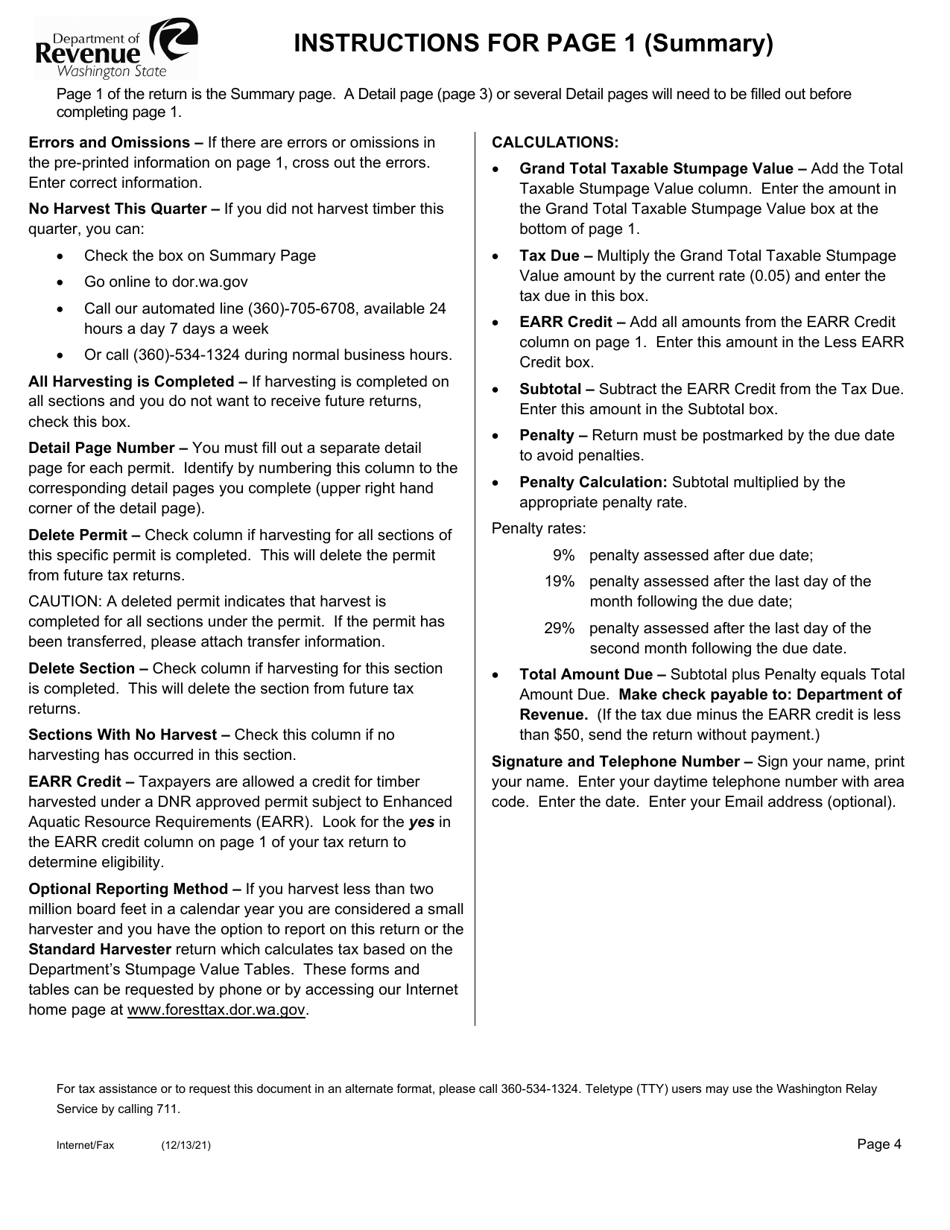

A: The tax return is filed annually, with a due date of January 15th of each year.

Q: What information do I need to provide on the Small Harvester Forest Excise Tax Return?

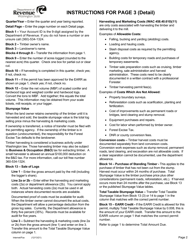

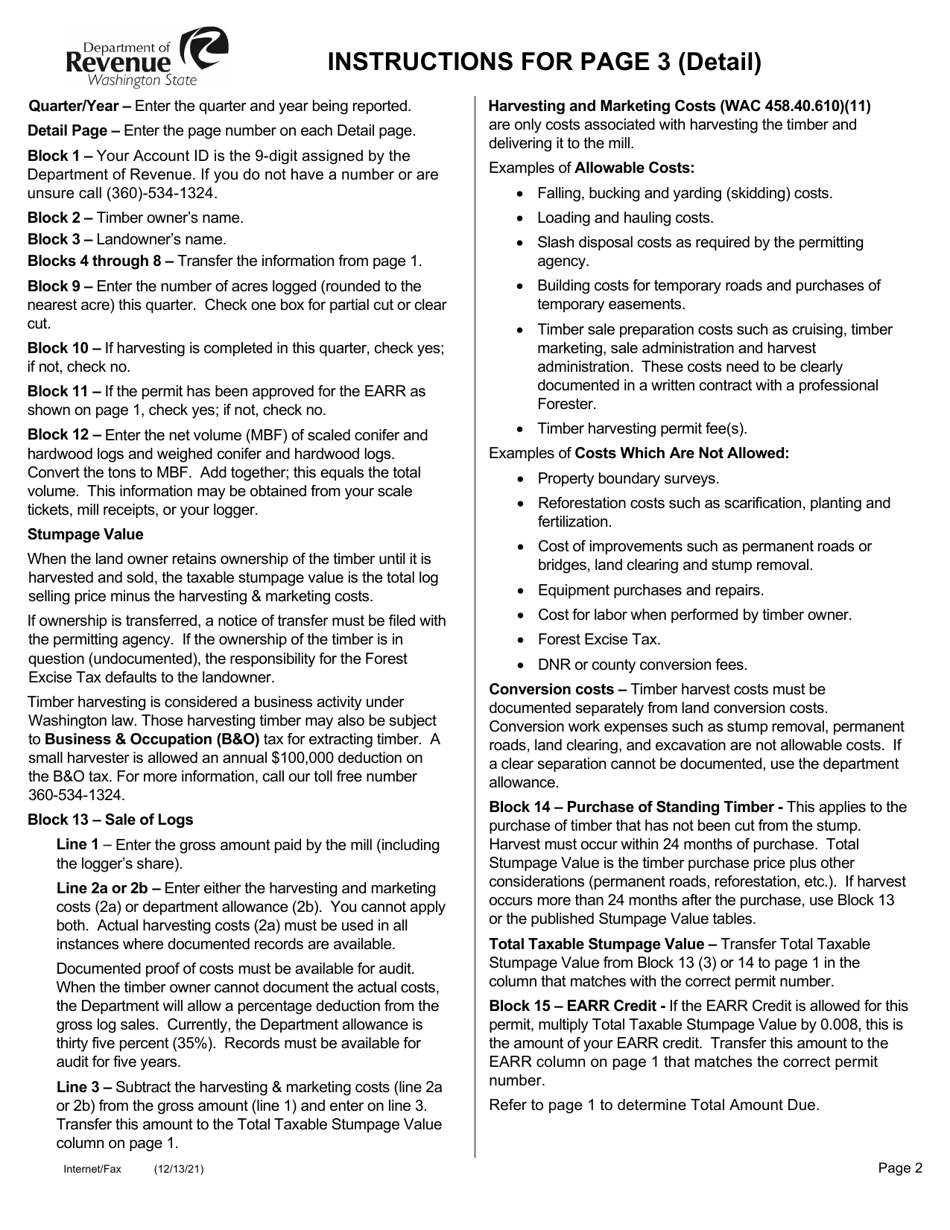

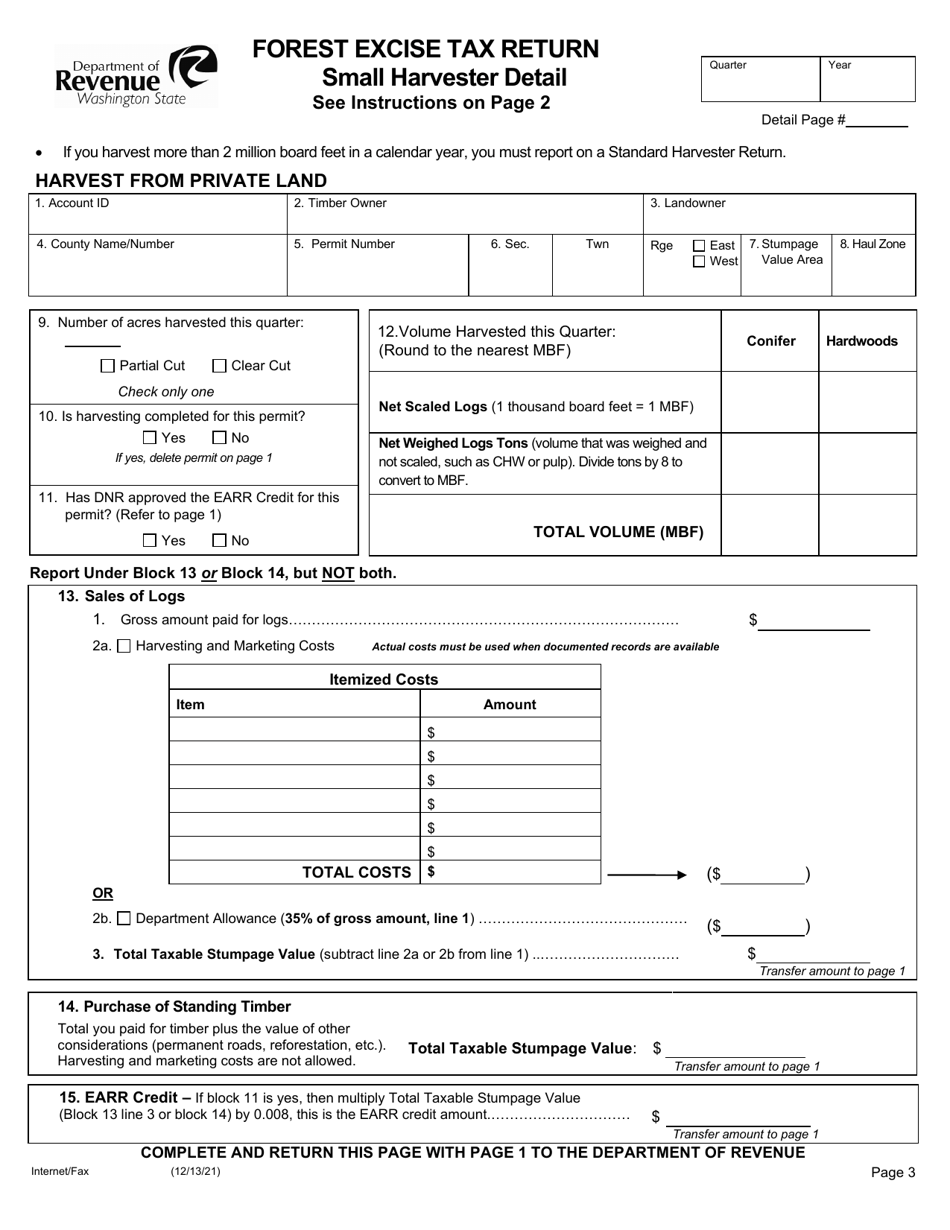

A: You will need to provide information about your forest land ownership, timber harvest activity, and calculate the tax owed based on the volume and value of timber harvested.

Q: Are there any penalties for late filing or non-payment of the Small Harvester Forest Excise Tax?

A: Yes, there are penalties for late filing or non-payment, including interest charges and potential legal action.

Form Details:

- Released on December 13, 2021;

- The latest edition currently provided by the Washington State Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.