This version of the form is not currently in use and is provided for reference only. Download this version of

Form F700-099-000

for the current year.

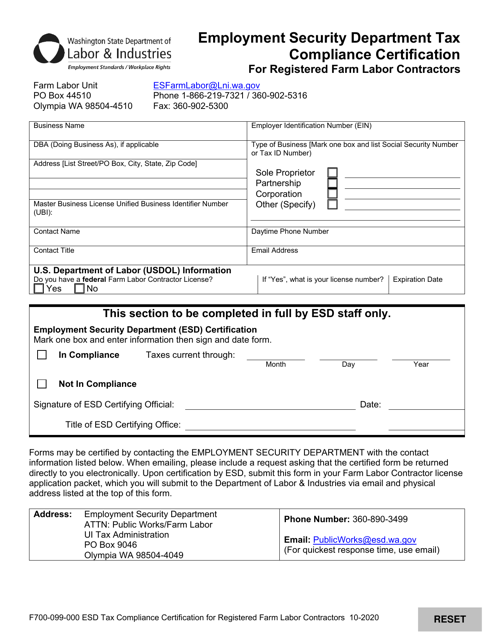

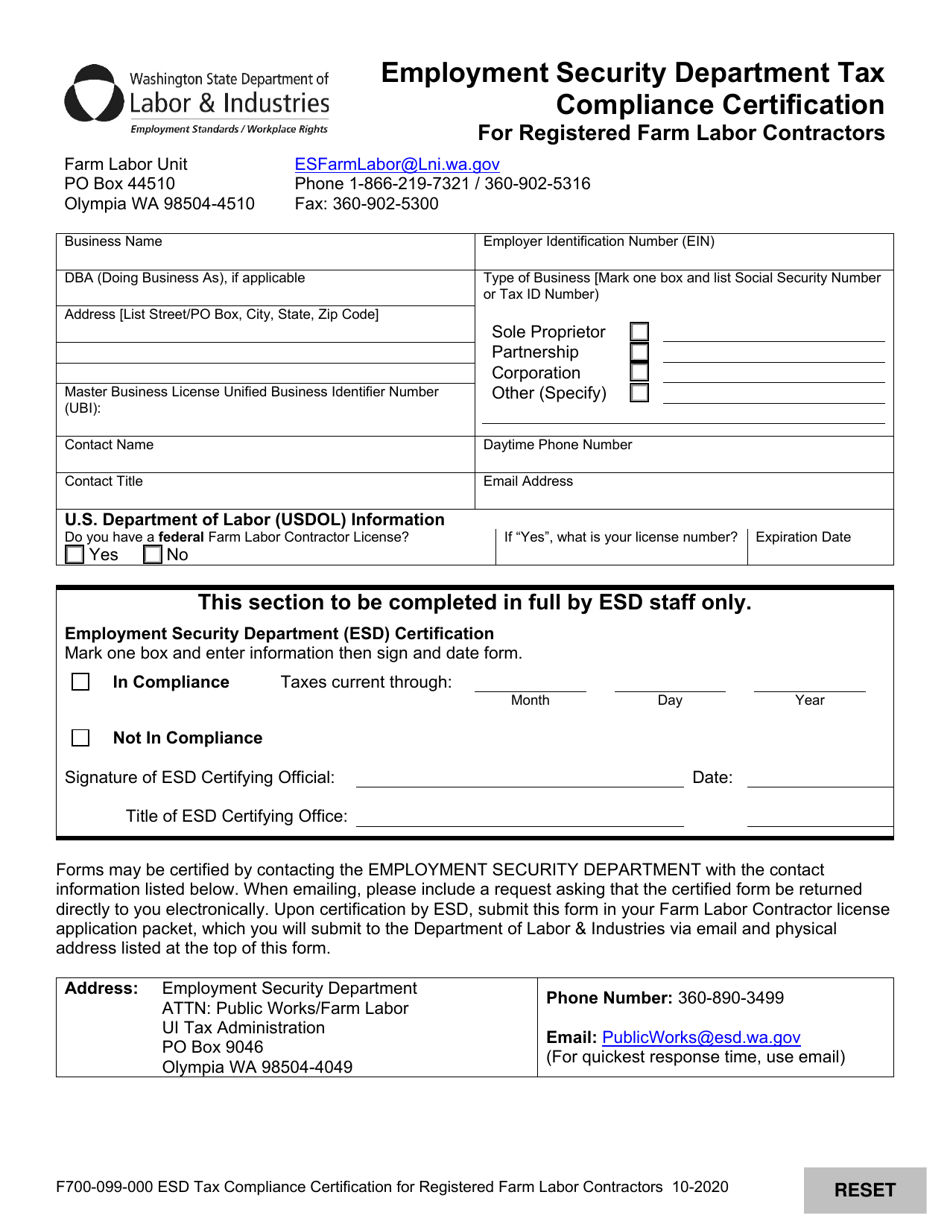

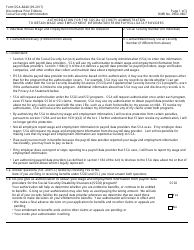

Form F700-099-000 Employment Security Department Tax Compliance Certification for Registered Farm Labor Contractors - Washington

What Is Form F700-099-000?

This is a legal form that was released by the Washington State Department of Labor and Industries - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F700-099-000?

A: Form F700-099-000 is the Employment Security Department Tax Compliance Certification for Registered Farm Labor Contractors in Washington.

Q: Who needs to fill out this form?

A: Registered Farm Labor Contractors in Washington need to fill out this form.

Q: What is the purpose of this form?

A: The purpose of this form is to certify the tax compliance of registered farm labor contractors.

Q: Is this form required by law?

A: Yes, registered farm labor contractors in Washington are required by law to fill out this form.

Q: What information is required on this form?

A: This form requires information related to tax compliance, such as federal employer identification number, state tax registration number, and unemployment insurance account number.

Q: Are there any fees associated with this form?

A: No, there are no fees associated with this form.

Q: What happens after I submit this form?

A: After submitting this form, the Employment Security Department will review the information and issue a tax compliance certification.

Q: How long is the tax compliance certification valid for?

A: The tax compliance certification is valid for one year from the date of issuance.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the Washington State Department of Labor and Industries;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form F700-099-000 by clicking the link below or browse more documents and templates provided by the Washington State Department of Labor and Industries.